Snapshot

Risk assets largely moved in line with expectations surrounding the US presidential election in the 2024 October-December quarter. Most asset classes were weak in the early part of the quarter, with both bonds and equities dropping. Stock market volatility rose ahead of the US election as equities reacted to the changing odds of Republican victories. In the mid part of the quarter, bonds gained and US equities moved higher. However, the picture was more mixed for markets outside the US. The final month of the quarter was negative for most asset classes, although global equities reached an all-time high before undergoing a correction.

Following the Republicans' victories in the US election, the prospect of corporate tax cuts drove gains in US equities. However, markets in Europe and elsewhere struggled amid the prospect of tariffs under the Trump administration. US equities were the best performers towards the end of the quarter, largely due to the Republicans' election success. In bond markets, the possibility of a Republican victory was viewed as negative early in the quarter in view of the party's preference for corporate tax cuts and tariff hikes, which are generally seen as inflationary. However, bonds gained in the mid part of the quarter on indications that Scott Bessent—Trump's pick for US Treasury secretary, later confirmed for the job by the Senate—would seek to reduce the country's deficit and increase its oil production. Bonds underwent a sell-off towards the end of the quarter after stronger-than-expected US economic data reinforced the perception that US interest rates would be higher for longer.

Furthermore, in view of persistent inflation, the US Federal Reserve (Fed) delivered a hawkish rate cut in December and indicated a slower pace of cuts in 2025. This led to a rally in the US dollar. We expect the contrast between the US monetary policy situation and the easier monetary path being taken in Europe to keep the euro under pressure in the near term.

Cross-asset 1

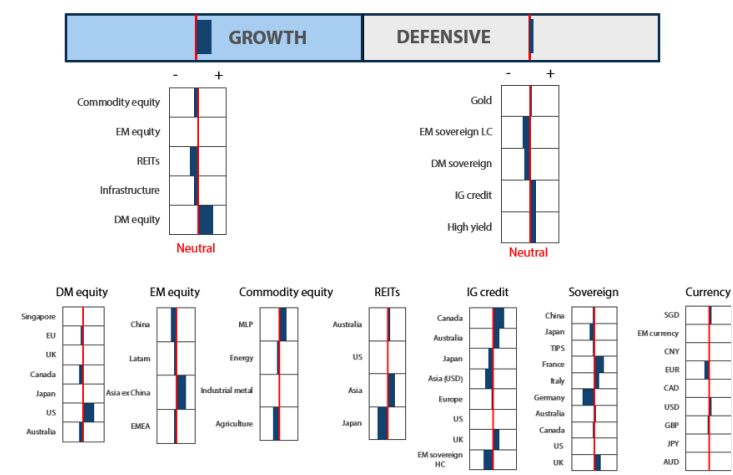

We maintained an overweight position on growth assets over the quarter. Our overweight position was supported by factors including the start of the Fed's interest rate cutting cycle and the US election, which resulted in a Republican presidency and fuelled expectations for a strong US economy. We consistently maintained a positive view on the US market, which has been driven by secular growth themes and increased energy demand boosting sectors such as utilities.

We increased our overweight position on developed market (DM) equities. Within DM, we kept our overweight on US equities thanks to better visibility driven by secular growth themes. We increased our position on Japanese equities from underweight to neutral as we view the country favourably for its long-term structural story of improving corporate governance and earnings growth momentum.

We reduced emerging market (EM) equities from overweight to neutral due to the potential implications of a stronger dollar and import tariffs under the Republican administration. We still favour India, Indonesia and Taiwan within EM as they are expected to benefit from structural long-term growth stories and as they are domestically-driven economies. Taiwan, in particular, is seen to be supported by the current global tech upcycle.

We maintained our underweight position on commodity equities. Within the asset class, we kept energy underweight due to oversupply and slowing demand.

Within infrastructure, we maintained a preference for US utilities, reflecting our positive view on increasing energy demand driven by growth in data centres.

Our view of defensives improved during the quarter with higher yields having made this group of asset classes more attractive. Both investment grade (IG) credit and High Yield were upgraded to larger overweight, as we still expect the spread environment to be positive given the strength of the US economy, although credit spreads have reached relatively tight levels and there may not be much room left for spread contraction.

While we kept our underweight position on DM sovereign bonds, their hedged yields now look relatively attractive due to the sell-off in US Treasuries (USTs) and the steepening in the bond curve makes the market more palatable. Within DM sovereigns, we continue to favour markets such as France and Italy, where additional spreads can be obtained and may hence provide a buffer against the poor carry of global sovereign markets.

Within EM Local Currency sovereigns, which we downgraded marginally to larger underweight as a whole due to potential pressure arising from a strong dollar, we selectively favour certain countries such as India and Indonesia. Lastly, we lowered the score for gold to marginal overweight. We still see gold as a strong diversifier that should perform well given the large fiscal deficits globally. However, the precious metal has had an extremely strong run for an extended period. As higher hedged yields are available, gold is now less attractive relative to DM sovereigns.

Asset Class Hierarchy (Team View 2 )

Research Views

Growth assets: summary of score changes in Q4

Growth assets are attractive as economic data remain resilient amid falling inflation and as global central banks lower interest rates after pivoting away from restrictive monetary policies. The US elections, which resulted in a Republican sweep, could lead to increased US fiscal spending and higher import tariffs, potentially reigniting inflationary pressures. This could mean a higher-for-longer rates outlook and a stronger dollar. However, expectations that the Trump administration will implement corporate tax cuts, along with the current rate-cutting cycle and deregulation, remain powerful drivers of returns. Earnings so far have been resilient, and the current reporting season should confirm the continued upward trajectory of earnings growth. This is supportive of growth assets, although the hurdle is now higher.

Growth assets topic: Peeking into the crystal ball as we look ahead to 2025

Markets declined recently on the back of stronger-than-expected US payroll numbers. Investor concerns centred around stronger-than-expected economic data and expectations of higher-for-longer interest rates due to stickier inflation. Higher yields do present risks to equities by increasing the borrowing costs of companies. Likewise, given that equities are long duration risk assets, the higher yields would imply a higher discount rate for future cash flows, leading to a lower intrinsic value. In addition, when comparing the two asset classes, the equity risk premium would look less attractive than the bond yields at these levels.

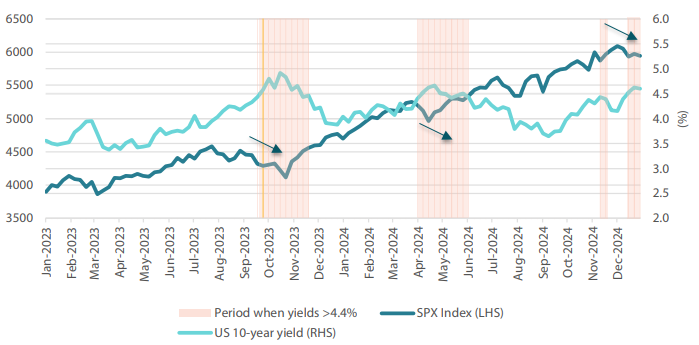

If we look in the past years when markets became concerned with higher yields, we see that the S&P index tends to struggle when the yields exceeds 4.4% (Chart 1). Yields at current levels could therefore generate headwinds for equities. Based on our internal view of higher yields for 2025, together with the stretched valuation of equities, we foresee a more arduous path to higher equity prices. Despite this, we continue to be positive on the companies delivering earnings growth in 2025. Moreover, market-friendly Trump policies such as tax cuts and deregulation, if implemented, should be supportive.

Chart 1: Higher yields provide headwinds to equities

Source: Bloomberg, January 2025

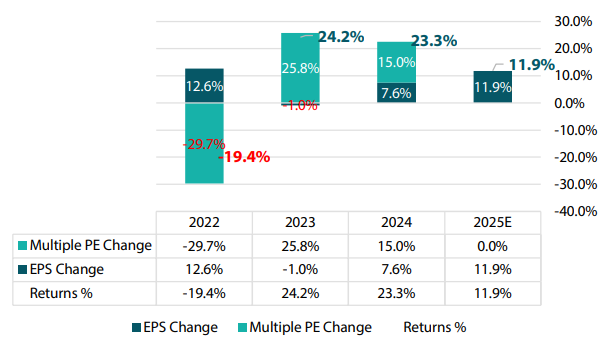

It is important to look at the drivers of returns in the past few years and understand what may propel equity prices higher in 2025. In 2022, despite a 12.6% growth in earnings, the US market de-rated with price-earnings ratio (P/E) contracting by 29.7% on fears of recession. Conversely, the market rallied 24.2% in 2023 as recession fears subsided, despite earnings declining by 1.0%. The P/E ratio expansion in 2023 drove all of the market returns as it rose 25.8% on the back of slowing inflation and a pause by the Fed. Moving on to 2024 when the Fed finally initiated the rate cutting cycle and inflation rolled over, the market again rallied, surging 23.3%. During this period, the P/E ratio expanding by 15.0%, and earnings grew by 7.6%.

Moving into 2025, the earnings outlook remains positive with a projected increase of 11.9% as corporations are seen benefitting from the stronger-than-expected economy and rate cuts. In addition, the Trump administration could potentially implement tax cuts and deregulation and provide a boost for risk assets. However, although not impossible, further P/E multiple expansions from current levels are highly unlikely. Hence, earnings growth is expected to drive most of the US market's returns in 2025 (Chart 2).

