On September 1, 2025, Nikko Asset Management Co., Ltd. will change its name to Amova Asset Management Co., Ltd.

The Fund seeks to achieve NAV that closely correlates with the movement of the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index by investing in component stocks of the index and by principally maintaining a portfolio constructed according to the calculation method of the index.

Key information

| Name: | Listed Index Fund MSCI Japan High Dividend Low Volatility |

|

| Code: | 1399 |

Net Asset Value and Performance

| Fund Name | Listed Index Fund MSCI Japan High Dividend Low Volatility Open-end/Domestic/Equities/ETF/Index type |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 1399 |

| Targeted Investments | This Fund invests in component stocks of the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index, principally maintaining a portfolio constructed according to the calculation method of the index. |

| Date Listed | 1 December 2015 |

| Exchange Trading Unit | 1 unit |

| Trust period | Unlimited (launch date: 30 November 2015) |

| Computation Period | From 9 January to 8 April, 9 April to 8 July, 9 July to 8 October of each year, and from 9 October to 8 January of the following year |

| Closing Date | 8th of January, April, July, and October every year |

| Dividends | As a general rule, the full amount of dividends and other income arising from the trust assets is distributed after deduction of expenses. *There is no guarantee on the payment or the amount of dividend. |

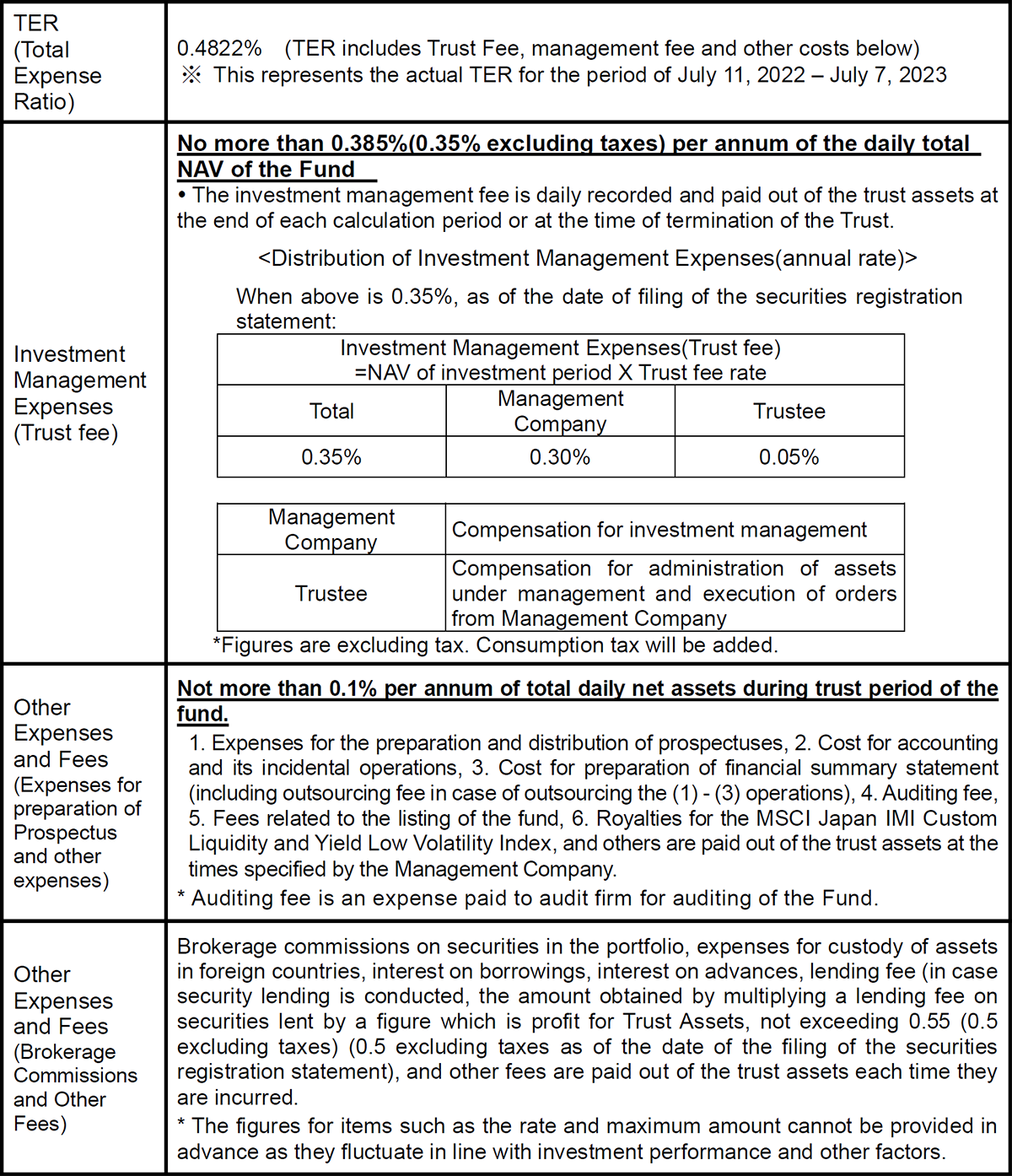

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your Distributor for further information. *Subscription Fee is compensation for explanation and information providing about the Fund or investment environment, and is also including expense of clerical processing of the subscription. |

| Exchange Fee | Independently set by Distributors *Please contact your Distributor for further information. *Exchange Fee is compensation for clerical processing of the exchange. |

| Amount to be Retained in Trust Assets | None |

■Costs paid indirectly by the customer for the trust assets (paid from the fund)

| TER (Total Expense Ratio) |

0.49% (TER includes Trust Fee, management fee and other costs below) Please refer to the prospectus for details. |

The total amount of expenses of the Fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Major Investment Restrictions

|

Trustee Companies

|

MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index is an equity index developed by MSCI, Inc. It is indexation of performance of securities that are optimized based on the investment ratio to minimize price fluctuation after analyzing historical prices by mathematical model, and its securities universe has relatively high liquidity and high dividend securities that excludes financial securities and REITs among the component shares of the MSCI Japan IMI index*.

*MSCI Japan IMI index is designed to measure performance of entire Japanese equity market and covers almost all market value after floating shares adjustment.

List of component shares is reviewed in every February, May, August and November.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

MSCI

*Link to external sites.

Copyright

This Fund is not sponsored, endorsed, sold, or promoted by MSCI Inc and its affiliated companies, information provider, and other third parties (hereinafter refers to "MSCI"), who were involved or related in the editing, calculation, or creation of the MSCI index. MSCI index is an exclusive property of MSCI. The name of MSCI and MSCI Index is a service mark of MSCI and its affiliated companies and Nikko Asset Management Co., Ltd. is allowed to use this for specific a purpose. Any companies related to MSCI make no expression or warranty, expressed or implied, as specified to the Fund’s owners or issuers, or any member of the public or organizations regarding the advisability of investing in securities generally or in the Fund particularly or in the ability of MSCI Index to track the performances of certain financial markets. MSCI and its related companies are licensers of MSCI Index and determine, create, and calculate the MSCI index regardless of specific trademarks, service marks or names, the Fund’s issuer or owners, and any member of the public or organizations. Any companies related to MSCI have no obligation to consider the requests of the Fund’s issuers or owners, or any member of the public or organizations when determining, editing and calculating MSCI Index. Any companies related to MSCI are not responsible for or been involved in the determination of the timing of, price at, or amount of the Fund to be issued, or in determination or calculation of the equation by which the Fund to be converted into cash, or the Fund’s conversion price. Any companies related to MSCI assume no obligation to the Fund’s issuer or owner, any member of the public or organizations regarding, nor do they take any responsibility for management, marketing or trading of the Fund whatsoever.

MSCI obtains information required for calculating and using in the MSCI Index from sources it thinks are reliable, however, any companies related to MSCI do not make any guarantee of the originality, accuracy or completeness of MSCI Index or the data of the Index. Any companies related to MSCI make no guarantee, expressed or implied, of the results to be obtained by the Fund’s issuer or owner, or any member of the public or organizations from the use of this Index or data included therein. Any companies related to MSCI take no responsibility for any error, omission in the data included or the discontinuation of MSCI Index. Furthermore, any companies related to MSCI expressively disclaim all warranties or conditions of merchantability or suitability for a particular purpose or use of this Index or the data contained therein, and make no guarantee, express or implied, on merchantability or suitability of this Index or the data contained therein. Without limiting any of the foregoing, any companies related to MSCI are not responsible for any direct, indirect, special, punitive, or consequential damages, and all other damages (including lost profits) arising from the use of the data contained therein, even if notified of the possibility of such damages in advance.

The Fund’s purchasers, distributors, owners or any member of the public or organizations cannot use or mention MSCI's name, trademark or service mark for the purpose of sponsoring, endorsing, selling, or promoting the Fund without checking whether it is necessary to obtain MSCI’s prior consent. Any member of the public or organizations cannot mention their relationship with MSCI without obtaining MSCI's written approval in advance.

- 21 Feb 2025 — Earnings Report for Fiscal Year ended Jan 2025

- 21 Aug 2024 — Earnings Report for Fiscal Year ended Jul 2024

- 21 Feb 2024 — Earnings Report for Fiscal Year ended Jan 2024

- 21 Aug 2023 — Earnings Report for Fiscal Year ended Jul 2023

- 21 Feb 2023 — Earnings Report for Fiscal Year ended Jan 2023

- 19 Aug 2022 — Earnings Report for Fiscal Year ended Jul 2022

- 21 Feb 2022 — Earnings Report for Fiscal Year ended Jan 2022

- 20 Aug 2021 — Earnings Report for Fiscal Year ended Jul 2021

- 19 Feb 2021 — Earnings Report for Fiscal Year ended Jan 2021

- 20 Aug 2020 — Earnings Report for Fiscal Year ended Jul 2020 (9 Jan 2020 - 8 Jul 2020)

- 20 Feb 2020 — Earnings Report for Fiscal Year ended Jan 2020 (9 Jul 2019 – 8 Jan 2020)

- 21 Aug 2019 — Earnings Report for Fiscal Year ended Jul 2019 (9 Jan 2019 - 8 Jul 2019)

- 21 Feb 2019 — Earnings Report for Fiscal Year ended Jan 2019 (9 Jul 2018 - 8 Jan 2019)

- 21 Aug 2018 — Earnings Report for Fiscal Year ended Jul 2018 (9 Jan 2018 - 8 Jul 2018)

- 21 Feb 2018 — Earnings Report for Fiscal Year ended Jan 2018 (9 Jul 2017 - 8 Jan 2018)

- 21 Aug 2017 — Earnings Report for Fiscal Year ended Jul 2017 (9 Jan 2017 - 8 Jul 2017)

- 21 Feb 2017 — Earnings Report for Fiscal Year ended Jan 2017 (9 Jul 2016 - 8 Jan 2017)

- 19 Aug 2016 — Earnings Report for Fiscal Year ended Jul 2016 (9 Jan 2016 – 8 Jul 2016)

- 19 Feb 2016 — Earnings Report for Fiscal Year ended Jan 2016 (30 Nov 2015 – 8 Jan 2016)

A unit stock is a unit in a stock basket that an investor applying for an acquisition through addition contributes to. A unit stock is also a unit in a stock basket that an investor who applies for an exchange receives in trade for a beneficial interest.

This Fund can be applied for as a direct addition and exchange at Authorised Participants in addition to the Tokyo Stock Exchange. In this case, "unit stock" is referred to as a unit. When applying as a direct addition and exchange, please keep in mind that we cannot accept your application on the following dates:

Authorized Participants

- SMBC Nikko Securities Inc.

- ABN AMRO Clearing Tokyo Co., Ltd.

- Barclays Securities Japan Limited

- BNP Paribas Securities Japan Ltd.

- Citigroup Global Markets Japan Inc.

- Daiwa Securities Co. Ltd.

- Goldman Sachs Japan Co.,Ltd.

- JPMorgan Securities Japan Co., Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

- Mizuho Securities Co., Ltd.

- Morgan Stanley MUFG Securities Co., Ltd.

- Nomura Securities Co., Ltd.

- Societe Generale Securities Japan Limited

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy at last price of T day's market.

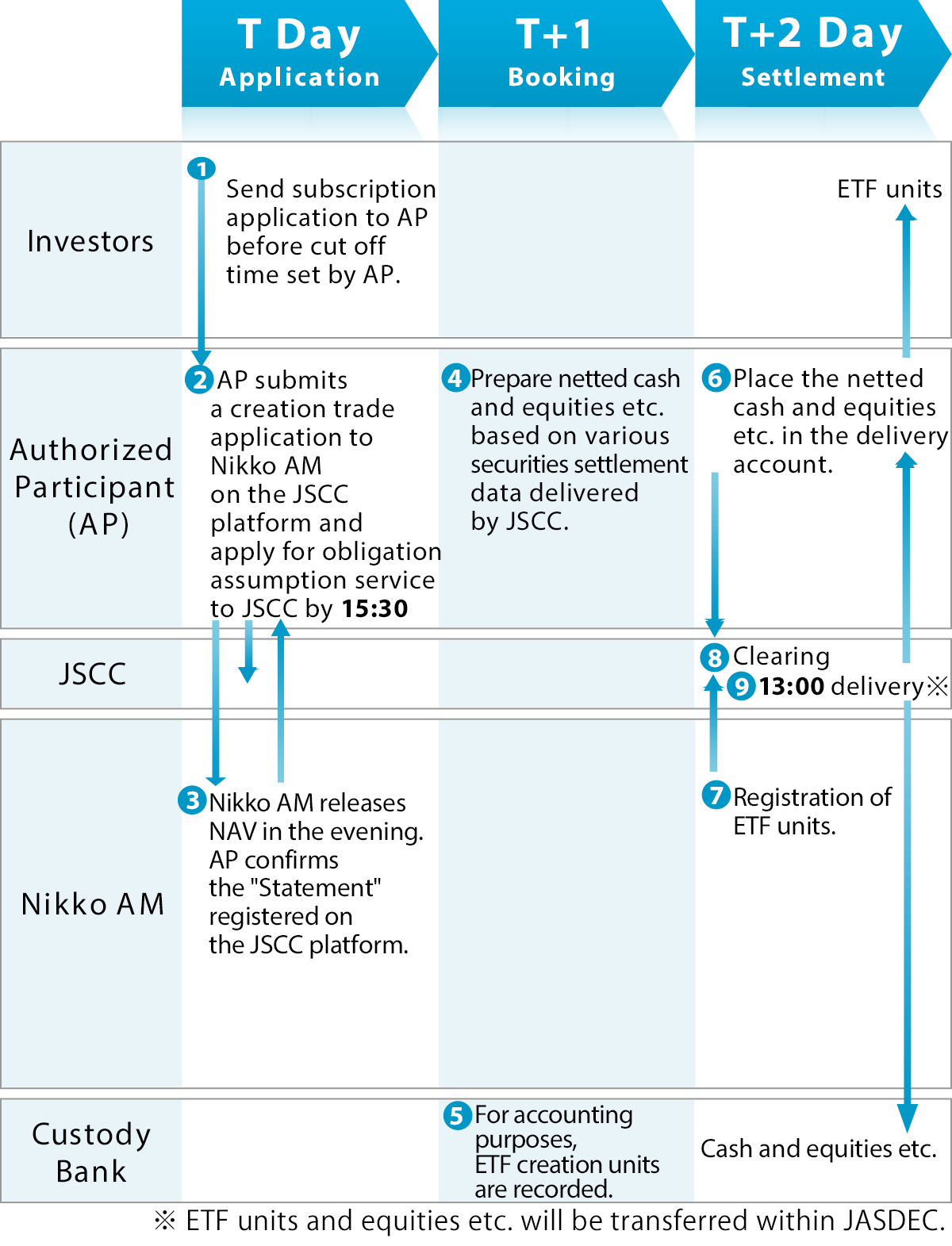

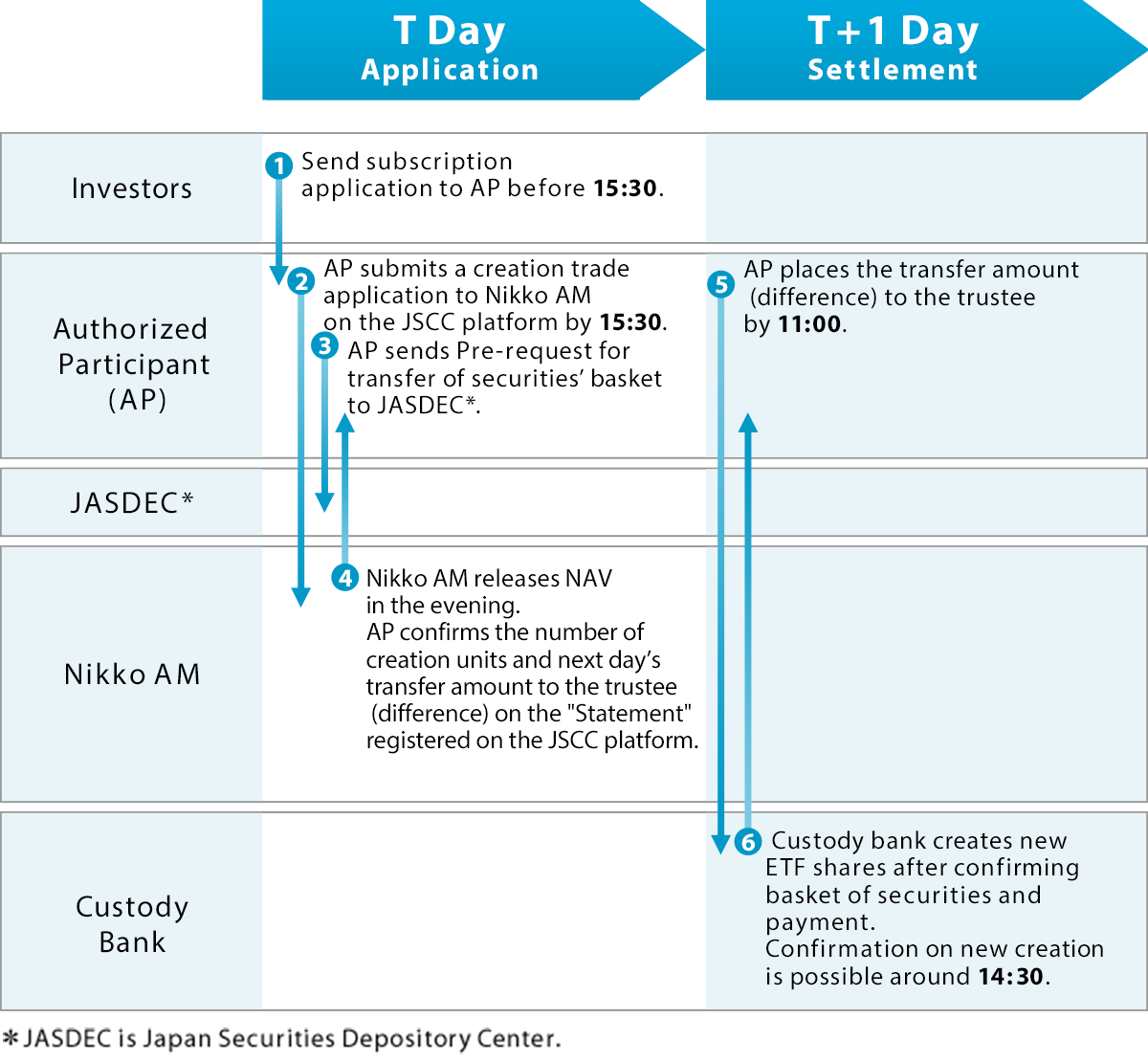

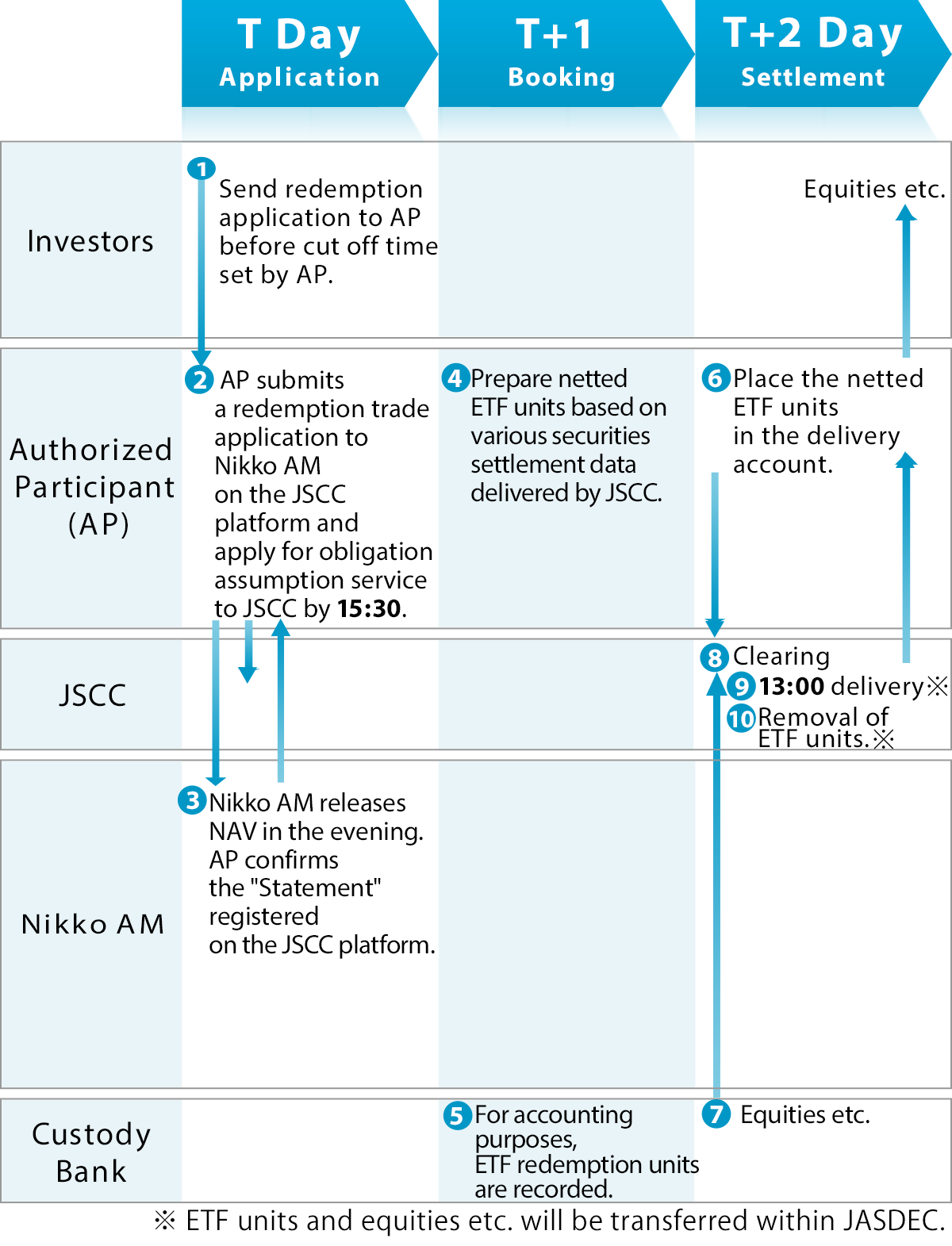

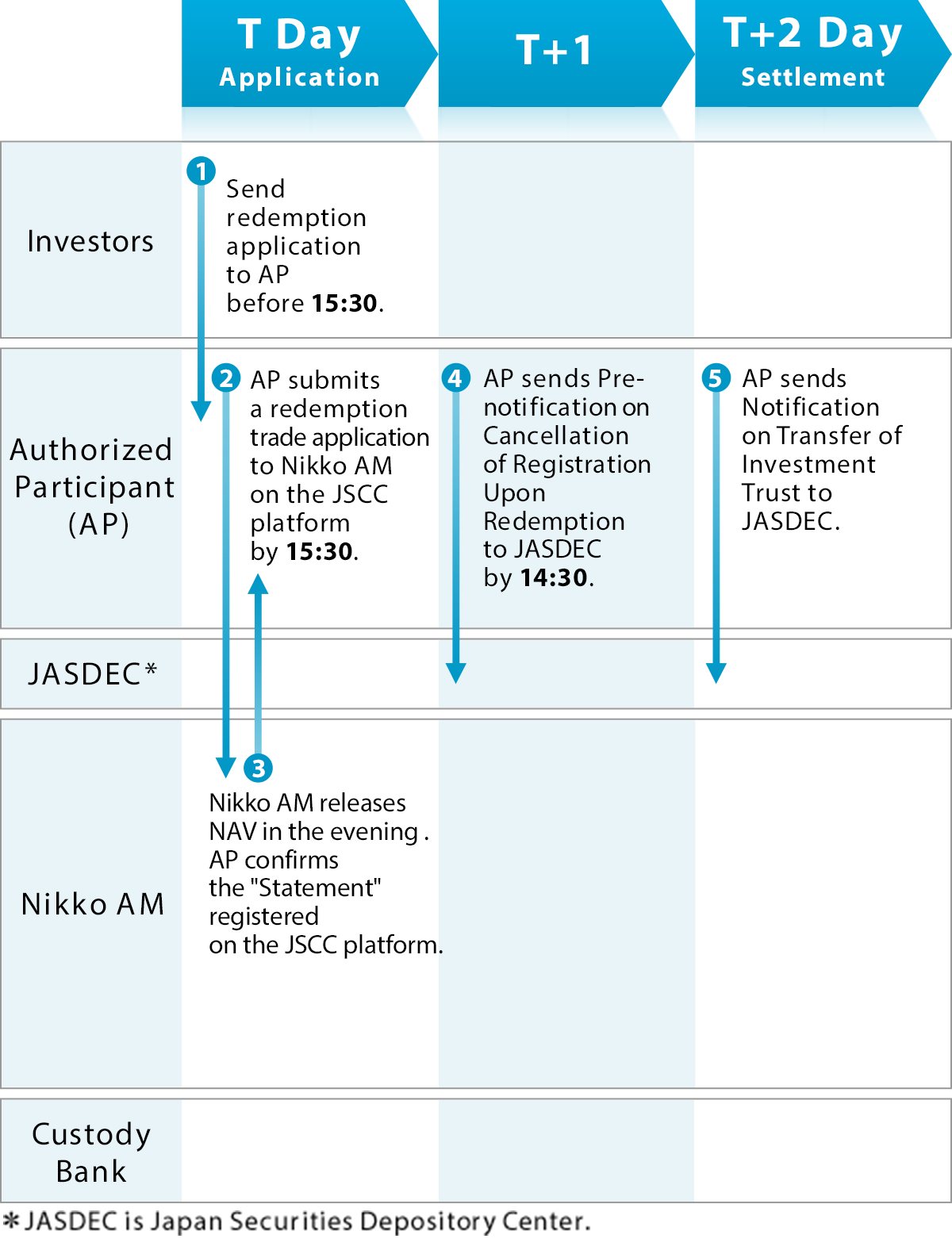

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for In-kind Creation/Redemption Type ETFs(Using obligation assumption service by JSCC)

Creation Flow for In-kind Creation/Redemption Type ETFs(Not using obligation assumption service by JSCC)

Essential Considerations

- Please secure the basket for creation ETF when making application.

- We recommend you to take measures like borrowing stocks in order to secure the basket for settlement for ETF creation.

Redemption flow for in-kind Creation/Redemption Type ETF(Using obligation assumption service by JSCC)

Redemption flow for in-kind Creation/Redemption Type ETF(Not using obligation assumption service by JSCC)

Investors are not guaranteed the investment principal that they commit. Investors may incur a loss and the value of their investment principal may fall below par as the result of a decline in market price or NAV. All profits and losses arising from investments in the Fund belong to the investors (beneficiaries). This fund is different from saving deposit.

The Fund invests primarily in stocks. The NAV of the Fund may fall and investors may suffer a loss due to a decline in stock prices or deterioration in the financial conditions and business performance of an equity issuer.

Major risks are as follows:

1. Price Fluctuation Risk

Stock prices fluctuate as they are affected by information on the company's growth rate and profitability as well as changes in such information. They also fluctuate as they are affected by economic and political conditions in Japan and abroad. There is a risk that the Fund will suffer material losses if unexpected changes occur in stock price or liquidity.

2. Liquidity Risk

The Fund may incur unexpected losses when the size of the market or trading volumes is small. The purchase and sale prices of securities are influenced by trading volume, resulting in the risks that they cannot be traded at prices expected to be realized in light of the prevailing market trend, sold at the estimated prices, or that the trading volume is limited regardless of the level of prices.

3. Credit Risk

There is a risk that the Fund will incur material losses in the event of a serious crisis that directly or indirectly affects the business of a corporation in which the Fund invests. The prices of stocks of issuers may substantially decline (possibly to zero) due to fears of default or corporate bankruptcy, which can contribute to decline in the Fund NAV.

4. Security-lending Risk

Lending of securities involves counterparty risks, which are the risks of contractual default or cancellation following bankruptcy, etc., by the counterparty. As a result, the Fund may suffer unexpected losses. Following the default or cancellation of a lending agreement, when liquidation procedures are implemented by using the collateral that is set aside in the lending agreement, the procurement cost of buying back the securities can surpass the collateral value, due to price fluctuations in the market. In such cases, the Fund is required to pay the difference, which may cause the Fund to incur losses.

Risks of Discrepancy between the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index and the NAV

The Fund seeks to match the NAV volatility with that of the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index, but it cannot guarantee that movements will be consistent with the Index for the following reasons:

- The Fund may be subjected to a market impact when buying or selling individual stocks as it adjusts its portfolio in response to changes in the stocks that comprise the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index and capital changes among corporations. In addition, the Fund will incur various expenses, including trust fees, brokerage commissions, and audit fees.

- Dividends may be paid by stocks in the portfolio and fees may be earned for securities lent.

- When derivative transactions such as futures are made, there may be disparity between the price movements of such transactions and that of some or all of the constituents of the MSCI Japan IMI Custom Liquidity and Yield Low Volatility Index.

Discrepancy between the market prices at stock exchanges and the NAV

The Fund is listed on the Tokyo Stock Exchange and the units are traded on that exchange. The market price of the units is affected primarily by the size of demand for the Fund, its performance, and how attractive it is to investors in comparison with their other investments. It is not possible to predict whether the units will sell in the market above or below the NAV.

* Factors that contribute to NAV fluctuations are not limited to those listed above.

Additional Considerations

- The provision stipulated in Article 37-6 of the Financial Instruments and Exchange Act ("cooling-off period") is not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Furthermore, units purchased from registered financial institutions, such as banks, are exempted from compensation by the Japan Investor Protection Fund.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption .

Risk Management System

- The departments in charge of risk management and compliance perform the evaluation and analysis of risks and performance, risk management, and monitoring of the status of compliance with laws, and are independent from fund management departments.

- To maintain an appropriate management system, the departments in charge of risk management and compliance will report and make proposals to the committees associated with risk management and compliance, and instruct fund management departments to take corrective actions as necessary.

* The system described above is as of the end of August 2015, and may be subject to change in the future.