Snapshot

While market positioning has shifted towards a more constructive outlook, the macroeconomic mood has not. Rather, persistent upside pressures in equity markets have forced investors back into the market so they do not fall too far behind benchmarks and their peers. The equity market bottom in mid-October 2022 is now rather distant in the rear-view mirror, usually indicative of clearer skies and a bullish outlook ahead. But the stubborn macro backdrop—that we are in the late stages of the most aggressive tightening cycle in decades—is a recipe that almost categorically suggests a slowdown cannot be too far over the horizon.

We agree on the eventuality of a slowdown and recession, particularly when one looks around the world to see disappointing growth in China and a recession in Europe that could deepen. However, the fiscal coffers in the US are full and flowing. Combined with strong investment incentives driven by the artificial intelligence (AI) disruption, it is proving to be a formidable counter-cyclical force to keep the economy going. This dynamic can continue, perhaps stretching the downcycle even further ahead.

As investors, we are rather used to the global cycle which is typically synchronised around the world as a function of boom and bust ultimately transmitting through the global trade mechanism. Interdependence and shared outlooks remain intact, but with increasing exceptions as governments and industry take a different path to adjust to a multi-polar world defined by the fault lines of the US-China economic rivalry and the Russia-Ukraine war. While central banks have ruled the cycle for many decades, their power may be diminished with strong secular forces driven by politics and broad-based industry disruption. In the current environment, we believe that it is sensible to remain neutral on these forces as no one can guess which will eventually prevail while growth opportunities today are real and growing.

Cross-asset1

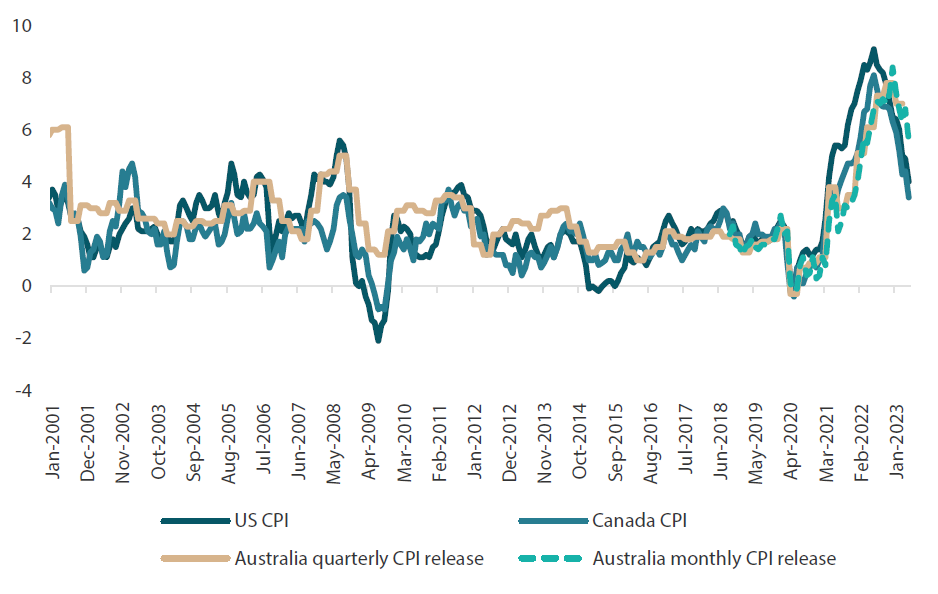

We lifted our underweight growth view to overweight while maintaining the same neutral view for defensives. Despite having endured the most aggressive monetary tightening cycles in recent history, growth endures and new green shoots of growth are emerging. Growth dynamics are at risk in the face of policy headwinds intended to contain them in pursuit of lower inflation. However, we believe that with inflation now trending lower and a slowing in the pace of monetary policy tightening, it is not a forgone conclusion that growth will be extinguished any time soon.