Chart 2: Breakdown of market returns, 2022-2025E

Source: Bloomberg, January 2025

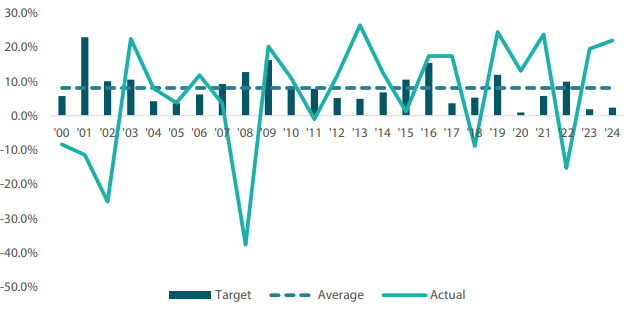

It is interesting to observe the targets set by global strategists at the start of each year. For the past two years bears probably outnumbered bulls, with projected target returns of +1.9% and +2.4% for 2023 and 2024, respectively. From a top-down perspective, strategists were also widely divided on their positioning for the various regions. Since then, the bears have largely capitulated, and for the first time, there is an almost unanimous call to overweight the US and underweight the rest of the world. This is despite the US having the richest valuation relative to the rest of the world. It appears that, after getting it wrong for two years, the fear of missing out (better known as FOMO) has caught up with the strategists. Historically, global strategists do seem to be more wrong than right (Chart 3). Perhaps at some point, it might be prudent to look beyond the US for other risk assets to deploy capital for a more diversified risk reward profile.

Chart 3: Strategists more likely to be wrong than right—S&P 500 return forecasts vs actual outcomes

Source: Bloomberg, January 2025

Conviction views on growth assets

- Maintain exposure to US secular growth: We continue to like US tech-related stocks despite market concerns regarding the returns expected on investments made on AI and data centres. Corporate earnings have been holding out well and the secular long-term growth story for the sector remains intact. Within the US, we are also starting to see the rally widening beyond the “Magnificent 7”, which is positive for the overall market. As inflation comes under control amidst a more dovish monetary policy, risk assets are expected to do well in the US. Likewise, the Republican sweep is positive for equity markets as we expect to see continued strong fiscal spending and protectionism from the US to support its economy.

- Reduce exposure to EMs: We maintained our neutral position in EMs on the back of the Republican sweep. While we maintain our view that interest rate cuts will continue into 2025, the pace will likely slow, resulting in a stronger-than-expected dollar. A strong dollar historically would present headwinds for EM performance as central banks in the region will have less leeway to cut rates to stimulate their domestic economies. Within EMs, we still like selective markets, notably India, which benefits from a domestically-driven economy and structural long-term growth story. Likewise, we like Taiwan for its exposure to the global technology upcycle.

- Maintain Japan equities: We retained a neutral position in Japan equities in lieu of our view on the weaker yen amidst a stronger dollar. We still like Japan's structural reform story where we expect companies to increase their capital and dividend returns to shareholders. However, the volatility of the yen and a hawkish Bank of Japan juxtaposed against dovish central banks globally also presents headwinds to sentiments. We will adopt a more positive stance on the country once we see its currency stabilising at a higher level.

- Remain underweight on commodity-linked equities: Given the slowing economic data and energy oversupply, we retained our underweight exposure in the asset class. We rebalanced the weights from materials equities given weak sentiments and remained overweight MLPs on strong defensive yields and a good structural story. We continue to believe that commodity-linked equities will continue to provide good diversification against inflation in the longer term. The fundamentals of commodity-linked equities remain compelling due to both cyclical and secular fundamentals.

Defensive assets: summary of score changes in Q4

With the Fed having cut interest rates by 100 basis points (bps) since September 2024, bond curves are now steepening to reflect the easier financial conditions. While this is gradually making bonds as a whole look more attractive, the strong economic data is now leading to the thought that this rate-cutting cycle may turn out to be slower than previously expected. This quarter's Balancing Act looks at the strength of the key US data to help determine just where fair value for bonds may lie in 2025. Despite the potentially more hawkish outlook for the US policy rate, overall, we think USTs are becoming increasingly attractive following their sell-off as yields approach 5%. After maintaining a cautious view on USTs for the past 12 months, we are now looking to close those underweights.

Defensive assets topic: Has the Fed changed its policy path already?

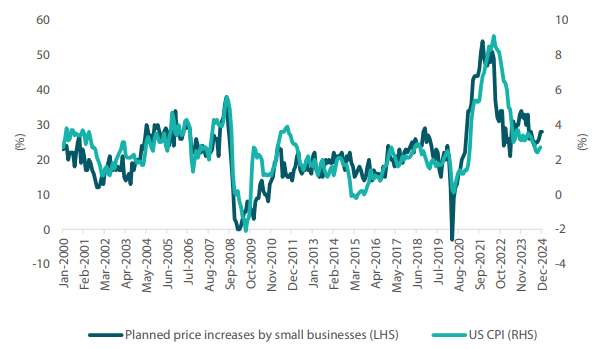

With inflation moving back towards its target and the unemployment rate drifting marginally higher, the Fed eased by 100 bps to move the economy out of a restrictive rate policy. When the Fed initiated its easing cycle, markets forecasted a policy rate as low as 2.5% in two years, expecting a drawn-out easing cycle. However, as we move into 2025, this narrative has shifted dramatically, as inflation appears stickier than expected and unemployment remains low. Following a string of positive data, the market now anticipates a policy rate of 4.13% in 12 months, barely pricing in one more rate cut before this easing cycle ends. While this is slightly ahead of what we previously forecasted—we expected a policy rate between 3.50% and 4.0%—lead indicators for inflation do show some signs that the fight against inflation is not over. For example, more small business are planning price increases, and ISM's survey of prices paid by manufacturers are points to higher prices once again.

Chart 4: Percentage of small businesses planning price increases and US CPI

Source: Bloomberg, January 2025

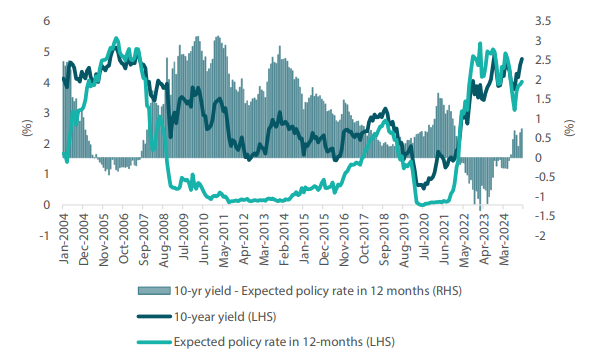

In addition to this, strong payroll figures have led the market to question its prior narrative that the labour market was beginning to soften. US payrolls expanded by over 250,000 jobs in December 2024, strong enough to keep the unemployment rate at a robust 4.1% and maintain payroll growth at a three-month average of 170,000. Given inflation remains at 2.9% and unemployment in the low single digits, it is difficult to dispute the market's expectation that the Fed should be actively considering ending their easing cycle soon. From a bond valuation perspective, this raises the question of just how far bond yields could rise if the higher for longer environment is truly upon us. From our perspective, we see 10-year bonds as representing a decent valuation when their yields are 100 bps above the market's expectation for policy rates in 12 months. Accordingly, we currently see the 10-year bond's 5% yield mark, a level which is now only about 25 bps away as of this writing, as an attractive entry point.

Chart 5: US 10-year yield vs. policy rate forecasts

Source: Bloomberg, January 2025

From a positioning perspective, the rise in yields has led portfolios to begin reducing their underweights to US debt, adding back both sovereign bonds and US IG Credit. Just last month, we made a case for Australian bonds; however, since that market's spread versus USTs has since contracted from +20 bps to -15 bps, we have revived our favourable view of the US. In terms of forecasting how far the Fed might move rates, we currently expect that at least a 1% real rate is required in order to tackle the last mile of inflation. Unfortunately for those who wanted easier policy rates, inflation is persisting in the 2.5% to 3.0% range and this may mean that a 4% policy rate could become the norm in the near term.

Conviction views on defensive assets

- IG credit and high yield: Credit spreads remain at fair levels, and as central banks ease, global growth should improve. With steeper bond curves and stronger levels of hedged yield, we look to use credit to add yield across all portfolios.

- Gold remains an attractive hedge: Gold has been resilient in the face of rising real yields and a strong dollar, while proving to be an effective hedge against geopolitical risks and persistent inflation pressures. Falling real yields should benefit the asset class and we use this allocation to supplement our long bond positioning.

- Adding duration: Although central bank easing cycles might end more quickly than expected, the global curve steepening makes bonds look more attractive. Our portfolios have begun to close underweights to USTs and are seeking a 10-year yield of around 5% to add additional duration.

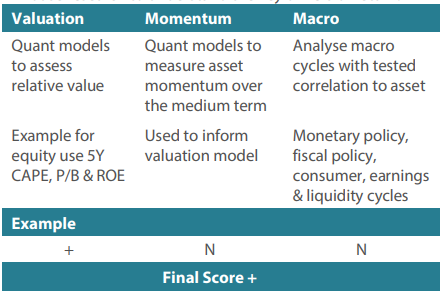

Process

In-house research to understand the key drivers of return:

1 The Multi Asset team's cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager's current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team's view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.