Snapshot

The markets are pricing “higher for longer” with US Treasury (UST) 10-year yields pressing above their October 2022 highs of 4.24%, tempering enthusiasm across global equities into neutral sentiment territory. As inflation pressures continue to ease without tipping the jobs market into recession, the US Federal Reserve (Fed) still looks on course to achieve a soft landing. However, not surprisingly the markets remain slightly on edge as the top in yields cannot yet be called for certain.

To date, diverging growth dynamics have in effect selectively supported growth where it is nurtured—such as in the US (fiscal) and Japan (monetary)—while simultaneously diffusing global inflationary pressures, mainly from China’s growth disappointment and now Europe, which fell into a technical recession.

The global economic mix still presents interesting growth opportunities with our views little changed, but we do keep a watchful eye on the contours of inflation including the sustained 27% rally in oil prices from US dollar (USD) 72 a barrel in late June to USD 92 in early September. While rising energy prices keep the inflation trajectory ambiguous, we still expect central bank hawkishness to dissipate—but so may expectations of an early rate cut that could nudge bond yields higher, albeit from levels much closer to fair value.

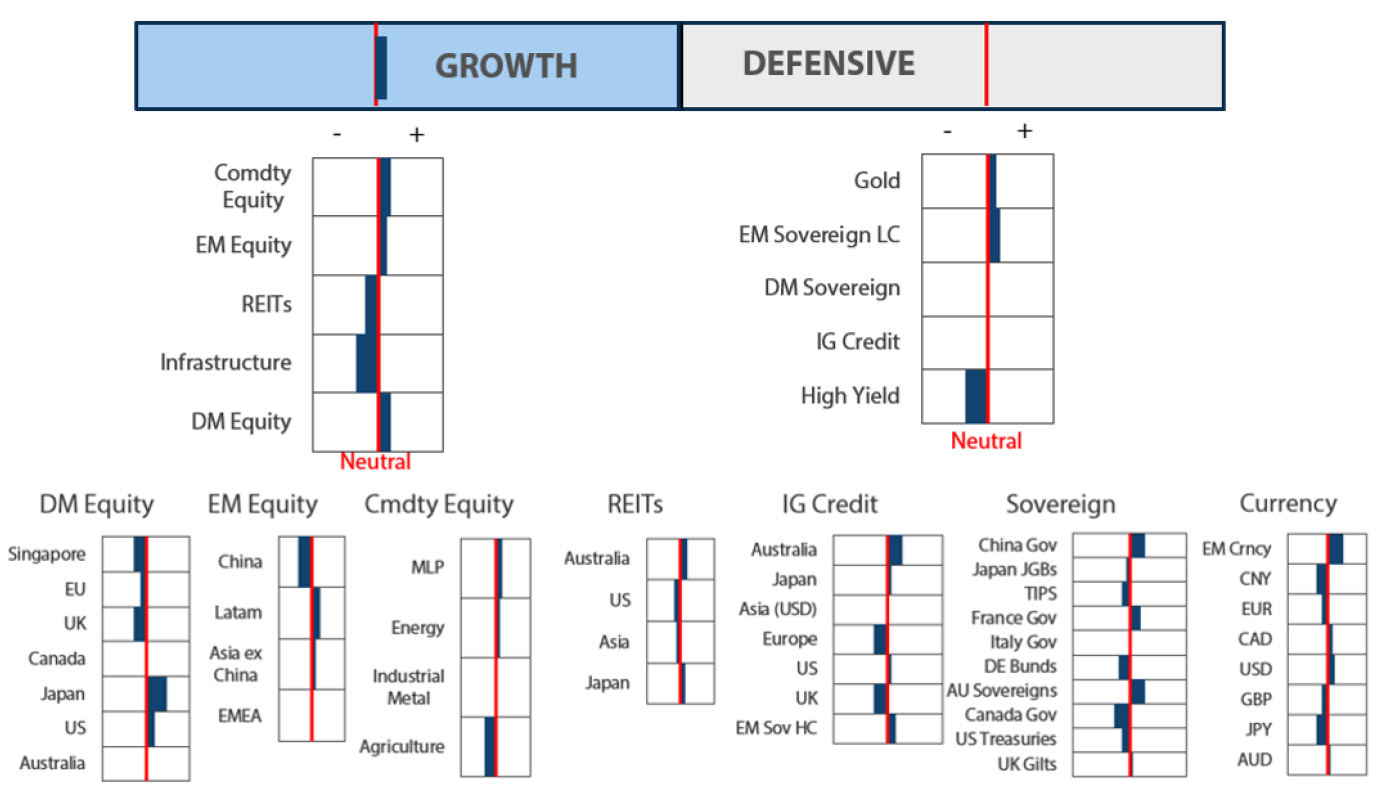

Cross-asset1

We reduced our overweight to growth assets and remained neutral to defensives. We are still constructive on growth assets as a function of still decent growth conditions on the back of US fiscal stimulus and overall strong investment, but we chose to be slightly more cautious on account of elevating yields—particularly real yields which tend to be a headwind to growth.

Global equities were due for a pullback given the extent of the rally since the October 2022 low, particularly in the technology sector. Tech has led the correction, but the story has not changed—particularly after the blowout earnings by Nvidia indicating that the rush to invest in artificial intelligence (AI) continues.

It is odd to say that while the Fed has tightened so aggressively to tackle inflation, from an economic perspective the substantial fiscal impulse seems to have offset the tightening. Nevertheless, this substantial fiscal impulse appears to be the dynamic in play that is supporting earnings and the growth outlook, though with a focus on quality while weaker balance sheets struggle to address the significant increase in the cost of capital. Of course, monetary policy transmits with a lag, so continued monitoring remains critically important.

From an allocation perspective, staying close to the middle still appears to make sense—that is, selective growth opportunities balanced against defensives offering yield that provide some protection if growth should falter. Within growth, we lifted commodity-linked equities again with a focus on energy, partly to mitigate risk of the pass-through of energy to higher rates. This upgrade to commodity-linked equities was funded from small reductions in developed market (DM) and emerging market (EM) equities. Within defensives, we brought investment grade (IG) credit to neutral, funded by a downgrade to high yield (HY), with the change underpinned by our favourable stance towards quality.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

We believe that the growth outlook, though mixed across geographies, remains positive. However, the goldilocks story of falling inflation and “soon to be” falling rates is going through an adjustment phase. August US inflation surprised to the upside, but does this mean sticky inflation is back? In our view, no; but the decline in energy prices, which was a tailwind for falling inflation, seems to have abated. Therefore, as far as headline inflation numbers suggest, tailwinds may be turning into headwinds.

There are many other different drivers of inflation but energy is still an important one. As such, the rise in UST yields amid climbing energy prices may prompt the markets to reprice the perceived timing of rate cuts; it may also be a time to pause and consider the right price for owning equities. Still, the rise in energy prices could be more of an adjustment than an indication of an overheating economy as demand is moderating in the US and Europe and remains very weak in China.

While the rising correlation between bond prices and equities is unwelcome from a multi-asset perspective, the dynamics are quite different from those experienced in 2022 when the Fed had been significantly behind the curve in normalising policy, and bond yields had to rise substantially before fair value could even begin to be priced in. Bond yields could climb further but we expect any such rise to be limited. Such an expectation that any rise in yields will be limited also implies that recession risk is being pushed out even further, which is generally always a good recipe for equities.

We remain constructive on growth assets, but we remain very selective on the right opportunities. The US and Japan are still growth supportive, the former from the strong fiscal impulse and the latter for reforms and still accommodative monetary policy. Of course, the balance of global growth remains critical, but so far stumbling growth in China and Europe is seen to be more of a demand offset rather than a factor reinforcing a net decline in global demand.

The mix of equities is important, and while we like selective growth opportunities, from a risk mitigation perspective we also favourably view other segments of the equity complex that are more immune to higher rates. In terms of risk mitigation energy is such a candidate with attractive valuations and a decent earnings outlook should energy prices stabilise.

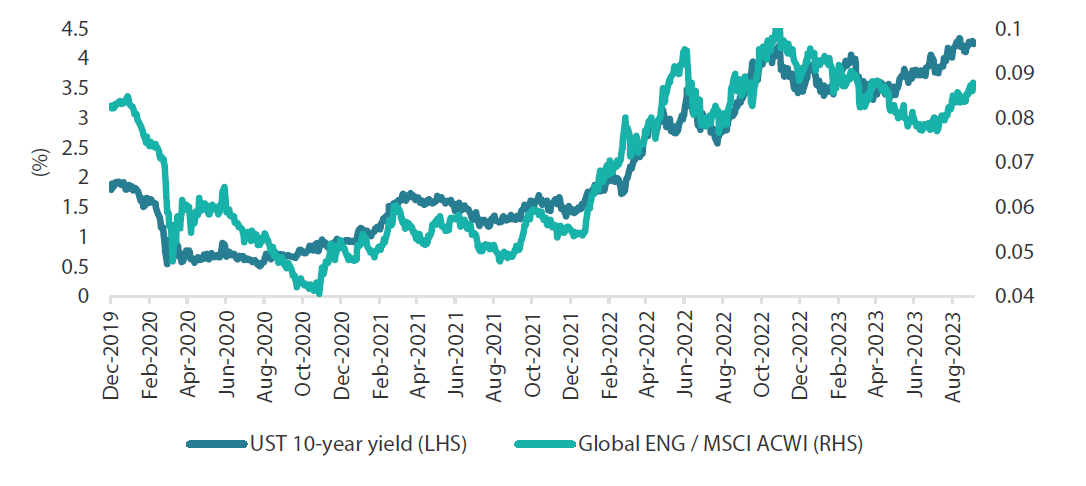

Energy equities as a hedge for higher yields

Energy equities was among the top-performing assets in 2022, with energy prices finding a lift both from the post-COVID recovery in demand and a sizable additional impulse from the Russia-Ukraine war that disrupted the energy market early in the year. Earnings remained extremely strong for energy stocks during this period while valuations were still quite reasonable, helping to lift the sector price quite significantly despite the rise in yields which caused the broader market to strongly derate. Oil prices peaked at USD 123 per barrel in June 2022, and energy companies continued to outperform the broader market until mid-September when central bankers had shifted to maximum hawkishness and fuelled concerns of an impending recession.

Chart 1: UST 10-year yields vs relative performance of energy over MSCI ACWI

Source: Bloomberg, September 2023

The banking crisis in March 2023 reinforced the markets’ conviction that a recession would come sooner than later on the back of tighter credit conditions, but as the economy continued to perform, this risk was steadily priced out—first in the bond market (UST 10-year yields hit a low of 3.35% in May), then in the oil market (crude bottoming at USD 73 per barrel in June 2023), and lastly in energy stocks, which began to outperform the broader market from late July when we first lifted our score for the asset class.

Yields currently appear closer to fair value, but since they remain below the cash rate, there is potential for the level to drift higher as risks of a recession and rate cuts are pushed further out in the future. While the steady decline in inflation had brought with it hopes that the Fed may be given the latitude to cut rates before a recession, the rising price of energy accompanied by an increase in inflation “stickiness” is the risk many will be watching.

Of course, there are supply-side pressures like the production cuts by OPEC+, but for now higher oil prices may also reflect healthy global demand. Therefore, in our view energy stocks continue to offer decent upside potential and a hedge to higher rates.

Conviction views on growth assets

- Still favour Japan and US: Japan equities are favoured for supportive growth dynamics with substantial reforms that are particularly favourable to the equity market. The US benefits from fiscal stimulus keeping demand intact despite tight monetary policy, while a new technology investment boom attributable to AI continues to unfold.

- Commodity-linked equities a favourable rates hedge: As recession risk is priced out of the energy complex an exerts upside pressure to bond yields, commodity-linked equities and energy, in particular, form a hedge against rising rates and potentially stickier inflation though this is not yet our base case.

- Still cautious on China and Europe: both regions continue to struggle, and while it is tempting to add to China purely for its depressed valuations, it is hard to find a catalyst to do so. In Europe, slowing demand with additional pressures from tight policy sees little upside catalyst for the moment.

Defensive assets

We maintained our neutral view on sovereign bonds within our defensive asset classes. Better-than-expected growth outcomes in the US have shifted the sentiment around global bonds from positive to negative. However, other economies are not getting the same level of support from fiscal policy as in the US, resulting in weaker outcomes outside of the US. This divergence suggests that policy may stay "higher for longer" in the US but perhaps not elsewhere. This leaves us with both positives and negatives for sovereign bonds and thus a neutral outlook.

We upgraded our view on IG credit again this month, bringing it up to neutral from slightly underweight. The recent rally in equities paired with stronger-than-expected US data have seen spreads continue to perform well globally. While we expected global growth and tighter financing conditions to cause spreads to widen, so far credit markets have been resilient and the potential for the US economy to avoid a recession may see investment grade spreads tighten for the rest of the year.

We continue to prefer IG credit and maintained our negative view on HY within our defensive asset classes. HY spreads continue to perform well this year despite the economic slowdown occurring through Europe. While the asset class has positive momentum, HY valuations are now somewhat tight as spreads trade slightly below their long-term average. Given the large amounts of monetary policy tightening that has occurred and the potential for increasing bankruptcies, we see poor performance as a risk for HY. However, as fears of recession in the US in the near term ease, spreads could tighten in the short term.

On gold, we have become more cautious from a macro perspective but maintained a positive overall view. Gold has been under pressure in recent months, pressured by higher real yields and a stronger dollar. Gold, in our view, is at an attractive level to be used as a hedge against systemic risks and inflation which could be caused by US fiscal spending. While global central banks are accumulating gold, the precious metal appears under-owned by investors.

Going back to HY, the asset class remains the least favoured within our defensives bucket. HY spreads have performed particularly well this year, despite continued fears that a recession is near. But overall, the outlook for the asset class is uncertain, as slowing lead indicators and tighter financial conditions could lead to spreads widening. While we acknowledge that the asset class has been resilient so far, the recent spread tightening makes the possibility for negative outcomes greater should a downturn occur, and the potential upside of the asset class is reduced with tighter spreads.

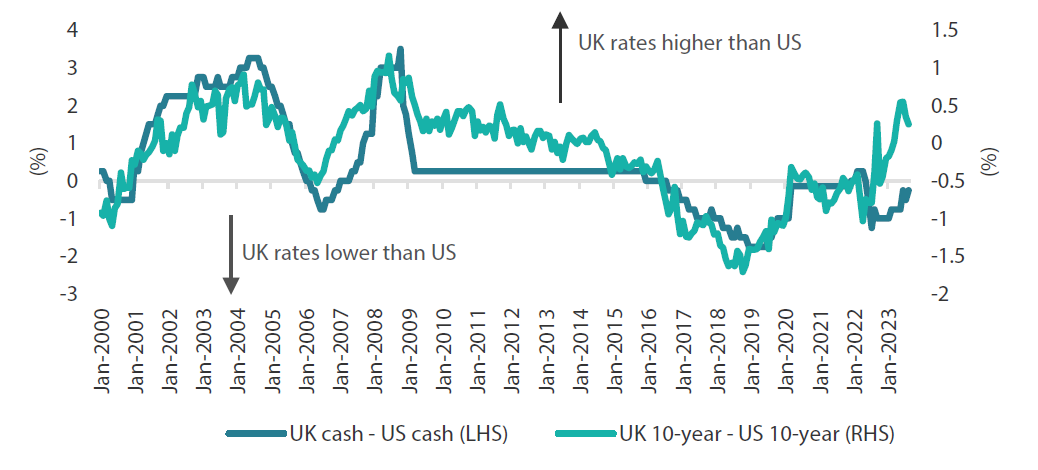

UK divergence

Since the global bond market sell-off got underway in 2022, the UK has had one of the worst performing bond markets with 10-year yields going as high as 4.75%. While many will remember the turbulence of 2022 when the solvency of the pension market came into focus, 10-year yields have continued to move higher since then as inflation sits uncomfortably above the Bank of England’s (BOE) 2% target. The markets expects the UK cash rate to hit approximately 5.60%, before dropping in one to two years’ time. As the chart 2 below shows, this higher-for-longer narrative is causing UK 10-year yields to sit above those of their US counterparts despite a cash rate which is 25 basis points lower.

Chart 2: UK and US interest rates

Source: Bloomberg, September 2023

From an inflation perspective, this interest rate differential is understandable. The UK’s headline consumer price index (CPI) currently sits at 6.8% compared to only 3.2% in the US. And while in the US services predominantly contribute to the strong CPI figures, in the UK goods, food and beverages and services are all exposed to strong upward pressure. These contributions have led the BOE to forecast that inflation will not reach 2% until 2025 and state that “risks around the modal inflation forecast are skewed to the upside”.

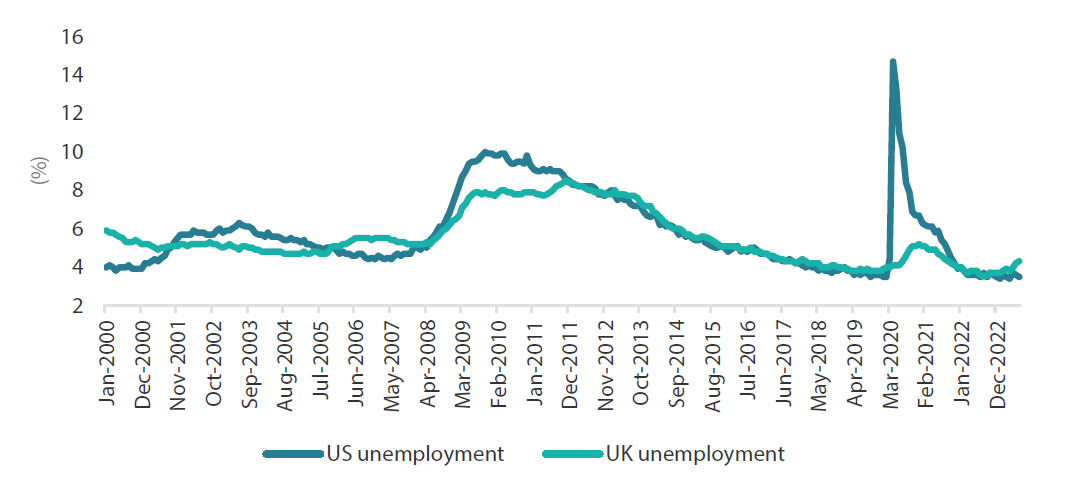

However, despite these stronger inflationary pressures, we see signs that the UK economy is beginning to buckle. Over the past 12 months, the UK economy has registered an anaemic growth rate of 0.4% year-on-year, with each of the past four quarterly GDP prints being 0.2% or below. In addition, the Purchasing Managers Index (PMI) manufacturing series has remained in a downtrend, hitting a contractionary level of 43. Retail sales are declining year on year, and corporate insolvencies have increased to 30-year highs. Additionally, unlike in the US where the unemployment rate is mostly stable, the June 2023 UK unemployment rate had reached 4.3% from a recent low of 3.5% marked in July 2022. Hence while the inflation outlook is clearly worse in the UK, the effects of the rate hikes appear to be flowing through to the economy faster and constraining activity.

Chart 3: UK and US unemployment rates

Source: Bloomberg, September 2023

Hence this raises a question of just how much longer the UK will be able to hold rates higher than its DM peers, as slower growth and rising unemployment will begin to test the resolve of the BOE. This dynamic puts UK gilts into focus, as an economic slowdown is more likely to occur in the UK than the US. In addition, the pound’s recent strength could begin to dissipate, as the market removes the yield premium for gilts and ask when the UK economy could enter recession.

Conviction views on defensive assets

- Australian rates still attractive: The Australian yield curve is still positively sloped, making it better relative value than many of its peers, and its IG spreads are some of the widest in the developed world and offer above-average pickup to other markets.

- Safety in China government bonds: A sputtering economic recovery and further monetary policy easing will continue to support China sovereigns, at least until it shows more robust and sustainable growth.

- Attractive yields in EM: Real yields in this sector are generally very attractive and we prefer quality EM currencies against the backdrop of a generally weaker dollar.

Process

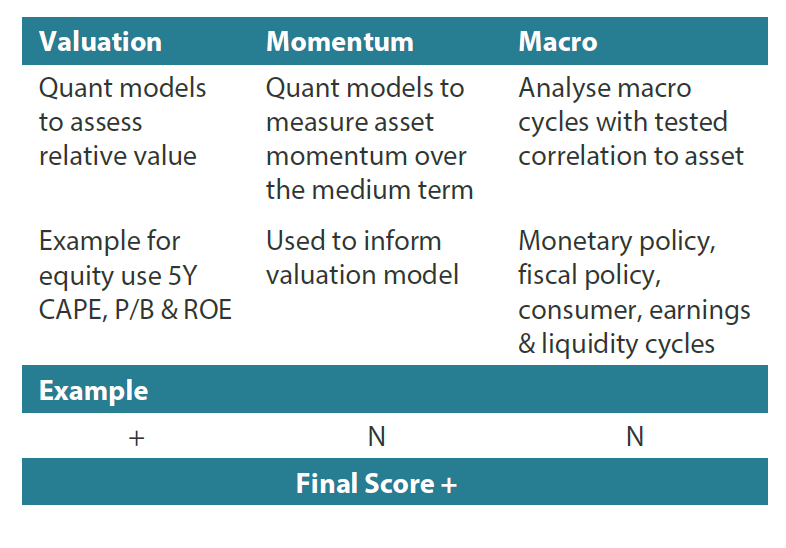

In-house research to understand the key drivers of return:

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.