Summary

- US Treasuries (USTs) experienced some volatility in May. At the end of the month, the benchmark 2-year and 10-year UST yields settled at 4.87% and 4.50%, respectively, 16.2 basis points (bps) and 18.1 bps lower compared to end-April. Within Asia, inflation trends were varied. The central banks of Malaysia, Indonesia, South Korea and the Philippines left their policy rates unchanged.

- We have shifted to a mildly positive stance on overall duration, preferring high-yield markets such as India, Indonesia and the Philippines. We consider it prudent to take a more constructive view on duration only after US data weaken or lower rates volatility changes the current market dynamics.

- Asian credits gained 1.33% in May, as credit spreads tightened about 9 bps and UST yields eased. Asian investment-grade (IG) credit underperformed its Asian high-yield (HY) counterpart, returning 1.08% with spreads widening 0.3 bps. Asian HY credit returned 2.75% with spreads tightening by 77 bps.

- From a technical perspective, we expect Asia credit to remain well-supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. However, the emergence of certain negative risk factors may exert some widening pressure on Asia credit spreads, particularly in the IG segment.

Asian rates and FX

Market review

UST yields ease in May

USTs experienced some volatility in May. The month began with USTs rallying on a dovish Federal Open Market Committee (FOMC) meeting and a weaker-than-expected US employment report. The US central bank left rates unchanged as anticipated. Despite acknowledging that disinflation had stalled during the first quarter, US Federal Reserve (Fed) Chair Jerome Powell projected inflation to slow further later in the year. He indicated that a rate hike was "unlikely" and suggested that softer inflation or a weakening labour market could facilitate a rate cut.

The April US jobs report reinforced the positive sentiment, with non-farm payrolls coming in at 175,000, below the expected 240,000, and the unemployment rate rising to a higher-than-anticipated 3.9%. Subsequently, cooling inflation data and other economic indicators pointing towards a slowdown pushed yields further down. However, this trend reversed as the initial optimism about rate cuts diminished.

On separate occasions, several Fed officials argued to keep rates higher for an extended period. This, together with resilient economic data and the FOMC minutes—which were perceived as more hawkish than Powell’s press conference—prompted a shift in sentiment. According to the minutes, "many" participants expressed doubts about the current policy’s restrictiveness, while "various" participants indicated a willingness to tighten policy rates further “should risks to inflation materialise in a way that such an action became appropriate”. These factors led markets to delay the timeline for the first expected rate cut until the end of the year. By the end of May, the benchmark 2-year and 10-year UST yields settled at 4.87% and 4.50%, respectively, 16.2 bps and 18.1 bps lower compared to end-April.

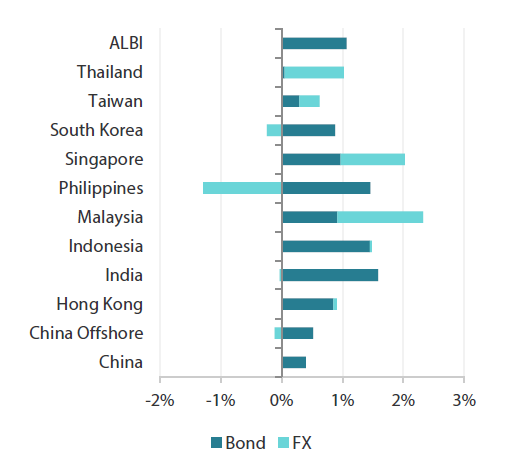

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 May 2024

|

For the year ending 31 May 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 May 2024.

Central banks leave their policy rates unchanged

In May, the monetary authorities in Malaysia, Indonesia, South Korea and the Philippines left their respective policy rates unchanged. Bank Negara Malaysia (BNM) maintained its overnight policy rate at 3.0%, emphasising that its current monetary policy continues to support the economy. The central bank is optimistic about economic prospects, expecting a recovery in exports, driven by the global technology upcycle. BNM also expects continued employment and wage growth to boost household spending and anticipates further increases in tourism.

Similarly, after delivering a surprise hike in April Bank Indonesia (BI) kept its benchmark seven-day reverse repo rate at 6.25%. BI Governor Perry Warjiyo described this decision as a “pre-emptive and forward-looking step” aimed at stabilising the rupiah and keeping inflation within the central bank’s target range. In addition, BI retained its 2024 economic growth forecast at 4.7–5.5%.

In the Philippines, the Bangko Sentral ng Pilipinas (BSP) kept the target reverse repurchase rate unchanged at 6.50%. The central bank revised its risk-adjusted inflation forecast for the current year down to 3.8% from 4.0% but raised its projection for 2025 to 3.7% from 3.5%. According to the central bank governor, the BSP might begin its easing cycle as early as August of this year or by the fourth quarter.

