Snapshot

The global economic recovery is continuing, although at a marginally slower pace; this is to be expected considering the impact of the second COVID-19 wave on the US sunbelt. The good news is that new COVID-19 cases in the US are once again showing signs of easing. However, new cells have emerged in other countries and regions such as Spain and parts of Asia. This includes Vietnam, which had not reported a new case in 100 days. Still, while such news is disconcerting, the world is developing ways to cope without resorting to major economic shutdowns. Looking ahead, we see more of the same. An ongoing recovery—but in fits and starts as the virus continues to roll around the world with no country being entirely safe from localised outbreaks.

As Washington debates the next stimulus package amid the political theatre we have come to expect around major US policy initiatives, we believe a deal will be sealed. While further US fiscal stimulus is clearly necessary, one has to wonder how long the high degree of stimulus can be maintained given the increasingly protracted nature of the pandemic. While fiscal hawks are few and far between, the virtues of a printing press that put few boundaries around spending seem many. The theory of Ricardian equivalence suggests that the private sector will save more and spend less in anticipation of the likely tax increases to follow in the years ahead; however, in the ostensible world order of modern monetary theory, anything seems possible.

Stimulus is necessary to help fill the demand gap, but the rapid rise in inflation expectations is an interesting development. Reflation could be a likely scenario with a vaccine seemingly on the horizon while plenty of stimulus is still sloshing through the system. The near-term benefit is a weak US dollar, which helps to support reflation, and therefore growth, around the world. However, these dynamics have also supported the price of gold. Rising gold prices is not inconsistent with a bull market as was the case in the 2000s, but it is worth keeping an eye on as a barometer for other systemic risks.

For the moment, plentiful liquidity, ongoing stimulus and a definitively weaker dollar coupled with signs of returning activity look to be the principal drivers of risk appetite. We remain cautious with respect to the pace of the recovery and the impending US election season that clearly adds to uncertainty—for both the eventual outcome and President Donald Trump pressing ever harder on China as part of his re-election campaign.

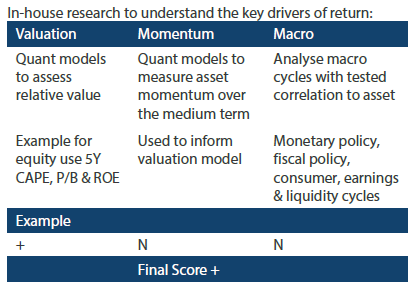

Cross asset1

While the US faces growth risks due to the second wave of COVID-19, growth is picking up in the rest of the world to support aggregate global demand. We favour growth assets tilted toward geographies that stand to benefit from some degree of rotation from the US to the rest of the world. It is early to call a broad rotation given that technology remains durable in a COVID-19 world where the US is still best in the class, but reflationary growth from Asia to Europe and emerging markets (EM) may be beginning to tip the scales.

Among growth assets, we increased our favourable view of EM equities and bonds because of improving demand and a weaker dollar, while at the same time, we took a more cautious view of REITs. Falling interest rates could benefit REITs, but the negative impact on commercial real estate looks increasingly deep and protracted.

We are neutral on defensive assets, still favouring gold (despite the aggressive rally). We also favour investment grade credit over sovereigns, which are more likely to perform well in a reflationary world. China bonds still offer attractive yields, particularly when compared to developed market (DM) equivalents.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset class hierarchy (team view1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Growth assets continue to grind higher, supported this month by much better-than-expected 2Q earnings and top line growth. Stimulus remains important, and while we believe that the US Congress will extend further relief in the country, the divide between Republicans and Democrats is still wide as benefits were left to expire at the end of July. On the bright side, the second COVID-19 wave in the US is showing signs of easing and the dollar remains weak, helping to support global demand. However, we do watch for pockets of stress. An example is Turkey, which currently has a large negative balance of payments with no currency reserves to lend support to its currency. There is some evidence of such stress spreading to other weak EMs, including South Africa and Brazil. We suspect Turkey will return to traditional policies to lend the currency support, but expect volatility to continue among weaker EMs in the meantime.

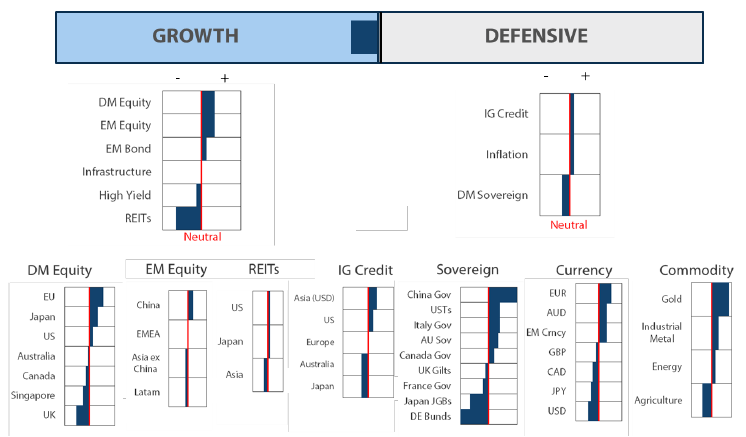

Better activity, better earnings to follow in Europe?

US earnings still topped Europe in the second quarter, supported mainly by its weightier technology sector. This is rational given technology has been a principal beneficiary of the crisis, both for increased demands in hardware but also software and online retail for obvious reasons. However, activity in Europe is picking up, which means earnings should accelerate in the months ahead.

Europe’s successful containment of COVID-19 and prevention of a second wave has allowed activity there to normalise much more quickly than in the US. Coupled with sizable stimulus and a pick-up in China demand, we expect Europe’s economy to outperform that of the US over the near term.

Chart 1: Apple mobility data shows Europe normalising far faster than US

Source: Apple, August 2020

The risk to this view is the continued dominance of the technology sector, which is not a difficult argument given the relatively rosy outlook. However, we are concerned with rising regulatory risks. The largest technology companies continue to dominate in their industry with little threat of competition, and Washington has taken notice with a number of investigations that could culminate into notable regulatory headwinds, which markets are currently not pricing in. Coupled with rising election risks, rebalancing to broader sources of growth outside the US is still sensible, in our view.

Singapore still a laggard

While we remain cautious on Singapore, we have recently turned more positive mainly for its compelling valuations rather than any new prospects for growth.

Chart 2: MSCI Singapore equities pricing just below book value, similar to the depths of the global financial crisis

Source: Bloomberg, August 2020

Singapore equities are largely driven by banks that weigh heavily in the index. Collapsing yield curves around the world also mean lower earnings prospects, while rising non-performing loans connected with COVID-19 are an ongoing headwind for the sector.

Even worse for Singapore banks, the Monetary Authority of Singapore (MAS) recently instituted a dividend cap for banks as a measure of prudence given high levels of uncertainty. However, this has been seen by markets as making bank equities even less attractive than before the measure. Still, Singapore banks have strong balance sheets, and valuations may be overly discounting future prospects, which is why we have marginally reduced the underweight.

Conviction views on growth assets

- European equities lifted to top of hierarchy: We believe faster normalisation of activity will reflect in stronger growth and earnings in the months ahead. Stimulus remains plentiful and demand from China is picking up, while the strong euro has not been able to weigh on profits or demand.

- China lifted to higher overweight: We increased our favourable view on China and in turn became more cautious towards the rest of Asia and EMEA. China has managed to contain threats of a second wave, while stimulus has picked up and growth is closer to normal levels than anywhere else in the world. Challenges include the fast-escalating tensions with the US.

- Still like quality EM FX, but watching Turkey: Balance of payments issues are adding pressure to the Turkish lira. Other weaker EMs such as South Africa and Brazil are feeling FX pressures as well given the negative sentiment that is spilling over. Ultimately, we believe Turkey will raise rates to reduce the currency pressure, but for now, it remains a near-term risk.

- REITs still challenged: Earnings came in weak, mainly driven by the hotel and resort sector, which is no surprise. Unfortunately, we see these same headwinds continuing with little visibility for a turnaround over the near term, at least until a vaccine emerges.

Defensive assets

An uneasy calm has descended over sovereign bond markets under the soothing embrace of global central banks. Bond yields have stabilised at very low levels in most regions even as economic activity continues to recover. Forward guidance from central bankers has been a steady mantra of supportive monetary policy as risks remain around the pandemic, upcoming US elections and other geopolitical concerns. All of this should continue to provide support for defensive asset classes.

Global investment grade (IG) credit spreads have continued tightening towards levels that prevailed in 2019 prior to the pandemic. While high-grade credit still offers value, the momentum of future spread tightening will likely slow over time. Nevertheless, demand will remain strong for the yield premiums on high quality corporate bonds as central bank programmes provide a backstop to any sustained widening of credit spreads.

The maintenance of accommodative monetary policy and generous liquidity conditions until economic data shows sustainable improvement are likely to keep nominal bond yields stable and compress real yields. Lower real yields are generally positive for gold, which has also broken its major resistance level of USD 1,800 per troy ounce, a key technical indicator. The large-scale quantitative easing programmes also pose risks to fiat currencies and lend support to gold as a store of value. As a result, we expect gold to continue to perform strongly and view the commodity, along with IG credit, as a better defensive allocation than sovereign bonds.

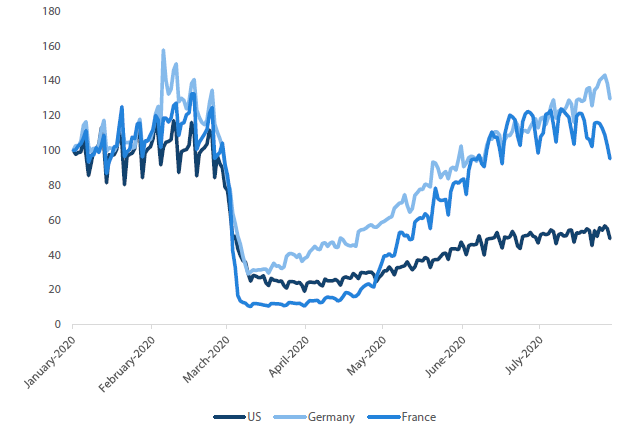

China has room to ease

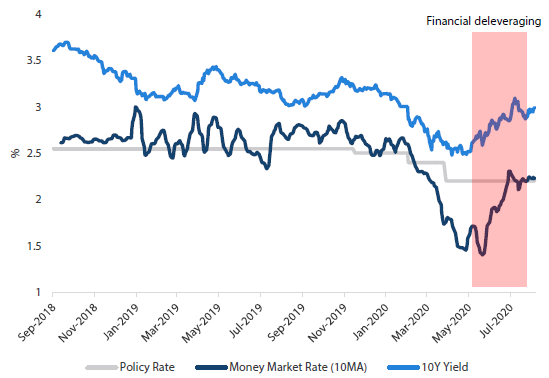

The People’s Bank of China (PBOC) is the only major central bank with much scope for further conventional easing of monetary policy. It cut interest rates in both February and March and released emergency liquidity earlier in the year as the first country confronted with the COVID-19 crisis. As other major central banks cut interest rates aggressively to cushion the impact of the pandemic on their economies and financial conditions, expectations were building for the PBOC to do more, as reflected in money market pricing. However, following successful reopening and subsequent improvements in China’s economic data, the PBOC retreated from its emergency settings and acted swiftly to contain risks associated with any over-leveraging that may have been encouraged by the sharp drop in funding costs.

Chart 3: Chinese interest rates

Source: Bloomberg, August 2020

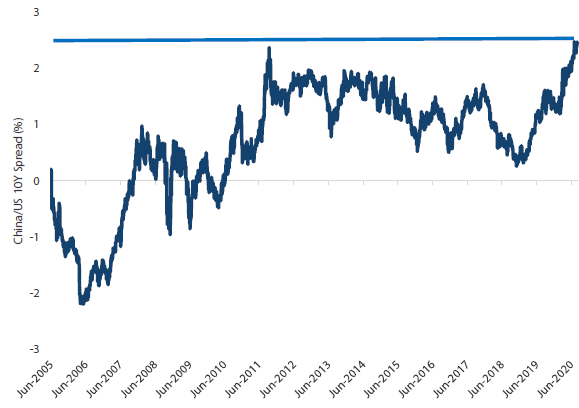

Even though China has weathered the pandemic relatively well so far, its economic recovery remains uneven. Production and public investments have rebounded strongly and the property market is heating up, although private investment and consumption have been slower to recover. As a result, we expect the central bank to remain accommodative for an extended period. Externally, global demand is still fragile amid the second and third waves of viral outbreaks, while US-China tensions will likely continue escalating ahead of the US presidential election. In addition, a stable renminbi (RMB) and attractive yield spreads relative to US Treasuries support foreign inflows.

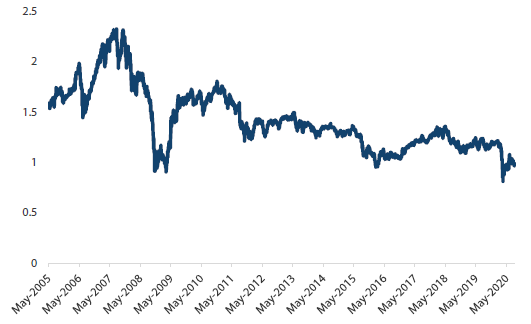

Chart 4: Chinese government bond spread to US Treasuries

Source: Bloomberg, August 2020

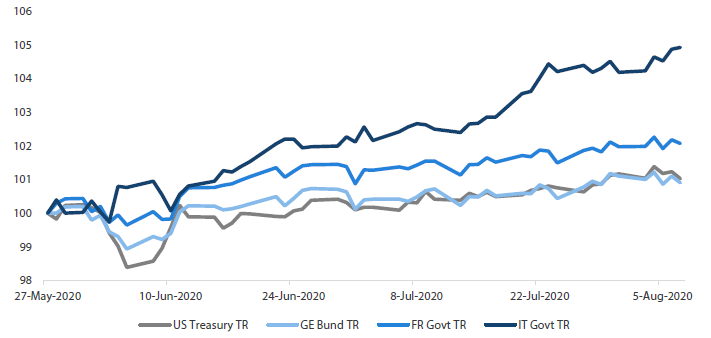

Italy the pick of European government bonds

The pandemic hit Italy hard in the early days although authorities have since managed to bring the situation under control. Italy was already facing financial challenges prior to the pandemic and the cost of responding to COVID-19 just added further stress on a generally acknowledged weakness.

The EU’s Growth and Stability Pact is a set of rules that seeks to govern the fiscal policies of its member countries. In the past, Italy was a serial offender in exceeding both the limits on budget deficits and total government debt as proportions of its GDP. This has long made Italy a financial “problem child” within the EU, causing Italy to pay a substantial yield premium on its government debt. However, Italy is not the only one as other EU countries have also struggled at times to abide by these rules.

The substantial toll on the finances of most EU member countries in fighting the pandemic will effectively sideline these rules over the medium term as focus shifts to support and recovery, whatever the costs. So far, the response from European authorities has been substantial. The European Central Bank (ECB) has provided considerable liquidity to the financial system and EU leaders have agreed on a EUR 750 billion Next Generation EU Recovery Fund. This agreement, funded by EU debt issuance, is a historic step, and advances Europe towards a closer fiscal union. It also demonstrates a renewed willingness of the EU to act as a whole to support its weaker members, a change from the more usual finger pointing and lecturing from its stronger members directed at its weaker members.

In this environment of renewed EU unity, support for weaker members of the currency bloc is particularly important for Italy and will likely result in a convergence of European bond yields towards German yields. Italian bonds have already been a significant benefactor of these ECB and EU policies as shown in Chart 5. Since Germany and France first announced their plan for a European recovery fund at the end of May, Italian bonds have outperformed. We expect this trend to continue and have upgraded Italian bonds to be our top pick in Europe.

Chart 5: European 7-10 year government bond returns (indexed to 100)

Source: Bloomberg, August 2020

Conviction views on defensive assets

- IG credit still tops sovereigns: The yield premium of IG corporate bonds will continue to reward investors alongside further contraction in spreads, in our view. Within the sector, we turned more cautious on Australia while increasing our favourable view of Asia and the US. Australian credit spreads have already returned to pre-pandemic levels and new issuance has been scarce, making new investments difficult. As a result, better opportunities can be sourced elsewhere.

- China sovereigns lead the pack: China’s government bonds yield substantially more than its peers in the sovereign bond arena. We expect the PBOC to make further use of its ability to ease interest rates to support the Chinese economy and lower bond yields, something that few other central banks have similar scope to deliver.

- Gold still our preferred inflation hedge: While gold prices have risen strongly this year, the twin supports of negative real yields and longer term concerns for fiat currencies in the midst of large scale asset purchases and rising budget deficits will continue to support the precious metal.

Process