On September 1, 2025, Nikko Asset Management Co., Ltd. will change its name to Amova Asset Management Co., Ltd.

In order to achieve investment results that track the price fluctuations of the Nikkei 225 Leveraged Index, the Fund seeks the net asset value per unit to track the performance of the Nikkei 225 Leveraged Index by composing and maintaining portfolio in principle so that the sum of total amount of listed investment trust securities linked to the Nikkei Stock Average and the total market value of long stock index futures position is about twice the net asset value.

Key information

| Name: | Listed Index Fund Nikkei Leveraged Index | |

| Code: | 1358 |

Net Asset Value and Performance

| Fund Name | Listed Index Fund Nikkei Leveraged Index Open-end/Domestic/Equities/ETF/Index type |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 1358 |

| Targeted Investments | This fund mainly invests in the Listed Index Fund 225 and the rights concerning futures index trading. *There will be cases where instead of the Listed Index Fund 225, the fund will be used for the Nikkei Stock Average or the Listed Index Fund Nikkei 225 (Mini). |

| Date Listed | 26 August 2014 (launched on 25 August 2014) |

| Exchange Trading Unit | 1 unit |

| Trust period | Unlimited |

| Computation Period | Every year, 11 July - 10 July *First computation period is from 25 August 2014 until 10 July 2015. |

| Closing Date | 10 July of each year |

| Dividends | All revenue from dividends arising from the trust assets will be, in principle, paid as dividends on the last day of the fiscal year after deducting expenses. *There is no guarantee on the payment or the amount of dividend. |

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your Distributor for further information. |

| Exchange Fee | Independently set by Distributors *Please contact your Distributor for further information. |

