Snapshot

The January-March 2025 quarter started positively for most asset classes, with bonds and equities both rising. In the US, the S&P 500 and Nasdaq indices both continued to move upward after Donald Trump's inauguration as US president on 20 January. European equities also started the quarter strongly, although performance in Asian markets was mixed. Bond markets were volatile in the early part of the quarter. The middle of the period was mixed for asset markets, with equities selling off overall and bonds rallying. Volatility dominated towards the end of the quarter, with global stocks seeing an overall decline and US Treasury yields moving in line with reports on Trump's likely tariff policies.

Speculation over the actions of the Trump administration had a major impact on asset markets throughout the quarter. ASEAN markets struggled early in the period on fears that Trump would target the region with tariffs. US equities then reacted negatively in the mid part of the quarter on nervousness over tariffs and disruption to government employees as the new administration began to implement its policy agenda. On the European side, equities were also impacted by expectations over the Russia-Ukraine war, with the possibility of a ceasefire driving gains in the first two months of the quarter. Speculation over US tariffs heavily influenced market movements in the last part of the quarter on resurfacing concerns over the risk of persistent inflationary pressures and a possible economic downturn in the US. In bond markets, yields rose towards the end of the quarter on reports that tariffs would be more targeted than previously expected.

Looking ahead, we expect markets to continue to focus on trade-related developments centred on tariff announcements by the Trump administration. In our view, the tense trade relationship between the US and China will be central to those developments.

Cross Asset 1

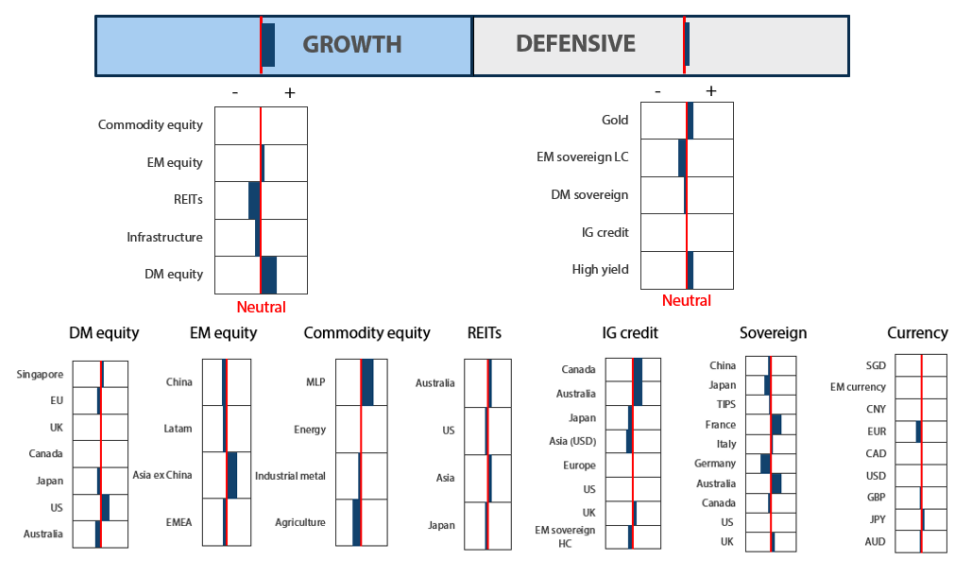

For the January-March quarter, we trimmed our overweight score in growth assets. Much of the reduction to the overweight score took place in January, when the beginning of the Trump administration in the US introduced uncertainties over trade, inflation and monetary policy.

Through the quarter, we reduced our overweight in developed market (DM) equities on the prospect of the Trump administration's tariff policies altering our views on global risk assets. While we reduced our score of the US within DM equities, we still kept the country at an overweight through the quarter as we continue to favour the secular growth trends found there despite the recent tariff-induced volatility. We maintained an underweight score for European equities as we think import tariffs and China weakness are headwinds for the region.

We shifted our score in emerging markets (EM) equities from neutral to a slight overweight for the quarter amid the prospect of a weaker US dollar supporting the asset class. Within EM equities we continue to favour India, which is expected to benefit from structural long-term growth stories and its standing as a domestically-driven economy. We are also positive on Taiwan amid the current tech upcycle.

Regarding commodity equities, we shifted from a slight underweight to neutral due to attractive valuations and for the diversification benefits the asset class offers.

We kept infrastructure at a slight underweight as we saw better risk reward opportunities in other asset classes.

Our view of defensive assets remained marginally positive during the quarter as the asset class began performing as a result of steeper curves, somewhat slower economic data, rate cuts and policy uncertainty. We reduced our underweight in our DM sovereign score as the hedged yield of owning sovereign bonds improved substantially. Within DM sovereigns, we increased our score in Australian bonds on views that Australia is more likely to ease to a greater extent than the US, which could be beneficial for Australian bonds.

We kept our score for EM local currency (LC) sovereigns underweight through the quarter. While high yields and the possibility of rate outs favour EM LC sovereigns, their outlook from a currency perspective is less certain. This is because the Japanese yen could strengthen in the short to medium term as the Bank of Japan looks to raise rates, which may detract substantially from EM LC sovereign returns.

We moved our investment grade (IG) credit score to neutral due to the tightness of spreads, which could widen from current levels due to volatility.

We increased our overweight score in gold during the quarter, as the asset class should benefit from strong momentum and elevated uncertainties stemming from the US administration's policies. Despite stretched valuations for gold, we believe EM central banks will continue to accumulate the precious metal to diversify their reserves, given that their percentages of forex reserves are still significantly lagging those of their DM counterparts.

1 The Multi Asset team's cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset class hierarchy (team view 2 )

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager's current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team's view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets: summary of score changes in Q1

Overall, growth assets remain appealing with market valuations looking attractive following corrections earlier in the quarter. Sentiment remains subdued as concerns about a global recession have recently gathered pace, with softening US economic data, coupled with the US administration's unpredictable stance on tariffs, adding to the uncertainty. Regarding US data, inflation appears to be stickier than the market expected; however, the pickup in inflation appears to be transitory, allaying stagflation concerns. Global economic data remains soft amid falling inflation, which is likely to prompt global central banks to lower interest rates to support their economies. Despite ongoing uncertainties, the outlook for corporate earnings remains positive. However, guidance may be affected by the prevailing uncertainty in the market.

Growth assets topic: staying invested through volatility

Investors have been nervous in the past few weeks due to the pending US import tariff announcements. However, staying invested during market volatility and resisting the temptation to time the market is often considered a wise strategy. Market timing can lead to missed opportunities during rallies and lower returns, as it involves predicting when to buy and sell assets based on market movements. This strategy is risky because it requires accurate predictions, which is a challenge even for experienced investors. Missing out on the best market days can significantly reduce overall returns.

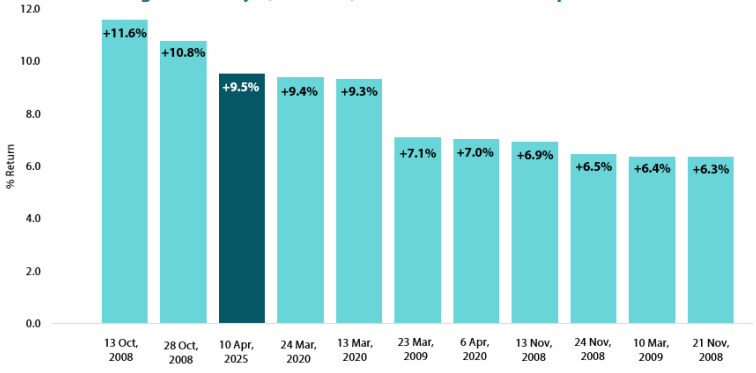

If we examine the past two decades and look at the top ten one-day rallies in the S&P 500, it becomes evident that seven of these rallies happened during bear markets. The recent one-day rally on 10 April is a case in point and now ranks as the third highest in this series (see Chart 1). We believe that staying invested, especially during periods of volatility, can provide better long-term growth and stability.

Chart 1: Ranking of best days (% return) in the S&P 500 for the past two decades

Source: Bloomberg, April 2025

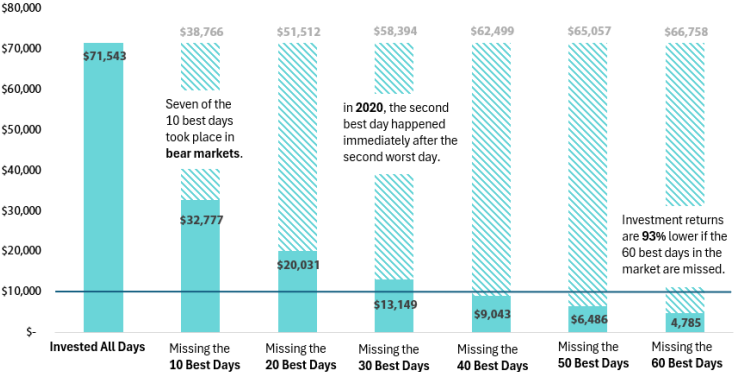

In Chart 2, we assess the potential impacts of missing out on significant one-day rallies. If we had invested from 31 December 2004 to 31 December 2024, starting with an investment of USD 10,000, the returns would have amounted to USD 71,543. If we had missed the top 10 best days, the returns would have dropped to just USD 32,777, representing a decrease of 54%. Skipping the 40 best days would have resulted in returns of USD 9,043 and below the initial investment; missing the top 60 best days would have led to returns 93% lower than the potential USD 71,543 that could have been earned (Chart 2).

Chart 2: The cost of trying to time the S&P 500

Source: Bloomberg, April 2025

Short-term volatility is common in markets and does not necessarily impact the long-term value of investments. Short-term losses do not erase the market's long-term gains. Staying invested allows for recovery and potential profitability over time, whereas exiting investments during market dips can lead to missing out on recovery periods and exceptionally good market days. Remaining invested allows for the power of compounding to work over time. It also reduces the emotional stress and potential mistakes associated with frequent trading.

Conviction views on growth assets

- Maintain overweight exposure to US growth for now: Following the recent selloff, we recognise the short-term impact of equity positions on returns, but we also do not want to overreact and sell at valuations that historically have been favourable levels to increase exposure. There remains potential for positive surprises in the market, such as responses from central banks. We see current US market valuations as attractive and are looking for catalysts that could drive further improvements.

- Overweight on Singapore: We have shifted to an overweight position on Singapore due to its defensive attributes. Singapore offers high dividend yields and low beta. The market is also strong in terms of relative valuation metrics and are least likely to be targeted by Trump's tariffs policies, given their trade balance deficit position.

- Maintain modest overweight exposure to EMs: Within EM, we prefer selective markets, such as India, which benefit from domestically driven economies and structural long-term growth stories.

- Neutral on commodity-linked equities: We continue to believe that commodity-linked equities will keep providing good diversification against inflation in the longer term. The fundamentals of the sector remains compelling due to both cyclical and secular factors.

Defensive assets: summary of score changes in Q1

Defensive assets are performing well so far in 2025, supported by central bank policies, inflation trends and geopolitical factors. Notably, global central banks are easing interest rates, making global bond markets more favourable than in previous years; this has allowed defensive assets to perform well despite volatility in US Treasury (UST) yields. That said, political uncertainty and fiscal deficits in Europe are raising concerns, particularly if the European Central Bank were to end its rate-cutting cycle earlier than expected. We also note that the strained US-China trade relationship is having ripple effects on currencies and interest rates, impacting defensive assets such as Chinese bonds.

Defensive assets topic: Chinese bonds—how much further?

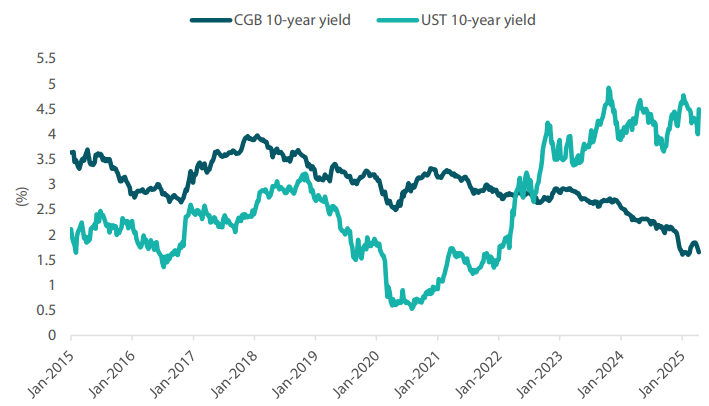

Chinese bonds present an interesting asset class when compared to DM sovereign bonds, as the correlation structure between Chinese government bonds (CGBs) and risk assets differs considerably from that of USTs, German Bunds and Australian government bonds. Part of this divergence can be attributed to the distinct performance of the Chinese economy compared to rest of the world. When inflation spiked in DM economies, China experienced deflation. Even before the trade war intensified, the Chinese economy showed persistent signs of weakness, highlighted by falling home prices, contracting industrial profits and mediocre GDP growth. Consequently, as DM yields rose from 2022 onwards, Chinese yields declined, becoming a more defensive asset relative to other sovereigns.

As Trump now tightens the screws on the Chinese economy with significant tariffs, it is clear that the Chinese authorities will need to provide more support for growth or face an economy that performs well below their targets. The People's Bank of China will likely need to further ease rates in order to boost domestic demand and offset the weakness in the export sector. Historically, this is a signal to go long interest rates and reinforces the appeal of using CGBs as a defensive allocation.

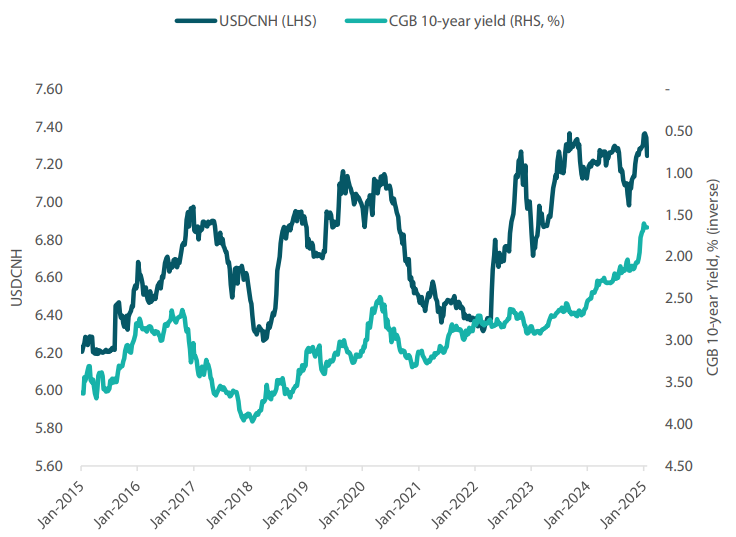

Chart 3: China vs US 10-year yields

Source: Bloomberg, April 2025

However, we are beginning to lean away from these allocations and are now favouring defensive positions in countries such as Australia and France. The key concern for a China bond position is that the 10-year yield may not decline much further from current levels. When comparing China to the US, US yields have historically struggled to break below 1%, with breaches really only occurring mainly during the COVID-19 pandemic. And while the outlook for the Chinese economy is challenging, it is increasingly becomingly harder to see the10-year CGB yield declining substantially from the current 1.6% level.

Furthermore, we typically favour unhedged CGBs due to their high correlation with the US dollar, which provides additional negative correlation with risk assets. However, the imposition of higher tariffs increases the likelihood of Beijing devaluing the Chinese yuan to improve competitiveness. While this could potentially provide a marginal boost to yields, it also heightens the risk of currency manipulation, creating a somewhat asymmetric risk profile for portfolios. Accordingly, while CGBs have been a key consideration for a number of years, we look to revise our stance and turn to other sovereign markets instead.

Chart 4: USDCNH vs China 10-year yield

Source: Bloomberg, April 2025

Conviction views on defensive assets

- Reduced IG credit allocations to neutral: Credit spreads have reached tight levels from which they have historically struggled to contract further. Despite our positive outlook for global growth, we view credit spreads less favourably and shifted our focus towards achieving stable carry in the front end of the bond curve.

- Gold remains an attractive hedge: Gold has been resilient in the face of rising real yields and a strong dollar, while proving to be an effective hedge against geopolitical risks and persistent inflation pressures. Gold has benefitted from declining real yields, and we use this allocation to supplement our long bond positioning. However, our long term expected return for gold is falling, and this may warrant reconsiderations to allocations in the coming months.

- Selective on DM sovereigns: After closing long-held underweights in USTs at 4.60%, we now see more value in owing Australian government bonds and French government bonds. These countries offer stronger levels of yield, and Australia, for example, could experience a number of rate cuts over the coming 12 months. With the steepening of the yield curves, we also see value in adding duration in selected DM countries.