Summary

- Fundamentals and technical backdrop for Asian credit remain supportive. However, valuation is a challenge with current Asian high-grade (HG) spreads near historical lows. While negative risk factors persist, a significant part of the positive factors appears to be priced in. As such, Asian HG spreads may trade sideways with a mild widening bias in 2024 while some credit quality decompression may also occur. Meanwhile, the myriad cyclical and structural factors driving the major sub-sectors within Asian high-yield (HY) credit makes it is difficult to call the direction for overall Asian HY spreads in 2024, although the current spread level remains wide and offers room for compression over the medium term.

- We head towards 2024 with a slightly defensive stance in terms of overall credit risk. We have a slight preference for taking greater credit exposure at the front-end considering the flatness of the credit curve. Outperformance could be derived from sectors that we believe will perform well despite the more challenging global backdrop.

- We expect risks to be balanced in 2024. One material downside risk is continued resilience in the US economy alongside a reacceleration of inflation dynamics, which could prolong the Federal Reserve’s (Fed) rate hiking cycle. On the other hand, a faster disinflation process with no hard landing in developed economies could see an earlier global monetary easing pivot, which could support further spread compression across global credit markets. A stronger than expected recovery in China’s property market along with further thawing in US-China relations are other positive risk factors.

2024 Asian credit outlook

Fundamentals

Macro

The year 2023 turned out differently than we initially envisioned. Throughout 2023, investors have eagerly watched US jobs data and inflationary readings, debating the timing of the last rate hike. Recent rhetoric from Fed officials suggests the central bank is not ruling out another increase in 2023, as labour market conditions remain tight, business activity continues to be more robust than expected and inflation stays above the Fed’s 2% target. Global growth defied any kind of recessionary expectations although interest rates have been raised further and cuts that the market anticipated continue to be postponed. The current macro and market backdrop may see little or minor change with growth expectations for major economies remaining low and some inflation stickiness resurfacing as we head towards 2024. We foresee the policy environment remaining restrictive, as monetary authorities continue to assess the cumulative impact of tighter financial conditions on inflation and the economy. The resilience of major economies, particularly the US, is prompting the markets to embrace the “higher for longer” narrative for interest rates. While this has weighed on total returns in 2023, the move higher in rates may also increase investors’ incentive to lock in historically high all-in yields with yields at post-Global Financial Crisis highs.

Over in Asia, the challenging external environment—prompted largely by rapidly weakening growth in China since the second quarter of 2023 together with a delay in the revival of the semiconductor industry cycle—has weighed heavily on trade recovery in the region. We expect economic activity in most Asian countries to remain broadly stable in 2024. On the other hand, China’s recovery momentum will be a significant wild card for regional growth. Although Chinese policymakers have unveiled a raft of measures to spur growth, economic momentum remains sluggish and labour market sentiment is still lacklustre. India and the Philippines are expected to register fairly robust growth in 2024, and open economies like South Korea and Singapore may benefit from a pick-up in exports.

We expect most central banks to keep policy rates unchanged, at least for the first half of 2024. China will likely be an exception, with the possibility of additional monetary accommodation to support the sluggish economy. Monetary policy is expected to remain relatively tight as central banks in the region face still-high US interest rates and grapple to anchor their currencies. As for inflation, China may see a slight acceleration from low levels, while disinflation trends are likely to continue in the rest of the region. Looming elections in India, Indonesia, South Korea and possibly Singapore mean policies in these countries could lean towards supporting growth. Although we expect increased fiscal support ahead of these elections, the size is likely to be minimal.

Credit

Going into 2024, we are more confident that credit quality is long past the peak. Nevertheless, any weakening in corporate credit profiles started from very strong levels, with higher debt-to-capital ratios, leverage ratios and tighter liquidity positions. The US hiking cycle, with interest rates raised higher than the market anticipated and rate cuts not forthcoming in the near term, heightened concerns about corporate borrowers having to adjust to a funding environment with higher-for-longer costs. Unlike the past few hiking cycles, during which the Fed and other central banks tightened financial conditions in response to a combination of firming inflation and robust economic growth, the ongoing tightening cycle is unfolding against a backdrop of decelerating growth and persistently high inflation.

This global macro environment creates a more challenging fundamentals backdrop for Asian credit. However, we believe there are strong mitigating factors that can support Asian credit fundamentals. In China, the recent step up in fiscal measures suggests that the country’s policymakers are aware of the challenging environment. This further raises expectations for policymakers to deliver additional measures to help broaden out China’s recovery and boost economic growth in 2024. Importantly, China is enacting measures to lower funding costs and ensure adequate financing availability for privately-owned enterprises (POE). Although the measures have so far not been very effective for POE property developers, it could mitigate refinancing risk and lower the financing burden for the rest of the corporate sector. Outside of China, corporate credit fundamentals across the region are expected to stay resilient although the region’s economic growth is expected to be slow in the first half of 2024. While non-financial corporates may experience a slight weakening in leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs, we believe that most have adequate ratings buffers, especially Asian HG corporates.

Oil prices could remain elevated and volatile heading into 2024. A multitude of forces ranging from climate change, regional conflicts and macroeconomic cycles are creating significant concerns in the market and making oil prices volatile. In such an environment, we see a mixed picture for companies along the value chain in this sector for 2024. We expect upstream companies continuing to do well in this environment, while downstream refining and petrochemical companies may face headwinds in the form of weakened profitability.

We see Asian technology firms’ credit fundamentals remaining relatively resilient, although geopolitical tensions continue to be an overhanging risk for the sector. Asian technology firms in the dollar bond market are, in general, industry leaders with low balance sheet leverage. For hardware companies, there are increasing signs that demand may have bottomed for various sub-segments such as those related to personal computers, smartphones and memory chips. At the same time, domestic regulatory risks which were a key concern in previous years have decreased significantly for Chinese technology firms.

We are cautious on the real estate sector overall as the high interest rate and weakening macroeconomic environment could dampen property demand and prices for developers and landlords. Within the China property sector, we prefer developers with state-owned backgrounds with stronger contracted sales and funding access. Outside mainland China, we believe most Hong Kong developers within the dollar bond market will be able to withstand the near-term pressure of falling property demand and prices, supported by their low gearing ratio and historically prudent financial policies. Singapore’s commercial real estate market has remained resilient; we continue to hold a positive view on the retail, hospitality, and industrial & logistics sub-segments thanks to continued tailwinds for these sectors. On the other hand, we remain cautious on the office space sector.

In general, the Asian banking sector remains resilient. With strong capital, adequate loan loss buffers, robust liquidity and expectations of stable profitability, we retain our favourable view on banks. We positively assess the capital structure of large players with strong fundamentals as non-call risk is seen to be minimal for such issuers’ bonds while being watchful on asset quality.

