Snapshot

Another upside surprise in the US inflation data—ouch. Almost universally, investors are positioned quite bearishly—understandably so given the US Federal Reserve’s (Fed) firmly expressed resolve to continue tightening aggressively to stomp inflation which is likely to (eventually) cause a recession. However, there has not been a full capitulation as evidenced by still-high valuations in the growth segment of the US equity market, while the Fed’s fast tightening has yet to meaningfully crimp demand and take down earnings.

Healthy private sector balance sheets have kept the demand intact, compensating for inflation pressures but also with a hint of release of pent-up demand for services during the summer months. The US job market is still healthy, so the market is stuck in an awkward phase of trying to price a more dire future while not staying overly bearish as the present still does not look so bad. Range-bound trading has ensued, and while the inflation print did shock equities on the day, inflation is still likely past peak, and another catalyst may be required for a full capitulation.

In Europe, challenges are more acute, in the form of an energy crisis that is feeding into inflation where the European Central Bank (ECB) has taken to a faster tightening cycle than expected following a decade of easing. Europe will need to adjust its energy policies, and UK’s new Prime Minister Liz Truss lifting the ban on fracking may be just the beginning. Again, the long-term path looks very challenging while near-term growth is already in decline, but with markets already deeply discounted to price such outcomes, it is challenging to see the near-term catalyst to take it even lower.

The world is fast entering the adjustment phase as deglobalisation is accelerating, requiring new solutions and investment to clear new imbalances from energy supply to labour and eventually normalise inflation. While the world is still awash in liquidity left over from massive post-COVID easing, it is difficult to assess when tightening will genuinely have its intended impact in terms of slowing demand—or an unintended impact when something breaks.

In the meantime, there are many discounted assets, some of which will be the new winners during the adjustment phase, requiring new investment to find a new global equilibrium. While it may not be an optimal backdrop for the global economy that ultimately drives broad earnings over the near-term, it is an interesting time to identify opportunities that are not particularly expensive—and sometimes dirt cheap. In this environment, staying invested in value makes good sense in our view, as does a rigorous downside protection program for the next shoe that has yet to drop.

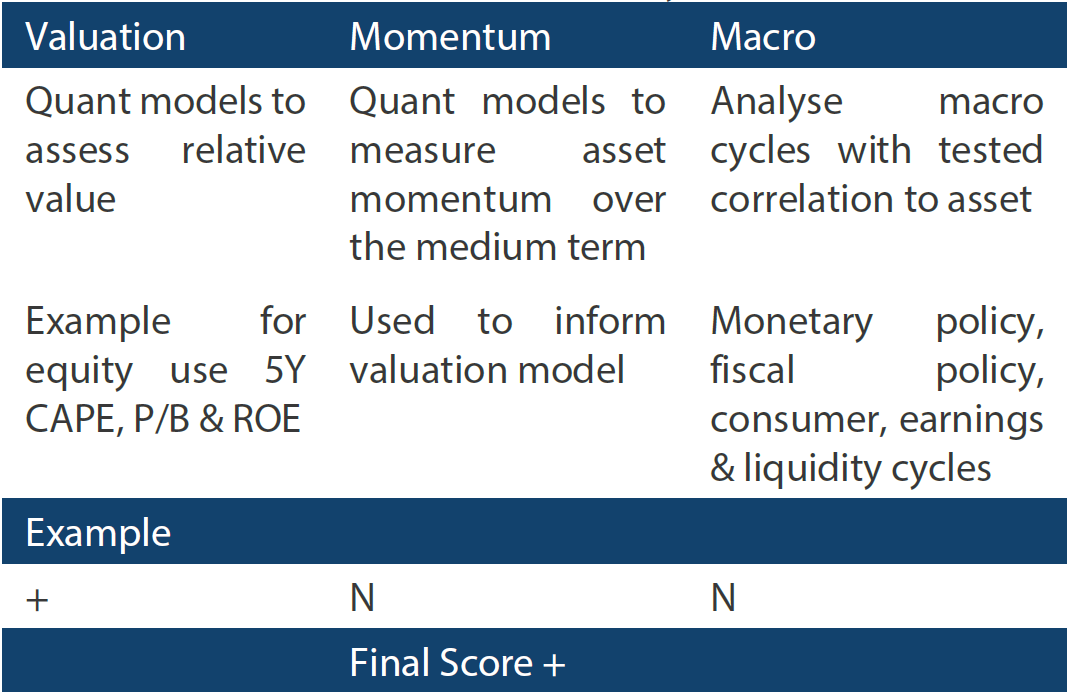

Cross-asset 1

We maintained an underweight to growth assets while slightly reducing defensive assets to a larger negative position. Earnings season came out relatively resilient, inflation did fall from peak, and risk assets lifted around the world—helped at the margin by a compression in rates and easing financial conditions. However, in an eight-minute speech at Jackson Hole, Fed Chairman Jerome Powell reminded markets of the Fed’s resolve to beat inflation with tight policy, leading to a significant drop in equities on the day.

Markets can seem fickle but based on low trading volumes and levels of liquidity, they are more susceptible to systematic flows that were partly responsible for the perhaps outsized levitation in the S&P, which could flip now to outflows given the break in momentum. As we’ve said before, while markets had seemed willing to look through the cycle to eventual Fed easing, the Fed’s resolve to keep policy tight for longer bodes less supportively for this proposition. As the Fed indicated, there will be economic pain that jobs will be lost, causing earnings to likely adjust to the downside eventually.

We compressed the conviction on our scores, upgrading developed market (DM) equities to a smaller underweight while reducing emerging market (EM) equities to neutral, as it could take time for China to work through its growth challenges given its cautious approach to easing. We also upgraded commodity-linked equities to neutral, funded by reducing REITs and Infrastructure to smaller overweights, on account of still-strong earnings in the commodity space, attractive valuations and with less certainty that demand destruction will be sufficient or even required if inflation continues to subside elsewhere, given the significant supply-side constraints that remain supportive of commodity prices. On the defensive side, we reduced DM sovereigns in favour of gold given more favourable valuations and the natural hedge to a policy mistake.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2 The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The growth outlook depends on the horizon being considered, since the short-term outlook does not look so bad on account of healthy private balances sheets and a decent jobs market supporting demand. However, the longer-term outlook is more grim on account of there being a decent likelihood of the Fed tightening into a recession. Of course, this market is difficult to price on account of future uncertainty—but to the extent that the future downside has been priced, some of the risks look skewed to the upside if news becomes less bad than is currently forecasted.

The August inflation print was ugly and, yes, the Fed may adjust to a slightly more aggressive tightening, but the general dynamics suggest inflation is most likely past peak and the Fed does not have much room to sound meaningfully more hawkish than it has already articulated. Taken together, the “hope” of a quick inflation decline followed by a fast pivot by the Fed is priced out, so there is less risk of hopes being dashed as experienced in August.

On the growth side, markets have deeply discounted Europe for its energy crisis and certain recession, while most have lost hope for China due to its zero tolerance COVID policies and property market stress. Yes, conditions could worsen, but policymakers are on both cases and any upside surprise probably would be meaningfully greeted with an improvement in risk appetite.

We are far from sanguine or bullish, but given attractive valuations in a number of geographies and sectors, it looks like a decent opportunity to accumulate selective risk while carefully managing downside. One of the opportunities we like is Japan. Foreigners have shunned Japanese equities—perhaps partly for perceptions of rising macro risks for the precipitous decline in the Japanese yen—but we see reasons for the equity market to remain durable in the months ahead.

Opportunities in Japan equities

It may be surprising to some that the Japan equities are basically flat year-to-date (YTD) while most markets have fallen quite negatively, in many cases well into the double digits. One might have guessed that investors would flock to this relative safe haven, particularly as it kept policy easy to support growth when the rest of the world was tightening. Certainly, the fast decline in the yen might have spooked investors on perceptions that the Bank of Japan (BOJ) might be forced to tighten and perhaps instigate a market shock.

While the yen does continue to weaken, usually currencies are driven by changes in relative policies and real yields. In this regard, if peak hawkishness is already priced into Fed plans, maybe the worst of pressures on the yen are over while the upside in earnings from a weaker yen is potentially compelling—for exports but also for a recovering economy with declining COVID-19 cases, and faces less of an inflation problem with still-easy policy to support domestic growth.

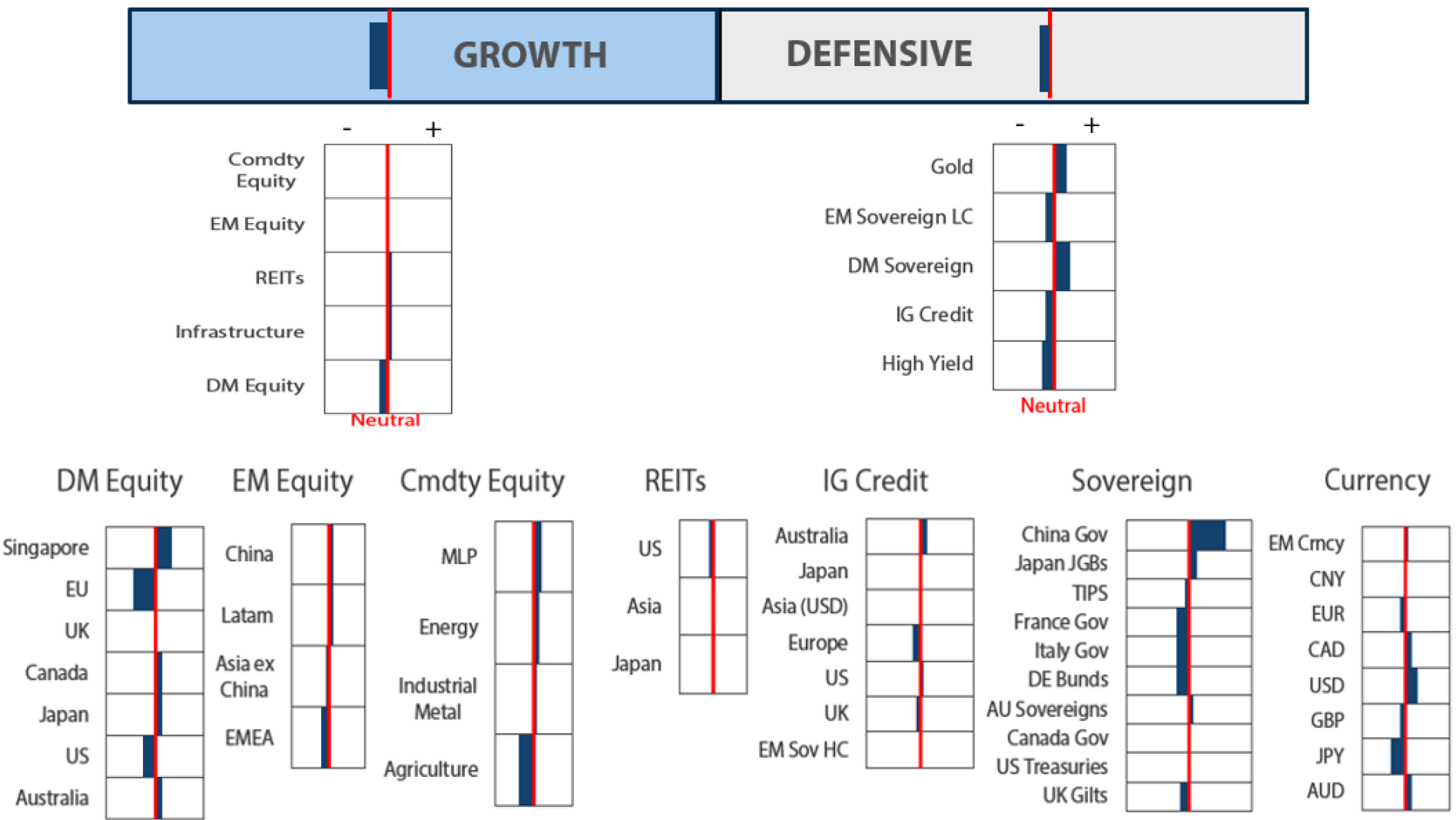

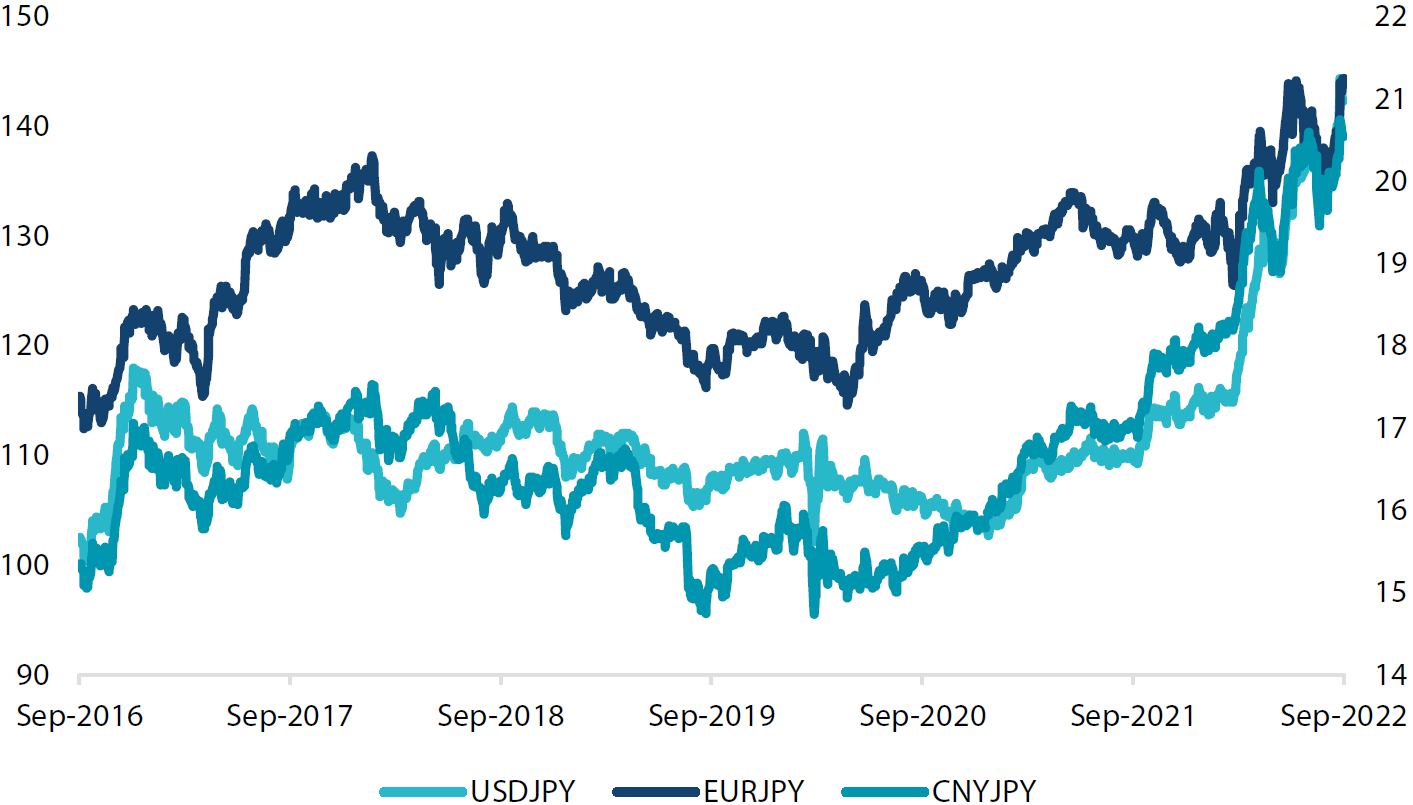

Typically, the yen weakness is a tailwind for Japan equities on account of the direct positive earnings impact. In fact, as China has surpassed the US as Japan’s most important trade partner, our analysis shows that Chinese yuan (CNY)/Japanese yen (JPY) is a more important driver of Japan equities and judging by the relative move in the currency, Japanese equities could have a way to catch up.

Chart 1: Japan equities versus CNY/JPY

Source: Bloomberg, September 2022

Of course, weak China demand is a near-term headwind—for both the property sector and the consumer—which may depress demand for Japanese exports. However, weak growth in China is well-priced and understood while policymakers continue to ease policy to stimulate growth and helping to stabilise the property sector. We think Japan could be a strong beneficiary, not just in terms of improving China demand but the massive earnings windfall from the weakness in the yen.

Conviction views on growth assets

- The worst may be priced in for near-term: Between peak inflation, peak hawkishness and peak fear both for Europe and China growth, there may be room for an upside surprise.

- Still favour value: We see value assets as having better upside over the long-term, as segments of growth still need to derate, and we see some of their outsized earnings deflate as a function of stimulus removal.

- Commodity-linked equities: While long term risks for a global recession would be a headwind for commodities, we are not there yet as demand destruction has yet to emerge, and supply-side issues remain. Moreover, valuations are very inexpensive, and the earnings outlook is quite positive.

Defensive assets

We retain our cautious view on sovereign bonds, although we prefer government bonds to credit within our defensive asset classes. Central banks still have a big task ahead to tame inflationary pressures without causing lasting damage to the global economy. The longer inflation pressures remain high, the more concerned we become that central banks won't be able to achieve soft landings. As a result, we continue to await further inflation and activity data to hopefully bring more clarity to their chances of success in avoiding recession.

Our negative view on credit remains this month although spreads found support as global equities rallied off recent lows. Central banks continue to tighten monetary policy and show their resolve to tackle high inflation. Global demand is likely to moderate in the face of higher rates and eventually weaken corporate credit quality. This tends to put widening pressure on both investment grade and high yield spreads, so we prefer the relative safety of sovereign bonds.

Gold has been challenged by higher real yields and a stronger US dollar, but the commodity has also been supported by high inflation and geopolitical risks. We view gold as still attractively valued and a useful hedge for any systematic risks. As central banks press on with policy tightening to fight inflation, the risk of creating unintended consequences rises.

The BOJ/Japanese yen

The BOJ’s monetary policy has largely been in synch with its global central bank peers in the post-global financial crisis period. As strange as that may sound in today’s environment, it is only this year that significant deviations have arisen. The BOJ introduced its negative interest rate policy (NIRP) and yield curve control (YCC) in 2016 but was beaten to the punch on NIRP by the ECB and copied much later by the Reserve Bank of Australia (RBA) on YCC. And while it’s true that the BOJ did not join in the brief tightening cycles by the Fed, Bank of Canada (BOC) and the Bank of England (BOE) in 2017, they weren’t alone as the ECB and RBA were also non-participants.

Since the beginning of the year however, central banks have delivered a series of large rate hikes, kicked off by the BOE and then followed aggressively by the BOC and the Fed. The odd bank out has been the BOJ that has steadfastly held onto its highly accommodative policies that have remained unchanged. Even its fellow NIRP supporter, the ECB, has recently lifted its target rate to positive.

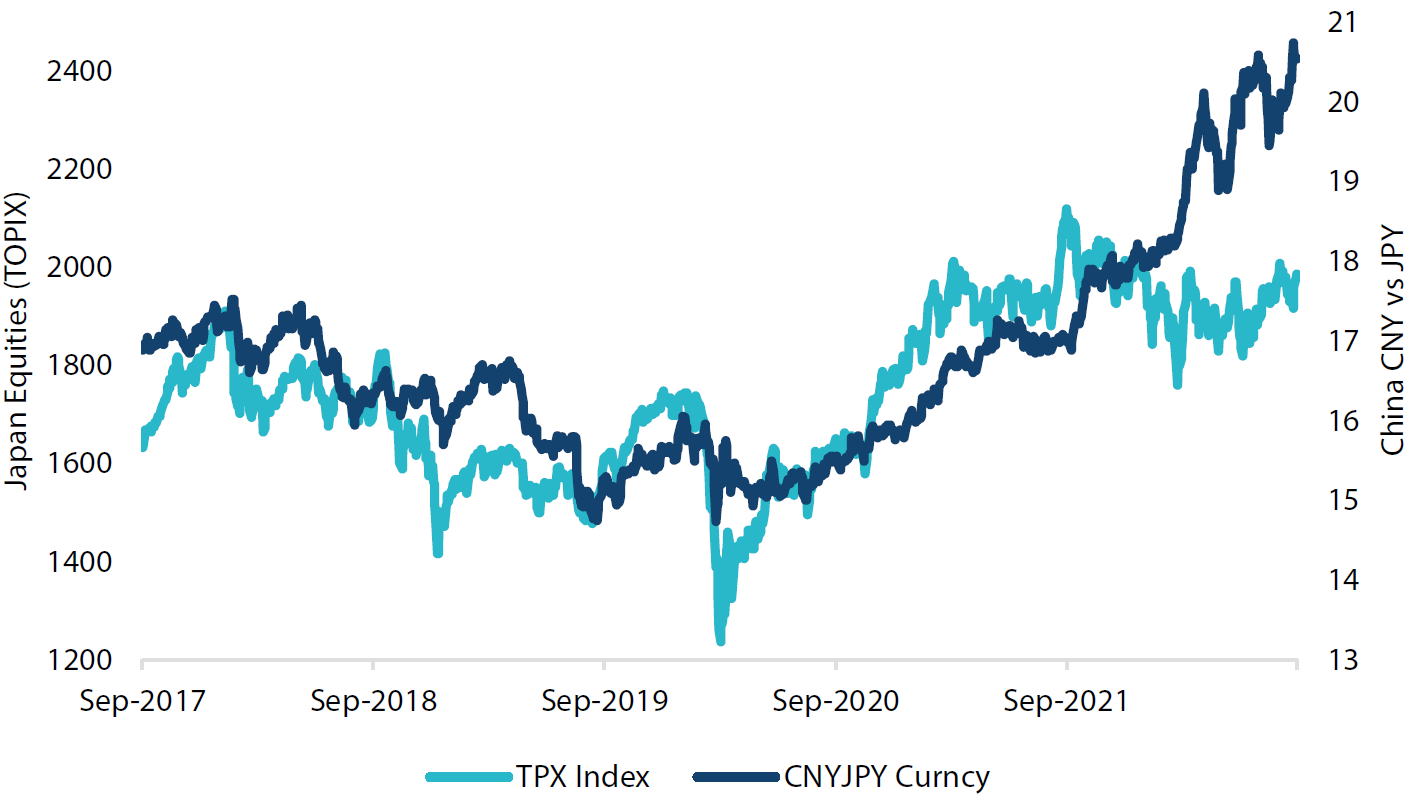

The main driver of this global tightening of monetary policy has been surging inflation on the back of higher energy prices and supply chain disruptions. Chart 2 shows both the headline and core CPI for Japan. While CPI has risen above the BoJ’s target inflation rate of 2% for the first time since the increase in Japan’s consumption tax in 2014, the core rate is still below the 2% mark. It has also risen sharply and may yet reach 2%, but both the core and headline rates are well below the high single digit rates seen in its developed market peers.

Chart 2: Japan consumer price inflation (CPI)

Source: Bloomberg, September 2022

The divergence in Japanese Government Bond (JGB) yields relative to US Treasury yields this year has undoubtedly been significant. The principal driver of this move is thought to be the rapid rise in US yields against the BOJ’s yield suppressing YCC policy. While the YCC policy is certainly a contributing factor, the favourable inflation outcomes in Japan also provide a fundamental underpinning to JGB outperformance.

Justified or not, the rising yield differentials have also led to a significant depreciation of the yen relative to some of Japan’s major export competitors. Chart 3 shows the yen weakness against the US dollar, Chinese renminbi and the euro. The euro has had its own struggles but has still managed to appreciate relative to the yen.

Chart 3: Japanese yen against other currencies

Source: Bloomberg, September 2022

The recent yen weakness and the potential for even wider yield differentials has drawn-out public comments from both government and BOJ officials. This mild “jaw-boning” is likely to be the first shot across the bow in a potentially longer battle. While the most obvious remedy for yen weakness would be a step towards higher rates from the BOJ, we think this is unlikely in the short term unless inflation makes a renewed push to even higher levels. The more likely choice would be some old-fashioned intervention if markets themselves lose faith in the yen.

Conviction views on defensive assets

- Conditions still challenging for duration: Central banks have seemingly put their reputation on the line in their stated desire to bring inflation to heel. Higher cash rates are the backdrop for higher bond yields as markets may still be underestimating how much tightening may be required.

- Favour sovereigns over credit: Global monetary policy is tightening rapidly as central banks fight to contain inflation. This will eventually have the desired effect of slowing global demand and putting pressure on corporate credit quality.

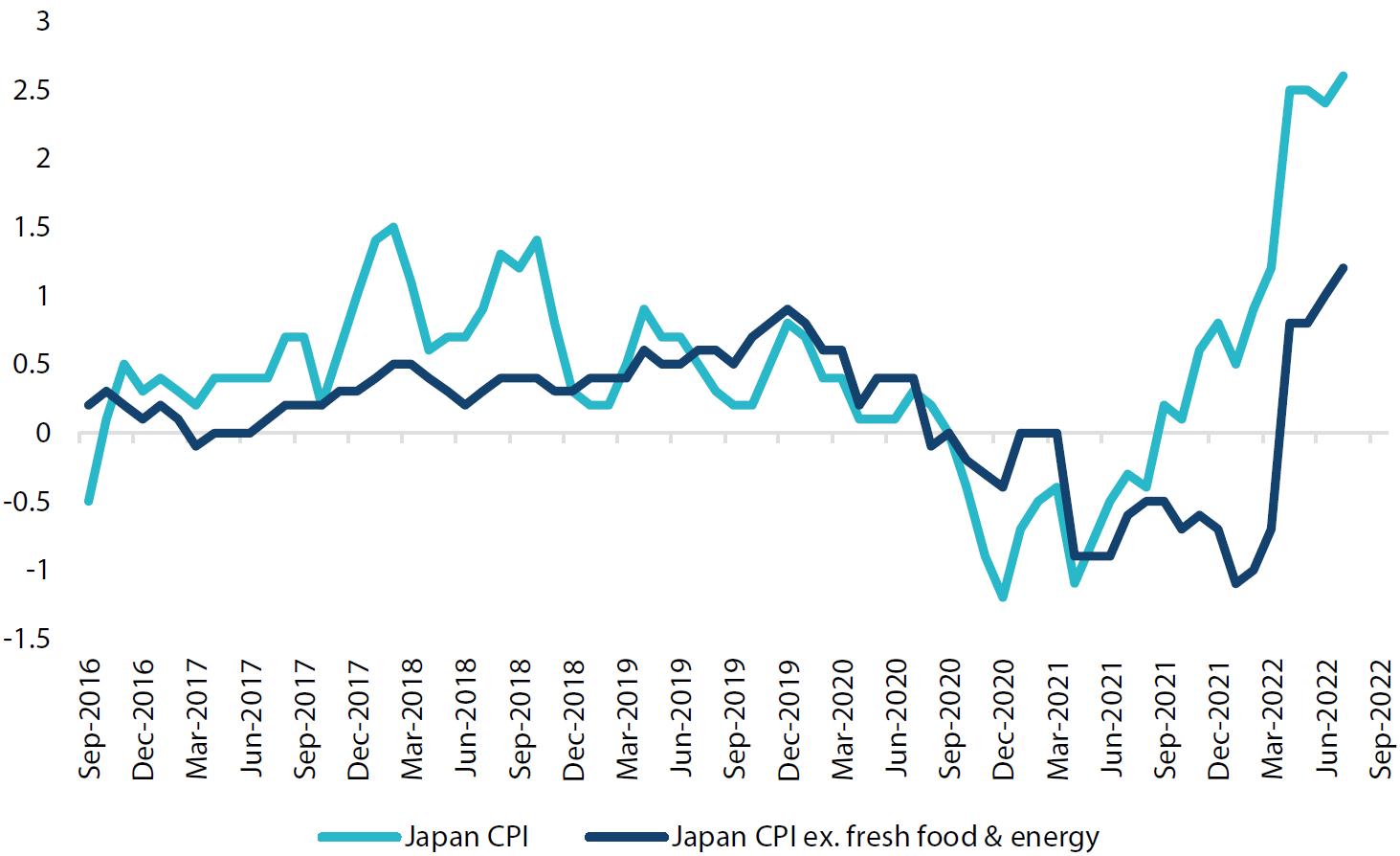

Process

In-house research to understand the key drivers of return: