The Fund mainly invests in U.S. government bond with a remaining maturity of two years or less, aiming to secure income and growth of the trust assets.

Key information

| Name: | Listed Tracers US Government Bond 0-2years Ladder (No Currency Hedge) | |

| Code: | 2093 |

Net Asset Value and Performance

| Fund Name | Listed Tracers US Government Bond 0-2years Ladder (No Currency Hedge) Open-end/Overseas/Bonds/ETF |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 2093 |

| Targeted Investments | The Fund mainly invests in U.S. government bond with a remaining maturity of two years or less, aiming to secure income and growth of the trust assets. |

| Date Listed | October 5, 2023 (launched on October 2, 2023) |

| Exchange Trading Unit | 10 units |

| Trust period | Unlimited |

| Computation Period | From 11 February to 10 May, 11 May to 10 August, 11 August to 10 November of each year, and from 11 November to 10 February of the following year |

| Closing Date | 10th of February, May, August and November of each year |

| Dividends | As a general rule, the full amount of dividends and other income arising from the trust assets is distributed after deduction of expenses. *There is no guarantee for the amount and payment of dividends in the future. |

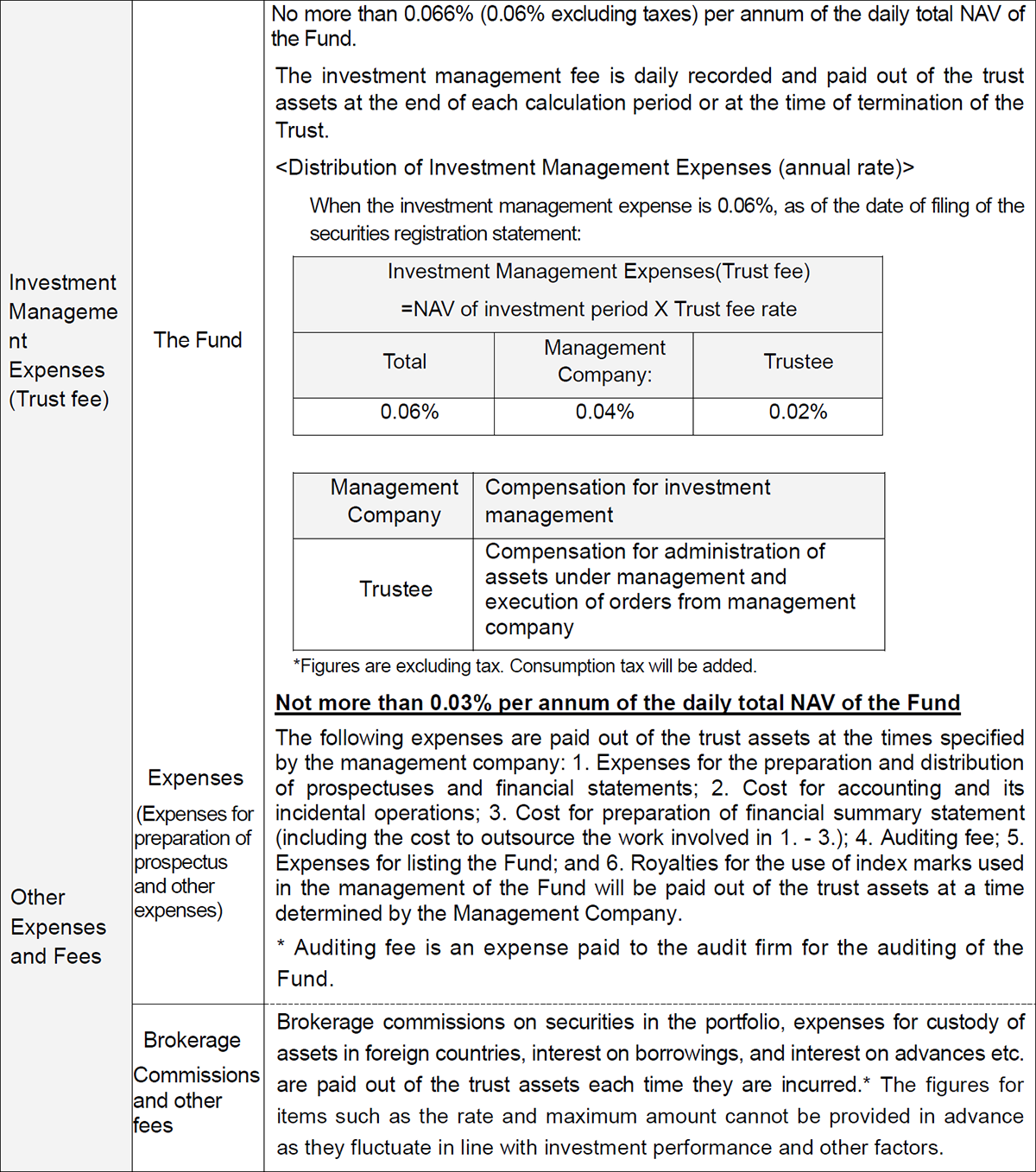

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your distributor for further information. *Subscription fee is compensation for explanation and information providing about the Fund or investment environment, and is also including expense of clerical processing of the subscription. |

| Exchange Fee | Independently set by Distributors *Please contact your distributor for further information. *Exchange fee is compensation for clerical processing of the exchange. |

| Amount to be Retained in Trust Assets | Not applicable |

■Costs paid indirectly by the customer for the trust assets (paid from the fund)

| TER (Total Expense Ratio) |

0.0930% (TER includes Trust Fee, management fee and other costs below) |

The total amount of expenses of the Fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Investment Restrictions

|

Distribution Policy

|

*There is no guarantee for the amount and payment of dividends in the future.

Trustee Companies

|

What is Listed Tracers?

Listed Tracers is a series of Nikko Asset Management's ETFs that follows* (traces) rule-based investing.

*This ETF is passively managed in accordance with a rules-based approach, but as there is no corresponding index to track, it falls under the category of "Domestic Actively Managed ETF" under TSE’s classification.

The Fund invests in U.S. government bond with a remaining maturity of two years or less.

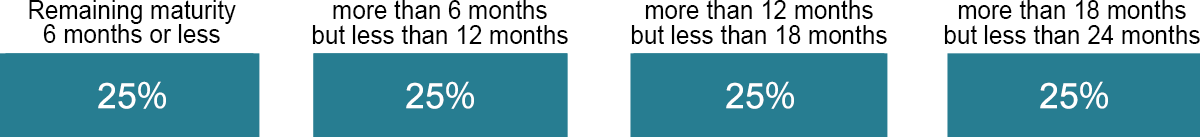

- In principle, the Fund invests into four groups according to their remaining maturity: 6 months or less, more than 6 months but less than 12 months, more than 12 months but less than 18 months, and more than 18 months but less than 24 months. The Fund invests in each group in approximately equal amounts, taking liquidity and trading costs into consideration. (=a bond ladder)

- Bond futures and foreign exchange forward contracts may be used to realize the same gains and losses similar to holding the underlying assets.

- In investing in foreign currency-denominated assets, in principle, currency hedging is not carried out.

*The investment management described above may not be carried out due to market and financial conditions.

Units are listed on Tokyo Stock Exchange and can be traded at any time during trading hours.

- Units may be traded in blocks of 10 units (as of the date when the securities registration statement was filed).

- Brokers determine trading commissions.

- The method of trading is generally the same as that for stocks.

*Please contact your broker for further information.

Units are subscribed for with cash.

- Units are subscribed using the NAV on the next business day when the subscription is accepted.

Units may be redeemed with a request for redemption.

- Units may be redeemed by the NAV on the next business day when redemption is accepted.

Units may not be exchanged for public and corporate bonds.

About the Fund’s bond ladder management

■Image of the Fund’s bond ladder management

The above is an image of the Fund's bond allocation by a remaining maturity.

■The reference index of the Fund

“The ICE BofA 1-Year U.S. Treasury Bond Index (no currency hedging, yen basis (TTM))" will be used as the reference index.

*The index is the ICE BofA 1-Year U.S. Treasury Bond Index converted into yen by Nikko Asset Management. This index is a reference index and is not a benchmark for the Fund.

* The ICE BofA 1-Year U.S. Treasury Bond Index is an index published by ICE Data Indices, LLC, and is based on the performance of a one-month holding of U.S. Treasury bonds with a remaining maturity of approximately one year (but not exceeding one year) and a rollover to U.S. Treasury bonds with the same maturity in the following month repeatedly.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

*Link to external sites.

Copyrights to The ICE BofA 1-Year U.S. Treasury Bond Index

SOURCE ICE DATA INDICES, LLC (“ICE DATA”), IS USED WITH PERMISSION. ICE® IS A REGISTERED TRADEMARK OF ICE DATA OR ITS AFFILIATES AND BOFA® IS A REGISTERED TRADEMARK OF BANK OF AMERICA CORPORATION LICENSED BY BANK OF AMERICA CORPORATION AND ITS AFFILIATES ("BOFA") AND MAY NOT BE USED WITHOUT BOFA'S PRIOR WRITTEN APPROVAL. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DISCLAIM ANY AND ALL WARRANTIES AND REPRESENTATIONS, EXPRESS AND/OR IMPLIED, INCLUDING ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, INCLUDING THE INDICES, INDEX DATA AND ANY DATA INCLUDED IN, RELATED TO, OR DERIVED THEREFROM. NEITHER ICE DATA, ITS AFFILIATES NOR THEIR RESPECTIVE THIRD PARTY SUPPLIERS SHALL BE SUBJECT TO ANY DAMAGES OR LIABILITYWITH RESPECT TO THE ADEQUACY, ACCURACY, TIMELINESS OR COMPLETENESS OF THE INDICES OR THE INDEX DATA OR ANY COMPONENT THEREOF, AND THE INDICES AND INDEX DATA AND ALL COMPONENTS THEREOF ARE PROVIDED ON AN “AS IS” BASIS AND YOUR USE IS AT YOUR OWN RISK. ICE DATA, ITS AFFILIATES AND THEIR RESPECTIVE THIRD PARTY SUPPLIERS DO NOT SPONSOR, ENDORSE, OR RECOMMEND NIKKO ASSET MANAGEMENT CO., LTD., OR ANY OF ITS PRODUCTS OR SERVICES.

This Fund can be applied for as a cash creation and a cash redemption at Authorised Participants in addition to the Tokyo Stock Exchange. When applying as a direct addition and exchange, please keep in mind that we cannot accept your application on the following dates:

Authorized Participants

- ABN AMRO Clearing Tokyo Co., Ltd.

- Barclays Securities Japan Limited

- Daiwa Securities Co. Ltd.

- Nomura Securities Co.,Ltd.

- SMBC Nikko Securities Inc.

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy at last price of T day's market while FX rate is TTM of one business day after the application (10am on T+1)

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for Cash Creation/Redemption Type ETFs

Redemption Flow for cash Creation/Redemption Type ETFs

Investors are not guaranteed the investment principal that they commit. Investors may incur losses and the value of their investment principal may fall below par as the result of a decline in the market price or NAV. All profits and losses arising from investments in the Fund belong to the investors (beneficiaries). The Fund is different from saving deposits.

The Fund invests primarily in bonds. The NAV of the Fund may fall and you may suffer losses for reasons such as a drop in the price of bonds or deterioration in financial conditions and business performance of an issuer of bonds. Investors may also incur losses due to exchange rate fluctuations when investing in assets denominated in foreign currencies.

Major risks are as follows:

Price Fluctuation Risk

Corporate and government bonds generally have a price fluctuation risk arising from changes in interest rates. Generally, their prices go down when interest rates rise, causing the NAV of the Fund to fall. The degree of price fluctuation varies by bonds depending on a remaining maturity, issuance conditions such as coupon rate and others.

Liquidity Risk

There is a risk that the fund will incur unexpected losses when the market size or trading volumes is small. The purchase and sale prices of securities are influenced by the trading volume, resulting in the risks that they cannot be traded at prices expected to be realized in light of the prevailing market trend, cannot be sold at the estimated prices, or that the trading volume is limited regardless of the level of prices.

Credit Risk

If a default has occurred or is expected to occur, for issuers of public and corporate bonds or short-term financial assets, the prices of such public and corporate bonds or short-term financial assets decline (the value could even fall to zero). This results in a decline of the Funds’ NAV. In addition, if default in fact occurs, there is a high possibility of being unable to collect invested cash.

Currency Fluctuation Risk

For foreign-currency-denominated assets, in general, if the yen is stronger than the currencies of such assets, the fund’s NAV will decline.

Discrepancies between the market price on the Tokyo Stock Exchange and the NAV

Although the Fund is listed and publicly traded on the Tokyo Stock Exchange, the market price of the Fund depends primarily on the demand for the Fund, the Fund's performance and investors' assessment of the Fund's attractiveness compared with other investments. Therefore, it is not possible to predict whether the market price of the Fund will trade below or above its NAV.

* Factors that may cause fluctuations in the NAV are not limited to those listed above.

Additional Considerations

- This document is meant as promotional material whose purpose is for Nikko Asset Management to provide information about its "Listed Tracers US Government Bond 0-2years Ladder (No Currency Hedge)" and for investors to gain further understanding about the fund.

- The provisions stipulated in Article 37-6 of the Financial Instruments and Exchange Act (the “cooling-off period”) are not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Nor are investment trusts protected by investor protection funds when purchased at banks or other registered financial institutions.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption.

- When applying to invest in the Fund, please make the decision to invest carefully after taking the time to read the delivered pre-agreement document and other relevant materials in detail.