| Amount to be Retained in Trust Assets | None |

■Expenses to be borne indirectly by investors from trust assets

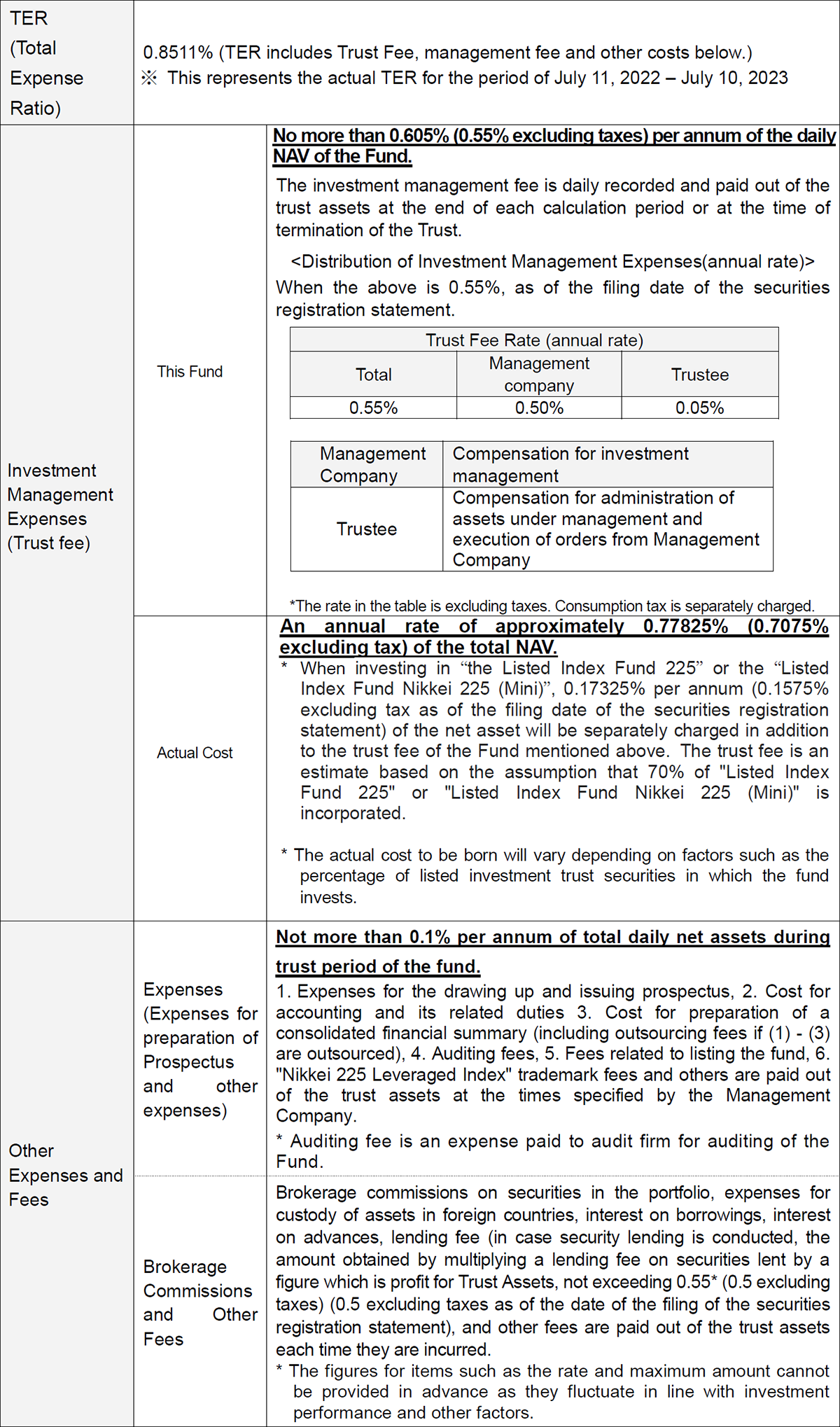

| TER (Total Expense Ratio) |

0.7787% (TER includes Trust Fee, management fee and other costs below.) |

The total amount of expenses of the fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Major Investment Restrictions

|

Trustee Companies

|

Nikkei 225 Leveraged Index is an index calculated by doubling the daily return of the Nikkei Stock Average. The base date is December 28, 2001 and the index value on that date is calculated as 10,000 points.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

Nikkei Inc.

*Link to external sites.

Copyrights of the "Nikkei 225 Leveraged Index"

The "Nikkei 225 Leveraged Index" is copyrighted work calculated through a method developed independently by Nikkei Inc. Nikkei Inc. holds the copyrights as well as any other intellectual property for the "Nikkei 225 Leveraged Index" itself, the calculation method of the "Nikkei 225 Leveraged Index", and the "Nikkei Stock Average", which is the foundation to calculate the "Nikkei 225 Leveraged Index".

All trademark rights and other intellectual property rights relating to trademarks of the "Nikkei" and the "Nikkei 225 Leveraged Index" belong to Nikkei Inc.

The fund is solely the responsibility of the investment trust service provider, and Nikkei Inc. has no responsibility for its management or transactions in regards to the fund.

Nikkei Inc. has no obligation to continue to publish the "Nikkei 225 Leveraged Index" and the "Nikkei Stock Average" and is not responsible for mistakes, delays or suspensions in its publication.

When applying to invest in this fund, please make the decision to invest carefully after taking the time to read in detail the pre-agreement documents provided to you and other relevant material.

- 21 Feb 2025 — Interim Earnings Report for Fiscal Year ending Jul 2025

- 23 Aug 2024 — Earnings Report for Fiscal Year ended Jul 2024

- 22 Feb 2024 — Interim Earnings Report for Fiscal Year ending Jul 2024

- 23 Aug 2023 — Earnings Report for Fiscal Year ended Jul 2023

- 22 Feb 2023 — Interim Earnings Report for Fiscal Year ending Jul 2023

- 23 Aug 2022 — Earnings Report for Fiscal Year ended Jul 2022

- 22 Feb 2022 — Interim Earnings Report for Fiscal Year ending Jul 2022

- 23 Aug 2021 — Earnings Report for Fiscal Year ended Jul 2021

- 22 Feb 2021 — Interim Earnings Report for Fiscal Year ending Jul 2021

- 21 Aug 2020 — Earnings Report for Fiscal Year ended Jul 2020 (11 Jul 2019 – 10 Jul 2020)

- 21 Feb 2020 — Interim Earnings Report for Fiscal Year ending Jul 2020 (11 Jul 2019 - 10 Jan 2020)

- 23 Aug 2019 — Earnings Report for Fiscal Year ended Jul 2019 (11 Jul 2018 – 10 Jul 2019)

- 22 Feb 2019 — Interim Earnings Report for Fiscal Year ending Jul 2019 (11 Jul 2018 - 10 Jan 2019)

- 23 Aug 2018 — Earnings Report for Fiscal Year ended Jul 2018 (11 Jul 2017 – 10 Jul 2018)

- 23 Feb 2018 — Interim Earnings Report for Fiscal Year ending Jul 2018 (11 Jul 2017 - 10 Jan 2018)

- 22 Aug 2017 — Earnings Report for Fiscal Year ended Jul 2017 (11 Jul 2016 - 10 Jul 2017)

- 23 Feb 2017 — Initerim Earnings Report for Fiscal Year ending Jul 2017 (11 Jul 2016 - 10 Jan 2017)

- 23 Aug 2016 — Earnings Report for Fiscal Year ended Jul 2016 (11 Jul 2015 - 10 Jul 2016)

- 23 Feb 2016 — Interim Earnings Report for Fiscal Year ending Jul 2016 (11 Jul 2015 - 10 Jan 2016)

- 21 Aug 2015 — Earnings Report for Fiscal Year ended Jul 2015 (25 Aug 2014 - 10 Jul 2015)

- 3 Apr 2015 — Interim Earnings Report for Fiscal Year ending Jul 2015 (25 Aug 2014 - 24 Feb 2015)

Authorized Participants

- SMBC Nikko Securities Inc.

- ABN AMRO Clearing Tokyo Co., Ltd.

- Barclays Securities Japan Limited

- BNP Paribas Securities Japan Ltd.

- BofA Securities Japan Co., Ltd.

- Citigroup Global Markets Japan Inc.

- Daiwa Securities Co. Ltd.

- Goldman Sachs Japan Co.,Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

- Morgan Stanley MUFG Securities Co., Ltd.

- Nomura Securities Co., Ltd.

- Societe Generale Securities Japan Limited

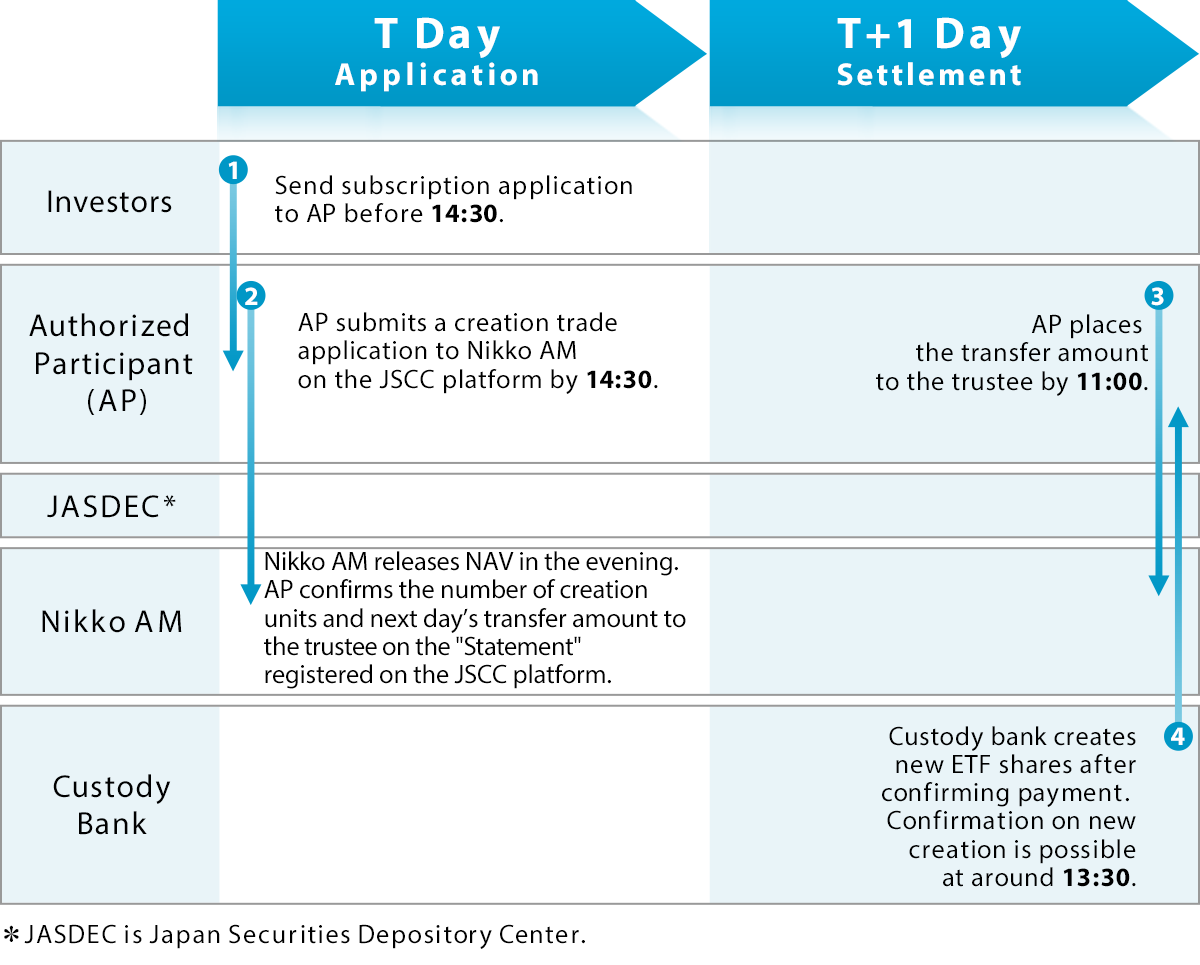

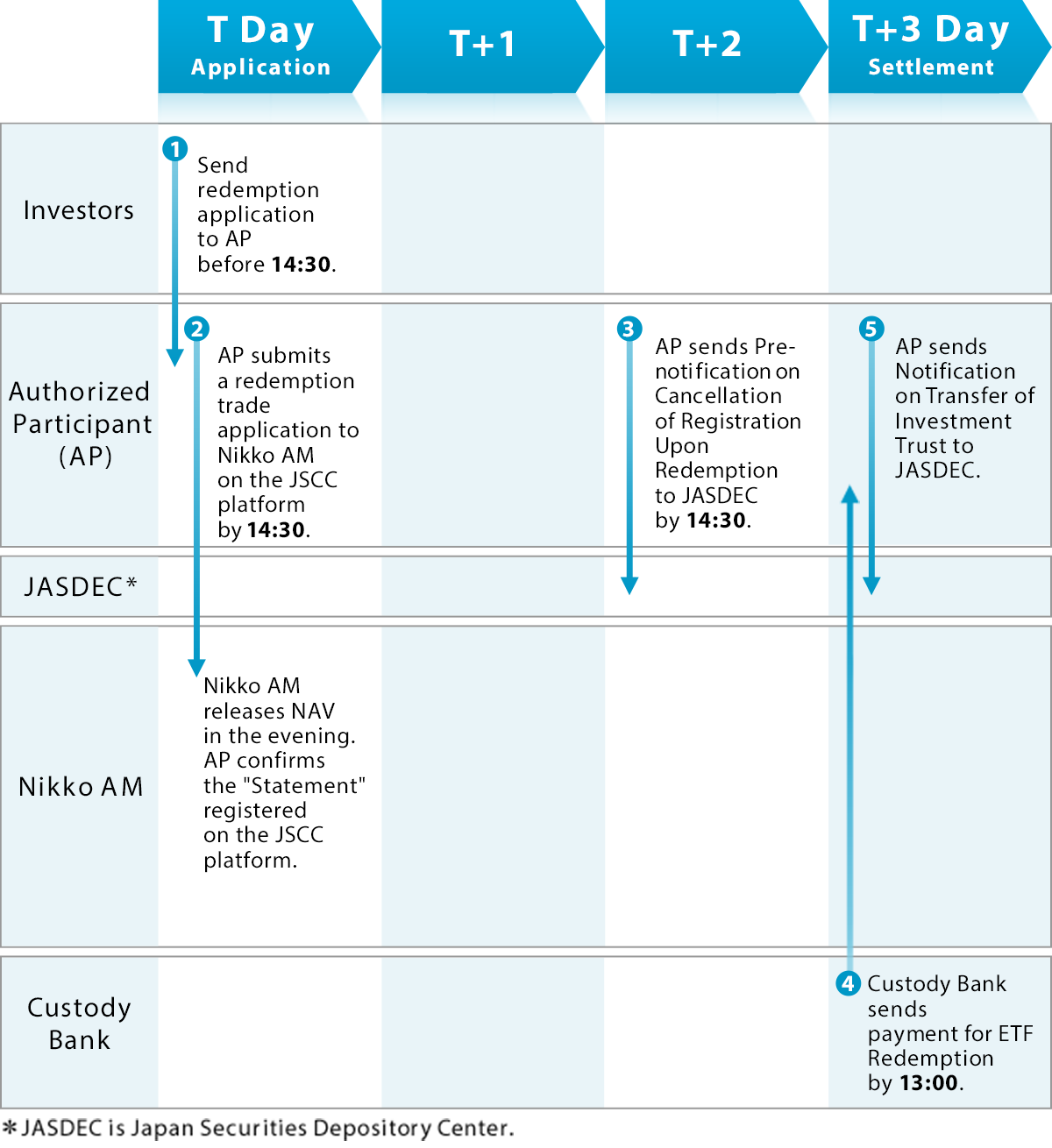

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy underlying asset at last price of T day's market.

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for Cash Creation/Redemption Type ETFs

Redemption flow for cash Creation/Redemption Type ETFs

Invested principal is not guaranteed and may incur losses where the value of your investment principal will fall below par as the result of a decline in market price or the NAV. All gains and losses from the management of the fund belong to the investor (beneficiary). This fund also differs from bank deposits.

This Fund will primarily invest in the rights for the Listed Index Fund 225 and the stock price index futures trading. Occasionally, it will be invested in other listed investment trust securities or stocks related to the Nikkei Stock Average. However, due to the possible effects such as a fall in stock prices, decrease in the value of rights (in regards to the listed securities investment trust and stock price index futures trading), poor performance of the stock, worsening of the financial standing of the stock issue etc. there will be time that the NAV falls and losses may be incurred. Investors may also incur losses due to exchange rate fluctuations when investing in assets denominated in foreign currencies.

Major risks are as follows:

1. Price Fluctuation Risk

Listed securities investment trusts such as the Listed Index Fund 225 that the fund will invest in may be influenced by the fluctuating Nikkei Stock Average (which the fund is closely linked to). In the case that the Nikkei Stock Average falls, there is a risk that the price of the listed securities investment trust's value will fall and the fund will incur a loss.

The value of rights relating to stock index futures will fluctuate due to the ever changing stock market prices. The stock market is made up of stock price indexes which are calculated using the stock prices of eligible companies. Furthermore, the value of rights may fluctuate from time to time due to price changes of other domestic and foreign stock price indexes. In the case that there are unexpected fluctuations in the prices of the stock market (which is made up of stock price indexes, and stocks related to said indexes) there is a possibility that the value of rights for stock index futures trading will have an unexpected fluctuation and may be at risk for a significant loss to occur.

In general, the price of a stock is vulnerable to company information on growth potential and profitability and changes in such information. In addition, stock prices are also vulnerable to domestic and overseas economic and political conditions and other factors. There is a risk that this fund may incur major losses in the event of stock price fluctuations or unforeseen fluctuations in stock liquidity.

Corporate and government bonds generally have a price fluctuation risk arising from changes in interest rates. Generally, their prices go down when interest rates rise, causing the NAV of the funds to fall. However, the range of price fluctuation varies by bond depending on duration and issuance conditions of coupon rate and others.

2. Liquidity Risk

In the event of small market scale or trading volume, when acquiring or selling securities, there is the risk of not being able to trade at the desired price due to actual market conditions as a result of the effects of large trading volume, the risk of being unable to sell at the valuation price, or the risk of trading volume being limited regardless of price highs and lows. As a result, there is the risk of suffering incalculable losses.

3. Credit Risk

In general, there is a risk that this fund may incur significant losses in the event that a major crisis directly or indirectly affects the management of companies in which the fund has made investments in. Due to concerns regarding default or bankruptcy, the stock price of those companies could plummet (the value could even fall to zero), causing the fundfs NAV to fall.

If a default has occurred or is expected to occur, for issues of public and corporate bonds or short-term financial assets, the prices of such public and corporate bonds or short-term financial assets decline (the value could even fall to zero). This results in a decline of the Fund's NAV. Also, if default in fact occurs, there is a high possibility of being unable to collect investment funds.

4. Currency Fluctuation Risk

In the case of foreign currency-denominated assets, generally if the foreign exchange market moves so that the yen appreciates against the currency in which the fund's assets are held, the fund's NAV may depreciate as a result.

5. Derivatives Risk

Financial derivatives based finance contracts may be used, therefore the value of derivatives will fluctuate depending on the value of underlying assets. The price of derivatives will fluctuate more than the underlying assets depending of the type of derivative. There is also the risk of suffering losses from being unable to execute transactions as originally contracted due to the bankruptcy of transacting parties, the risk of being unable to perform a reverse trade once a transaction has been settled, or the risk of only being able to perform a reverse trade under markedly unfavorable conditions compared to the theoretical price.

6. Leverage Risk

The "Nikkei 225 Leveraged Index" which the fund is closely linked to is an index that is calculated so that the day to day percentage change is equal to twice the percentage change of the Nikkei Stock Average. In principle, the fund structures its portfolio in a way that the fund will be adjusted day to day, so that the total amount of the market capitalization of the short seller's stock price for futures index trading and the total amount of the money invested in the Listed Index 225 are equal to approximately twice the total amount of the trust asset's NAV. Therefore, the fund will be greatly impacted by the conditions of the stock market. If the Nikkei Stock Average falls, there is a possibility that the fund will incur a significant loss greater than the price changes of the Nikkei Stock Average.

7. Risk-Not Able to Invest as Planned

There might be cases when the Fund may not be able to be invested as planned or the desired return on investment are not achieved due to the following factors:

- When the Nikkei Stock Average fluctuates immensely and the stock price index futures trading reach the daily trading limit (max or min).

- When all or part of the required trade volume is not placed due to a liquidity drop of stock price index futures market, etc.

- When significant fluctuation of investment funds occurs due to additional issuances and cancellations.

8. Security-lending Risk

Lending of securities is accompanied by counterparty risks (default or cancellation of lending agreements as a result of bankruptcy) and as a result, there is a risk that the fund will incur unexpected losses. Following a default or cancellation of a lending agreement, when liquidation procedures are implemented using the collateral set aside in the lending agreement, the procurement cost of buying back the securities may exceed the amount of collateral due to market price fluctuations. In such cases, the fund is required to pay the difference, which may cause the fund to incur losses.

Risk of divergence between the Nikkei 225 Leveraged Index and the fund's NAV

This fund will aim to match NAV volatility with the volatility of the Nikkei 225 Leveraged Index. Due to the following factors, however, it cannot guarantee that movements in the fund's NAV will always be consistent with that index.

- Changes in the value of the stock price index futures trading and changes in the price of the Nikkei Stock Average are not consistent. Furthermore, changes in the value of the securities investment trust such as the Listed Index Fund 225 (which the fund will be invested in) and changes in the Nikkei Stock Average prices do not match.

- There will be difference in the contracted and appraised values within listed securities investment trusts (e.g. Listed Index Fund 225) and stock price index futures trading due to day to day additions and cancellations.

- If there are adjustments done to the portfolio because of transferring capital or the modification of brands adopted on the Nikkei Stock Average, there is a possibility that there will be an impact on the market for trading each individual brand. Furthermore, the fund will carry the burden of covering the expenses (trust fees, brokerage fees for trading, auditing fees etc).

- Management fees from the lending of securities or dividends of incorporated issues.

Discrepancy between the market prices at which stocks are traded on financial instruments exchanges and the NAV

This fund is listed on the Tokyo Stock Exchange and traded publicly, however, its market price will depend mainly on demand for the fund, its investment performance, and how attractive it is to investors in comparison with alternative investments. Accordingly, it is not possible to predict whether the fund's market price will trade above or below the NAV.

* Points to note about the inherent nature of the Nikkei 225 Leveraged Index.

- The Nikkei 225 Leveraged Index is calculated as follows. The percentage change between the business day in question and the previous business day on the leverage index is calculated as being twice the percentage of the change of the Nikkei Stock Average price over the same period of time. If the difference is calculated for a period greater than two days the percentage change for the Nikkei 225 Leveraged Index will not be equal to twice the Nikkei Stock Average Price. There will be a "gap" between the calculated amount and the generally targeted price of two times the Nikkei Stock Average by compound interest effect.

- The "gap" discussed above will change depending upon the price change of the Nikkei Stock Average Price for the period in question. This "gap" can either be a positive or negative one. But in general if price changes for the Nikkei Stock Average are extremely volatile in a certain range, the chances of the "gap" becoming a negative one are increased and the index level will gradually decrease. The longer the period of the time that the calculation is used for, the larger the gap tends to become.

Additional Considerations

- These materials are distribution materials created by Nikko Asset Management in order to increase investors' understanding of"Listed Index Fund Nikkei Leveraged Index".

- The provisions stipulated in Article 37-6 of the Financial Instruments and Exchange Act ("cooling-off period") are not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Furthermore, units purchased from registered financial institutions, such as banks, are exempted from compensation by the Japan Investor Protection Fund.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption.

- The fund NAV does not always move in direct proportion of twice the rate of increase/decrease in the Nikkei Stock Average during the period of two business days or more. Therefore, the expected investment results may not be obtained if invested for a long period of time. For the above reasons, the fund is generally not suitable for long-term investment, but for investment to capture market price movements in a relatively short term period.

- When applying to invest in the Fund, please make the decision to invest carefully after taking the time to read the delivered pre-agreement document and other relevant materials in detail.