Nikko AM’s Commitment to Responsible Investing

Nikko Asset Management (“Nikko AM” or “we”) is a long term, global investor across multiple asset classes, acting in the best interests of our clients. We believe that the three core factors behind sustainable, responsible investing - environmental, social, and governance (“ESG”) - are inherent to long-term value creation. Incorporating them in the investment process is consistent with our fiduciary duty.

Sustainability means managing the challenges and risks facing all organisations to meet the needs of the present, without compromising future generations. Our ESG policy is consistent with how we manage and govern ourselves sustainably, and our Code of Ethics describes Nikko AM’s core values, corporate social responsibility and global citizenship.

Nikko AM became a UN PRI signatory in 2007 (PRI representing the Principles for Responsible Investment). This early commitment is testament to our dedication to all six Principles, where consistent with our fiduciary responsibilities.

Nikko AM’s ESG Steering Committee governs the fulfilment of ESG commitments, and is mandated by the Global Executive Committee ("GEC") and chaired by the Global Head of Investment. Composed of leaders from Nikko AM’s equity and fixed income investment teams worldwide, it is responsible for evaluating effectiveness and maximizing Nikko AM’s approach to ESG and the Principles. Where Nikko AM actively manages money, we implement our commitment both by considering ESG issues in the investment process, and through engagement and the exercise of our shareholder rights. Where appropriate to the asset class, investment strategy and client requirements, certain investment teams may maintain specific ESG policies and procedures pertaining to their investment philosophy and process. The Steering Committee is also responsible for monitoring and improving the investment teams’ implementation of the Principles.

Based on the six PRI Principles, Nikko AM adheres to the following firm-wide policy:

Principle 1: Nikko AM incorporates ESG issues in investment analysis and decision-making

We believe ESG issues are inseparable from our fundamentals-based investment process. As such, their incorporation in the investment process is the direct responsibility of all the investment professionals at Nikko AM, rather than a separate team of ESG specialists. Each team may address ESG issues in their own specific investment policy statements. The head of each investment team, and ultimately the Global Head of Investment, are accountable for the implementation of ESG and the Principles. The firm realizes that the sustainability practice is evolving and helps to facilitate and continuously develop abilities to incorporate ESG by providing tools and information to, and requiring annual training for, the investment teams. We also encourage service providers to continue developing how they incorporate ESG into their products and services. Where Nikko AM invests through external managers, we consider a manager’s incorporation of ESG and practices relating to the Principles.

Principle 2: Nikko AM is an active owner and incorporates ESG issues into its ownership policies and practices

Nikko AM is an active owner, through its proxy voting process with its invested companies. As a long term investor, we believe an active dialogue and engagement with the management team, where appropriate, can both improve ESG performance and sustainability, and help an investor to more fully understand these efforts. Where we invest through passive strategies, we strive to incorporate ESG through the voting of proxies and the engagement process, where appropriate. To assist in the promotion of the Principles, Nikko AM discloses our voting, as is consistent with local practice.

Principle 3: Nikko AM seeks appropriate disclosure on ESG issues by the entities in which it invests

Nikko AM supports transparency and disclosure on ESG issues. Adequate and accurate information is essential to the appropriate incorporation of ESG issues in the investment process. As long term investors, we believe active dialogue with the management of the companies we invest in enhances disclosure. As such, we support further efforts by issuers to disclose, and investors to promote the disclosure of, robust, consistent and standardised information.

Principle 4: Nikko AM promotes the acceptance and implementation of the Principles within the investment industry

We see ESG issues as inseparable from the investment process. We communicate to employees and existing and potential clients, why and how such issues are integrated into investment decision making. Nikko AM considers supporting regulatory or industry actions that further promote the acceptance and incorporation of the Principles over time.

Principle 5: Nikko AM collaborates to enhance effectiveness in implementing the Principles

Nikko AM actively collaborates with clients and members of the investment management industry to promote and implement best ESG practices. Such engagements are supported by the Steering Committee and reported to the GEC. Nikko AM supports dedicated resources, including external research providers, for ESG analysis and mandates a policy of continuous staff training on ESG and responsible investing. This may include participating in networks and information platforms to share tools, pool resources, and make use of investor reporting.

Principle 6: Nikko AM reports its activities and progress towards implementing the Principles

Nikko AM takes various steps to report and disclose progress on our implementation of the Principles, in part to encourage others within the investment industry to do the same. Internally, we report on all ESG implementation and relevant activities to the GEC and Board of Directors at least annually, including progress in implementing the Principles and the impact on our investment activities. Externally, we respond to client inquiries regarding all ESG issues related to specific portfolios, as well as more generally how ESG issues are integrated in the investment process and practices. More generally, we communicate our stance on the importance of ESG issues in the investment process with employees, the broader investment industry and beneficiaries, including disclosure of active ownership activities.

It is important to note that we do not exclude particular asset types, industry sectors or securities wholly on moral or ethical grounds, unless this is expressly built into the product’s investment strategy or client agreement.

This policy will be revised to reflect our continued capability enhancement in the sustainable and responsible investing space.

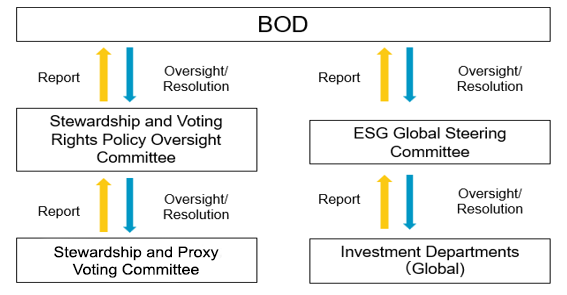

Governance

Fiduciary and ESG principles guide everything we do at Nikko AM, so any discussions on resolutions or reports relating to these areas are carried out at our Board of Directors meetings. Our Stewardship and Voting Rights Policy Oversight Committee is made up of a majority of outside members, and the Chairperson is an outside member, as well.