Snapshot

It is not surprising that after the S&P 500 posted negative returns for seven weeks in a row (from the beginning of April through the third week of May), market participants became firmly bearish with an increasing contingent calling for an imminent recession. Defined as negative growth for two consecutive quarters, a recession is certainly in the realm of possibilities (if not probable). However, it may be more a reflection of continued extreme economic volatility following the COVID-19 pandemic, rather than a conventional recession that follows an extended period of economic expansion.

The economic shock that began with COVID-19 lockdowns in early 2020 is still reverberating—from an extreme decline to an outsized upswing, and the aftershocks continue. Policymakers eased the pain into the downturn, but the “all-in” stimulus effort followed by a panicked withdrawal has exaggerated the dysfunctionality of the inventory cycle, where channels of supply and patterns of demand remain imbalanced and highly out of synch. Growth may slow as stimulus is withdrawn and now, excess inventories enter the early stages of burn-off period, which is disinflationary.

Markets are currently pricing for a tightening of as much as 75 basis points in the upcoming Federal Open Market Committee (FOMC) meeting. If the US Federal Reserve (Fed) stays on this projected course, a recession seems likely. But if the whippy data relieves inflationary pressures at the margin—say, with the inventory burn-off—the Fed can and likely will adjust accordingly. The cycle is different in that tightening is less about draining credit excesses from the system than speculation driven by an overextended period of stimulus. Critically, the private sector maintains healthy balance sheets, and there are many pockets of the global economy and capital markets that did not participate in the stimulus-fuelled bubble. They still stand to benefit from returning demand, provided the Fed is not compelled to crush the recovery.

Of course, there are no shortage of risks, and key among them are the potential unintended consequences emanating from the Russia-Ukraine War and the sanctions that followed. For now, provided there are no major policy errors or mistakes, easing growth and with it some degree of inflationary pressures, risk appetite may find some support—but limited to those portions of the market that did not participate in stimulus-boosted earnings and multiple expansion excesses.

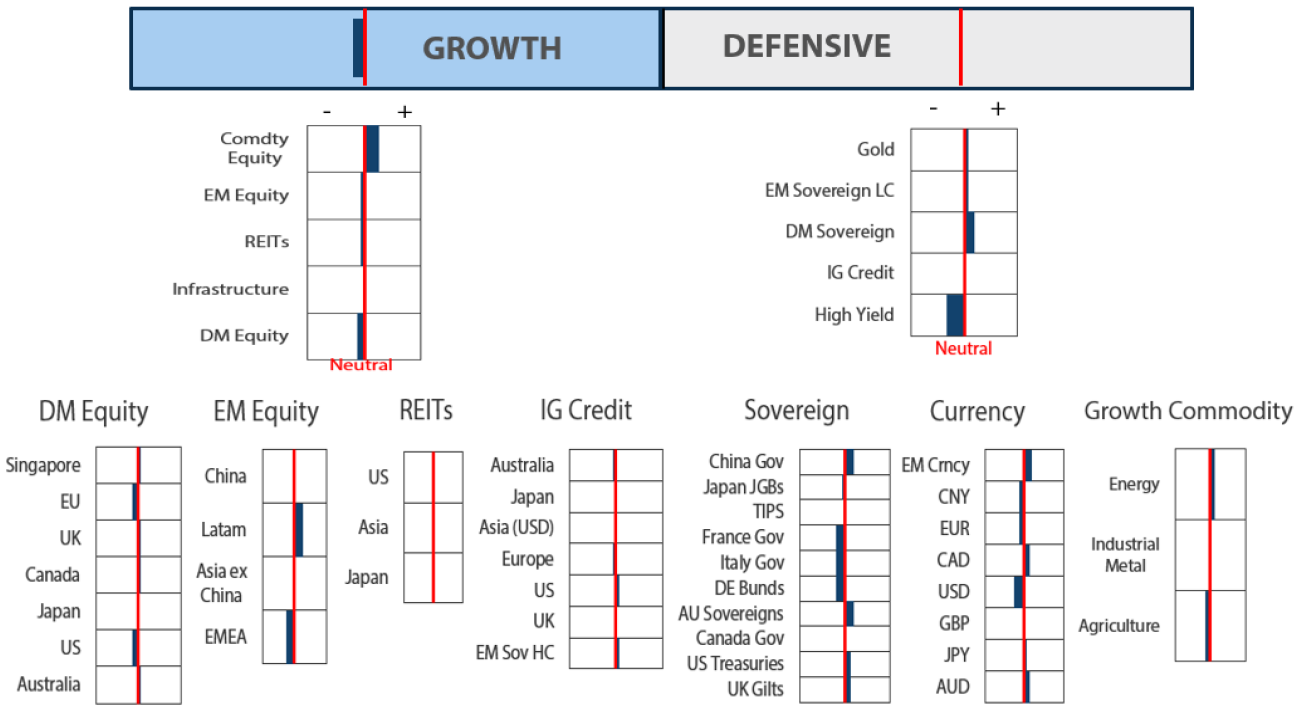

Cross-asset 1

We maintained an underweight to growth assets while increasing defensive assets to neutral on our view that the aggressive repricing of rates is likely behind us, at least for now. Given the tightening of financial conditions, demand is likely to slow at the margin which could impact jobs numbers and other growth measures in the months ahead. Coupled with fading inflation—mostly base effect but with the potential to fade more on sliding demand data—the pressure may be off central banks to sound ever more hawkish in expressing policy intentions. Indeed, some FOMC members have already hinted at the possibility of a rate pause and allowing high levels of bond volatility to ease.

The shift has implications across assets, which is mainly supportive of asset prices—albeit with many risks still hot on the horizon. This month, we added commodity-linked equities to the growth bucket, meaning that we score it relative to other equity risk exposures. Given our positive view on this asset (a view that we have maintained for some time), we assigned it the highest weight among equity peers, funded from REITs and Infrastructure. While inflation may ease at the margin, production-side impediments continue, which is supportive of commodity prices and earnings. On the defensive side, we reduced high yield (HY) and, to a lesser extent, credit on the premise that weaker growth data adds pressure to spreads; however, we are mindful that if relief transforms into a broader rally in risk assets, spreads have the potential to compress as well. We added to developed market (DM) sovereigns, emerging markets (EM) local currency and gold, which are all likely beneficiaries if Fed policies continue to tilt more dovish.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Given the latest “ugly” inflation print coming from the US, we are left to wonder if the Fed will indeed kill the recovery to bring inflation “under control”. The fact of the matter is that while the Fed can tame inflationary pressures when driven by excess demand (usually fuelled by credit), they will readily admit that they cannot fix supply-side shocks with blunt monetary instruments, except perhaps to crush demand, requiring a deeper recession.

Policy has two sides: (1) central banks that drive monetary policy affecting mainly demand side and (2) political leadership that drives fiscal policy affecting demand, along with other policies that have more effect on the supply side. Collectively, these policies drive supply-demand dynamics, and clearly it is the political faction that has more control over the supply side. Currently, while political leadership has already pulled back on the fiscal impulse to ease demand pressures, other regulations (and sanctions against Russia) are less favourable to supply-side pressures.

Our greatest concern for prospective growth is the lack of coordination between the two sides of policy, monetary and political. In times of war, as currently exists between Russia and Ukraine—and by proxy, NATO and Russia—it can be difficult to coordinate both political policy and monetary policy, but this does not change the mandate of central banks, which is to adhere to its inflation target that is currently significantly out of range.

However, as central bankers pursue their mandate to head off inflation while political policymakers are avidly focused on other matters, other legacy central bank policy pursuits are at risk. Chief among them is Europe where dis-/de-flationary conditions gave cover back in 2012 for then European Central Bank (ECB) chief, Mario Draghi, to declare that the ECB would do “whatever it takes” to keep the Eurozone together through an extended arsenal of monetary tools.

Necessarily, as this ECB prepares to meet its own mandate to fight inflation, some of these measures will have to be withdrawn. This will be an important watch point in the coming weeks or months as the ECB forges ahead in its plans to tighten and what the impact will be on the state of the Eurozone.

The European policy conundrum

Europe is in a difficult position for multiple reasons. It is near the epicentre of the Russia-Ukraine War and is greatly dependent on Russia supply to meet its energy needs. With the massive sanctions imposed on Russia, including direct measures to stop or slow energy imports from Russia, Europe is in a precarious position to find alternative supplies, which become more imperative later in the year as the winter months near.

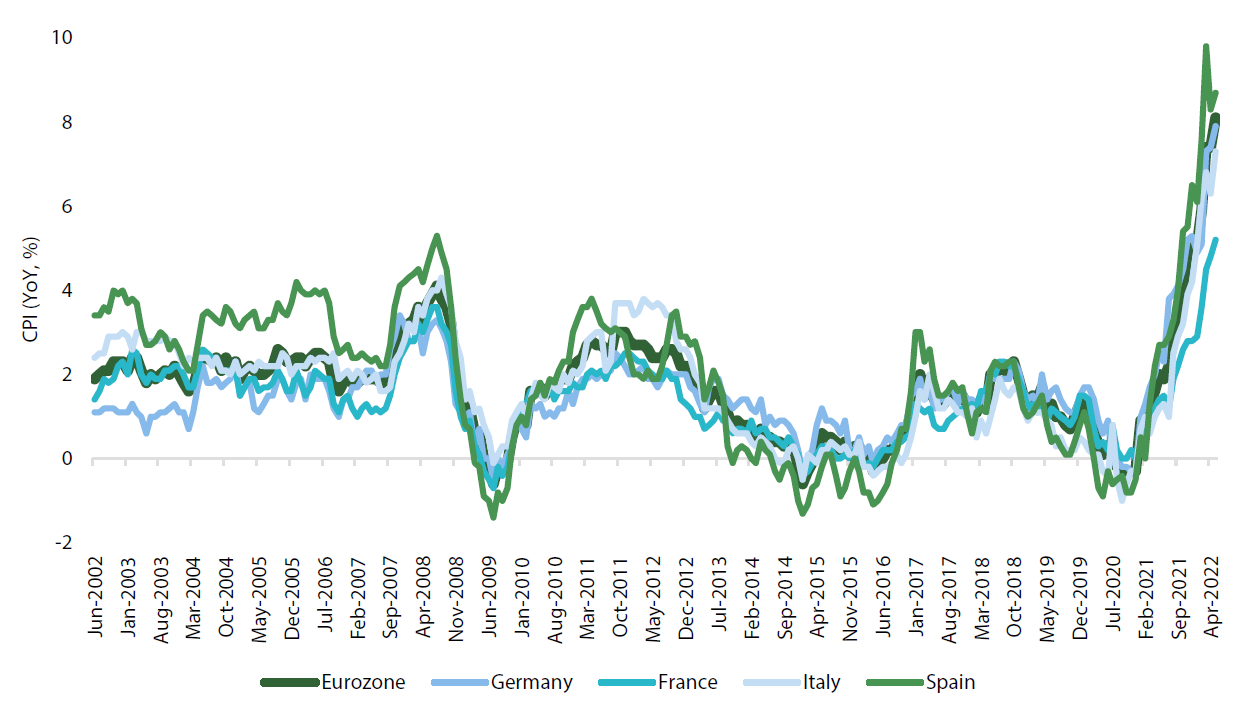

In the meantime, the supply-side constraints including energy are driving inflation to record levels not seen in many decades. This inflationary dynamic is shared by many other parts of the world, but it is different for Europe in the sense that it has been essentially stuck in a deflationary condition for about a decade.

