Summary

- Bonds are rarely viewed as attractive, especially when compared to stocks. However, the bond market can still pack a punch—and do it quickly too. Investors had plenty to think about when yields of long-dated US Treasurys surpassed the key 5% threshold at one point, amid a US credit downgrade and growing concerns around fiscal spending plans. At the end of May, the benchmark 2-year and 10-year UST yields were at 3.90% and 4.40%, respectively, 30 basis points (bps) and 24 bps higher compared to the end of April.

- Within Asia, central banks in China, South Korea and Indonesia lowered their policy rates in May. While inflationary trends diverged across the region in April, inflation has remained largely benign in most countries.

- We continue to believe that Asia's local government bonds are positioned to perform decently in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Within the region, we expect investor appetite to remain firm for higher yielding bonds such as those of Malaysia, India, Indonesia and the Philippines relative to their regional peers.

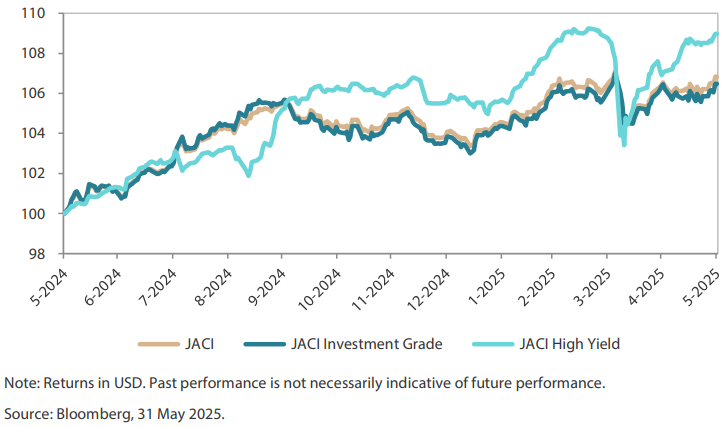

- Asian credits were up (+0.36%) in May, supported by a 18-bp tightening in credit spreads despite rising UST yields. Asian investment grade (IG) credits underperformed Asian high-yield (HY) credits, with IG credits returning +0.11%, as spreads tightened by 15.2 bps. Asian HY credits rose 1.92%, with spreads narrowing by 32 bps.

- — We had a constructive long-term view of Asian credit spreads after spreads widened in April. However, the quick retracement of Asia credit spreads to levels slightly below pre-Liberation Day amid the still uncertain macroeconomic backdrop makes the valuation angle somewhat less appealing. While we note the supportive credit fundamentals and decent demand-supply technicals, we are wary of trade and geopolitical re-escalation risks. We would therefore be inclined to take a more cautious and defensive approach over the near term.

Asian rates and FX

Market reivew

Jitters in the bond market send yields leaping

The US bond market shuddered in May, as investors began to have second thoughts about lending to Uncle Sam over the long term. USTs sold off in May, with yields climbing steadily through most of the month. There was optimism surrounding trade developments—particularly the resumption of US-China negotiations and the finalisation of a US-UK trade deal. The Fed kept interest rates unchanged as expected, with Chair Jerome Powell reiterating a patient, data-dependent approach and offering little forward guidance.

In the latter half of the month, fiscal concerns gained traction after the US House advanced a budget plan projecting a USD 5.2 trillion federal deficit over the next decade. Then the US lost its top-rated triple-A bond rating, as Moody's downgraded the US sovereign credit rating to “Aa1”. Treasury Secretary Scott Bessent was quick to play down the US credit downgrade, commenting in an interview that Moody's ratings were a “lagging indicator” and “that's what everyone thinks of credit agencies”—which may not be so true, seeing how yields experienced renewed upward pressure. A concurrent sell-off in long-dated Japanese government bonds spilled over into the UST market and briefly pushed the 30-year UST yield above 5.10%. The elevated yields, however, attracted bargain hunters, and helped bring long-end rates back down. At the end of May, the benchmark 2-year and 10-year UST yields settled at 3.90% and 4.40%, respectively, 30 bps and 24 bps higher compared to the end of April.

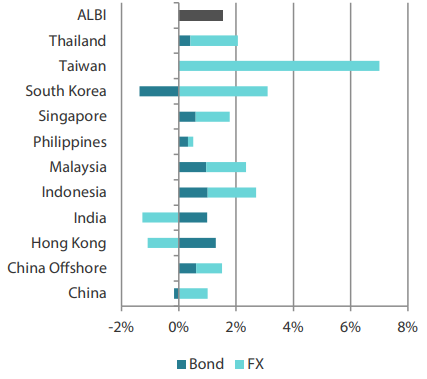

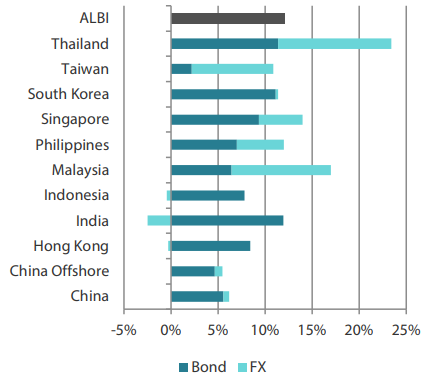

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 May 2025

For the year ending 31 May 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, 31 May 2025.

Central banks in China, South Korea and Indonesia lower their policy rates

Regional central banks continued reducing interest rates during the month. Bank Indonesia (BI) cut its benchmark seven-day reverse repo rate by 25 bps to 5.5% to support domestic demand. Alongside the rate cut, BI slightly lowered Indonesia's 2025 growth forecast to between 4.6% and 5.4% from the previous 4.7% to 5.5%, citing heightened global uncertainty. Still, the central bank expects growth momentum to strengthen in the second half of the year, driven by increased domestic demand and government spending. Similarly, the Bank of Korea (BOK) reduced its policy rate by 25 bps to 2.50%, projecting a sharp slowdown in South Korea's economic growth from 1.5% to 0.8% for 2025, while maintaining its inflation outlook at 1.9% for the year.

Meanwhile, the People's Bank of China (PBOC) implemented several easing measures, including a 10-bp cut to both the seven-day reverse repo rate and the benchmark loan prime rate, as well as a 50-bp reduction in banks' reserve requirement ratio. Later in the month, it lowered the one-year loan prime rate (LPR) by 10 bps to 3.0%, and the five-year LPR—a key benchmark for mortgage rates—by 10 bps to 3.5%.

April's headline inflation prints were mixed. Indonesia's inflation quickened, while inflationary pressures in India, Thailand and the Philippines eased. Elsewhere, consumer prices in South Korea, China, Singapore and Malaysia remained largely stable. Several countries also released their GDP data. Indonesia's economy grew by 4.87% YoY in the first quarter, marking its slowest pace in over three years and down from 5.02% in the previous quarter. This was attributed to softer exports, household spending and investment. Thailand's economy, meanwhile, expanded more than expected in the first quarter of 2025, growing by 3.1% YoY. The Philippines saw its GDP expand 5.4% YoY in the first quarter, as consumer spending remained the main driver of the economy.

Overall, Asian local government bond yields mostly declined in May, diverging from the upward trend in UST yields. Indian bonds were supported by easing inflation and expectations of further rate cuts by the Reserve Bank of India, while BI's rate cut and a downward revision to growth projections boosted demand for Indonesia bonds. Chinese bonds also benefited from further monetary easing by the PBOC.

Market outlook

Remain constructive on higher carry bonds

We continue to believe that Asia's local government bonds are positioned for a decent performance, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Concerns over further potential growth shocks from US tariffs are likely to provide additional support for regional bond markets.

Within the region, demand for higher-yielding bonds in Malaysia, India, Indonesia and the Philippines is expected to remain firm relative to regional peers. Furthermore, government bond yields in Indonesia, India and the Philippines could decline further, as we anticipate further monetary easing by their central banks in the second half of 2025.

Amid the persistent uncertainties associated with the Trump administration, we remain broadly cautious on Asian currencies in near term. Nevertheless, we see the region's strong economic fundamentals softening the blow stemming from such uncertainties, with the Malaysian ringgit remaining our preferred currency.

Asian credits

Market review

Asian credit markets post gains in May

Asian credits returned 0.36% in May, supported by an 18-bp tightening in credit spreads despite rising UST yields. The increase in UST yields weighed on IG performance, which, due to their longer average duration, lagged behind HY. IG credits returned +0.11% as spreads tightened by 15 bps, while HY credits gained 1.92%, with spreads narrowing by 32 bps.

Improving global risk sentiment—driven largely by optimism around trade negotiations—was the primary driver of Asia credit spread tightening in May. The scale of tariff reductions significantly surpassed market expectations, triggering a significant narrowing in Asia credit spreads, especially in lower-rated credits. For the remainder of the month, Asia credit spreads remained largely range-bound, amid volatility in USTs and renewed tariff-related uncertainty. By the month-end, credit spreads had tightened across most major country segments compared to end-April.

In China, on top of the series of easing measures, PBOC governor Pan Gongsheng also indicated plans to expand relending programs to support services consumption, elderly care, and tech innovation. While May's Golden Week consumption data was relatively strong, April's high-frequency indicators pointed to subdued overall activity. Real estate credits underperformed in May led by a large Hong Kong developer's decision to skip call on its perpetual bond, while Chinese real estate credits posted resilient performance despite weak property sales and home prices trend as the market shifted focus on expected policy support. In India, rising geopolitical tensions with Pakistan pressured credits from both countries at the start of May, but a swift ceasefire helped stabilise sentiment. Adani-related credits had a strong performance in May, buoyed by news that the group is meeting Trump officials in a bid to end bribery cases.

Primary market activity picks up in May

Primary market activity rebounded in May following a subdued April, supported by improved risk sentiment. The IG space saw 19 new issues totalling USD 9.75 billion, including the USD 1.75 billion two-tranche issue from Standard Chartered PLC, the USD 1.5 billion two-tranche issue from China Construction Bank Hong Kong and the USD 1.0 billion issue from Pertamina Hulu Energi. In the HY space, three new issues raised USD 770 million over the month.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 May 2024

Market outlook

Still supportive credit fundamentals and decent demand-supply technicals but less appealing valuation after sharp rally in May

Persistent trade and tariff-related uncertainties, coupled with question marks over the trajectory of US economic growth and the Fed's monetary policy, are expected to present some challenges to external demand and Asia's macroeconomic fundamentals in the near term. Certain country-specific developments, such as potential fiscal policy shifts in Indonesia, also bear monitoring. However, most Asian economies entered this period of higher volatility with relatively robust external fiscal, and domestic demand conditions, which should provide a good buffer to withstand the challenges ahead.

Chinese authorities continue to roll out comprehensive fiscal and sector-specific policies to support domestic consumption and investments, as well as to stabilise the stock and property markets. In addition, most of Asia's central banks retain some room to ease monetary policy to support domestic demand. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

The quick retracement of spreads to levels slightly below pre-Liberation Day levels, coupled with the still uncertain macroeconomic backdrop, makes the valuation angle of Asian credits somewhat less appealing, at least in the short term. While we still see supportive credit fundamentals and decent demand-supply technicals, we are wary of trade and geopolitical risks resurfacing, especially as we near the end of the 90-day pause on reciprocal tariffs. The implementation of these tariffs has been upheld by the US appeals court. We would therefore be inclined to take a more cautious and defensive approach over the near term.