Valuations

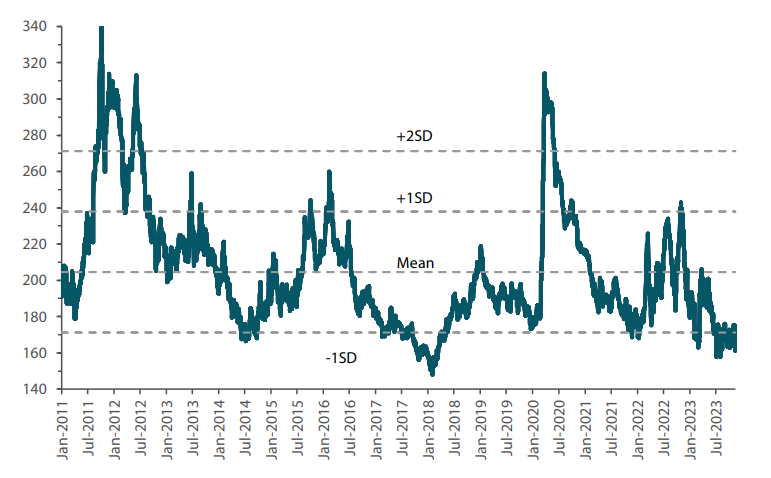

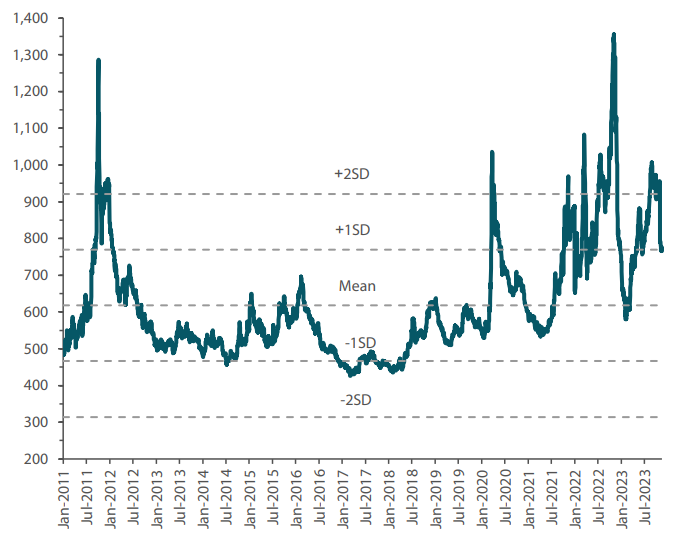

Asian credit spreads tightened in 2023 against a challenging macro backdrop, although much of it reflects the tightening in the Asian HG space. At the index level, Asian HY spreads also tightened. However, this was distorted by index rebalancing in the wake of defaults and the removal of several large China real estate issuers from the index.

Despite the tighter spreads year-to-date, Asian HG credits have not been without volatility. Spreads widened notably in mid-March 2023 following the collapse of several regional banks in the US, and the forced merger between Credit Suisse (CS) and UBS, which triggered the write-down of CS Additional Tier 1 (AT1) securities. Despite having much stronger fundamentals, Asian bank capital instruments were not immune to the events, although the observed spread widening was much more muted. However, following the liquidity and regulatory measures implemented by authorities in the US and Europe, which helped prevent the worsening of the banking turmoil, Asian financial spreads tightened back along with their global counterparts.

In the second half of 2023, Asian HG spreads displayed remarkable resilience and stability, moving within a narrow range of 160 basis points (bps) to 175 bps. This was despite (1) increasing concerns over China’s growth recovery, (2) further weakening of China’s property sector after initial optimism towards the country’s post-pandemic reopening faded, (3) continued pressure from rising US Treasury (UST) yields and hawkish rhetoric from the Fed and other major central banks and (4) ongoing US-China geopolitical tensions. Part of this resilience stems from robust sovereign and corporate credit fundamentals across most of the Asian HG space, including the non-property HG credits in China. At the same time, a low gross supply of new issues and negative net supply provided technical support to spread valuation. The rise in yields, while a headwind to broad market sentiment, also served to attract all-in yield buyers with longer-term perspectives.

Looking into 2024, we expect most of the factors that supported Asian HG spreads in 2023 to remain in place. However, with current Asian HG spreads near historical lows and at relatively tight levels relative to developed market spreads, a significant part of the positive factors seems to be priced in, limiting the room for further tightening. Additionally, there are also negative risk factors including a potentially sharper-than-expected slowdown in global growth and higher domestic interest rates exerting an incremental but nevertheless negative impact on Asian economies and corporate credit fundamentals. All these factors suggest that Asian HG spreads may trade sideways with a mild widening bias in 2024. There is also risk of some decompression with the spread differential between BBB-rated bonds and A-rated bonds tightening from 78 bps at end-2022 to 66 bps as of this writing in end-2023, which is some distance below 90 bps, the average over the last five years.

Developments in the China property sector continued to impact Asian HY spreads throughout 2023. However, with the much smaller weight of the China HY real estate sector, the influence of this sector on the overall Asian HY space is likely to decrease going forward even though volatility within the sector will likely remain. In turn, the direction of Asian HY spreads will increasingly be influenced, in our view, by developments in the Macau gaming space, India HY, Indonesia HY and unrated issuers across the Philippines and Hong Kong. Given the myriad cyclical and structural drivers for each of these sectors, it is difficult to call the direction for overall Asian HY spreads in 2024, although the current spread level remains wide and appears to offer room for compression over the medium term.

Chart 1: Asian high-grade spread

Source: JP Morgan, Bloomberg, as at 15 November 2023

Chart 2: Asian high-yield corporate spread

Source: JP Morgan, Bloomberg, as at 15 November 2023

Technicals

We see the technical backdrop for Asian credit remaining favourable in 2024. Elevated UST yields and cheaper onshore funding alternatives, particularly in China and India, have resulted in a second year of very subdued primary issuance in Asian of US dollar (USD) credit in 2023. As these factors are likely to remain, at least in the first of 2024, we expect another year of low gross supply of around USD 100 billion to USD 120 billion. This is slightly higher than in 2023 as we expect issuance to pick up somewhat in the second half of 2024 with yields in the US dollar market expected to become more conducive to issuers. As with 2023, a large part of the gross issuance will likely be for refinancing, leaving net issuance at a manageable level. While issuance from China and India are likely to remain low, we expect issuance from South Korea to stay at a high level, along with a steady supply of Indonesia and Philippines sovereigns.

In addition, we see potential for fund flows to turn more positive for Emerging Market (EM) and Asian credit. The persistent rise in UST yields and elevated front-end rates in developed markets have been a powerful driver of EM bond fund outflows in 2023, along with investor concerns over China’s growth recovery and geopolitical tensions. However, with the Fed seemingly nearing the end of its rate hike cycle potentially easing in the second half of 2024, conditions could turn more favourable for global investor allocation into EM credit. For Asia, a potential stabilisation in the Chinese economy and easing of geopolitical tensions could be additional incentives for fund inflows into Asian credit.

Strategy

Our base case envisions a slowdown in global growth in 2024, with the US in particular losing some of its exceptional strength seen in 2023. At the same time, inflation is likely to continue moderating across the developed world—albeit at a slower and more uneven pace than in 2023. The aggressive policy rate hiking cycles by major central banks could be nearing an end, although the timing of the easing pivot will remain uncertain. Against this backdrop, UST yields are seen declining moderately from current levels.

Closer to home, the sustainability of China’s recovery momentum remains a significant wild card. The effectiveness of various measures that have been announced by the Chinese authorities to support its property sector will be key to the spread performance of the China real estate sector. This sector is now a smaller segment of the Asian credit market today but is still an important driver of overall performance given the scale of potential spread tightening or widening. Elsewhere, macro and corporate credit fundamentals across Asia ex-China are expected to stay robust despite some slight downward pressure. We see demand and supply technicals for the Asian credit market remaining favourable. However, given the current spread level and quality compression that has taken place, particularly on the HG side, some caution is warranted as we head into 2024 given the prevailing uncertainties.

We therefore head into 2024 with a slightly defensive view in terms of overall credit risk. We have a slight preference for taking greater credit exposure at the front-end considering the flatness of the credit curve. We believe outperformance can be derived from sectors that we believe will perform well despite the more challenging global backdrop. These sectors include Macau gaming, upstream oil & gas, India renewables and financial subordinated debt from strong jurisdictions such as Singapore and South Korea, while remaining cautious on the real estate sector. As always, credit selection within each sector and country will remain a key differentiator as well.

We see balanced risks to our base case scenario. One material downside risk is continued US economic resilience alongside a reacceleration of inflation dynamics, which could prolong the Fed’s rate hiking cycle. This would necessitate an even more defensive stance and outright caution regarding duration. On the other hand, a faster disinflation process with no hard landing in developed economies could see an early shift by global central banks towards monetary easing, which could support further spread compression across global credit markets. A stronger than expected recovery in China’s property market along with further thawing in US-China relations are other positive risk factors that would necessitate changes in outlooks as we progress through 2024.

Sector Outlooks

Financials and non-bank financials

Higher interest rates had a net positive impact on the banking sector in Asia through 2023. Banks were able to add pre-emptively to their coffers for non-performing assets and raise their capital buffer, while recording manageable unrealised losses on their portfolio of financial securities due to their strong banking franchise and limited reliance on financial securities for income. As the fundamentally strong financial institutions exude enduring strength and resilience, the divergence taking place within the sector is difficult to ignore. Amid a dynamic operating environment owing to macroeconomic headwinds and geopolitical risks, the main problems plaguing the sector—high household debt against GDP and exposure to weak segments such as mainland China real estate—developed over an extended period. These problems cannot be solved overnight, and they have become recurring themes over the years.

Fundamentally strong banks include institutions from Singapore and the dominant players across Asia. We see limited room for further upside on the profitability front (specifically, on a year-on-year basis) given where we are at in the interest rate cycle, and our focus is on resilience. Having benefited from higher interest rates, these banks have accumulated large provisions and are well prepared to weather weaknesses in asset quality if the macroeconomic environment deteriorates. The strong funding profiles of these domestic retail banking-driven banks are the bedrocks of their defensive nature and provide stability to their fundamentals as there is a reduced need for these banks to compete for deposits. Substantial capital buffers have allowed these banks to pursue inorganic growth as well as buybacks of shares and capital instruments in 2023. Amid macroeconomic uncertainty and a high interest rate environment, loan growth is expected to remain subdued across the sector. As such, the differentiating factor among the strong banks may lie in their ability to generate fee income from segments such as wealth management.

Among the Thai banks, we have a more favourable view of institutions with relatively large proportions of corporate clients over those focused more on retail and SME banking due to the country’s high household debt relative to GDP. With a high interest rate, it is inevitable that concerns arise towards the debt servicing ability of borrowers and asset quality of banks’ loan books. That said, such risk continues to be moderated by the provision buffers the banks have set aside over the quarters.

Within South Korea’s financial sector, we see the bulk of the risk residing among the smaller players in the banking and non-bank financial institutions (namely, savings banks, community banks and securities firms). This is because their businesses are positioned to service the lower credit quality customers; in addition, to generate income, they rely more materially on higher risk business activities, such as those linked to the capital market, rather than mortgage lending. As such, we continue to differentiate among financial institutions and remain comfortable with the dominant players in South Korea that have consistently demonstrated fundamental strength.

For Hong Kong and Chinese banks, the key source of risk continues to revolve around real estate. A majority of the banks have manageable exposures in the double-digit percent handle, and loans specifically for property development account for an even smaller part of banks’ loan books. They also have adequate capitalisation, except for a handful of joint-stock banks. That said, we are yet to see a reprieve from credit deterioration within real estate. In addition, margin compression has been unique to the mainland Chinese banks, as policies have been introduced to guide interest rates and fees lower. Therefore, even though we remain comfortable with the major mainland Chinese banks, they appear less attractive compared to the past.

Elsewhere, improvements in asset quality lifted the fundamentals of Indian banks as loan books were cleaned up and as underwriting and risk management capabilities were enhanced. We continue to view Indonesian banks favourably as loan growth is supported by ample liquidity while the restructured loan situation continues to improve.

Overall, we believe that the banking sector is resilient. With strong capital, adequate loan loss buffers, robust liquidity and expectations of stable profitability, we retain our favourable view of banks, positively assessing the capital structure of large players with strong fundamentals as non-call risk is seen to be minimal for these issuers’ bonds while being watchful on asset quality.

For the non-bank financial intermediation sector, we see pockets of opportunities in the asset management companies in mainland China as we continue to observe timely acts of support for the sector. Lastly, we like insurance companies for their resilience in operations. We view securities firms with caution due to their strong correlation to their domestic capital market conditions.

Real estate

We are cautious on the real estate sector overall, given that the high interest rate and weakening macroeconomic environment could dampen property demand and prices for developers and landlords.

Through 2023, China’s government removed a series of tight property polices that were introduced during the property bull market period in order to stabilise the physical property market. While incremental marginal policy easing could continue to be rolled out at various city levels, we do not expect such policies to be sufficient for the overall sector. As such, physical property sales are expected to continue facing downward pressure, especially in lower tier cities amid a weak macro and employment environment. For the sector, access to funding remains tight and polarised. Coupled with tight escrow account control, new starts will likely remain low which will be a further drag on new home sales. Overall, we view the China property sector with caution. Within the sector, we prefer developers with state-owned backgrounds as we expect them to continue outperforming private firms in terms of contracted sales and funding access.

Outside mainland China, we expect the Hong Kong property market to face headwinds in 2024 amid oversupply, high interest rates and softening economic activities. However, we believe most Hong Kong developers and landlords within the dollar bond market will be able to withstand the near-term pressure of falling property demand and prices, supported by their low gearing ratio and historically prudent financial policies.

Over in Singapore, the residential property market held steady throughout 2023 despite the rising rates environment, held together by relatively tight supply. As key demand drivers from previous years fade, we turn more cautious on the sector with headwinds from the government’s cooling measures deterring foreign buyers, and softer rents and increasing public and private supply hitting the market. Within the S-REITs space, Singapore’s commercial real estate market has remained remarkably resilient, as positive rental reversions offset expanding cap rates, and as portfolio valuations held steady. We continue to be positive on the retail, hospitality and industrial & logistics sub-segments given continued tailwinds. We remain cautious on the office space sector amid a softening in broader demand as businesses strive to rein in costs.

Oil & gas

We expect oil prices to remain elevated but volatile heading into 2024. A multitude of forces ranging from climate change, regional conflicts and macroeconomic cycles are creating significant concerns in the market that we see making oil prices volatile. The ongoing conflict in Ukraine, along with recent eruption of the Israel-Hamas war, could destabilise the Middle East and disrupt oil supply. On the demand side, the weakening business environment following the sharp increase in interest rates will likely begin to bite into overall consumption in 2024 and potentially curb demand for oil.

Asian upstream oil & gas companies are likely to continue benefitting from volatile but high oil prices. However, a volatile oil price environment will be a challenge for downstream oil refining companies as they manage feedstock prices and inventories. A softening demand outlook will also likely weigh on refining margins that adds an additional layer of complexity for refiners to manage. As for petrochemical companies, a combination of a weak macro environment coupled with industry capacity additions in the region could place downward pressure on margins. In summary, we see a mixed picture for companies along the value chain in this sector for 2024. Upstream companies could continue to do well in this environment, while downstream refining and petrochemical companies may face headwinds stemming from weakened profitability.

Consumer and entertainment

We expect the leisure and entertainment industry to continue performing well in 2024. Within the Macau gaming sector, the recovery momentum remains strong as the sector’s gross gaming revenue continues to reach new monthly highs. We expect the sector’s strong performance to continue into 2024, driven by strong visitations from mainland Chinese tourists into the territory. Such a trend would be a boost to casino concessionaires. Following the period of severe operational disruptions that battered their balance sheets during the pandemic lockdown, casino operators are now laser-focused on improving their balance sheet leverage and business cash flow generation. This is seen improving the credit profile of issuers within the sector. Capex commitments that were made as part of the concession renewal agreements made between the Macau government and the casino operators are expected to be spread across the new concession term and support the overall deleveraging profile of the sector. We have a positive view on the outlook of the Macau operators.

As for the broader consumer segment, we think consumers could become more cautious regarding their spendings going into 2024 as inflation starts to have negative impact on discretionary income. We believe that consumers are likely to save more, delaying purchases of big ticket items such as properties and cars and forgoing upgrades to their homes. And if they do splurge, they are more likely to do so on smaller ticket items and on experiences, such as domestic and regional travel or speciality dining. In general, we prefer consumer staple companies over consumer discretionary-related companies.

Technology

We see Asian technology firms’ credit fundamentals remaining relatively resilient in 2024. However, geopolitical tensions remain an overhanging risk for the sector.

Asian technology firms in the dollar bond market are generally industry leaders and have low balance sheet leverage. For hardware companies, there are increasing signs that demand may have bottomed for various sub-segments such as those related to personal computers, smartphones and memory chips. At the same time, domestic regulatory risks, which were a key concern in previous years, have declined significantly for Chinese technology firms.

At the same time, heightened geopolitical tensions continue to be a headwind for many Asian technology firms. We expect the direct impact of Washington's recent measures on Chinese technology firms, such as restrictions on some US investments into certain Chinese technologies and tightened access to artificial intelligence chips, to be limited and manageable for the sector. However, these geopolitical tensions remain a large overhang for Asia’s technology firms, given the risk of further escalations in the future, especially as the US heads into the 2024 presidential elections.

Utilities

We expect the credit profile of Asian utilities companies to be largely stable in 2024 as fuel prices continue to moderate. The peak out in coal prices is mainly due to China’s expansion of its domestic coal production and cheaper coal imports across the region. These have led to the profit recovery of most of the coal-fired power producers in 2023. These producers also benefitted from rising energy demand as various economies fully reopened after the pandemic. China’s new tariff policy takes effect on 1 January 2024; we believe that the new tariff regime will further reduce the current earnings volatility of China’s independent power producers. We also believe that the new tariff regime will help speed up their energy transition developments, which are viewed to be positive for the sector from a credit perspective.

The Asia-Pacific is witnessing a significant shift towards clean energy sources as both governments and corporations in the region increasingly prioritise their sustainability goals. We believe the demand for renewable power sources will continue to accelerate as industry regulators tighten carbon emission standards and implement and enforce carbon taxes across the region. In this space, we prefer companies that have clear transition pathways towards decarbonisation, backed by strong project sponsors and execution track records in addition to effective cost controls.

Transportation and infrastructure

We expect the Asian aviation sector to remain firmly on a recovery track in 2024 and head back towards pre-pandemic levels. The sector is expected to witness sustained growth thanks to increasing demand for air travel, especially with the return of tourists from China following the easing of travel restrictions there. We remain constructive over the sector given Asia's rising middle income segment, which is expected to continue driving tourism-related activities over the medium to longer term. We expect airport infrastructure operators and airlines issuers to benefit from the demand resurgence. In contrast, we see seaport operators experiencing slower growth amid heightened global geopolitical tensions and structural shifts taking place within the shipping industry which could slow trade activity. The slowdown in trade across several developed and emerging markets caused by softer demand conditions could further reduce cargo and container traffic volumes. That said, we believe that most of the seaport operators we track have strong financial profiles and adequate financial flexibility to control their growth capex if necessary. As such, we expect the credit profiles of most seaport operators to remain stable well into 2024.