Chart 1: Inflation across Europe

Source: Bloomberg, June 2022

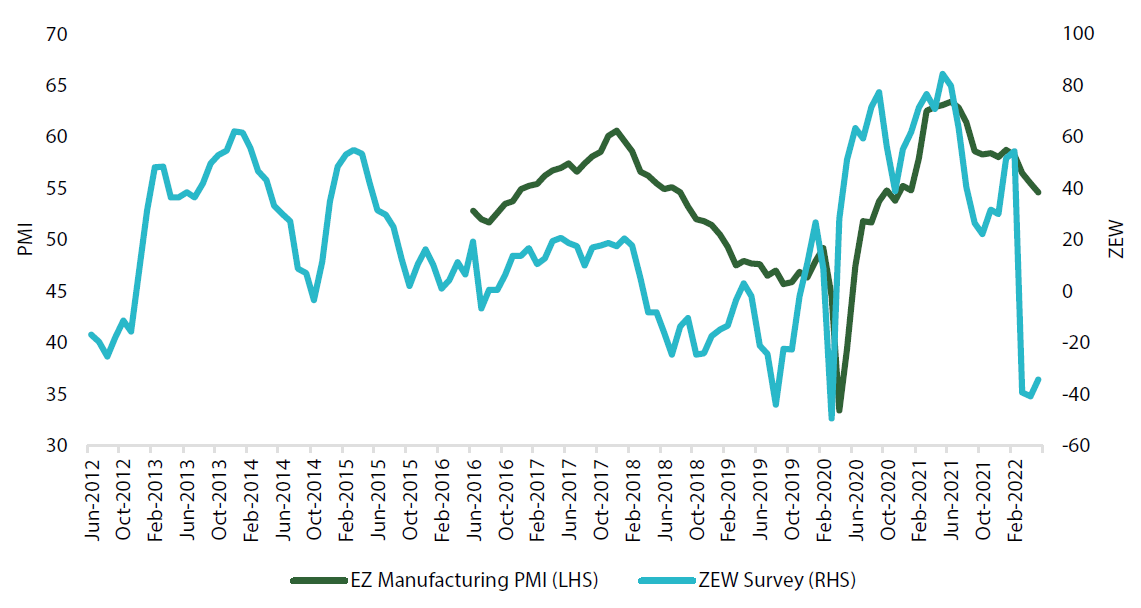

European growth is slowing, but surveys suggest that the growth outlook is deteriorating rather quickly. Part of this is driven by supply-side constraints and inflation at home, but China’s adherence to zero tolerance policies with rolling lockdowns also does contribute, considering the relative dependence of Europe on China demand.

Chart 2: Eurozone PMIs and Germany Expectation of Economic Growth (ZEW)

Source: Bloomberg, June 2022

European equities certainly look inexpensive on the surface, and there is evidence of valuation support, but earnings are clearly at significant risk given the near certainty of a recession. The question is how deep the recession will be. We do believe that China demand will improve later in the year, which would certainly be a tailwind for Europe. However, the removal of extraordinarily easy policy implemented for more than a decade is a serious unknown.

For the moment, we stay very cautious on Europe, which will hinge not just on the degree of its recession but also how it manages the unwind of its accommodative policies. For the moment, the cost of capital in the periphery is on the rise relative to the core, so it will be an important watchpoint to assess the degree of systemic risk as the ECB’s journey to tighter policy progresses.

Conviction views on growth assets

- Relief rally averted: We still believe that numerable aspects of inflation will prove transitory, particularly as it relates to the inventory cycle where companies will soon be draining excess inventories. The wild card is that energy is a key risk to the print numbers, and higher energy prices are keeping inflation prints high. Markets are pricing even more tightening ahead and central banks are currently in alignment, so it is difficult to see the case for a relief rally just yet.

- Broadly cautious: So long as central banks stay on their aggressive course to tame inflation and inflation print numbers do not relent to adjust this course, recessionary risk is certainly on the rise and so is demand. We still like commodity-linked equities for their inflation mitigating characteristics, but even these assets are at risk if recessionary risks continue to be on the rise.

- Long-term structural headwinds: To be clear, we still believe the global economy will need to adjust to structurally higher inflation as a function of commodity price pressures and deglobalisation that continues. This will take time, and we expect volatility to remain elevated for some time as the adjustment continues.

Defensive assets

Our positive view on sovereign bonds has certainly been challenged this month. Even though annual core inflation rates have begun to peak across developed economies, headline inflation is still pushing higher. Rising energy prices continue to flow through, and central bankers have seemingly given up on differentiating between sources of inflation, be it driven by the supply side or those from the demand side. At the same time, financial conditions have already tightened substantially even though we are still in the early stages of central bank actions. While it is evident that rising oil prices continue to feed into headline inflation pressures, they are also putting the squeeze on household budgets. Central banks will need to balance these forces going forward and therefore we continue to view the current market expectations for aggressive rate hikes this year as overzealous.

We downgraded our view on credit this month as the widening trend for spreads continues. While the push higher has been reasonably orderly to date, the potential for central banks to overtighten monetary policy in pursuit of lower inflation is also rising. Credit fundamentals are still robust, but risk sentiment has soured as US equities struggle to find their footing. Spreads have maintained a tight negative correlation to global equities and so we remain cautious until sentiment turns for the better.

Gold prices have undergone a significant correction since mid-April as the outlook for hikes in the Fed funds rate turned more hawkish. Longer term US real yields also turned positive over this period, likely reducing demand for gold as an inflation hedge relative to inflation linked bonds. As a result, we remain cautious on gold for now.

