Summary

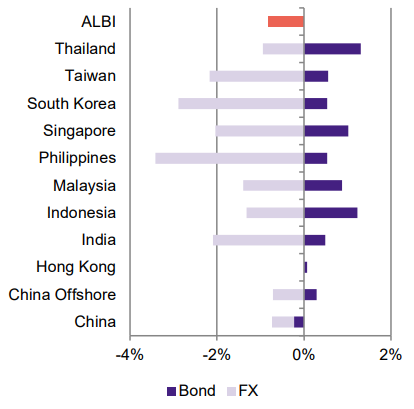

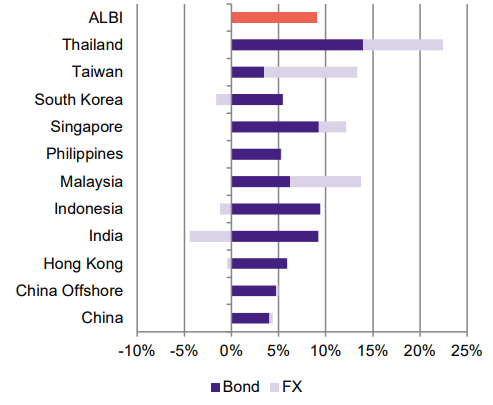

- In July, Asian local government bond yields broadly declined, diverging from the rise in US Treasury (UST) yields. On a total return basis, Thai government bonds outperformed, while Chinese bonds lagged. Meanwhile, most regional currencies weakened against the US dollar.

- Within Asia, central banks in Malaysia and Indonesia lowered their policy rates in July. Inflation rates across the region picked up but remain subdued.

- We continue to believe that Asia’s local government bonds are positioned to perform decently. Within the region, we expect investor appetite to remain firm for higher yielding bonds in India, Indonesia and the Philippines relative to their regional peers, while strong inflows in Singapore and Thailand have boosted liquidity and buoyed local bonds.

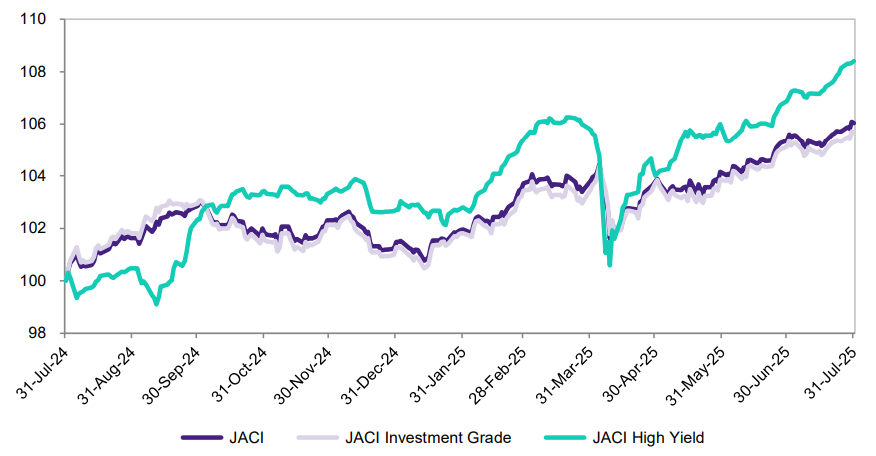

- Asian credits saw total returns of 0.63% in July, as credit spreads tightened by about 12 basis points (bps). The rise in UST yields weighed on the performance of Asian investment grade (IG) credits, causing them to underperform Asian high-yield (HY) credits over the month. IG credits returned +0.50%, while HY credits gained 1.43%.

- The quick retracement of Asia credit spread levels to slightly below pre-Liberation Day levels amid the still uncertain macroeconomic backdrop puts a dent on the valuation angle. While credit fundamentals and decent demand-supply technicals are supportive, we are wary of trade and geopolitical re-escalation risks. We are therefore inclined to take a more cautious and defensive approach over the near term.

- UST yields rebounded in July, driven by developments in tariff negotiations and shifting expectations for US interest rates. At the end of July, the benchmark 2-year and 10-year UST yields were at 3.96% and 4.38%, respectively, about 24 bps and 15 bps higher compared to the end of June.

Asian rates and FX

Market review

In July, Asian local government bond yields broadly declined, diverging from the rise in UST yields. On a total return basis, Thai government bonds outperformed, while Chinese bonds lagged. Subdued inflation, coupled with strong inflows into Thailand and market interpretations of the Thai cabinet’s approval of Vitai Ratanakorn as the next Bank of Thailand governor—signalling a more dovish policy stance—boosted demand for Thai government bonds. In contrast, robust first-half growth in China lifted risk sentiment, prompting outflows from Chinese government bonds as investors rotated into equities.

Meanwhile, most regional currencies weakened against the US dollar, which strengthened broadly as markets pushed back expectations for US rate cuts and increased demand for the greenback. After falling by record levels in the first half of 2025, the dollar has managed to recover some ground.

Central banks in Malaysia and Indonesia lower their policy rates

In July, Bank Negara Malaysia cut its benchmark interest rate for the first time in five years, lowering the overnight policy rate by 25 bps to 2.75%. Described as a “pre-emptive measure,” the move was intended to support growth amid moderate inflation prospects. Similarly, Bank Indonesia (BI) resumed its rate-cutting cycle in July, lowering its benchmark seven-day reverse repo rate by 25 bps to 5.25%. The decision reflects a milder inflation outlook for 2025 and 2026, with price increases expected to remain within the 1.5–3.5% target range. BI Governor Perry Warjiyo noted that a stable Indonesian rupiah and the need to support economic growth also justified the move.

Elsewhere, the Bank of Korea kept its key policy rate unchanged at 2.50%. While it acknowledged that economic growth is likely to remain subdued “for some time,” the central bank pointed to rising household debt as a key concern. It is increasingly cautious about easing policy too aggressively, amid a stronger-than-expected property market in Seoul and elevated household leverage. The Monetary Authority of Singapore maintained its foreign exchange policy, keeping the rate of appreciation, width, and centre of the Singapore dollar nominal effective exchange rate (also known as SGDNEER) policy band unchanged.

Headline inflation prints for June pick up across most countries, though they remain mild

Headline consumer price index (CPI) readings across the region generally remained in positive territory in June, with the exception of Thailand. In the Philippines, inflation broke a four-month downtrend, edging up to 1.4% year-on-year (YoY) in June from 1.3% in May, driven mainly by faster increases in utility costs. Indonesia’s headline inflation rose to 1.87% YoY in June, up from 1.60% in May and slightly above market expectations of 1.80%, fuelled by quicker price gains in food, beverages and tobacco. In Malaysia, consumer prices grew 1.1% YoY in June, easing marginally from 1.2% in May. Core inflation was steady at 1.8% YoY, unchanged from the previous month. In Singapore, headline inflation was unchanged at 0.8% in June, with higher private transport costs offset by lower accommodation inflation. Core inflation also held at 0.6% YoY in June, matching May’s figure, as higher retail prices were offset by lower food and services costs.

Thailand saw consumer prices fall for a third consecutive month, led by lower energy costs. Headline CPI declined 0.25% YoY in June after a 0.57% drop in May, while core inflation eased to 1.06% from 1.09%. Policymakers noted that inflation averaged 0.37% YoY in the first half of the year and expect July’s reading to remain negative due to last year’s high base.

Solid economic expansion across the region in the second quarter of 2025

China’s economy grew 5.2% YoY in the second quarter of 2025, slightly below the 5.4% expansion in the first quarter but above market expectations. Chinese policymakers have been adept so far at managing the world’s second-largest economy. The country’s GDP rose by 5.3% YoY for the first half of the year, on track to meet China’s “around 5%” annual growth target, which seemed ambitious when first announced by Chinese Premier Li Qiang. In South Korea, GDP rebounded by 0.6% quarter-on-quarter after contracting 0.2% in the previous quarter, supported by recovering consumption and robust export performance. On an annual basis, GDP rose 0.5%, up from 0% in the first quarter.

Singapore’s economy grew 4.3% YoY in the second quarter of 2025, slightly above the 4.1% pace recorded in the first quarter, according to advance estimates. Malaysia’s economy also expanded faster than expected in the second quarter, supported by robust activity in the services sector. Advance estimates show GDP rising 4.5% YoY during the period April to June, ahead of the 4.2% forecast and up slightly from 4.4% in the first quarter.

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 31 July 2025

For the month year 31 July 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 July 2025.

Market outlook

Asian local government bonds well-positioned for a decent performance

After months of uncertainty surrounding US tariffs, most Asian countries managed to negotiate lower tariff rates compared to those announced during April’s “Liberation Day” speech by President Donald Trump. Nonetheless, the eventual global “base rate” of 15–20% remains higher than the optimistic base case of 10%, and will likely weigh on many export-oriented Asian economies.

While several Asian central banks have pre-emptively cut rates to mitigate the economic impact, policymakers will be monitoring trade and investment growth to determine their next course of action—with a bias toward further monetary easing and potentially, the implementation of some fiscal measures if economic growth deteriorates further.

We continue to believe that Asia’s local government bonds are well-positioned for a decent performance, given the likely slow growth environment, underpinned by Asia’s strong fundamentals and fiscal condition, which allows Asian central banks to implement monetary and fiscal policies to cushion the impending impact. Within the region, demand for higher-yielding bonds in India, Indonesia and the Philippines is expected to remain firm relative to regional peers, while strong inflows in Singapore and Thailand have boosted liquidity and buoyed local bonds.

In the near term, with the Fed preferring to wait for the inflationary impact of tariffs to filter through the economy before deciding on policy direction, the US dollar is likely to see a respite against Asian currencies. However, rising costs may eventually result in slower aggregate demand, softening the outlook for the US economy and the US dollar over the medium term.

Asian credits

Market review

Asian credit markets register positive returns in July

In July, Asian credits delivered total returns of +0.63%, as credit spreads tightened by about 12 bps. The rise in UST yields weighed on the performance of IG credits, causing IG to underperform their HY counterparts. IG credits returned +0.50% with spreads tightening by 9.7 bps, while HY credits gained 1.43% as spreads narrowed by 17 bps.

Strong economic data, easing tariff concerns, and optimism over potential China policy measures supported a broad tightening in Asia credit spreads in July. The month opened on a positive note, with risk sentiment buoyed by stronger-than-expected economic data from both the US and China. Risk appetite was supported as market speculation grew around potential new stimulus measures for China’s property sector, prompting a sharp rally in Chinese property-related equities. Sentiment was further supported by stronger-than-expected second-quarter GDP data from China, which showed the economy expanding 5.2% YoY—keeping it on track to meet the government’s “around 5%” full-year growth target.

Over the month, newly-announced trade agreements between the US and many Asian economies, including South Korea, Indonesia, and the Philippines, helped reduce policy uncertainty and supported broader investor sentiment. GDP data across Asia also surprised to the upside, with South Korea, Malaysia and Singapore all reporting stronger growth in the second quarter.

Confidence was also bolstered by Chinese Premier Li Qiang’s announcement of the start of construction on what is set to become the world’s largest hydropower dam, located on the eastern edge of the Tibetan Plateau. With an estimated cost of around CNY 1.2 trillion—roughly 4.5 times that of the Three Gorges Dam project—markets interpreted the project as a clear sign of economic stimulus. Indications from Chinese officials that they will promote capacity management in key industries and address disorderly competition also helped to boost commodity prices. Against this backdrop, credit spreads tightened across all major country segments by the end of July.

Primary market activity remain relatively active in July

The IG space saw 17 new issues totalling USD 7.95 billion, including the USD 2.2 billion two-tranche sovereign sukuk issue from the Indonesian government. In the HY space, four new issues raised USD 1.35 billion.

UST yield curve shifts higher in July

UST yields rebounded in July, driven by developments in tariff negotiations and shifting expectations for US interest rates. The initial rise by UST yields was prompted by a stronger-than-expected June nonfarm payroll and unemployment data, which led markets to reassess the likelihood of a July rate cut. On the fiscal front, the US Congress passed and President Trump signed into law the “One Big Beautiful Bill,” which introduced new tax relief measures while widening fiscal deficits. The bill certainly is big, but its beauty remains to be seen, given that the US government’s finances and the economy now appear to be on shakier grounds.

Although the US delayed the implementation of new tariffs to 1 August, it raised tariff rates on key partners, including the European Union (EU) and Japan, and imposed additional sector-specific tariffs, weighing on market sentiment. Fiscal concerns in Japan also pressured super-long Japanese government bonds, with weakness spilling over to longer-dated USTs. While headline US CPI was benign, underlying details showed signs of tariff-driven pressure on core goods prices, pushing yields higher.

Towards month-end, sentiment improved as the US secured trade agreements with Japan and the EU. Renewed US–China negotiations also lifted risk appetite after US Trade Secretary Scott Bessent indicated that talks could proceed in 90-day phases, sparking risk-on sentiment and a pullback in USTs. At month-end, the Fed left interest rates unchanged again. What was uncommon though, was that two Fed Board governors—both Trump appointees—dissented on the central bank policy decision. However, the Fed Chair’s reluctance to signal a September rate cut during the post-meeting press conference was interpreted as hawkish by markets. At the end of July, the benchmark 2-year and 10-year UST yields settled at 3.96% and 4.38%, respectively, about 24 bps and 15 bps higher compared to the end of June.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 July 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2025.

Market outlook

Still supportive credit fundamentals and decent demand-supply technicals but less appealing valuation after May’s sharp rally

While trade and tariff-related uncertainties have eased in recent weeks, effective US tariff rates remain significantly higher than prior years. This, coupled with question marks over the trajectory of US economic growth and the Fed’s monetary policy, are expected to present some challenges to external demand and Asia’s macroeconomic fundamentals in the near term. Certain country-specific developments, such as potential fiscal policy shifts in Indonesia, also bear monitoring. However, most Asian economies entered this period of higher volatility with relatively robust external, fiscal and domestic demand conditions, which should provide a good buffer to withstand the challenges ahead.

Chinese authorities continue to roll out comprehensive fiscal and sector-specific policies to support domestic consumption and investments, as well as to stabilise the stock and property markets. In addition, most of Asia’s central banks retain some room to ease monetary policy to support domestic demand. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

The quick retracement of Asia credit spreads to levels slightly below pre-Liberation Day levels, coupled with the still uncertain macroeconomic backdrop, makes the valuation angle somewhat less appealing. While we still see supportive credit fundamentals and decent demand-supply technicals, we are wary of trade and geopolitical risks resurfacing. We also note that Trump has previously re-escalated trade tariffs after pauses during his first term of presidency. We would therefore be inclined to take a more cautious and defensive approach over the near term.