On September 1, 2025, Nikko Asset Management Co., Ltd. will change its name to Amova Asset Management Co., Ltd.

The Fund seeks the net asset value per unit to track the performance of the yen-converted S&P/ASX200 A-REIT Index by manly investing in the separately stipulated investment trust securities.

Key information

| Name: | Listed Index Fund Australian REIT (S&P/ASX200 A-REIT) | |

| Code: | 1555 |

Net Asset Value and Performance

Fund of Funds Structure

This Fund is a Fund of Funds investing in investment trust securities.

- Australian REIT Index Fund (for qualified institutional investors)

The fund seeks to achieve investment results that correlate to the movement of the yenconverted S&P/ASX200 A-REIT Index by investing mainly in Australian Stock Exchange listed REIT securities. - Money Open Mother Fund

This fund seeks to achieve stable returns through stable management by investing in public and corporate bonds.

| Fund Name | Listed Index Fund Australian REIT (S&P/ASX200 A-REIT) Open-end/Overseas/REITs/ETF/Index type |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 1555 |

| Targeted Investments | Investment trust securities that seek to closely match the movement of the yen-converted S&P/ASX200 A-REIT Index. |

| Date Listed | 9 March 2011 (launched on 3 March 2011) |

| Exchange Trading Unit | 1 unit |

| Trust period | Unlimited |

| Computation Period | Every year, 11 Jan - 10 Mar, 11 Mar - 10 May, 11 May - 10 Jul, 11 Jul - 10 Sep, 11 Sep - 10 Nov, and 11 Nov - 11 Jan of following year. |

| Closing Date | Every year, the 10th day of odd-numbered month |

| Dividends | All revenue from dividends arising from the trust assets will be, in principle, paid as dividends on the last day of the fiscal year after deducting expenses. *There is no guarantee on the payment or the amount of dividend. |

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your Distributor for further information. *Subscription Fee is compensation for explanation and information providing about the Fund or investment environment, and is also including expense of clerical processing of the subscription. |

| Redemption Fee | Independently set by Distributors *Please contact your Distributor for further information. *Exchange Fee is compensation for clerical processing of the exchange. |

| Amount to be Retained in Trust Assets | An amount calculated by multiplying NAV at the time of a redemption by 0.3% (per unit) |

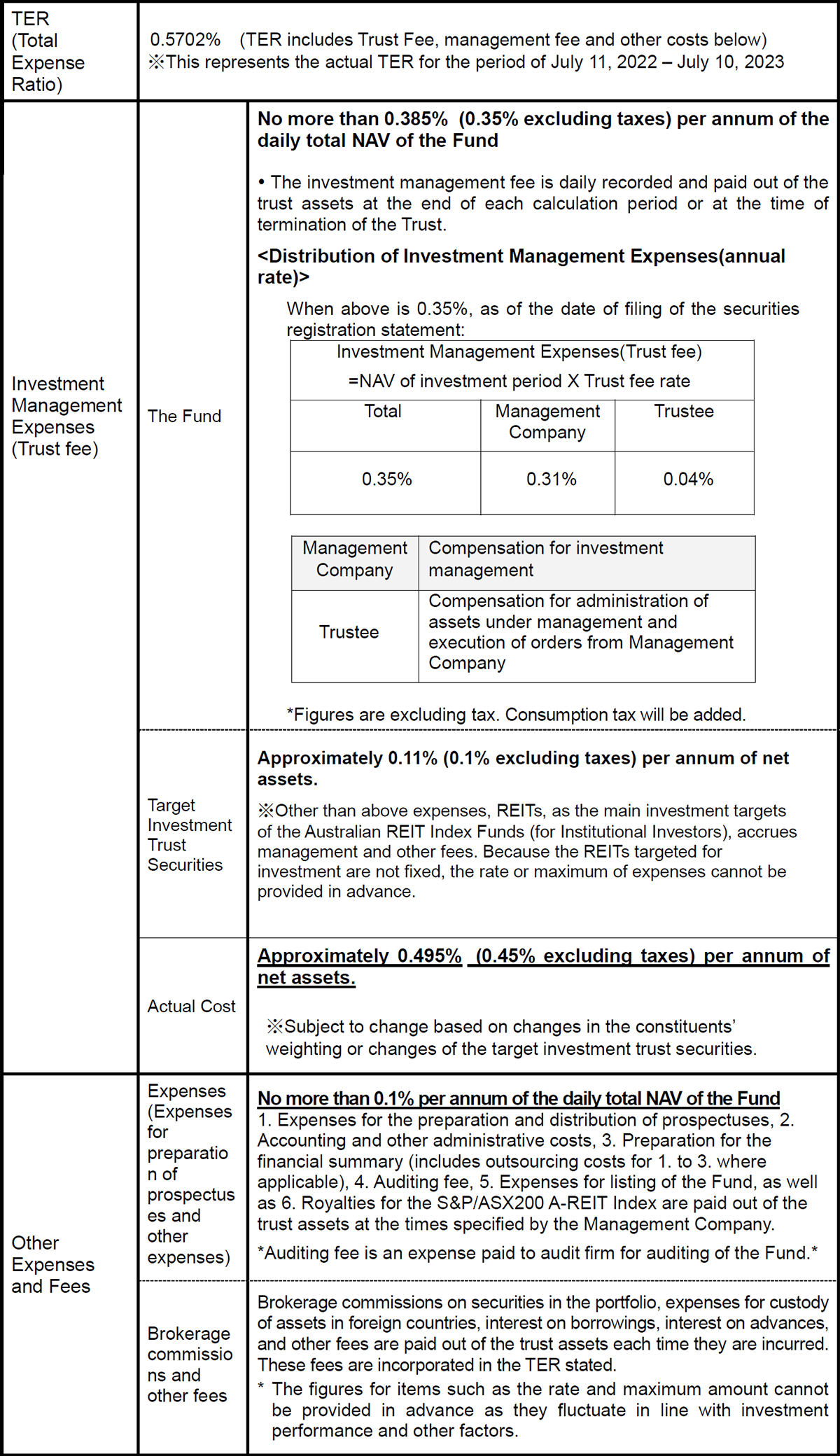

■Costs paid indirectly by the customer for the trust assets (paid from the fund)

| TER (Total Expense Ratio) |

0.62% (TER includes Trust Fee, management fee and other costs below) Please refer to the prospectus for details. |

The total amount of expenses of the Fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Major Investment Restrictions

|

Trustee Companies

|

S&P/ASX200 A-REIT Index is an Australian REIT index disclosed by S&P calculated to be an index of the total return of REITs that are listed on Australian Stock Exchange weighted by its market capitalization.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

Standard & Poor's

*Link to external sites.

Copyrights of the "S&P/ASX200 A-REIT Index"

Standard & Poor's® and S&P® are registered trademarks owned by Standard & Poor's Financial Services LLC ("S&P") and ASX® is the registered trademark owned by ASX Operations Pty Ltd ("ASX").

Nikko Asset Management, Co., Ltd. is licensed to use these trademarks. S&P and ASX or their related companies do not sponsor, recommend, sell, or promote Listed Index Australian REIT (S&P/ASX 200 AREIT)(hereinafter, refers to "the Fund") and makes no expression, guarantee, or condition on the suitability of investment in this Fund. This Fund is not sponsored, endorsed, sold, or promoted by Standard & Poor's Financial Services LLC and its related companies (hereinafter refers to "S&P"), and the ASX Operations Pty Ltd and its related companies (hereinafter refers to "ASX").

S&P and ASX make no expression, condition or warranty, express or implied, as specified to the owners of the Fund or any member of the public regarding the advisability of investing in securities generally or in the Fund particularly or in the ability to track the performances of certain financial markets and/or to accomplish investment purpose stated, and/or in the ability of establishing the base for the success of investment strategy. The relationship of S&P/ASX and Nikko Asset Management is only in respect of this Index which S&P and ASX determine, create and calculate regardless of Nikko Asset Management or this Fund and its registered trademark. S&P and ASX have no obligation to consider Nikko Asset Management's requests and others in determination, creation, and calculation of S&P/ASX 200 A-REIT Index (hereinafter refers to "the Index"). S&P and ASX are not advisors for the Fund and are not responsible for or been involved in the determination of the timing of, prices at, or amount of the Fund to be issued or in the determination or calculation of the equation by which the Fund is to be converted into cash.

S&P and ASX assume no obligation regarding, nor do they take any responsibility for management, marketing, or trading of the Fund whatsoever. S&P and ASX do not make any guarantee of the accuracy or completeness of the calculation or basic data of the Index. S&P and ASX take no responsibility for any error, lack, or fault in the Index.

S&P and ASX make no explicit or implicit warranty, condition, or expression whatsoever as to the results to be obtained by Nikko Asset Management, owners of the Fund, or any other persons or organizations from the use of this Fund or any data included therein. S&P and ASX expressively disclaim all warranties or conditions of merchantability or suitability for a particular purpose or use of this Index or the data contained therein, and make no guarantee, expression, or condition, express or implied, on merchantability or suitability of this Index or the data contained therein.

Without limiting any of the foregoing, S&P and ASX are not responsible for any special, punitive, indirect, or consequential damages (including lost profits) arising from the use of the data contained therein, even if notified of the possibility of such damages in advance.

- 21 Feb 2025 — Earnings Report for Fiscal Year ended Jan 2025

- 23 Aug 2024 — Earnings Report for Fiscal Year ended Jul 2024

- 22 Feb 2024 — Earnings Report for Fiscal Year ended Jan 2024

- 23 Aug 2023 — Earnings Report for Fiscal Year ended Jul 2023

- 22 Feb 2023 — Earnings Report for Fiscal Year ended Jan 2023

- 23 Aug 2022 — Earnings Report for Fiscal Year ended Jul 2022

- 22 Feb 2022 — Earnings Report for Fiscal Year ended Jan 2022

- 23 Aug 2021 — Earnings Report for Fiscal Year ended Jul 2021

- 22 Feb 2021 — Earnings Report for Fiscal Year ended Jan 2021

- 21 Aug 2020 — Earnings Report for Fiscal Year ended Jul 2020 (11 Jan 2020 – 10 Jul 2020)

- 21 Feb 2020 — Earnings Report for Fiscal Year ended Jan 2020 (11 Jul 2019 - 10 Jan 2020)

- 23 Aug 2019 — Earnings Report for Fiscal Year ended Jul 2019 (11 Jan 2019 – 10 Jul 2019)

- 22 Feb 2019 — Earnings Report for Fiscal Year ended Jan 2019 (11 Jul 2018 - 10 Jan 2019)

- 23 Aug 2018 — Earnings Report for Fiscal Year ended Jul 2018 (11 Jan 2018 – 10 Jul 2018)

- 23 Feb 2018 — Earnings Report for Fiscal Year ended Jan 2018 (11 Jul 2017 - 10 Jan 2018)

- 22 Aug 2017 — Earnings Report for Fiscal Year ended Jul 2017 (11 Jan 2017 - 10 Jul 2017)

- 23 Feb 2017 — Earnings Report for Fiscal Year ended Jan 2017 (11 Jul 2016 - 10 Jan 2017)

- 23 Aug 2016 — Earnings Report for Fiscal Year ended Jul 2016 (11 Jan 2016 - 10 Jul 2016)

- 23 Feb 2016 — Earnings Report for Fiscal Year ended Jan 2016 (11 Jul 2015 - 10 Jan 2016)

- 21 Aug 2015 — Earnings Report for Fiscal Year ended Jul 2015 (11 Jan 2015 - 10 Jul 2015)

- 23 Feb 2015 — Earnings Report for Fiscal Year ended Jan 2015 (11 Jul 2014 - 10 Jan 2015)

- 22 Aug 2014 — Earnings Report for Fiscal Year ended Jul 2014 (11 Jan 2014 - 10 Jul 2014)

- 21 Feb 2014 — Earnings Report for Fiscal Year ended Jan 2014 (11 Jul 2013 - 10 Jan 2014)

- 23 Aug 2013 — Earnings Report for Fiscal Year ended Jul 2013 (11 Jan 2013 - 10 Jul 2013)

- 22 Feb 2013 — Earnings Report for Fiscal Year ended Jan 2013 (11 Jul 2012 - 10 Jan 2013)

- 17 Aug 2012 — Earnings Report for Fiscal Year ended Jul 2012 (11 Jan 2012 - 10 Jul 2012)

This Fund can be applied for as a cash creation and a cash redemption at Authorised Participants in addition to the Tokyo Stock Exchange. When applying as a direct addition and exchange, please keep in mind that we cannot accept your application on the following dates:

Authorized Participants

- SMBC Nikko Securities Inc.

- Citigroup Global Markets Japan Inc.

- ABN AMRO Clearing Tokyo Co., Ltd.

- Barclays Securities Japan Limited

- BNP Paribas Securities (Japan) Limited

- BofA Securities Japan Co., Ltd.

- Daiwa Securities Co. Ltd.

- Goldman Sachs Japan Co.,Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

- Mizuho Securities Co., Ltd.

- Nomura Securities Co., Ltd.

- Phillip Securities Japan, Ltd.

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy at last price of T day's market while FX rate is TTM of one business day after the application (11am on T+1)

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for Cash Creation/Redemption Type ETFs

Redemption Flow for cash Creation/Redemption Type ETFs

Investors are not guaranteed the investment principal that they commit. Investors may incur a loss and the value of their investment principal may fall below par as the result of a decline in market price or NAV. All profits and losses arising from investments in the Fund belong to the investors (beneficiaries). This fund is different from saving deposit.

The Fund invests primarily in REITs. The NAV of the Fund may fall and you may suffer a loss for reasons such as a drop in the price of REITs or deterioration in the financial conditions and business performance of an issuer of REITs, deterioration in real estate market, etc. Losses may also be incurred due to exchange rate fluctuation when investing in assets denominated in foreign currencies.

Major risks are as follows:

1. Price Fluctuation Risk

The source of revenue in real estate investment trusts comes from income and capital gains by way of investment in real estate and real estate securitization products. Prices will fluctuate due to various factors, such as regulations on the real estate environment, rent levels, occupancy rates, trends in the real estate market and long and short-term interest rates, or changes in the macro economy. There is also the possibility that prices will be affected by losses and damage to real estate resulting from deterioration, changes in location's condition, fire or natural disaster. There is a risk that the Fund will incur losses due to a decrease in dividends and prices of real estate investment trusts if there is deterioration in their financial standing, or worsening performance and market conditions.

Corporate and government bonds generally have a price fluctuation risk arising from changes in interest rates. Generally, their prices go down when interest rates rise, causing the NAV of the funds to fall. The degree of price fluctuation varies depending on the remaining time to maturity, coupon rate and other issuance conditions.

2. Liquidity Risk

Where the market size or trading volume is small, buying and selling prices for securities may be largely affected. This results in the risk that securities cannot be traded at the expected prices, sold at the appraised prices, or that trading volume is limited regardless of prices. This creates the risk of unexpected losses.

3. Credit Risk

There is a risk that this Fund will incur material losses in the event that the real estate investment trusts are in a state of insolvency or excessive debt or if it is expected that such a situation will arise.

If a default has occurred or is expected to occur, for issuers of public and corporate bonds or short-term financial assets, the prices of such public and corporate bonds or short-term financial assets decline (the value could even fall to zero). This results in a decline of the Fund's NAV. In addition, if default in fact occurs, there is a high possibility of being unable to collect investment funds.

4. Currency Fluctuation Risk

For foreign-currency-denominated assets, in general, if the yen is stronger than the currencies of such assets, the Fund's NAV will decline.

5. Security-lending Risk

Lending of securities is accompanied by counterparty risks, which are the risks of default or cancellation of lending agreements as result of bankruptcy, etc., by the counterparties. As a result, there is a risk that the Fund will suffer unanticipated losses. Following the default or cancellation of a lending agreement, when liquidation procedures are implemented by using the collateral that is set aside in the lending agreement, the procurement cost of buying back the securities can surpass the collateral value, due to price fluctuations in the market.

Factors Contributing to the discrepancies between yen-converted S&P/ASX200 A-REIT Index and NAV

This Fund seeks to ensure that its NAV has the same volatility as the yen-converted S&P/ASX200 A-REIT Index; however, we cannot always guarantee that the Fund will have the same volatility as the Index due to the following factors attributable to this Fund and to the investment trust securities invested in by this Fund:

- Lag in the timing of fund inflows and to the purchase of investment trust securities;

- The potential market impact from the trading, etc., of individual issues when portfolio adjustments are made due to changes in selected issues on S&P/ASX200 A-REIT Index or capital transfers, or costs borne by the Fund such as trust fees, brokerage commission, and audit costs, etc.

- The share-lending fee from lending securities or dividends of incorporated issues.

- When derivative transactions such as futures are conducted, discrepancies in price movements between such transactions and part or all of the constituent issues of the S&P/ASX200 A-REIT Index.

Discrepancies between the market prices at which REITs are traded on the exchange and the NAV

This Fund is listed on and will be publicly traded on the Tokyo Stock Exchange; however, the market price of the units will depend mainly on the demand for the Fund, its investment performance, and how attractive it is to investors in comparison to alternative investments, etc. We cannot predict whether this fund will be traded at a market value below or above its NAV.

Concentrated Investment

Investments may be concentrated in only some investment targets in order to track the movement of the S&P/ASX200 A-REIT Index.If losses arise due to price fluctuations in some of the investment targets subject to concentrated investment, there is a risk that such losses will be significantly larger in comparison to when investment is diversified.

*The prices of securities targeted for investment of this Fund will fluctuate due to the effects of the aforementioned risks. Therefore, please note that this Fund itself has these risks as well.

*The factors that contribute to fluctuations in the NAV are not limited to those listed above.

Additional Considerations

- These distribution materials have been created by Nikko Asset Management with the intention of communicating information on "Listed Index Fund Australian REIT (S&P/ASX200 A-REIT)" in order to increase investors' understanding of this Fund.

- The provisions stipulated in Article 37-6 of the Financial Instruments and Exchange Act ("cooling-off period") are not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Furthermore, units purchased from registered financial institutions, such as banks, are exempted from compensation by the Japan Investor Protection Fund.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption.

- When applying for the purchase of this fund, please read carefully the documents that are provided to you before concluding the contract.