Elsewhere, the Bank of Korea (BOK) kept its benchmark seven-day repurchase rate unchanged at 3.50%. The BOK also revised its 2024 GDP growth forecast upward to 2.5% from an earlier estimate of 2.1% and expects headline inflation to average 2.6% for 2024, which is in line with its previous forecast.

Inflation trends vary in April

In April, overall inflation rates increased in China, Thailand and the Philippines, while Malaysia and Singapore experienced stable headline consumer price index (CPI) readings. Indonesia, India and South Korea experienced slight moderations in their inflation rates.

Inflation in the Philippines quickened for the third consecutive month, rising by 3.8% year-on-year (YoY) in April, up from 3.7% in March. The acceleration was primarily driven by faster rises in food and transport costs.

Similarly, Thailand’s headline inflation rate rose 0.19% YoY in April, following a 0.47% drop in the previous month. This was the first increase in seven months, although the headline CPI remains below the central bank’s target of 1–3%.

In Malaysia, headline CPI remained stable at 1.8% YoY in April, marking the third consecutive month without change.

Singapore’s inflation rates also remained stable, with both headline and core inflation in April remaining unchanged from March. Private transport costs rose, but this increase was offset by lower inflation in accommodation costs.

Elsewhere, the inflation rate in Indonesia eased slightly in April, with headline CPI rising 3.0% YoY, down from 3.05% in March and below a predicted 3.1% increase. This moderation was partly due to improved rice stocks at the start of the harvest season, which helped ease food inflation. In contrast, the core inflation rate accelerated slightly to 1.82% YoY in April, up from 1.77% in March.

Decent growth seen in 1Q24

Thailand’s GDP increased by 1.5% YoY in the first quarter of 2024 (1Q24), which was slightly lower than the 1.7% growth seen in the last three months of 2023. Despite this, growth still beat the Bank of Thailand’s forecast of 1.0%. Thailand’s growth was supported by private consumption and tourism, which helped offset weakness in public sector spending and goods exports.

Malaysia’s economy grew faster than initially estimated. The GDP growth rate was 4.2% YoY, up from the 3.9% advance estimate.

Indonesia’s economy expanded by 5.11% YoY, a slight increase from the 5.04% growth witnessed in the previous quarter, supported by household consumption, investment and government spending.

Meanwhile, Singapore’s GDP grew 2.7% YoY, matching the advance estimate and surpassing expectations of a 2.5% increase. The Ministry of Trade and Industry maintained its 2024 GDP growth forecast range at 1–3%. The ministry continued to highlight downside risks from geopolitical tensions, prolonged tight global financial conditions, increased volatility in capital flows and currency fluctuations.

China issues ultra-long bonds, government announces substantial measures to support real estate sector

China rolled out its most significant measures to date aimed at stabilising the real estate market. The measures address both supply and demand aspects of the market. Some cities announced measures such as easing purchasing restrictions for non-residents, scrapping minimum interest rates on mortgages and reducing down payment requirements for home buyers.

The central government guided local governments to consider purchasing unsold homes from developers so they can be converted into affordable housing, and some local governments have initiated such purchases. However, the market was disappointed with the size of the People’s Bank of China (PBOC) re-lending quota of renminbi (RMB) 300 billion that was meant to support these efforts.

Separately, the government issued the first two tranches of a planned Chinese yuan one trillion of ultra-long bonds. These bonds, with terms of 20 and 30 years, were well-received by the market.

Market outlook

Positive on India, Indonesia and Philippine bonds

We have turned mildly positive on duration overall with a preference for high-yield markets such as India, Indonesia and the Philippines on the view that their higher yields can provide buffers against any near-term volatility in US bond markets. We consider it prudent to take a more constructive view on duration only after evidence of softening US data or lower rates volatility changes the current market dynamics.

Asian credits

Market review

Asian credits register gains in May

Asian credits returned +1.33% in May as credit spreads tightened about 9 bps and UST yields eased. The sharp rally in Chinese property credits led to Asian HY credits outperforming Asian IG credits. Asian IG credits gained 1.08% with spreads widening by 0.3 bps, while Asian HY returned +2.75%, with spreads tightening by 77 bps.

The tightening in Asian credit spreads was sustained largely by the rally in Chinese credits. Despite economic data suggesting that China’s economy is struggling to maintain the momentum from the first quarter, markets responded positively to policymakers’ efforts and determination to stimulate the economy through accelerated fiscal spending and significant measures to stabilise the property market.

Following the recent Politburo statement pledging to digest housing inventory, as mentioned above China rolled out its most significant measures to date since the start of the property sector turmoil in 2021. In a historic move, the State Council called for local governments to purchase unsold completed properties for conversion into affordable housing based on demand and reasonable prices, while the PBOC simultaneously announced the RMB 300 billion re-lending facility to support the measure.

The PBOC also announced the abolishment of mortgage floor rates and further lowered the minimum down payment ratios for first- and second-time home buyers. Separately, the US imposed new tariffs on Chinese imports, targeting strategic sectors like electric vehicles, batteries, steel and critical minerals, but markets largely shrugged off the news.

Elsewhere in Asia, S&P Global Ratings upgraded India’s sovereign rating outlook to “positive” from “stable” while maintaining its rating at “BBB-“. According to the credit rating agency, India’s “sound economic fundamentals” are expected to underpin growth momentum over the next two to three years. Meanwhile, India’s six-week election process concluded on 1 June, with Prime Minister Narendra Modi’s Bharatiya Janata Party securing another term in office.

By the end of May, spreads for all major country segments, except for Malaysia, South Korea, Taiwan and Thailand, tightened. Notably, the market capitalisation of Macau gaming in the JACI index increased to 2.4%, up from 2.2% at the end of the previous month, following the inclusion of Las Vegas Sands in the index.

Primary market activity picks up in May

Activity in the primary market picked up further in May. The IG space saw 19 new issues amounting to USD 12 billion, including the USD 3.0 billion three-tranche issue from Standard Chartered PLC and the USD 2.0 billion two-tranche sovereign issue from the Republic of the Philippines. Meanwhile, the HY space saw just three new issues amounting to USD 1.25 billion.

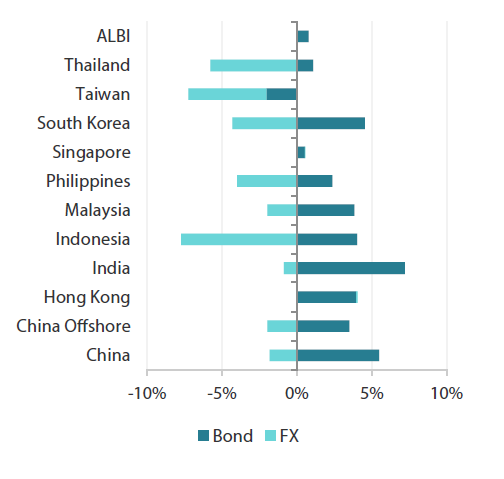

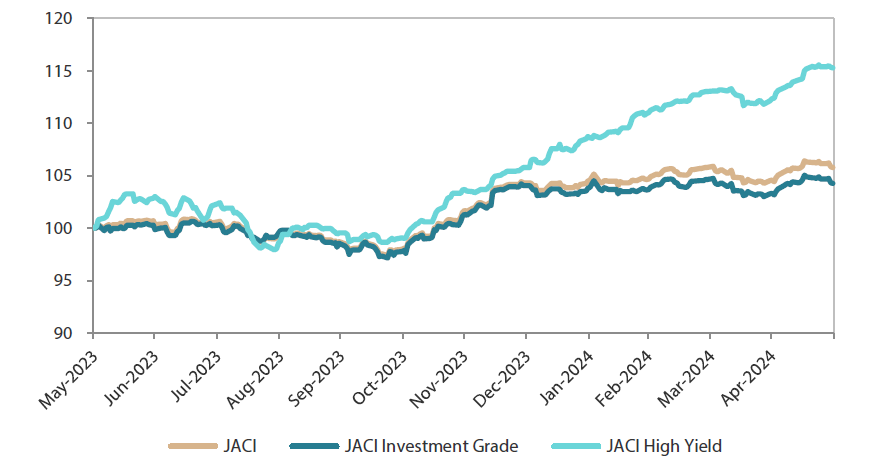

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 May 2024.

Market outlook

Supportive Asia credit fundamentals and strong technicals, but tight valuation calls for caution

The fundamentals backdrop for Asian credit remains supportive. Previously in March, China’s National People’s Congress announced a 2024 growth target of “about 5%”, with a larger augmented deficit and continued accommodative monetary policy. This suggests policy makers are aware of the challenging environment. We believe China’s recent property measure asking local governments to purchase unsold properties for conversion into affordable housing—which represents a shift in policy stance—could help stabilise the ailing property sector if implemented on the right scale. However, the key factor to monitor will be execution.

Meanwhile, we expect macroeconomic and corporate credit fundamentals across Asia ex-China to stay resilient, with a potential recovery in exports growth offsetting softer domestic conditions. Non-financial corporates may experience a slight weakening in both leverage and interest coverage ratios stemming from lower earnings growth and higher funding costs; however, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

Technically, Asia credit is expected to remain well supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive all-in yields. Nevertheless, following the sharp rally in recent months, these positive factors have been largely priced in. The emergence of some negative risk factors such as a weaker-than-expected global economy, as well as local political uncertainties and geopolitical tensions, may exert some widening pressure on Asia credit spreads, particularly the IG segment.