Geopolitically, governments need to invest more for their own security needs, shifting more production to their home markets and moving supply chains to friendly global neighbours, while simultaneously addressing climate change that is still high on the policy agenda. It takes a lot of money, much of it flowing to the private sector, which is also motivated to invest to keep up with transformative technologies such as generative AI which has the capacity to disrupt many industries. While the goal of sustainably lower inflation falls largely at odds with continued large amounts of investment, it is possible that increased productivity can at least partly offset new inflationary pressure. It is impossible to know how this plays out over time, but it is likely to be a bumpy journey where significant opportunities and formidable risks will coexist for some time. Fortunately, these dynamics support growth and defensive assets in nearly opposite ways, offering diversification opportunities that we believe will persist. Hence, we are inclined to take a neutral view on each broad class over the longer term.

Within growth, we increased emerging markets (EM) equities from neutral to overweight, funding it evenly from a reduction to REITs and infrastructure as growth opportunities improve more outside of China. Within defensives, we added to high yield and investment grade credit and EM local currency bonds, as overall growth conditions have shown resilience in the face of tighter monetary conditions.

1TThe Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

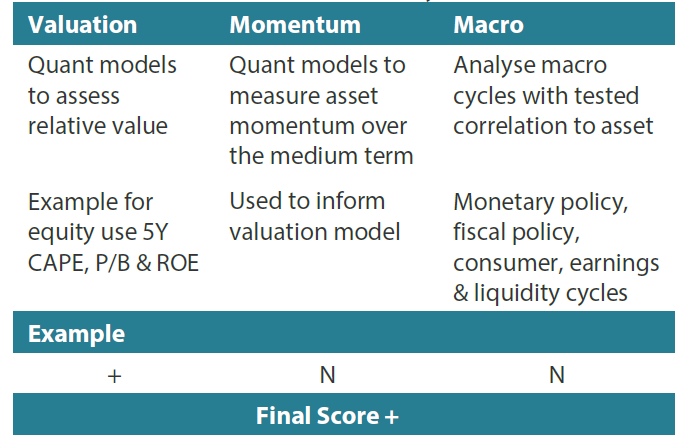

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

In a last-minute update to this report, we increased the growth score mid-month, following the favourable consumer price index (CPI) print for the cumulative data flow that increasingly suggests a soft landing in the US may indeed be possible. This defies conventional wisdom as the US Federal Reserve (Fed) is notoriously prone to overtightening and seemed well on course to do it again. However, inflation continues to dissipate and labour pressures have eased—just enough to make it possible for the Fed to stop hiking before bringing employment over the tipping point into a recession.

We are not convinced that a goldilocks soft landing is yet a probable outcome. But such an outcome is becoming increasingly possible, and not one to bet against, in our view. The fiscal impulse in the US is quite strong and is gathering pace as reflected in new construction. Ordinarily, fiscal impulses would add to inflationary pressures, but this time inflation remains in rapid descent, partly for monetary policy taking effect and also partly for deflationary tailwinds blowing in from the rest of the world, including China and increasingly Europe.

Amidst this disparate growth outlook, areas of risk remain local with different regional opportunities emerging in the US, Japan and parts of emerging markets that benefit from US demand and also favourable local characteristics in this fast-evolving multi-polar world.

The Fed could continue to lift rates to bring in a recession, but the rationale for doing so—that there is no alternative—is starting to ring hollow. Given the continued pace of easing inflation, the Fed should be willing to pause and enjoy a possible soft-landing that few, if any, believed that they could achieve. This is not to say that inflation will gently return to the 2% target. Indeed, we think the “last mile” to 2% inflation will prove very difficult if not impossible, but this is likely a lingering dynamic not to be realised until 2024.

The unnoticed return of the US fiscal thrust

Almost one year ago, following the US dollar (USD) 1.2 trillion “Infrastructure Investment and Jobs Act” (IIJA) signed into law in November 2021, US President Joe Biden signed the “CHIPs and Science Act” in early August 2022, allocating USD 50 billion to semiconductor manufacturing investment. This was followed days later by the “Inflation Reduction Act” (IRA), allocating USD 500 billion in new investment. Many derided the name “Inflation Reduction Act” for its front-loaded spending feature versus back-loaded funding.

Markets nevertheless rallied, helped by a seemingly dovish Fed turn in late July 2022, but bulls quickly turned to bears when Fed Chair Jerome Powell crushed pivot hopes in his “super hawkish” speech given at Jackson Hole in August 2022. Markets plunged to the mid-October bottom almost two months later, but while markets have been laser-focused on inflation dynamics to surmise when the tightening cycle might end, investment stimulus has quietly gathered momentum.

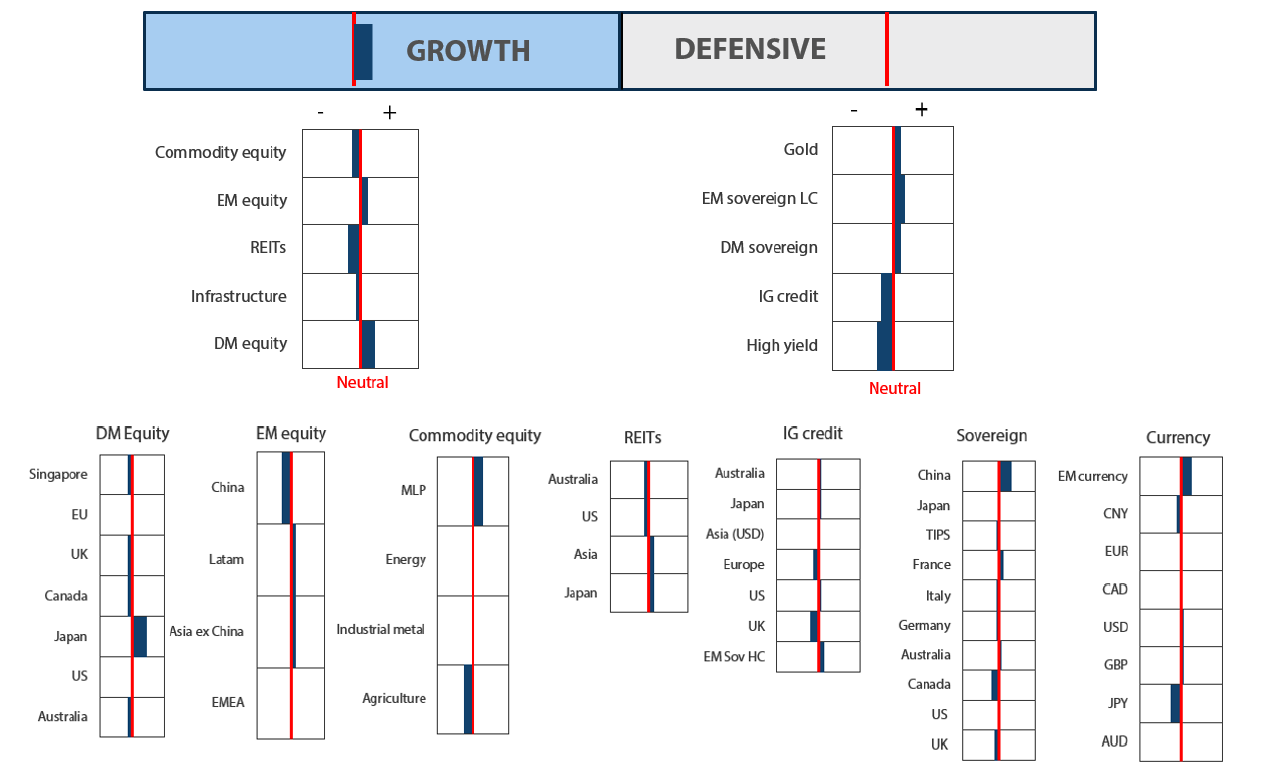

Chart 1: Private construction, growth led by new manufacturing facilities for computers & electronics

Source: US Census Bureau, July 2023

Source: US Census Bureau, July 2023

Most, like ourselves, have been stumped as to why the labour market has remained so buoyant given the aggressive tightening cycle to date. Part of it has to do with the burn of excess savings (USD 2.2 trillion in 2021 dissipating to USD 660 billion today) supporting demand while the labour market has yet to fully recover. However, it is becoming increasingly clear that new construction is an important feature in supporting demand and creating new jobs.

Meanwhile, inflation continues its descent, so far not evidencing upside pressures due to fiscal excesses as originally feared. Then again, perhaps such pressures are offset by weakness elsewhere—China growth disappointment and Europe entering a technical recession. In any case, the US growth story looks balanced and sustainable for now, while new developments in AI have opened a new host of investment opportunities.

Conviction views on growth assets

- Favour Japan and US: Both countries lead the growth recovery, Japan exiting deflation with a strong reform agenda while the US finds support from new investment on the back of stimulus and new AI technologies.

- Favour pockets of EM: Latin America (Latam) is seen to be well-positioned to benefit from high real rates with a likely easing cycle starting later this year. Mexico, in particular, looks attractive for the twin tailwinds of impending rate cuts and its preferential status in the US supply chain to feed US investment. India benefits from cheap energy, strong demographics and now new manufacturing supply chain opportunities in the Middle East and the US. South Korea and Taiwan benefit from an impending upturn in the chip cycle.

- Cautious on China and Europe: Outside of the US and those noted above that would benefit from upturns in demand, China and Europe look likely to remain challenged. China confidence is deeply damaged and stimulus is unlikely to be large enough to turn the situation around. Europe is in a technical recession, and the European Central Bank (ECB) remains on course to tighten even further, while German PMIs are not contracting.

Defensive assets

We maintained our overweight view on sovereign bonds within our defensive asset classes but with a slight downgrade to developed market bonds matched by an upgrade to EM bonds. It was a mixed month for global sovereigns as central banks wrestled with effectively communicating the path forward for the relentless tightening campaign that started over a year ago. While the Fed paused in June, some other central banks either continued or restarted their tightening cycles, and all while global inflation is trending down and economies are slowing. Conversely, unemployment rates remain quite low in most countries and this contrast has made the situation challenging for bond markets again this year. Real yields have also risen and are very attractive across a number of EM sovereign bonds which is also supportive of local currencies.

We upgraded credit slightly again this month but retained our underweight view. The recent rally in global equities markets has led to a contraction in credit spreads that has outweighed the negative contribution from rising global government yields. The growth outlook also remains challenging as central banks have yet to end their global tightening campaign. Nevertheless, employment strength has kept economies from sliding into recession and pessimism has not been rewarded so far. Looking ahead, we expect the twin headwinds of monetary policy tightening and tighter bank lending conditions to continue to pressure borrowers as we enter the second half of the year.

We remain positive on gold but downgraded our view to modestly overweight. Gold prices have gained relative to the dollar this month after trending lower from recent highs reached in May. However, gold has weakened against the Japanese yen as it failed to keep pace with the currency’s strengthening. Overall, we remain constructive on demand for the precious metal as central banks continue to add gold to their reserves and investor positioning remains low.

RBA pause—fool me once?

After claiming that interest rates would not rise until 2024, the Reserve Bank of Australia (RBA) has embarked on its fastest tightening cycle in history, increasing the cash rate from 0.1% in April 2021 to 4.1% over a period of 14 months. Yet for the second time this year, the RBA has decided to skip increasing the cash rate to provide time to “assess the state of the economy… the economic outlook and associated risks”. This is not dissimilar to the rationale given when the central bank paused briefly in April, at which point “time to assess the state of the economy” turned out to be 30 days, as it followed up with two 25-basis-point hikes in May and June.

While the RBA’s speeches over the past 24 months make it hard to read too much into their actions, there is an increased likelihood of rates being on hold for a longer period than in April. From a timing perspective, the RBA’s decision to pause in both April and July reflects the fact that inflation is a quarterly release in Australia, with data being released in those respective months.

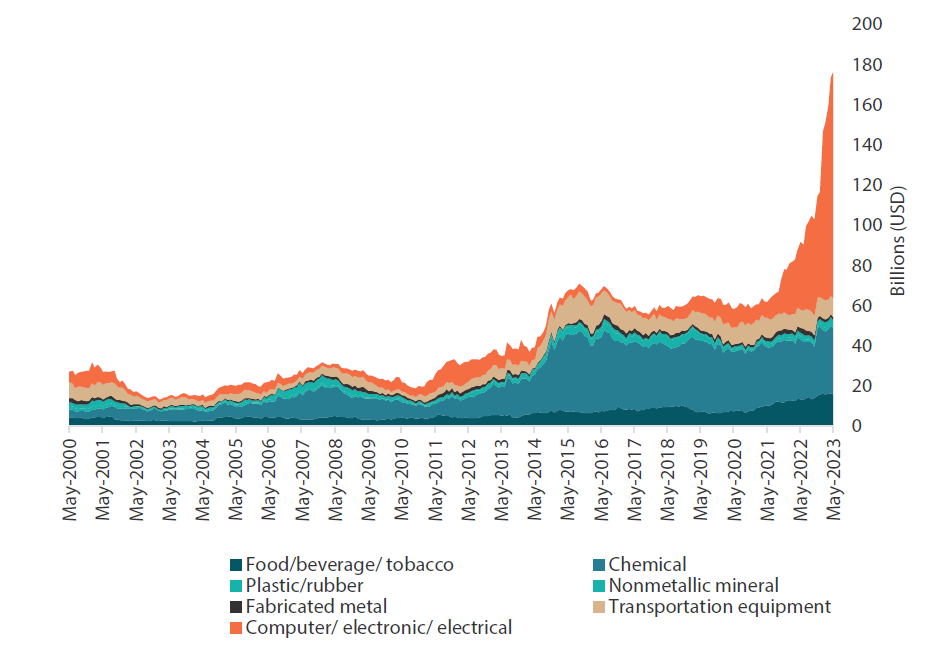

And while inflation was higher than expected in April, tentative signs suggest that this will not be the case in July. The recently introduced monthly Australian inflation index has begun to fall, registering 5.6% in June, after peaking at 8.4% in December 2022. Australian inflation has mostly been in lockstep with Canadian and US inflation in the post-pandemic period, much like it has been for the past 20 years. As Chart 2 shows, inflation in Australia appears to be six months behind the US and Canada, taking a few extra months to rise but peaking at a similar level and likely now turning lower from its multi-decade highs.

Chart 2: Australian inflation versus US and Canadian inflation

Source: Bloomberg

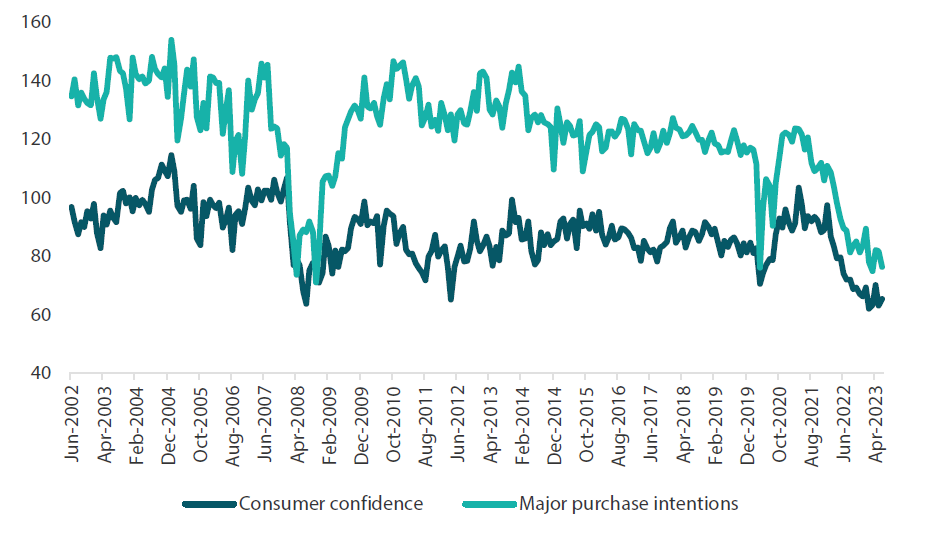

Much like its offshore peers, the unemployment rate in Australia remains strong, and GDP growth, while slowing, is not in recessionary territory. However, unlike those peers, Australia’s mortgage market is predominantly a floating rate market, meaning the flow through of interest rates to households should occur faster with each RBA action. Early signs of the effect of this passthrough have become evident in Australia as shown in Chart 3. Household consumption has begun to slow, real retail sales are registering declines, consumer confidence is on its lows and surveys of large purchase intentions have rarely been lower. The RBA is aware of this dynamic and earlier this year stated that mortgage repayments as a percentage of household income “were projected to be around an historic high later this year”.

Chart 3: Australian consumer confidence

Source: Bloomberg

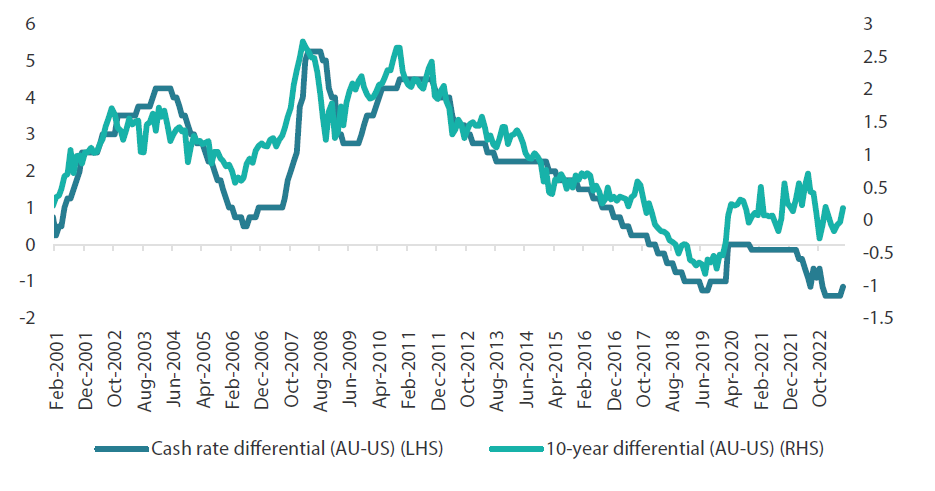

Should Australian inflation continue to move similarly to those of Canada and the US, then Australia should be approaching its terminal rate as household debt servicing costs reach all-time highs. Assuming there are only one to two hikes left in both Australia and the US, the cash rate differential should end with the Australian cash rate approximately 100–125 points below that of the US. As Chart 4 shows, this cash rate differential implies that Australian 10-year bonds should trade approximately 50 points below the 10-year US bond, making Australian interest rates a standout market in the developed world.

Chart 4: Australian and US rate differentials

Source: Bloomberg

Conviction views on defensive assets

- China bonds still offer stability: Growth has slowed materially in the second quarter, prompting the People's Bank of China to ease monetary conditions and provide support to bonds in the process. Stability also arises from their low correlation to global rate moves.

- Attractive yields in EM: Real yields in this sector are generally very attractive and we prefer quality EM currencies against the backdrop of a generally weaker dollar.

- Prefer French government bonds: The ECB's determination to bring inflation down rapidly has them tightening into an already weak economy where inflation is past its peak and trending down, increasing the risk of overtightening. We prefer French bonds as our pick in Europe given their mix of stable finances and yield premium over German bunds.

Process

In-house research to understand the key drivers of return: