Summary

- US President Donald Trump’s economic agenda set off alarm bells in the bond market during the month, and US Treasuries (USTs) experienced heightened volatility. At the end of April, the benchmark 2-year and 10-year UST yields were at 3.61% and 4.16%, respectively, 28 basis points (bps) and 4 bps lower compared to the end of March.

- Within Asia, central banks in India, Thailand and the Philippines sought to brace their economies for the impact of US tariffs by cutting interest rates. Additionally, inflationary pressures across the region continued to ease in March.

- We continue to believe that Asia’s local government bonds are positioned to perform decently in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Within the region, we expect investor appetite to remain firm for higher yielding bonds such as those of Malaysia, India, Indonesia and the Philippines relative to their regional peers.

- Asian credits inched down slightly (-0.03%) in April, as a decline in UST yields helped cushion the impact of wider credit spreads. Asian investment grade (IG) credits outperformed Asian high-yield (HY) credits, with IG credits returning +0.25%, despite spreads widening by 11 bps. Asian HY credits fell 1.69%, as spreads widened by 46 bps.

- While uncertainties loom over the trajectory of US economic growth and the Fed’s policy direction, most Asian economies have entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions. We expect these factors to provide a good buffer to withstand the challenges ahead. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

Asian rates and FX

Market review

Markets cast doubt over safe-haven status of USTs

USTs experienced heightened volatility in April, driven by a surge in financial market stress triggered by the aggressive trade policies of Trump, who was reported to have said “I was watching the bond market”. Investors also kept a close eye on the bond market in April. Yields fell sharply at the start of the month amid strong safe-haven demand, following the announcement of “Liberation Day” tariffs that far exceeded market expectations and prompted retaliation from China. The UST yield curve bear steepened significantly, driven by sharp moves in the long end. These moves were fuelled by rumours of potential tariff delays and renewed concerns over significantly higher inflation, challenging the traditional role of USTs as a safe haven for investors during times of stress. However, confirmation of a 90-day delay in reciprocal tariffs for economies outside China helped calm markets, leading to a pullback in yields as panic subsided. At the end of April, the benchmark 2-year and 10-year UST yields settled at 3.61% and 4.16%, respectively, 28 bps and 4 bps lower compared to the end of March.

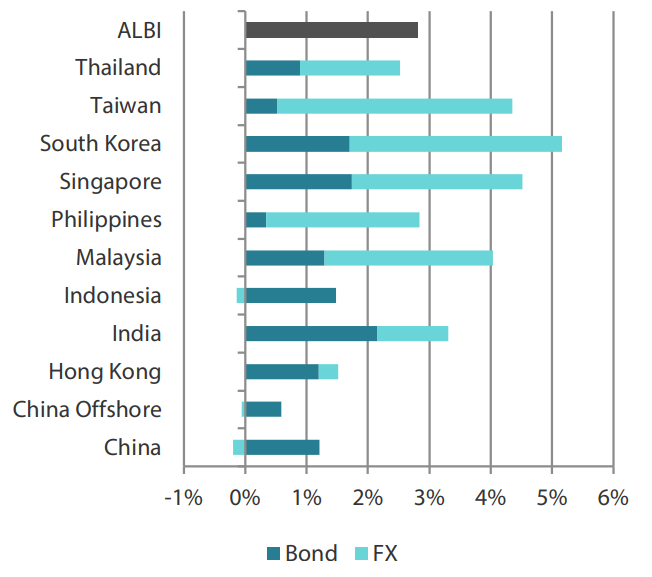

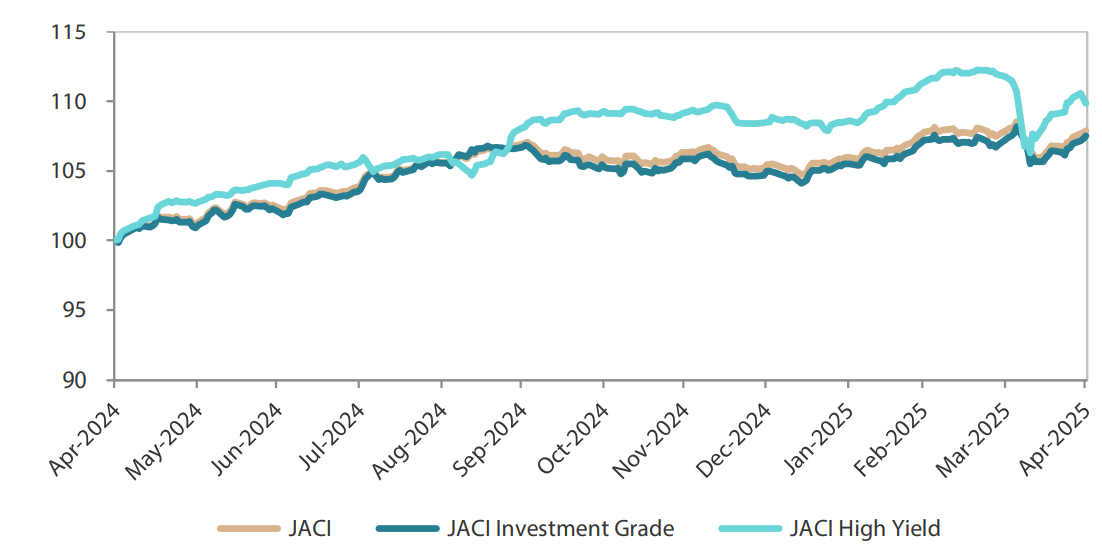

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 April 2025

For the ending 30 April 2025

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 April 2025.

Asian central banks cut rates; price gains generally slow in March

To brace for furtheyearr uncertainty from Trump’s widespread tariffs, several central banks in the region cut interest rates in April. The Reserve Bank of India (RBI) lowered its policy repo rate from 6.25% to 6.00%, while revising down its FY26 gross domestic product (GDP) growth and inflation forecasts. India’s consumer price index (CPI) inflation eased to 3.34% year-on-year (YoY) in March from 3.61% in February, undershooting forecasts due to a moderation in food prices Alongside the rate cut, the committee shifted its policy stance from neutral to accommodative. This essentially means the RBI is now more inclined to lower interest rates further.

Similarly, the Bank of Thailand cut its policy rate by 25 bps to 1.75%, citing weaker-than-expected economic momentum, rising downside risks from global trade policy uncertainty and falling tourist arrivals. Thailand’s headline inflation slowed to 0.84% YoY in March from 1.08% in February, below the central bank’s target, partly due to lower oil prices. Meanwhile, the Bangko Sentral ng Pilipinas also lowered its benchmark interest rate by 25 bps to 5.5%. The central bank cited easing inflationary pressures, which allowed it to “shift toward a more accommodative monetary policy stance”. Headline inflation in the Philippines eased to 1.8% YoY in March from 2.1% in February, partly driven by a more moderate rise in food and non-alcoholic beverage prices. The Monetary Authority of Singapore eased its policy settings again by slightly reducing the pace of appreciation of the Singapore dollar nominal effective exchange rate (SGDNEER).

Market outlook

Remain constructive on higher carry bonds

We continue to believe that Asia’s local government bonds are positioned to perform well, supported by accommodative central banks amid an environment of benign inflation and moderating growth. Concerns over further potential growth impacts from US tariffs are likely to provide additional support for regional bond markets.

Within the region, demand for higher-yielding bonds in Malaysia, India, Indonesia and the Philippines is expected to remain firm relative to regional peers. Additionally, government bond yields in India, Indonesia and the Philippines could decline further, as we anticipate further monetary easing by their central banks in 2025.

Amid the persistent uncertainties associated with the Trump administration, we remain broadly cautious on Asian currencies in the near term. However, we see the region’s strong economic fundamentals softening the blow, with the Malaysian ringgit remaining our preferred currency.

Asian credits

Market review

Credit spreads fluctuate with risk sentiment in April

Credit markets also experienced volatility in April. Asian credits ultimately delivered a near flat return (-0.03%) in April, as falling UST yields helped cushion the impact of wider credit spreads. Asian IG credits returned +0.25%, outperforming Asian HY credits, with spreads widening by 11 bps. HY credits fell by 1.69%, with spreads widening by about 46 bps.

Not surprisingly, they key driver of the Asia credit market in April was the unpredictable policy environment under the Trump administration. Spreads spiked early in the month on recession concerns and risk-off sentiment triggered by Liberation Day tariffs. China’s retaliatory tariffs and unyielding stance exacerbated market concerns. Sentiment improved after Washington announced a 90-day delay in reciprocal tariffs for non-China economies, sparking a rally in risk assets. Further gains, especially in the HY segment, were supported by subsequent US and China tariff exemption announcements.

Given such a whirlwind month, it was not surprising to see China’s Politburo take the opportunity to reassure fearful market observers during its meeting at the end of April. The decision-making body reaffirmed its commitment to growth-supportive measures to mitigate the impact of US tariffs. These included potential interest rate cuts, a reduction in banks’ reserve requirement ratio, and broader fiscal and monetary tools aimed at supporting technological innovation, exports and domestic consumption. Financial assistance was also proposed for companies hit hard by tariffs to help preserve employment.

Meanwhile, in South Korea, the Constitutional Court upheld former President Yoon Suk Yeol’s impeachment, paving the way for elections in June and signalling a possible return to political stability.

Amid the shifting macroeconomic landscape, Fitch Ratings downgraded China’s sovereign credit rating from “A+” to “A”, citing deteriorating public finances. In contrast, the Philippines’ “BBB” rating was affirmed, with a stable outlook. By month-end, credit spreads had widened across most major country segments, except China and Indonesia.

Primary market quiet in April

Following a period of robust primary market activity in March, issuance slowed sharply in April due to heightened volatility and growing macroeconomic uncertainty. The IG space saw only seven new issues totalling USD 3.5 billion, while the HY space saw no new issuance for the month.

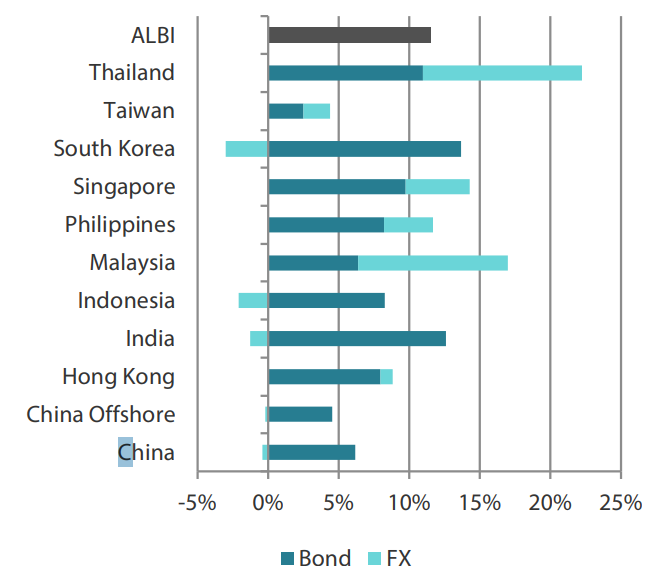

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 April 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2025.

Market outlook

Better spread valuation, supportive credit fundamentals and robust demand-supply technicals to support medium-to-long term performance of Asian credits

Intensifying trade and tariff-related uncertainties, coupled with question marks over the trajectory of US economic growth and the Fed’s monetary policy, are expected to present some challenges to external demand and Asia’s macroeconomic fundamentals in the near term. Certain country-specific developments, such as potential fiscal policy shifts in Indonesia, also bear monitoring. However, most Asian economies entered this period of higher volatility with relatively robust external, fiscal, and domestic demand conditions, which should provide a good buffer against the challenges ahead.

Chinese authorities continue to roll out fiscal and sector-specific policies to support domestic consumption and investments, as well as to stabilise the stock and property markets. In addition, most of Asia’s central banks retain some room to ease monetary policy to support domestic demand. Against this more challenging but still benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or geopolitical dynamics.

The “reopening” of the Asia IG primary market towards the latter half of April is positive for sentiment and price discovery. For the full year, gross and net supply in the Asia credit space is still expected to remain benign. Additionally, we expect demand from regional investors to stay firm. While heightened volatility is likely to persist, the de-escalation in the tariff rhetoric and tentative signs of preliminary US trade deals with several key Asian trading partners including India, Japan and South Korea may provide a better backdrop to investor sentiment compared with April. The widening of Asia credit spreads over the last two months after a long period of compression also creates more attractive entry points. The better spread valuation, combined with still supportive credit fundamentals and decent demand-supply technicals, IS expected to support the medium-to-long term performance of Asian credits.