Nikko Asset Management is one of Asia’s largest asset managers, with

AUM USD

USDUnit

USD* under management, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive

strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

In the pursuit of excellence, we approach everything we do with an entrepreneurial mindset. This enables us to think differently, transforming intelligent insights into innovative, relevant

investment opportunities for our clients. Leveraging our unique combination of a global perspective complemented by our Asian DNA, we aspire to create sophisticated and diverse solutions

that set new standards in the asset management industry.

*As of

31 Dec 2020

Stefanie Drews

President and CEO

Kuniyuki Shudo

Executive Chairman

Nikko AM's range of specialist Asian equity, fixed income and ETF investment products have been singled out for distinction by consultants and financial media across the globe. We appreciate this recognition and strive to remain the leading Asia-based asset management company, by delivering consistent outperformance and high quality client service.

While Nikko Asset Management has over half a century of experience in the marketplace, we have an entrepreneurial culture that is building strong global investment capability in equity,

fixed income, multi-asset and alternatives.

Headquartered in Asia for

+

years*, the firm represents more than 200 investment professionals* and

nationalities* across

countries*. More than 300 banks, brokers, financial advisors and life insurance companies around the world distribute the company’s products.

Our talent strategy is to recruit and retain the performance-driven leaders and technical specialists who are experts locally, think globally, and can help us expand quickly in this growing

industry.

*As of

Nikko Asset Management

Nikko Asset Management is one of Asia’s largest asset managers, with USD* under management, providing high-conviction, active fund management across a range of Equity, Fixed Income and Multi-Asset strategies. In addition, our complementary range of passive strategies covers more than 20 indices and includes some of Asia’s largest exchange-traded funds (ETFs).

In the pursuit of excellence, we approach everything we do with an entrepreneurial mindset. This enables us to think differently, transforming intelligent insights into innovative, relevant investment opportunities for our clients. Leveraging our unique combination of a global perspective complemented by our Asian DNA, we aspire to create sophisticated and diverse solutions that set new standards in the asset management industry.

Our global investment teams have a strong appreciation for the unique characteristics of individual countries and sectors, helping them to cut through the noise to determine the real risks and opportunities. Using local market intelligence to unearth new ideas, they exploit these on-the-ground insights to build strong, dynamic portfolios for our clients.

At Nikko Asset Management, we believe in partnering with our clients to build progressive investment solutions. In a world where one-size-fits-all solutions are no longer the answer, our ability to turn insights into opportunities sets us apart. Our understanding of both our clients and the drivers of investment markets underpins the innovation and relevance of the solutions we develop.

*As of

Progressive Solutions

We are committed to delivering progressive solutions that align to the various goals of investors. In an increasingly challenging market environment, we aim to support our clients with innovative, insight-driven and relevant investment opportunities.

Performance

Our primary focus is delivering real value for our clients. Our rigorous risk management framework and research-driven culture help to guide our investment decisions as we strive to generate sustainable outperformance for our clients.

Global Citizen with Asian DNA

We leverage our global perspective and Asian DNA to help our clients navigate dynamic investment markets. Our global investment teams share local expertise and regional perspectives to provide unparalleled insights that help us to develop relevant products and build strong investment portfolios for our clients.

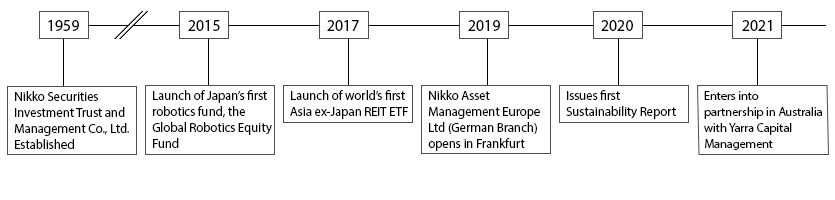

History

|

Nikko Securities Investment Trust

and Management Co., Ltd. Established December 1959 |

Nikko International Capital

Management Co., Ltd. Established September 1981 |

|||

|

Tokyo

office opens

|

|

1959

|

||

|

First investment trust launches

the Nikko Bond Fund |

|

1961

|

||

|

1981

|

|

Tokyo

office opens

|

||

|

New York

office opens

|

|

1984

|

|

London

office opens

|

|

London

office opens

|

|

1987

|

|

Registers as investment adviser and becomes licensed for discretionary asset management

|

|

1988

|

|

Singapore

office opens

|

||

|

Singapore

office opens

|

|

1990

|

|

Company enters corporate pension fund market

|

|

Nikko Securities Investment Trust & Management Co., Ltd. and

|

||

|

Nikko Asset Management Co., Ltd. (Nikko AM)

Established April 1999 |

||

|

1999

|

|

|

|

2000

|

|

|

|

2001

|

|

|

|

2003

|

|

|

|

2005

|

|

|

|

2007

|

|

|

|

2008

|

|

|

|

2009

|

|

|

|

2010

|

|

|

|

2011

|

|

|

|

2013

|

|

|

|

2014

|

|

|

|

2015

|

|

|

|

2017

|

|

|

|

2018

|

|

|

|

2019

|

|

|

|

2020

|

|

|

|

2021

|

|

|

|

2022

|

|

|

|

2024

|

|

|

*1 Based on Nikko Asset Management's research

*2 Except for mutual funds launched in Mainland China (based on Nikko Asset Management's research)

Example 2

Leadership

Global Executive Committee

|

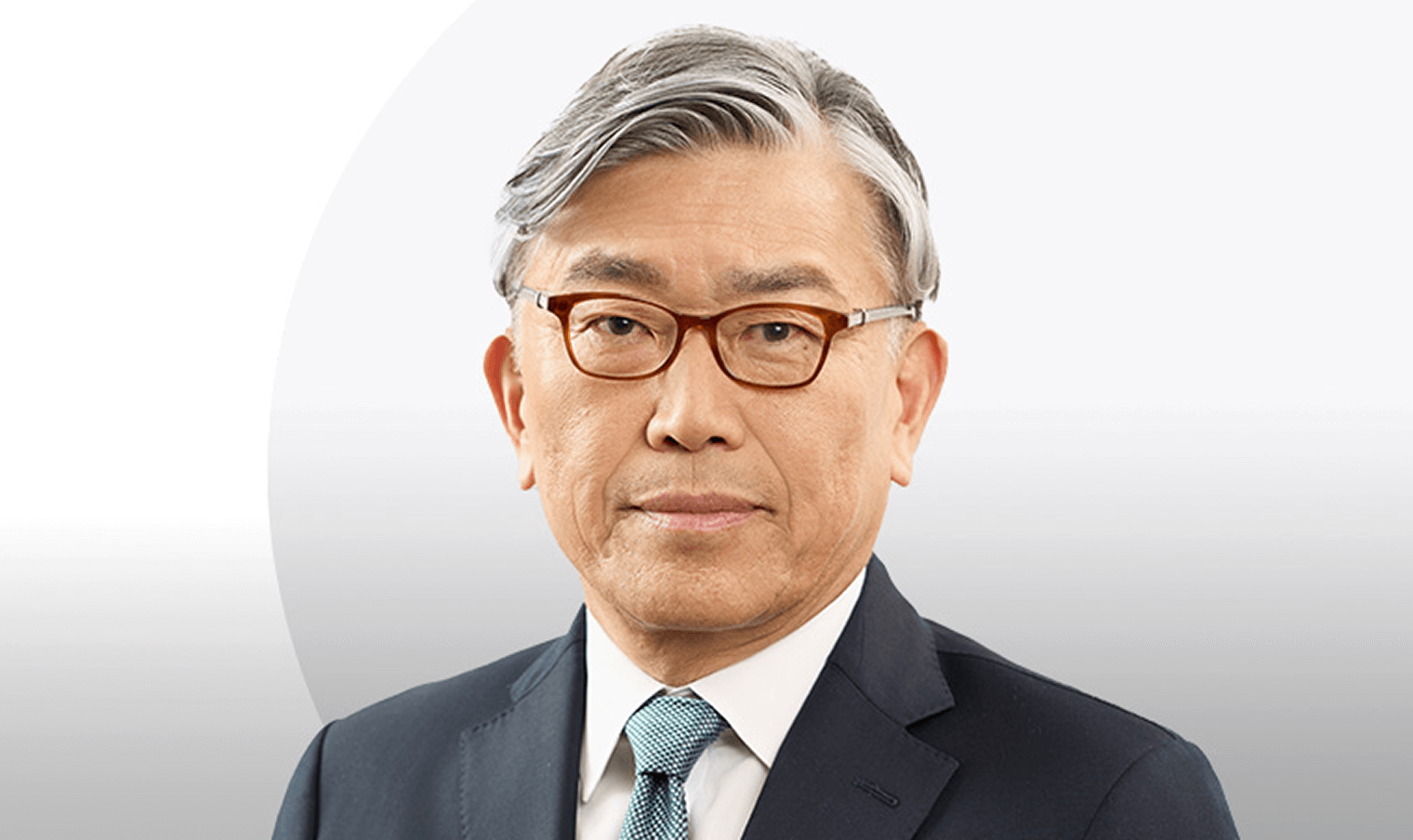

Kuniyuki Shudo

Executive Chairman

Kuniyuki Shudo was appointed Executive Chairman of Nikko Asset Management Co., Ltd. (Nikko AM) effective April 2025. Prior to joining Nikko AM, Shudo built an extensive career in global business at The Sumitomo Trust and Banking Co., Ltd. (currently Sumitomo Mitsui Trust Bank, Ltd.) and Sumitomo Mitsui Trust Holdings Inc. (currently Sumitomo Mitsui Trust Group, Inc.) since joining the former in 1984. He has over 30 years of experience in the global banking as well as asset management and services business, giving him outstanding knowledge of global management standards. He has served as President and Chairman of the Board of Sumitomo Trust and Banking Co. (U.S.A.) (currently Sumitomo Mitsui Trust Bank (U.S.A.)), and later General Manager of Global Business Planning and Coordination Department at the global head office in Tokyo. He then became Executive Officer responsible for the Bank’s overall business in the U.S. in the capacity of Regional Executive for the Americas and General Manager of New York Branch. Shudo then went on to become Managing Executive Officer of Sumitomo Mitsui Trust Bank, Limited and had overall responsibility for the Bank’s global business activities. He also held global business management positions at the Sumitomo Mitsui Trust Group as Executive Officer of Sumitomo Mitsui Trust Holdings, Inc. In June 2019, he became a member of the Board of Directors of Sumitomo Mitsui Trust Holdings, Inc. and a member of its Audit Committee. He provides insight into supervising the status of business execution from a fair and objective standpoint. Shudo graduated from Hitotsubashi University in March 1984, majoring in Law and International Relations, and holds a Master in Law Degree from the University of Pennsylvania Law School. |

|

Stefanie Drews

President and CEO

As the CEO of the firm, Stefanie Drews is responsible for the oversight and execution of all the firm’s functions and global offices. Drews joined the firm in August 2014 as Global Head of Institutional Marketing and Proposition. She went on to hold key roles across many business functions, including Product, Marketing, Communications, Sales, ETF and Corporate Sustainability. In May 2019, she was named Senior Corporate Managing Director, and was appointed President in April 2022, followed by her CEO appointment in April 2025. Drews was previously the Global Head of Key Clients and Family Offices at Barclays Wealth and Investment Management in London. Prior to Barclays, she was a Managing Director at Morgan Stanley Private Wealth Management in London. Drews graduated from Oxford University with a Bachelor of Arts in Politics, Philosophy & Economics, and earned her MBA at Harvard University Graduate School of Business Administration. |

|

Allen Yan

Executive Corporate Officer

Chief Financial Officer (CFO) Allen Yan is Executive Corporate Officer and Chief Financial Officer, Global Head of Finance and Head of Finance Division, responsible for all financial accounting and capital management throughout the firm globally. He also serves as Global Head of Strategic Planning, and oversees all strategic activities. He has held his current roles since April 2023, and is based in Tokyo. Yan first joined Nikko Asset Management in May 2006 as Head of Financial Planning & Analysis Department. In March 2008, he became Head of Strategy & Financial Planning Department. Then in April 2011, he was seconded to joint venture Rongtong Fund Management Co., Ltd. headquartered in Shenzhen, China, as Executive Deputy CEO. In May 2013, with the founding of Rongtong’s subsidiary in Hong Kong Rongtong Global Investment Limited, he took on the additional role as its CEO. He returned to Nikko Asset Management in January 2023 as an Executive Corporate Officer and Chief Financial Officer. Prior to joining Nikko Asset Management, Yan joined the New Business Development Group at Fidelity Investments in Boston in 2000 and later transferred to Fidelity Investments Japan in 2001. There, he was in the finance division, responsible for business planning and financial analysis for Fidelity Investments Japan and subsequently Fidelity Investments Asia. He earned his BA in Economics at the University of Chicago and his Master of Commerce and Management at Hitotsubashi University in Japan. He holds the designation of Chartered Financial Analyst (CFA). |

|

Mark E. Stoeckle

Executive Corporate Officer

Chief Investment Officer and Global Head of Investment Mark E. Stoeckle’s time with Nikko Asset Management began in April 2024 when he was appointed to be an Outside Director. In April 2025, he transitioned to inside the firm to become Executive Corporate Officer, Chief Investment Officer and Global Head of Investment. He is responsible for directing all of the firm’s investment management activities globally. Stoeckle has built a well-rounded career in finance spanning over 30 years with key leadership roles at asset managers and investment banks. For the 10 years prior to joining Nikko Asset Management, he was CEO at Adams Funds in the US and board member. He also led the Funds’ Management Committee, and later became one of the firm’s outside directors. He has extensive experience in investment roles, including CIO of US Equities and Global Sector Funds at BNP Paribas Investment Partners (currently BNP Paribas Asset Management), CIO of US Equities at Fortis Investments, and investment banker at Bear Stearns Companies. Stoeckle earned an MBA in Finance from the F.W. Olin Graduate School of Business at Babson College and graduated from Bethany College in the US with a degree in English. |

|

Kunihiro Asai

Senior Corporate Officer, Chief Risk Management Officer, Global Head of Risk Management, Global Head of Enterprise Risk Management, Joint Head of Risk Management Division

Kunihiro Asai has held the position of Senior Corporate Officer since May 2019. In that role, he had previously been responsible for execution of the firm’s corporate strategy, risk management, internal control, global operations and global technology. As of April 2023, he oversees all of the firm’s risk management on a global basis. Asai joined Nikko Asset Management as Head of Risk Management in August 2006. He served as Head of Product Development for seven years from 2007 onwards, and was appointed Global Head of Corporate Office and Head of Corporate Office in 2014. A veteran financier with more than 20 years of experience in the financial industry, Asai has a strong background in risk management. Prior to joining Nikko Asset Management, he worked for the major trading house Mitsui & Co, Ltd. between 2001 and 2006, engaged in planning and managing the product derivatives business globally. He also spent more than a decade working at both Sanwa Securities and Sanwa Bank, serving in the overseas dealing business. Asai holds a Master of Science in computational finance from the Carnegie Mellon University Graduate School of Industrial Administration and a Bachelor’s degree in engineering from the University of Tokyo. |

|

Hiroshi Yokoyama

Senior Corporate Officer, Global Head of Products & Solutions, Global Head of Product Development and Management, Head of Products & Solutions Division

Hiroshi Yokoyama leads the Products & Solutions Division, and oversees all of the firm’s product development and management worldwide. Yokoyama joined Nikko Asset Management in September 2005. From August 2016, he was subsequently appointed as Global Head of Product Development and Management. In May 2019, he also took on the role of Head of Products & Solutions Division. In November 2020, he was also appointed Head of ETF Business Division. In April 2022, he was named Global Head of Products & Solutions, Joint Global Head of Sales Support and Joint Head of Sales Support Division. He has been a Senior Corporate Officer since July 2022. Prior to Nikko Asset Management, he began his career in 1997 in product development at UFJ Partners Asset Management Co., Ltd. (currently Mitsubishi UFJ Asset Management Co., Ltd.) Yokoyama is a graduate of Waseda University, where he studied Political Science and Economics. |

|

Tony Glover

Senior Corporate Officer, Global Head of International Sales, Global Head of Consultant Relations, Head of International Sales Division, Joint Head of Japan Institutional Business

Division

Tony Glover oversees the strategy and execution of all of Nikko Asset Management’s sales activities outside of Japan, and for institutional investors in Japan. He also coordinates the firm’s relations with global, regional and local investment consultants. Glover joined the firm in March 2020, and was originally appointed as Global Head of Intermediaries. He became Global Head of Consultant Relations in November 2020, and has held the position of Global Head of International Sales since September 2021. He was named Head of International Sales Division when the division was established in April 2022. In April 2023, he took on oversight of the Japan institutional business when he was appointed as Senior Corporate Officer and Joint Head of Japan Institutional Business Division. Glover has a career in asset management in Japan spanning over 20 years. Prior to joining Nikko Asset Management, he worked in the Japan offices of a number of global asset managers headquartered in Europe, including WestLB Asset Management, Fortis Investments, and BNP Paribas Asset Management. He spent a decade working as an analyst and fund manager investing in the Japanese equity markets before moving to management roles, first as head of the investment team, and then later as Chief Administrative Officer, while also acting as an investment specialist for Japanese equity products, covering clients in Europe, Asia and Latin America. He is a fluent Japanese speaker after graduating from SOAS (London University) with a BA in Japanese and Economics, and is a CFA and CAIA charterholder. |

|

Tetsuji Yasunaga

Senior Corporate Officer

Head of Japan Retail Business Division Joint Head of Japan Institutional Business Division Tetsuji Yasunaga is Head of Japan Retail Business Division, managing all sales to retail investors in Japan. He also jointly oversees Japan Institutional Business Division. Yasunaga joined Nikko Asset Management in July 2006, with a consistent focus on sales of investment trusts. He was appointed Head of Asset Management Support Department in July 2011, and Head of Japan Retail Business Division in September 2019. He has been a Senior Corporate Officer since June 2023, and Joint Head of Japan Institutional Business Division since January 2024. Prior to Nikko Asset Management, Yasunaga worked at Nomura Investment Management Co., Ltd. (now Nomura Asset Management Co., Ltd.) and Nissay Investment Trust Management Co., Ltd. (now Nissay Asset Management Corporation) involved in sales of investment trusts to retail investors in Japan. Yasunaga is a graduate of Kwansei Gakuin University, where he studied law. He is a Chartered Member of the Securities Analysts Association of Japan (CMA). |

|

Kiyotaka Ryu

Head of China, Nikko Asset Management

President, Nikko Asset Management Hong Kong Limited Kiyotaka Ryu is responsible for planning and promoting Nikko Asset Management Group’s optimised business strategy for China and enhancing the Group’s strategy in Asia, including with the Asia-related businesses of parent company Sumitomo Mitsui Trust Group. He also manages Nikko Asset Management Hong Kong Limited. Ryu joined Nikko Asset Management in September 2007 and went on to hold positions such as Global Head of Internal Audit and Head of Internal Audit Department. In July 2018, he was also appointed Global Head of Internal Control, and from December 2018 held the roles of Chief Risk Officer and Global Head of Risk Management. From October 2021, he was also Global Head of Corporate Planning and Head of Corporate Planning Division. In January 2024, he took on the additional role of Deputy President of Nikko Asset Management Hong Kong Limited, before becoming the office’s president in October that year. He has held his current roles since January 2025. Before joining Nikko AM, he worked for KPMG Business Assurance (currently KPMG Consulting) and the KPMG Sydney Office as a financial and technology auditor and consultant and served clients from various industries including the financial sector. Ryu graduated from Waseda University with a Bachelor of Arts in Human Sciences and has also earned a Master of Professional Accounting Degree from the University of New South Wales. Ryu is a CPA and a member of the American Institute of Certified Public Accountants. |

|

Eleanor Seet

Head of Asia and President, Nikko Asset Management Asia Limited

Eleanor Seet joined Nikko Asset Management in 2011 as the President and Director of the Singapore entity. She became the Head of Asia ex-Japan in 2015 with expanded responsibility for driving the growth of Nikko AM in the region. She has oversight of Nikko AM’s Singapore and Hong Kong offices and joint venture relationships in China and Malaysia and is a board member of Affin Hwang Asset Management Berhad. Ms Seet is a pioneer in the asset management industry with over 20 years of experience. Prior to joining Nikko AM Asia, Ms Seet led the distribution efforts for iShares concentrating on the wealth segments across Asia ex Japan. Previously, she spent 12 years at AllianceBernstein, where she was responsible for building and developing the firm’s distribution channels and business. In that capacity, she was responsible for the overall strategy and execution of the firm’s product offerings in South East Asia via intermediaries. She graduated with a Bachelor of Economics from the University of New South Wales, Sydney. |

|

Rob Bluzmanis

Regional Head of EMEA, Chief Executive Officer, Nikko Asset Management Europe Ltd

Rob Bluzmanis is Regional Head of EMEA and Chief Executive Officer of Nikko Asset Management Europe Ltd (Nikko AM Europe). He is responsible for all aspects of Nikko AM’s business across the EMEA region, including its offices in London, Edinburgh, Luxembourg, the Netherlands and Frankfurt, and its continuing growth strategy. He joined Nikko AM in 2015 in Sydney, where his most recent role was Head of Distribution for Nikko AM Australia, where he was responsible for the sales strategy, execution, and management of institutional, intermediary sales and clients service teams. When Nikko AM entered a strategic partnership with Yarra Capital Management and transferred ownership of Nikko AM Australia to Yarra in 2021, Bluzmanis was selected to lead the combined sales and distribution teams. He has over 20 years’ industry experience in asset management, having previously held senior management roles as Head of National Accounts & Research at Blackrock Australia and Senior Business Development Manager at Colonial First State. Rob holds a Bachelor of Commerce (Economics) from Macquarie University, and the Graduate Diploma of Applied Finance from Financial Services Institute of Australasia (FINSIA). He is also a Fellow of FINSIA and holds the Certified Investment Management Analyst (CIMA) designation. |

|

Stuart Williams

Managing Director and Country Head, Nikko Asset Management New Zealand Limited

Stuart Williams is responsible for managing all aspects of the Nikko Asset Management New Zealand business. Williams joined the firm in 2014 as Head of New Zealand Equities. He was named Managing Director and Country Head, as well as Co-Head of New Zealand Equities in April 2023, and has held his current roles since October 2023. Williams has been in investment management since 1997 and has extensive experience in virtually all aspects of investment management. Most recently this entailed conducting detailed research and developing investment recommendations on listed companies in both New Zealand and Australia. He previously worked at ANZ Investments and its predecessors. He holds a Bachelor of Commerce degree from the University of Auckland and is a Chartered Accountant. |

|

James Wesley

Chief Executive Officer, Country Head, Nikko Asset Management Americas Inc.

James Wesley is Chief Executive Officer for Nikko Asset Management Americas Inc. (Nikko AM Americas). He manages all aspects of Nikko AM’s business across the United States, Canada and Latin America. Wesley joined Nikko Asset Management New Zealand Limited in 2013, where he was responsible for leading Nikko AM’s sales, marketing and client servicing functions in the country. He relocated to New York following his appointment as Deputy CEO in April 2023. He has held his current role since January 2024. Wesley has over 20 years of investment management experience with multi-national organisations. Prior to Nikko AM, he spent eight years at Columbia Threadneedle Investments, initially based in London and then Australia. Wesley holds a Bachelor of Business degree and Graduate Diploma of Business from Auckland University of Technology and holds the FSA (UK) recognised Certificate in Investment Management. |

|

Mariko Matsui

Chief Compliance Officer (CCO), Chief Legal Officer (CLO), Global Head of Legal, Global Head of Business Compliance, Head of Legal & Compliance Division

As Chief Compliance Officer and Chief Legal Officer, Mariko Matsui has the key responsibility of overseeing the firm’s legal and compliance efforts around the world. She has held her current roles since June 2024. Matsui joined Nikko Asset Management in July 2011, and has continuously utilised her expertise across a host of international and domestic legal and compliance efforts. She was appointed International Head of Legal in October 2021 before expanding her remit to Global Head of Legal and Co-Head of Legal Department in October 2022. She took on the additional title of Joint Global Head of Business Compliance in March 2023, and further, Global Head of Business Compliance in June 2024. Prior to joining Nikko Asset Management, Matsui worked in risk management and legal at Citibank, N.A., Tokyo Branch and Deutsche Securities Limited. She graduated from Keio University Faculty of Law and earned her Master of Laws (LL.M.) from Columbia Law School, along with a Masters in Law from Waseda Law School. She is a member of the New York State Bar Association. |

|

Olga Bobrova

Chief Administrative Officer (CAO)

Global Head of Sales Support Global Head of Client Service Head of Sales Support Division Olga Bobrova was appointed as Chief Administrative Officer in April 2025, where she is responsible for driving the execution of enterprise transformation initiatives while overseeing the firm’s global operational framework. She is also Global Head of Sales Support and Head of Sales Support Division, overseeing the functions that focus on the firm’s prospective and existing clients, such as Product Specialists, Client Services and Institutional Marketing & Proposition. Bobrova joined Nikko Asset Management in August 2013, before becoming Global Head of Client Services in October 2019. She then took on the roles of Global Head of Sales Support and Head of Sales Support Division in April 2022 (initially as one of two joint heads and later as the single head.) She was also Global Head of Data and Performance and Head of Data and Performance Management Division for 18 months from April 2023. Bobrova has over 20 years of experience in sales, institutional relationship management, and client services. Before joining Nikko Asset Management, she was Partner responsible for Client Relations at hedge fund platform provider Bridge Capital Securities. Bobrova holds a Master of Science degree in Economics from the Graduate School of Economics of Hitotsubashi University, Japan and is also a Chartered Financial Analyst (CFA). Having worked in Japan for most of her career, she is a fluent Japanese speaker. |

|

Jiro Ikegaya

Deputy CEO, Nikko Asset Management Europe Ltd

Joint Global Head of Strategic Planning Nikko Asset Management Jiro Ikegaya is a Director and Deputy CEO of Nikko Asset Management Europe Ltd, and concurrently Joint Global Head of Strategic Planning, overseeing management of the firm’s joint ventures. He has held his current roles since April 2025 and is based in London. Ikegaya first joined Nikko Asset Management in Tokyo in May 2006, and went on to hold key positions related to corporate planning, strategy and M&A, including Head of Strategy & Financial Planning Department, Head of Strategic Planning Department, Head of International Sales Planning Department and Head of Institutional Sales Planning Department. In August 2017, he relocated to Nikko Asset Management Group’s UK subsidiary Nikko Asset Management Europe Ltd (NAME) as Chief of Staff. In February 2023 he was appointed as NAME’s Deputy CEO and was responsible for overseeing product management, marketing, systems and operations for the entire EMEA region. That April, he joined NAME’s Board of Directors. Prior to joining Nikko Asset Management, Ikegaya served at Japan Ernst & Young Consulting Co., Ltd., specialising in operational efficiency and project management. He later moved to Hudson Japan K.K., a firm under the umbrella of a US fund, where he worked to improve investee companies’ corporate value. Ikegaya graduated with a Bachelor of Science from the Stern School of Business at New York University with a double major in Finance and Information Systems. |

|

Tomoya Narikiyo

Global Head of Human Resources

Head of Human Resources Division Tomoya Narikiyo is Global Head of Human Resources and Head of Human Resources Division, responsible for all of the function’s activities firmwide. He has held his current roles since August 2025. Narikiyo joined Nikko Asset Management in May 2018, and went on to become Acting Global Head of Internal Audit and Head of Internal Audit Department in July 2018 and later Global Head of Internal Audit in November 2019. Prior to joining the firm, during the time he was at The Dai-ichi Life Insurance Company, he was involved in asset management, corporate planning and other activities. He then moved to accounting firm Deloitte Touche Tohmatsu, where he was engaged in advisory services related to governance, risk management and compliance for financial institutions. Narikiyo graduated from the Keio University Faculty of Economics. He is a Certified Member Analyst (CMA) of the Securities Analysts Association of Japan, a Certified Internal Auditor (CIA) by The Institute of Internal Auditors – Japan, and a certified Internal Administrator by the Japan Securities Dealers Association. |

Global Non-Executive Chairman

|

Yoichiro Iwama

Outside Director, Chairman of the Board of Directors

Mr. Iwama holds a wealth of managerial experience in asset management in Japan, encompassing a broad range of senior roles, including most recently President & CEO of Tokio Marine Asset Management Co., Ltd. until 2010. He also acted as Chairman of the Japan Securities Investment Advisers Association for seven years from June 2010, the self-regulatory body for the industry in Japan. In this role, he displayed strong leadership in heightening stewardship at asset managers and corporate governance at invested companies. He graduated from the University of Tokyo, with a BA in Law. |

Nikko Asset Management Affiliates Key Executives

http://www.rtfund.com/

|

Jiang Tao

Executive Deputy CEO Rongtong Fund Management Co., Ltd.

CEO Rongtong Global Investment Limited Jiang Tao is Executive Deputy CEO of Rongtong Fund Management Co., Ltd. He oversees retail distribution and marketing. He is also the CEO of Rongtong Global Investment Limited, where he is responsible for the day-to-day management of the firm across asset classes and investor types. He has held both these positions since December 2022. Jiang has nearly 30 years of experience in the financial industry with a specialisation in fund distribution and international business. In 1993, he joined the Bank of Communications Anhui, China branch, before transferring to its Tokyo branch in 2001 to be in charge of trade settlements and liaisons between the head office, branches and external institutions. He returned to the Anhui branch in 2006 as General Manager of Personal Finance Business Department. Jiang then joined Rongtong Fund Management Co., Ltd. in 2008 as Deputy Director of Marketing Department and Deputy General Manager of the Beijing branch, and from 2008 to 2016 he was General Manager of the Shanghai branch, responsible for the entire East China region. In 2016, he moved to Golden Trust Sinopac Fund Management Co., Ltd. as Deputy General Manager, where he was in charge of institutional, intermediary, retail and online sales and marketing. Jiang graduated with a BA in English, and went on to earn a Master’s in Economics, both from Anhui University in China. |

https://aham.com.my/

|

Teng Chee Wai

Managing Director,

AHAM Asset Management Berhad Dato' Teng Chee Wai is the founder of AHAM Asset Management Berhad (formerly known as Affin Hwang Asset Management Berhad) (“AHAMCapital”). Over the past few decades, he has built the Company to be the fastest growing independent investment management house in Malaysia with RM76 billion in assets under administration as at 31 March 2023. In his capacity as Managing Director/ Executive Director, Teng manages the overall business and strategic direction as well as the management of the investment team. His hands-on approach sees him actively involved in investments, product development and marketing. Teng's critical leadership and regular participation in reviewing and assessing strategies and performance has been pivotal in allowing the Company to successfully navigate the economically turbulent environment. Teng's investment management experience spans more than 30 years, and his key area of expertise is in managing absolute return mandates for insurance assets and investment-linked funds in both Singapore and Malaysia. In addition, Teng is also the Chairman of Bintang Capital Partners Berhad, AHAM Capital's Private Equity subsidiary. Prior to his current appointments, he was the Assistant General Manager (Investment) of Overseas Assurance Corporation (OAC) and was responsible for the investment function of the Group Overseas Assurance Corporation Ltd. Teng began his career in the financial industry as an Investment Manager with NTUC Income, Singapore. He is a Bachelor of Science graduate from the National University of Singapore and has a Post-Graduate Diploma in Actuarial Studies from City University in London. |

https://www.yarracm.com/

|

Dion Hershan

Executive Chairman and Head of Australian Equities

Dion is Executive Chairman and Head of Australian Equities. He is responsible for leading the Australian Equities team, and is a Portfolio Manager focused on large cap equities. Prior to transitioning to Yarra Capital Management, Dion was the Head of Australian Equities of Goldman Sachs Asset Management, a position he held since July 2007. He was previously a Fund Manager at Citadel Investment Group based in New York where he managed a long/short portfolio. He also worked as an Analyst and Fund Manager for Boston-based Fidelity Investments, where he was responsible for managing a diversified fund. Before moving to the US, Dion worked at Boston Consulting Group where he undertook financial and quantitative analysis, project and client account management. Dion holds a Bachelor of Commerce and a Bachelor of Arts from Monash University and an MBA from Columbia Business School, New York. |

Awards

Nikko AM's range of specialist Asian equity, fixed income and ETF investment products have been singled out for distinction by consultants and financial media across the globe. We appreciate this recognition and strive to remain the leading Asia-based asset management company, by delivering consistent outperformance and high quality client service.

| Asia Asset Management — 2015 , 2016 , 2018 , 2019 , 2020 , 2021 , 2022 , 2023 , 2024 , 2025 |

| AsianInvestor Asset Management Awards — 2006, 2007, 2008, 2011, 2012, 2013 , 2014 , 2015 , 2017 , 2019, 2020 , 2023 , 2024 , 2025 |

| The Asset Awards — 2017, 2020 , 2021 , 2022 , 2023 , 2024 , 2025 |

| ETF Express Awards — 2010, 2011, 2013 , 2014 , 2015 , 2016 , 2017 , 2018 , 2019 , 2020 |

| Global Investor/isf Award for Investment Excellence — 2010 |

| Lipper Fund Awards (Japan) — 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2013 , 2014 , 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, 2023 |

| Lipper Fund Awards (UK) — 2010 |

| Morningstar "Fund of the Year" Awards — 2005, 2006, 2007, 2009, 2013, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021 |

| R&I Fund Award — 2007, 2008, 2009, 2010, 2011, 2013 , 2014 , 2014 , 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022 |

| TBLI ESG Leaders Awards — 2010 |

Our subsidiaries and affiliates have also been recognised through industry accolades.

- Nikko AM Asia (Singapore): https://www.nikkoam.com.sg/about-us/our-company#awards

- Affin Hwang AM: http://www.affinhwangam.com/

- Rongtong: http://www.rtfund.com/main/About/Overview/index.shtml

Notes:

Morningstar

References to any specific securities do not constitute an offer to buy or sell securities. Those awarded funds based upon the past performance cannot guarantee their future performance.

Data or statements are obtained from sources Morningstar Japan K.K believed to be reliable but are not guaranteed as to accuracy or completeness.

All information is the property of Morningstar Japan K.K. or Morningstar, Inc. and protected by copyright and intellectual property laws. All rights reserved.

Thomson Reuters Lipper Fund Awards

The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the

highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Lipper Fund Award. For more information, see

lipperalpha.financial.thomsonreuters.com/lipper Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed

by Lipper.

Asia Investor Achievement Awards

AsianInvestor ("AI") annual Awards for Achievement recognise fund houses that have demonstrated skill in institutional fund management, as well as all-round excellence among hedge funds,

service providers and domestic businesses. Nominations are based purely on past performance. AI does however select winners on more qualitative factors so our awards reflect consistent

skill. For the Annual awards, the methodology for AsianInvestor's Achievement Awards in institutional asset management involves two steps:

- First: AI collects performance data from various consultants that is used to shortlist the top 3-4 candidates in each category. For one-year awards, AI looks at pure returns; for other awards, information ratios. AI picks the top three or four performers on that basis.

- Step two: AI asks the candidates to pitch themselves and provide some areas (such as sources of alpha, strategy, team experience, innovation, testimonials, etc) to consider. After than it is purely an editorial decision, based on the pitches.

Firms that have demonstrated consistent performance in a particular asset class may have an edge and AI also values client testimonials highly.

The Asset ETF Awards

For The Asset Triple A Private Banking, Wealth Management, Investment and ETF Awards, the editors of The Asset adopt a rigorous approach in selecting the most deserving institutions and

products. Point scores for both quantitative factors and qualitative factors are combined to determine a shortlist for each award. The Asset editorial team then conducts follow-up

interviews and participates in presentations organized by the investors, investing institutions and product originators to make a final judgment.

R&I Fund Award

The R&I Fund Award is presented to provide reference information based on the past data R&I believes to be reliable (however, its accuracy and completeness are not guaranteed by

R&I) and is not intended to recommend the purchase, sale or holding of particular products or guarantee their future performance. The Award is not the Credit Rating Business, but one

of the Other Lines of Business (businesses excluding Credit Rating Business and also excluding the Ancillary Businesses) as set forth in Article 299, paragraph (1), item (xxviii) of the

Cabinet Office Ordinance on Financial Instruments Business, etc. With respect to such business, relevant laws and regulations require measures to be implemented so that activities

pertaining to such business would not unreasonably affect the Credit Rating Activities. Intellectual property rights including copyright and all other rights in this Award are the sole

property of R&I, and any unauthorized copying, reproduction and so forth are prohibited. The Award for the "Investment Trusts/Aggregate" category is based on the average performance of

the relevant funds of a fund manager, and does not indicate the excellent performance of all individual funds of the manager.

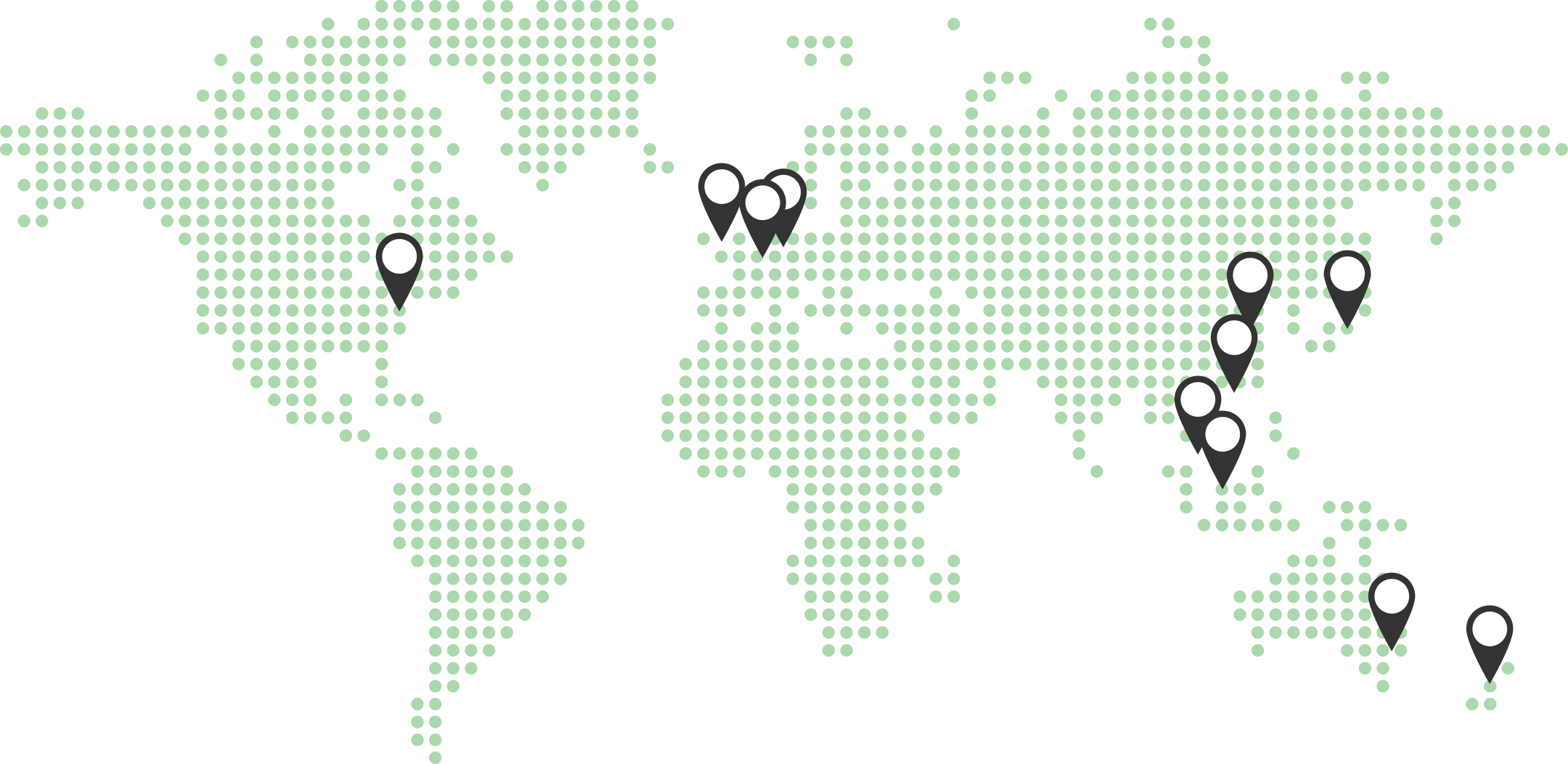

Global Offices

Japan

Nikko Asset Management Co., Ltd. (Nikko AM)

Nikko AM provides investment management services, focused on sourcing, packaging and distributing retail investment fund products which are managed in-house or outsourced to third-party sub-advisers. In-house, Nikko AM specialises in Japanese and Asian equities, fixed income and REITs. For institutional clients, the firm also provides separate account and privately placed fund products.

Through the firm’s Fund Academy locations in Tokyo and Osaka, it provides an unrivalled network of Japanese distributors with market information, product knowledge and sales strategies. Nikko AM is a member of the Investment Trusts Association, Japan (JITA) and the Japan Investment Advisers Association (JIAA).

Website: https://en.nikkoam.com/

Registration Number: Director of Kanto Local Finance Bureau (Financial instruments firms) No.368

Nippon Institutional Securities Co., Ltd. (NIS) (Subsidiary of Nikko AM)

NIS provides institutional investors worldwide quality financial products, including ETFs and investment trusts, serving their needs throughout the investment process.

Website: https://www.ni-sec.com/en/

Registration Number: Director of Kanto Local Finance Bureau (Financial instruments firms) No.3081

Singapore

Nikko Asset Management Asia Limited (Nikko AM Asia)

Nikko AM Asia comprises the integrated operations of two award-winning Singapore-based asset managers: the former DBS Asset Management Ltd and Nikko Asset Management Singapore Limited. Nikko AM Asia provides investment management services for the group’s Asia ex-Japan products, with core competencies in Asian equities, Asian fixed income and absolute return strategies. It also provides client service and business development relating to institutional, intermediary and retail clients.

Website: https://www.nikkoam.com.sg/

Co. Registration No. 198202562H

New Zealand

Nikko Asset Management New Zealand Limited (Nikko AM New Zealand)

Part of the Nikko AM group since March 2011, Nikko Asset Management New Zealand actively manages New Zealand/Australasian equities, fixed interest and cash through its Auckland-based investment team and employs carefully selected offshore managers to manage global equities, bonds and alternative investments. Nikko Asset Management New Zealand also manages a range of socially responsible funds.

Website: https://www.nikkoam.co.nz/

Nikko AM New Zealand is a Registered Financial Service Provider in New Zealand (No.FSP22562).

EMEA

Nikko Asset Management Europe Ltd (Nikko AM Europe)

Nikko AM Europe provides institutional client service and business development to European and Middle Eastern clients seeking global investment solutions. Additionally, its specialist investment professionals manage Global Equity and Global Fixed Income products on behalf of the Nikko AM group.

Website: https://emea.nikkoam.com/

Authorised and regulated in the United Kingdom by the Financial Conduct Authority (reference number 122084).

Nikko Asset Management Luxembourg S.A. (Germany Branch)

Website: https://www.nikkoam.de/

Nikko Asset Management Luxembourg S.A.

Website: https://emea.nikkoam.com/

Americas

Nikko Asset Management Americas, Inc. (Nikko AM Americas)

Nikko AM Americas provides global manager due diligence and investment management across multiple asset classes including global macro, currency, fixed income, equities and asset allocation. Nikko AM Americas also manages institutional client service and business development within the USA.

Website: https://americas.nikkoam.com/

Regulated in the United States by the U.S. Securities and Exchange Commission (SEC file number: 801-60881)

Hong Kong

Nikko Asset Management Hong Kong Limited (Nikko AM HK)

Nikko AM HK was formed following the integration of DBS Asset Management’s operations with Nikko AM’s representative office in Hong Kong. It provides on-the-ground equity fund management, analysis and research.

Authorised and regulated in Hong Kong by the Securities and Futures Commission. Please note that authorisation does not imply official recommendation.

Website: https://www.nikkoam.com.hk/

China

Rongtong Fund Management Co., Ltd. (Rongtong)

With its head office in Shenzhen and branch offices in a number of Chinese cities, including Beijing and Shanghai, Rongtong provides investment management services, primarily to the retail market in China. It offers products across active and passive equities, fixed income, as well as balanced and money market asset classes. Nikko AM’s strategic 40% stake in Rongtong enables us to promote our ongoing presence within China’s emerging asset management industry.

Website: http://www.rtfund.com/main/About/Overview/index.shtml

Authorised and regulated in People's Republic of China by the China Securities Regulatory Commission

Malaysia

AHAM Asset Management Berhad

Headquartered in Kuala Lumpur with sales offices across Malaysia, AHAM AM caters to retail, corporate and institutional clients. It offers a wide range of solutions from unit trust funds, cash management solutions, dedicated discretionary and non-discretionary mandates and wealth management products and services.

Nikko AM has a 27% stake in AHAM AM.

Website: https://aham.com.my/

Australia

Yarra Capital Management Limited (Yarra)

An independent, active Australian fund manager with offices in Melbourne and Sydney serving institutional and retail clients. The firm’s offering includes its fundamental Australian equities product set, consisting of long-only, concentrated strategies, and fixed income capabilities which provide clients with access to credit and hybrid products. Nikko AM has a 20% strategic stake in Yarra.

Website: https://www.yarracm.com/

Careers

While Nikko Asset Management has over half a century of experience in the marketplace, we have an entrepreneurial culture that is building strong global investment capability in equity, fixed income, multi-asset and alternatives.

Headquartered in Asia for + years*, the firm represents more than 200 investment professionals* and nationalities* across countries*. More than 300 banks, brokers, financial advisors and life insurance companies around the world distribute the company’s products.

Our talent strategy is to recruit and retain the performance-driven leaders and technical specialists who are experts locally, think globally, and can help us expand quickly in this growing industry.

Our philosophy in developing human capital is to hire the right people, execute powerfully on the basics of performance management and rewards, and ensure leadership is driving a leaders-building-leaders culture in order to ensure that the right behaviours are being modelled for managers and other future leaders.

Leaders and managers are encouraged to discuss the career aspirations of all employees, and to use their experience and resources to work with their team members to identify creative development opportunities that will stretch, in particular, our mission critical as well as our high potential leadership talent.

This email address is being protected from spambots. You need JavaScript enabled to view it.

if you believe that Nikko Asset Management is a fit for you.

*As of