The ECB’s challenge

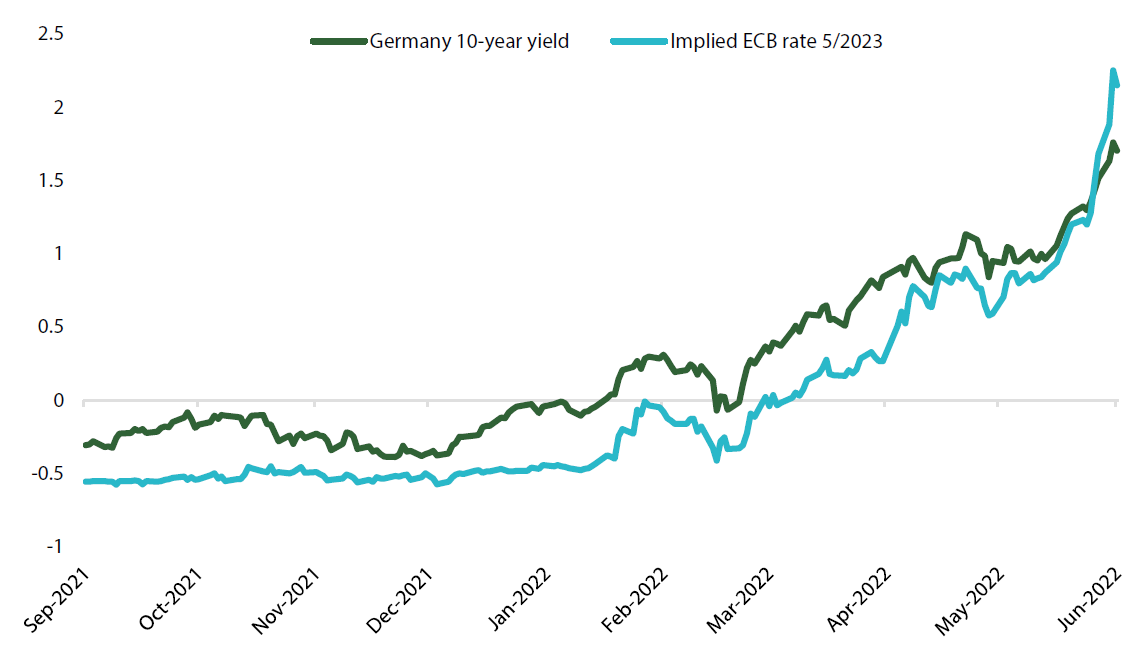

European bond yields have risen in line with global trends. German 10-year Bunds began the year with negative yields and are now over 1.5%. Chart 3 also shows the significant change in market expectations for the ECB’s monetary policy, from a no-change in rates to a deposit rate exceeding 2% in a year’s time.

Chart 3: Germany 10-year yield versus cash rate expectations

Source: Bloomberg, June 2022

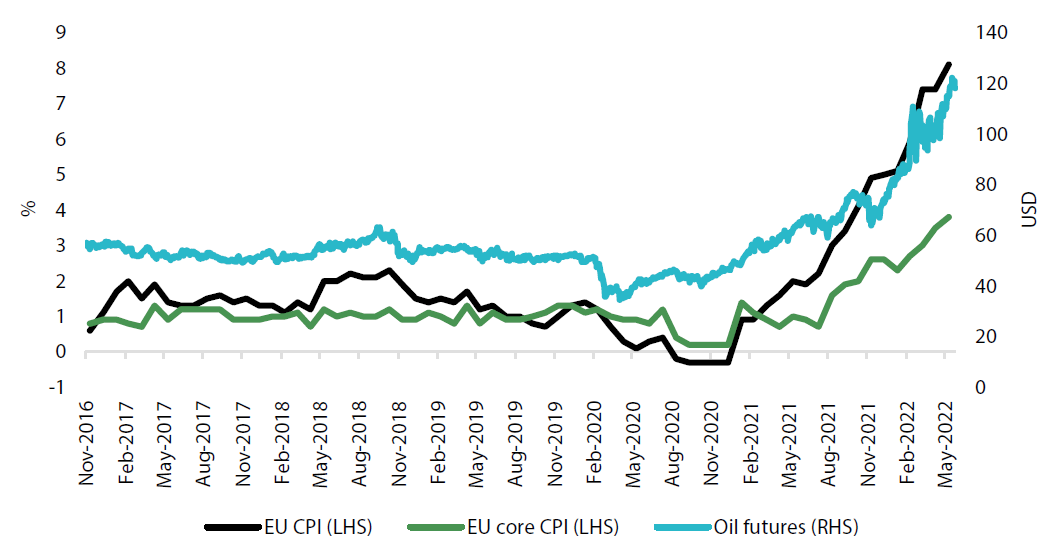

Viewed primarily through an inflation lens, this aggressive path for monetary policy tightening would seem reasonable. Eurozone CPI is undoubtedly running hot, exceeding 8% per annum, as shown in Chart 4. Core inflation is not nearly as strong, at just under 4%. However, the challenge for all central banks is how to bring down inflation that is strongly impacted by volatile inputs such as energy and food prices. Along with many other countries and regions, European inflation is currently being pressured by rising oil prices.

Chart 4: Eurozone inflation versus oil prices

Source: Bloomberg, May 2022

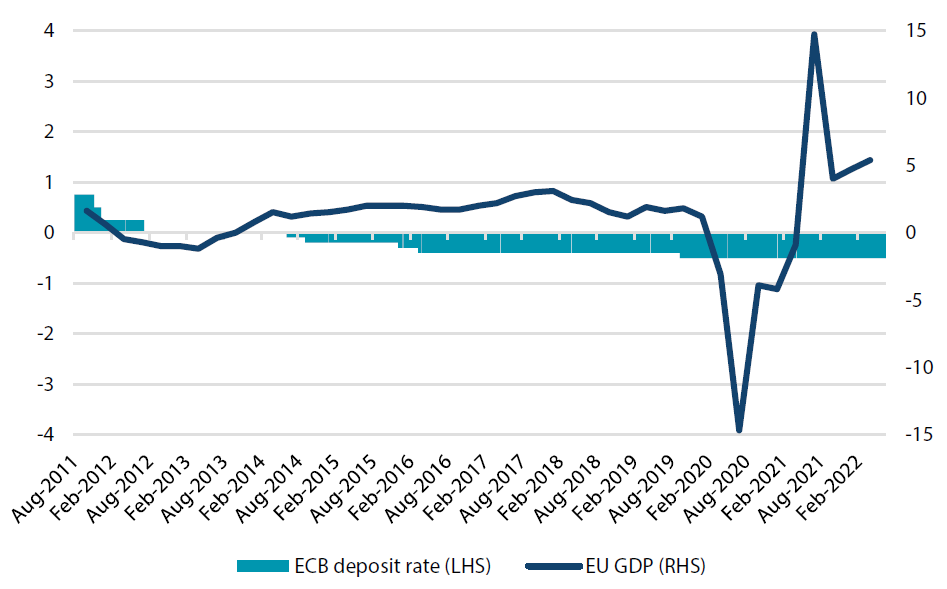

These strong inflation pressures most certainly present a particular challenge for the ECB given its monetary policy over the last 10 years. Chart 5 shows annual GDP growth averaging a little over 1% in Europe over the last 10 years. For most of this period, the ECB’s monetary policy has been very supportive with a negative deposit rate and two significant periods of quantitative easing starting in 2014 and again in 2020.

Chart 5: ECB deposit rate and EU GDP

Source: Bloomberg, May 2022

This begs the question as to how much ECB tightening can Europe really withstand in its pursuit of taming inflation. Its economy has only managed to grow at 1% even with the extraordinary support from the ECB since 2014. Against this backdrop, we believe that scepticism around the ECB’s ability to raise rates at the pace implied by market pricing is surely warranted.

Conviction views on defensive assets

- Back to being cautious on duration: While core inflation measures have shown signs of peaking, headline inflation is still on the rise. Central banks are responding to these headline pressures and seem willing to apply the monetary policy brakes strongly in response.

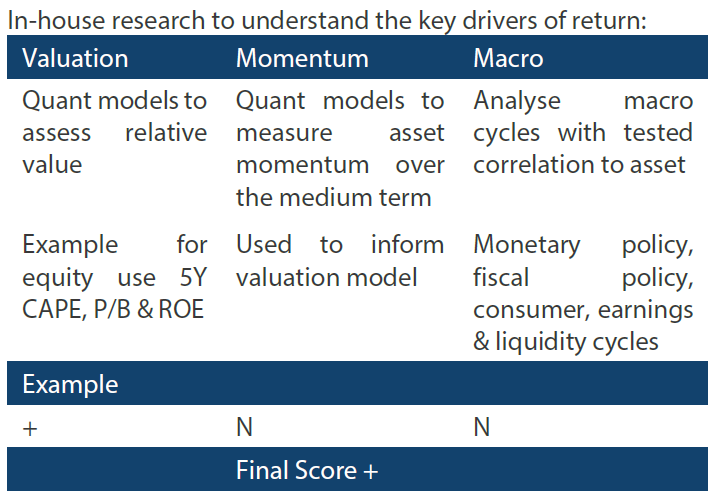

Process

In-house research to understand the key drivers of return: