Snapshot

As we contemplate a post-pandemic world, it is becoming more likely that things will not return to “normal” as we once knew it. While vaccines have been highly successful in preventing serious illness in those who are still contracting the virus, the Delta variant of COVID-19 is also proving to be harder to contain. Countries are learning to live with the virus and minimise its impact on public health. The effect of this will be shifting patterns of demand from pre-pandemic norms and perhaps a more gradual continuation of the recovery after the initial strong bounce back. In the meantime, economies are still being supported by highly accommodative monetary and fiscal policies.

In the short to medium term, however, a number of central banks have begun discussing a reduction in their unprecedented monetary policy. This process has the potential to lift volatility as economies and markets adjust to a gradual reduction in global liquidity. We also expect greater uncertainty around fiscal policy as the pandemic emergency subsides and deficit hawks regain their voices. While both monetary and fiscal policies have successfully supported the global economy through a very difficult period, economic activity will have to become more self-supporting in the future with less government intervention.

Perhaps the biggest determinant of how quickly central banks will act to reduce monetary policy support are inflation outcomes over the next six months. Inflationary pressures have been rising in many of the world’s developed economies, but the US has stood out with its high core inflation readings. Some US Federal Reserve (Fed) officials have suggested that quantitative easing (QE) asset purchases should be reduced soon, but Chairman Jerome Powell continues to advise that patience is still required. There is certainly support for his view that today’s inflationary pressures will prove to be transitory, but it nevertheless is still a forecast. We don’t yet know whether inflation will prove “stickier” than anticipated. What we do know, however, is that we will be joining the central banks in keenly assessing both inflation and employment data in the coming months.

Over the last decade, markets seemed almost trained to believe in binary outcomes contingent on stimulus being added or removed, however slowly. This makes some sense following the Global Financial Crisis (GFC) given the extent of systemic damage that did require a more prolonged stimulus programme. This time around, the financial system is healthy and spreading growth has the potential to be more self-sustaining. Of course, the path toward that end will not be easy with spikes in volatility virtually guaranteed, and while we remain cautious on this front, the growth outlook remains quite positive, in our view.

Cross-asset1

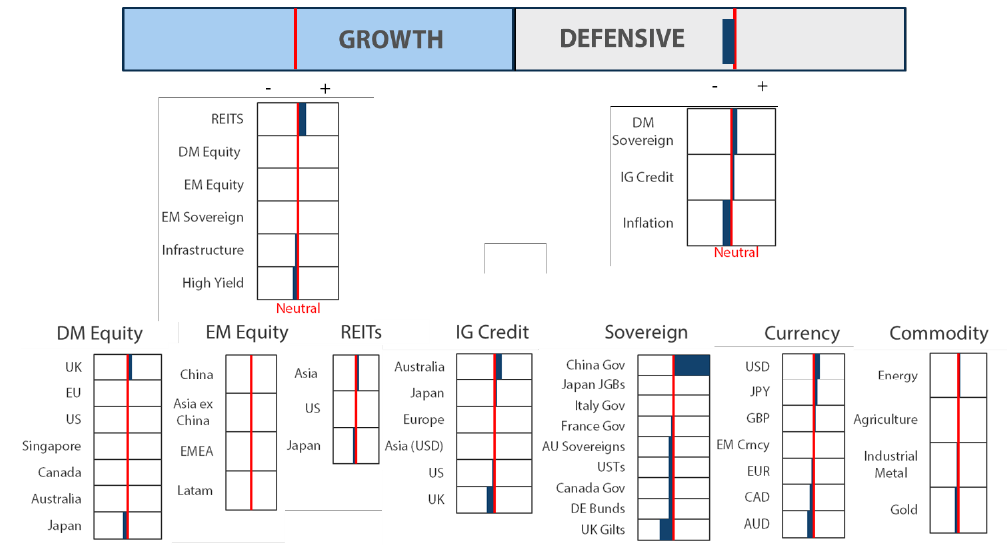

We maintained our neutral view on growth assets and marginally downgraded further our negative view on defensive assets. Volatility has been low through the North American summer months and US equity markets have continued to reach new highs. These calm waters have benefitted both growth and defensive assets, although we foresee some challenges for markets ahead. The strongest stage of the rebound in economic growth is likely behind us now. Potentially softer outcomes may lie ahead in the face of persistent difficulties in controlling the Delta variant and a reduction in fiscal support as pandemic-related payments begin to wind down.

The Fed has also begun to signal a reduction in its large-scale asset purchases later this year. Our concern at this stage is that traditional defensive assets in fixed income may become a source of volatility as opposed to a mitigator of risk. Recent communications from the Fed and other central banks have shared a common theme in viewing the current higher levels of inflation as transitory. The jury is still out on how global growth and inflation will settle in a post-pandemic world and we have kept our allocations steady this month, with only a slight tempering of our positive view on REITs and negative view on listed infrastructure.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Equity markets are often viewed as the best predictor of future economic performance and, through this lens, the US outlook remains quite “outstanding” with barely a pullback since the US elections in early in November 2020. For the rest of the world, the outlook has been much more varied, more or less following the various COVID-19 waves and prospects for achieving herd immunity through the vaccine rollout.

The logic of US outperformance does make sense, as its massive fiscal and monetary stimulus, along with its fast vaccine rollout versus the rest of the world, have collectively driven powerful earnings results. However, markets may have overshot, particularly when one considers that current positioning favouring the US over the rest of the world has never been more divergent.

Why is positioning so extreme? There may be several factors at play. First, the regulatory crackdown on China tech is most certainly driving capital flows to the calmer regulatory waters of the US. Second, while risk appetite almost always takes a hit as the Fed prepares to withdraw stimulus—as it is now with the impending taper—US equities can prove to be more defensive. This is particularly true if a shift toward tighter policy leads to a stronger US dollar, which often matters less to US equities than the rest of the world.

We watch the dollar closely to help guide our growth outlook. Lately, it has shown strength, indicating growth headwinds in the form of the Delta variant spread, but dollar strength is also reflecting the anticipated rise in rates as the Fed begins to taper. Even still, we see the global recovery continuing, albeit at a slower pace, which should temper the rise in rates while allowing the dollar to stabilise. In this sense, we believe it is a good idea to look for opportunities outside the US that are offer far greater value than the perfection seemingly priced into US equities.

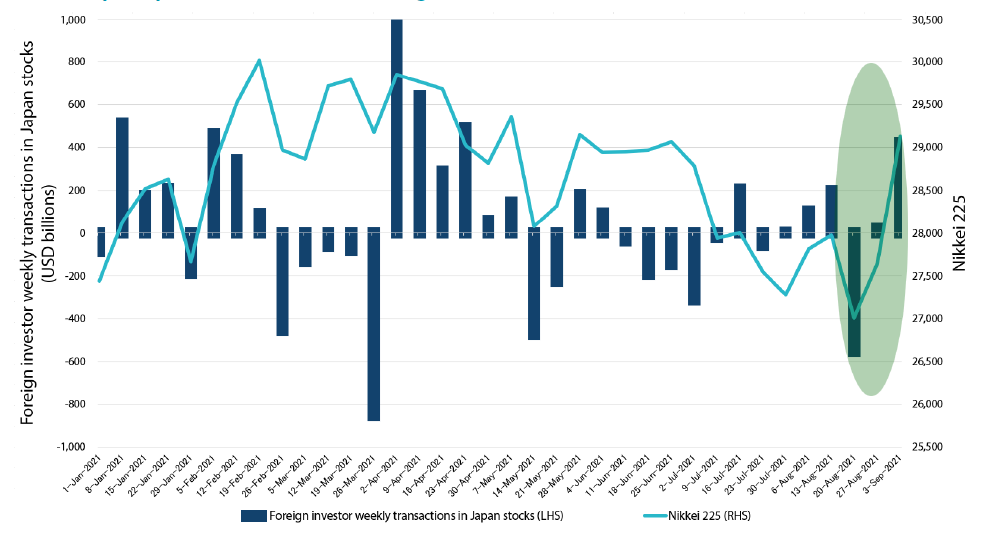

Japan equities finally perking up?

As an investor that favours assets showing value, Japan equities are often a frustrating market as value alone is an ineffective catalyst and, at times, can feel like a value trap. Japan equities had an explosive start to 2021, outperforming most other markets. But the market peaked by Mid-February, and after going sideways for a couple of months, it lost all year-to-date gains by mid-August. Like a coiled spring, winds of political change and/or perhaps a pullback in the dollar might have been catalysts to lift the equity market 10% in a matter of weeks, helped by foreign flows, as shown in Chart 1.

Clearly, frustration has been building in Japan for its COVID-19 response, both for its handling of the various outbreaks but mostly for the slow pace of its the vaccine rollout. Despite strong export demand from China, sentiment—both domestically and among foreign investors—remained weak, which was exacerbated back in March when the Bank of Japan adjusted its ETF purchase programme, determining it would step in far less frequently to support equity markets.

This analyst is far from an expert in understanding Japan politics, but experience has demonstrated that political change can usher in a swift turn in sentiment, and perhaps Prime Minister Yoshihide Suga’s decision not to run for re-election in the ruling party’s leadership race is such a positive catalyst. The rally also overlaps with a multi-week reprieve in dollar strength. It is too early to tell, but the coming ruling party election and the relationship to the dollar will undoubtedly be important watch points in the weeks and months ahead.

Chart 1: Japan equities (Nikkei 225) versus foreign transactions

Source: Bloomberg, Nikko AM, as at 3 September 2021

Source: Bloomberg, Nikko AM, as at 3 September 2021

We will keep a close watch on Japan and the coming ruling party election to determine whether the recent rally is sustainable or perhaps more of a short squeeze where many investors, including commodity trading advisors (CTAs), were caught very short into the sudden rally and forced to cover their positions. We still believe Japan shows attractive opportunities but also think it important to identify durable catalysts to strengthen our conviction.

Conviction views on growth assets

- Cheap downside protection makes sense: Asymmetric risks may be building in equity markets, particularly in the US, that has barely corrected since early November of 2020. We still believe the economic recovery will remain durable, but as the Fed begins to prepare to taper, volatility is likely to lift and may be coupled with a growth scare as the Delta variant continues to present challenges to many economies. Currently, volatility is still cheap and purchasing protection makes sense in light of the asymmetric risks.

- Favour REITS over Infrastructure and High Yield: At the moment, our bets are relatively small as we await a new regime of Fed tapering that is likely to lift volatility. Still, we like REITs for the re-opening that continues and are slightly cautious on infrastructure and high yield, which we believe are closer to full value.

Defensive assets

We continue to have a cautious view of defensive assets. While the odds are rising that the Fed will begin tapering its QE purchases this year, other major central banks have not yet followed the Fed's lead. The US has made significant progress towards its inflation goal as pricing pressures are evident in many parts of its economy; however, inflationary pressures in other countries remain more muted. Nevertheless, a common theme across recent central bank communication has been that the current higher levels of inflation will prove to be transitory. Central bank policy is still broadly supportive of sovereign bonds as a result, but we believe that the time is approaching for adjustments that reflect the strong recovery underway.

We maintained our slightly favourable view of investment grade credit this month. The sector has been helped by positive momentum and improving credit quality as the pandemic begins to recede. Central bank support continues to provide ample liquidity and concerns for China's support of its state-owned enterprises have receded. At the same time, spread compensation for credit risk is at very low levels historically which tempers our view somewhat.

Real yields have rebounded from historically very negative levels but continue to be supported by the Fed's QE programme. However, the time is approaching for a reduction in the Fed's asset purchases which will gradually put pressure on real yields to rise (become less negative). Both inflation-linked bonds (ILBs) and gold will likely underperform in a rising real yield environment, so we maintained our less favourable view of inflation assets amongst our defensive sectors.

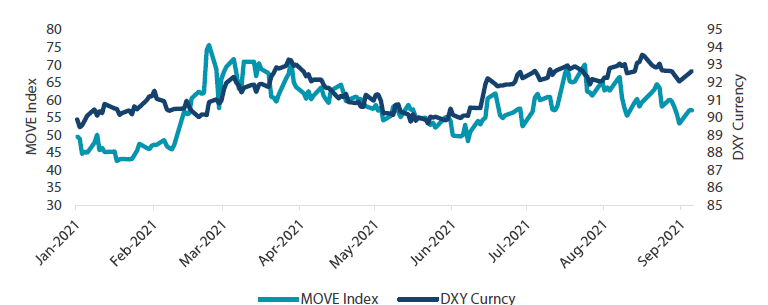

US dollar’s defensive role

Following the sharp rise in volatility that accompanied the COVID-19 lockdowns at the beginning of the pandemic, markets were quickly calmed by the unprecedented fiscal and monetary support applied to the economic and financial system. Such loose liquidity conditions also saw the US dollar weaken 13% (peak to trough in 2020). However, at the lows of the 2020 equity drawdown, the US dollar rebounded sharply and reached its 3-year high. Since March this year, the MOVE index, a measure of volatility of US Treasuries (USTs), has shifted to a higher range. As seen in Chart 2, the US dollar has also moved higher during periods of higher volatility in bond markets. As we navigate through the new normal in which equity prices are at all-time highs and bond yields remain low, uncertainties around future monetary and fiscal policies have the potential to introduce further volatility.

Chart 2: US dollar and US treasuries volatility in 2021

Source: Bloomberg, September 2021

Source: Bloomberg, September 2021

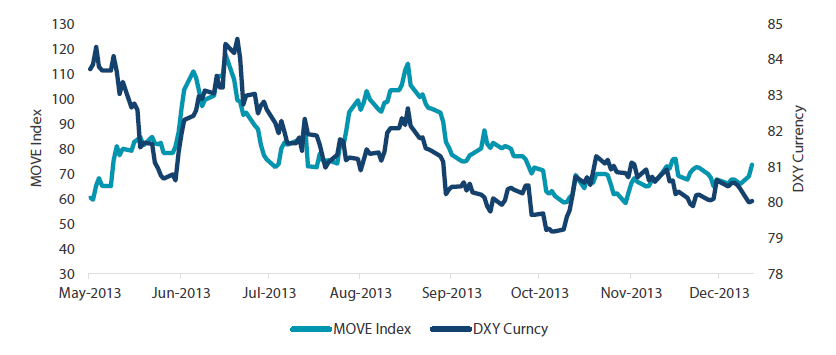

Back in 2013, the Fed's unexpected discussion of the potential for tapering its quantitative easing policy resulted in a surge in UST yields and an initial sell-off in equities. A period of US dollar strength also coincided with the higher volatility in USTs. Following the experience in 2013, central banks are taking greater care when approaching the idea of tapering, signalling any changes in a gradual, methodical, and transparent fashion.

Chart 3: US dollar and US Treasuries volatility in 2013

Source: Bloomberg, September 2021

Source: Bloomberg, September 2021

More recently, the Jackson Hole Economic Symposium provided some comfort around dollar liquidity conditions and markets appeared comfortable with the idea that tapering may begin this year. Yet, there are still various reasons for yields to move higher by year-end. Given that the US dollar remains the leading foreign reserve currency, it is unlikely to relinquish its role as a defensive asset in the near term, especially in a steepening UST yield curve environment.

Conviction views on growth assets

- China bonds still favoured: China’s government bonds offer higher yields and lower volatility than traditional developed market sovereign bonds and have tended to outperform in a rising global yield environment.

- Shorter duration in dollar-bloc bonds: The Bank of Canada and the Reserve Bank of Australia have already begun the process of tapering and the Fed is likely to follow later this year.

Process

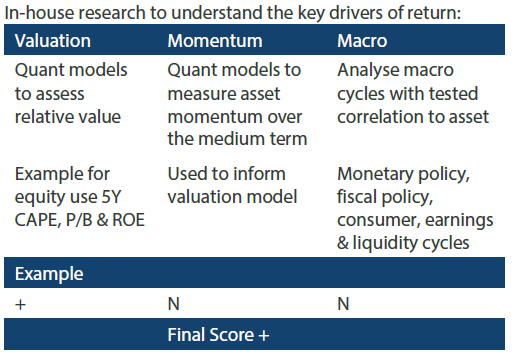

In-house research to understand the key drivers of return: