Snapshot

The global spread of the Omicron variant continues to make splashy news headlines, such as the US reaching a record number of new COVID-19 cases—but the dire predictions of overwhelmed hospitals and high death counts are so far not among them. As news of the new variant emerged, we worried that governments’ pre-emptive efforts to add restrictions might once again impede global demand and interrupt the recovery. However, evidence is mounting that Omicron may be less virulent and thus populations appear less tolerant of government lockdowns in the face of rising cases. As a result, demand may not be curtailed as much as we initially feared.

As is often the case, markets are a better reflection of general sentiment than news headlines and so far, it points to an ongoing global recovery as equities hold their gains of 2021 and long-term bond yields rise. It may not be time yet to write off more difficult scenarios derived from the outbreak of Omicron, but facts so far do speak more positively than just one month ago.

It is never a particularly comfortable time to invest in risk assets when the US Federal Reserve (Fed) speak turns increasingly hawkish, but as we have long said, markets are supported by policy that is still very accommodative and we are a long way from the Fed approaching anything that resembles restrictive policy. Assuming of course that Omicron doesn’t throw the knock-out punch, and we don’t believe it will, the economic recovery will continue, particularly outside of the US where stock prices have yet to catch up to earnings improvement. Of course, many things can go wrong, which makes it increasingly important to keep a close eye on potential emerging risks before the Fed can adequately respond.

Cross-asset1

Markets have remained cautious, considering the latest global COVID-19 outbreak and the Fed holding firm to its hawkish turn. Initial government reactions to the Omicron variant, including restrictions on travel and mobility, seemed odd in light of high vaccination rates and lack of concrete information. As we learn more about Omicron, transmissibility appears to be much greater than the Delta variant, but the infected (many of whom are vaccinated) seem to be showing rather mild symptoms. This bodes well for populations learning to live with the virus with minimal disruptions to the economy. Meanwhile, the Fed’s plans to begin removing its extraordinarily easy monetary policy support in 2022 will not equate to tight policy any time soon. There are also signs that banks are beginning to lend more, in effect replacing the need for Fed asset purchases in the first place, so it is difficult to paint a negative picture on global growth. Inflation is still an important watchpoint, but so far demand remains robust and profit margins intact, so it is not a headwind—yet.

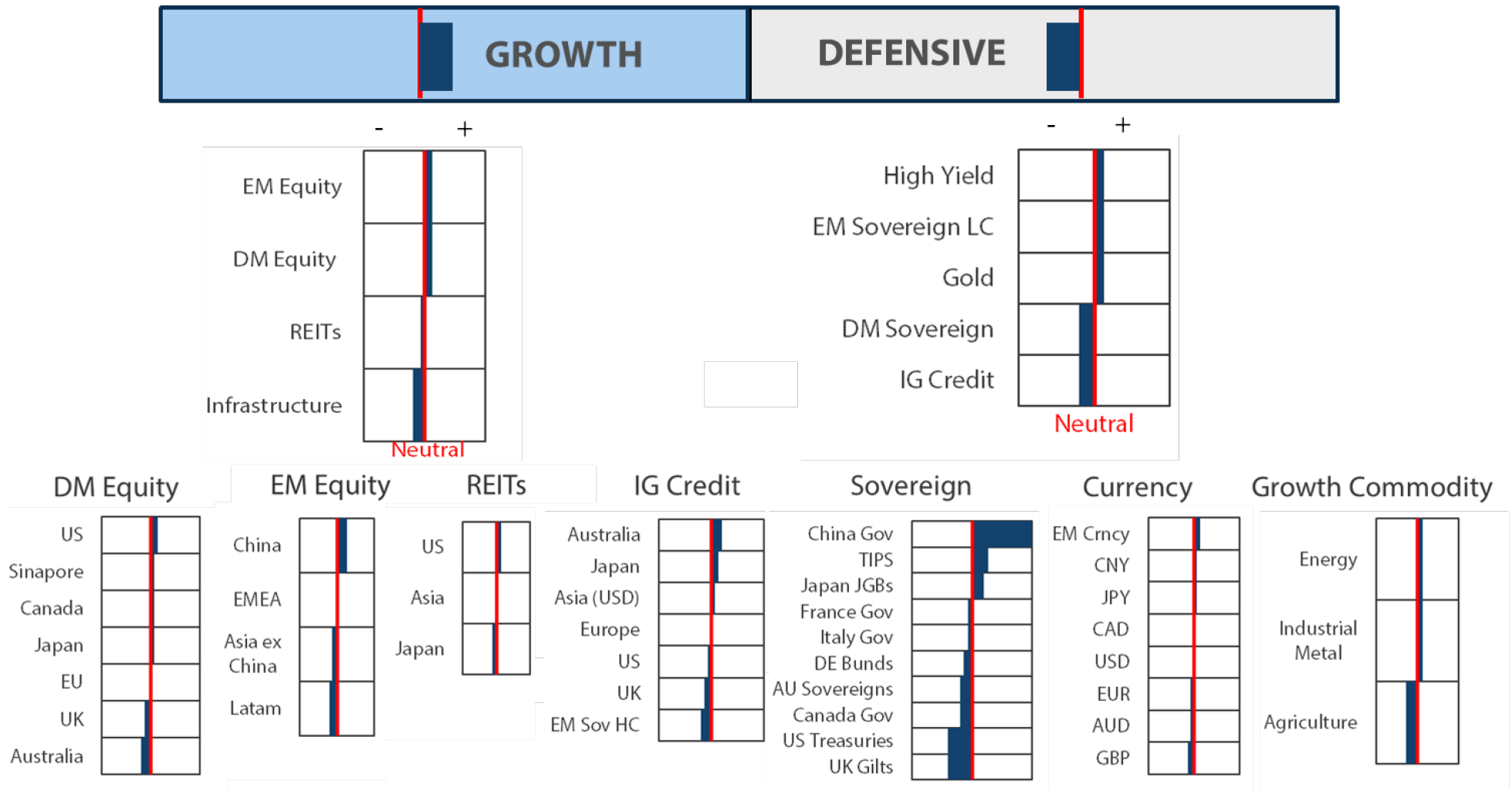

We maintained a positive view on growth assets in relation to defensive assets. Within growth assets, we continue to favour traditional global equities that stand to benefit from the continued economic recovery, and we are more cautious on listed infrastructure and, to a lesser extent, REITs. On the defensive side, we turned more cautious on investment grade credit and developed market sovereigns that face headwinds from a better growth outlook and withdrawal of central bank largesse. We are marginally more positive on gold, on the premise that high inflation prints will weigh more on break-evens than real yields, which should be supportive of gold prices.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Despite the bumpy start to the new year, we stick with our positive view on growth assets. As we have long said, a hawkish Fed does not equate to tight policy—which is generally the necessary headwind to look out for when investing in growth assets. Yes, volatility is likely to remain elevated as exceptionally easy policy and excess liquidity are removed, but the outlook for demand remains positive and may improve in the months ahead for several reasons.

First, it is never easy for the Fed to transition from easing toward tightening without a market hiccup, particularly when it is as extreme as today. As much as the Fed verbally tries to smooth the transition, market psychology invariably skips past the narrative to test more aggressive scenarios. In 2013, when then Fed Chair Ben Bernanke first alluded to the prospect of reducing quantitative easing, the infamous “taper tantrum” ensued, rocking markets—but, importantly, without derailing the recovery. We’d argue that such a tantrum is unlikely this time as markets are much more cautious and less leveraged to risk assets than they were back then. In any case, the recovery continues.

Second, Omicron certainly offered a scare with its high rate of transmissibility, but the degraded virulence likely means we are accelerating to herd immunity, allowing us to live with the virus with fewer restrictions ahead. This is a strong positive for global demand and growth. At the same time, banks are lending more to make up for lost excess liquidity that central banks aim to mop up.

Lastly, while the inflation print is still uncomfortably high, it is expected to peak in the coming months and may even come off more quickly as supply chains continue to normalise—particularly if Omicron marks the transition from pandemic to endemic where restrictions ease. This is not to say that there aren’t many risks to this scenario, including more virulent future variants and/or stickier inflation, but it does paint a positive backdrop as we enter the new year.

Positioning for growth in 2022

In the early days of 2022, markets reacted aggressively to a hawkish sounding Fed, which coupled with positive news on Omicron left market participants seeing the glass as half empty—perhaps allowing the Fed to be even more aggressive in its tightening cycle. Not surprisingly, yields rose much as we thought they would, but at an uncomfortably high velocity. Similar to 1Q21, the quick move in rates also led to a strong rotation from growth to value.

Is the reflation trade back? If Omicron marks the transition from pandemic toward endemic, we think so. As always when major market moves occur, it is important to understand what moved and why. Interestingly, the US dollar was notably weak relative to the bout of volatility, and despite concerns of a more hawkish Fed. Typically, hawkishness and rising yields lends support to a currency, but in the case of the dollar, it can weaken instead when growth prospects are improving. Oil prices also rose strongly, another indication of better growth prospects ahead.

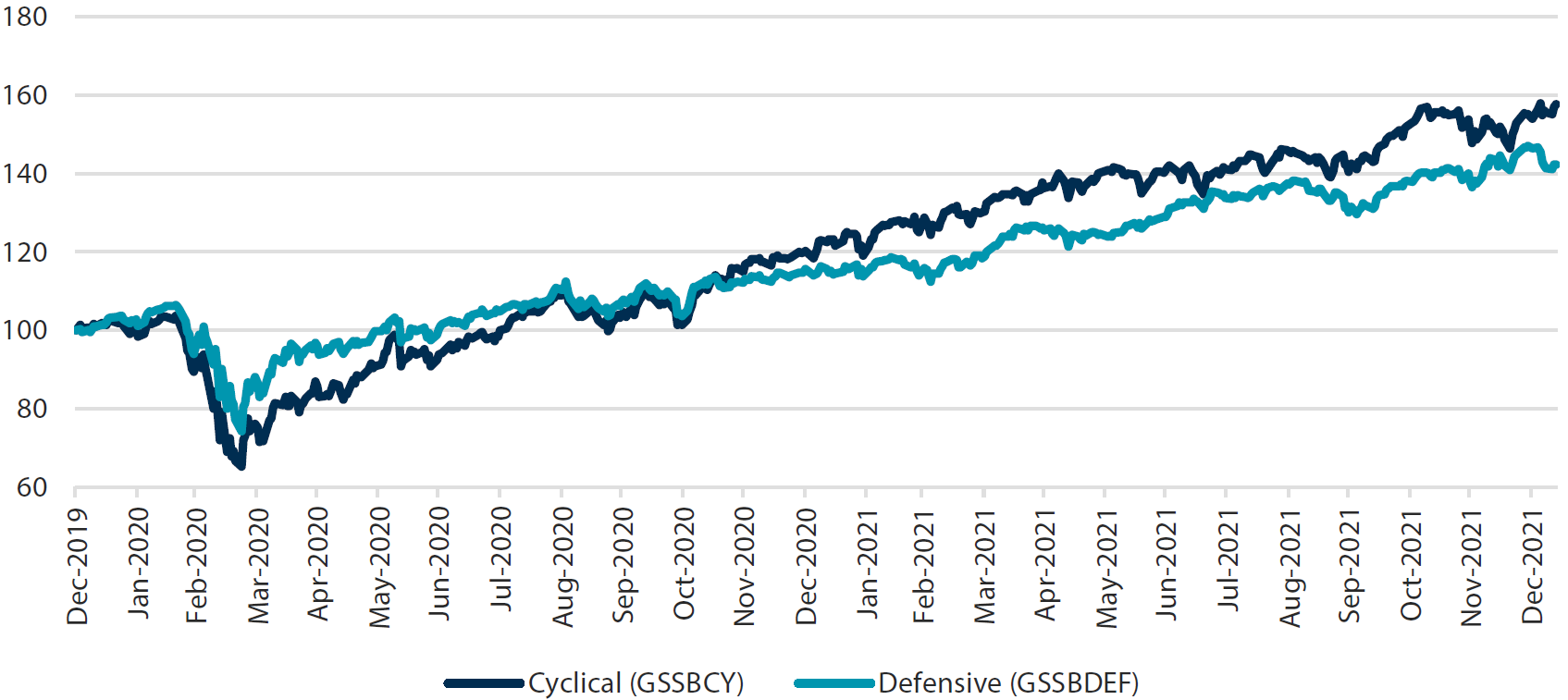

The rotation from growth to value is another indicator of potentially better growth prospect, but what does this mean? “Value” is a broad category of disparate assets including both cyclicals as well as defensives, such as utilities. If markets rotate to defensive assets over cyclicals, this suggests a more ominous outlook, namely deteriorating growth ahead. Defensives outperformed in the early days following the COVID-19 outbreak, but cyclicals subsequently gathered pace and, most notably, strongly outperformed defensives in the recent rotation. This is another bullish sign for prospective growth.

Chart 1: Cyclicals versus defensives

Source: Bloomberg, January 2022

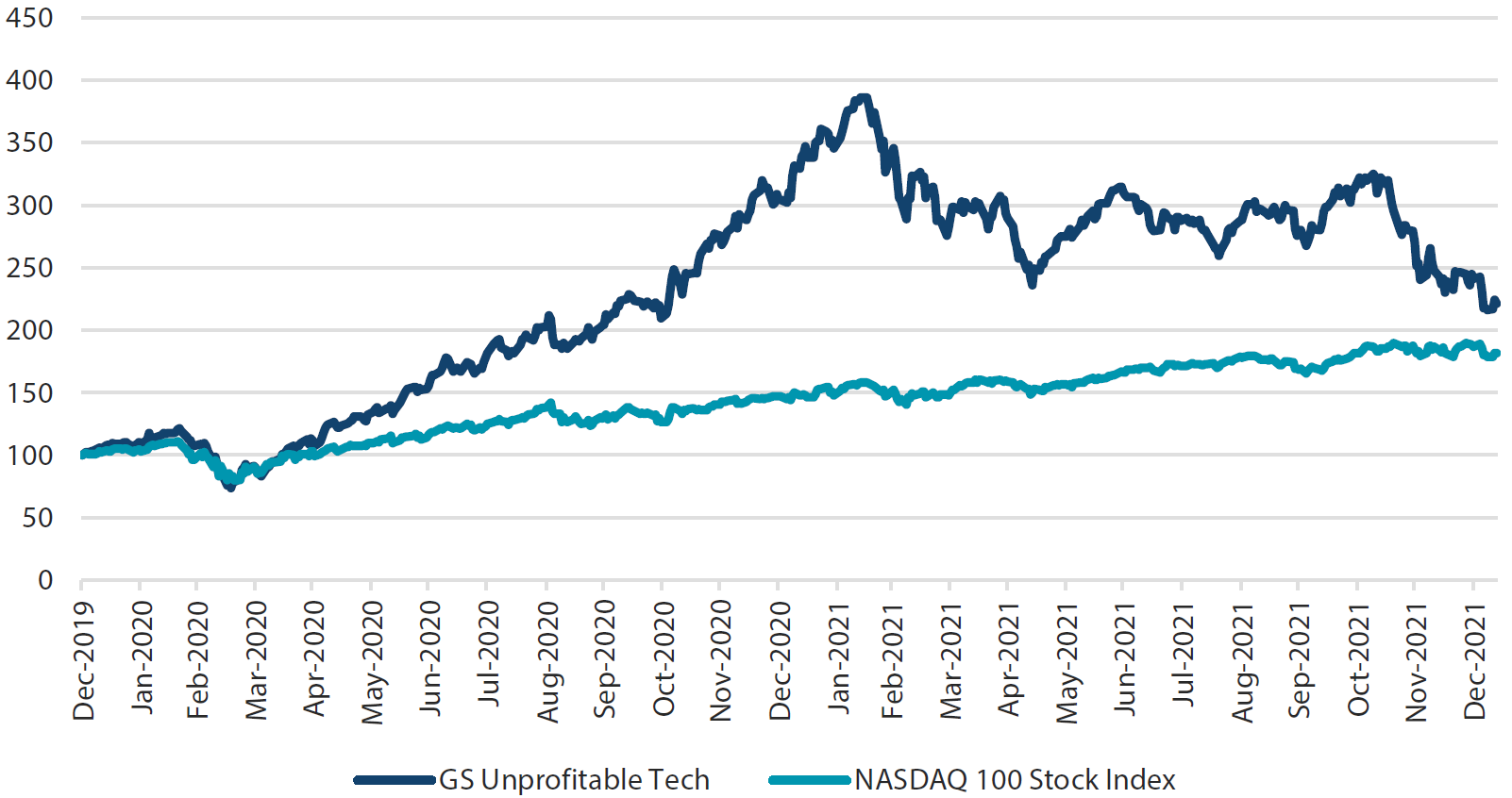

Does this mean we dump growth stocks and buy cyclicals? Not necessarily. Once again, under the hood there are growth stocks with different characteristics—those that are currently profitable and those that are not, on the promise that revenue growth will turn profits not now but in the years ahead. Markets can be patient, willing to invest for longer term earnings prospects, but not usually in a tightening cycle.

Think back to the dotcom bubble when most of the tech sector exhibited high revenue growth but little to no profits, similar to the unprofitable, high growth companies of today. As the Fed tightened aggressively, the bubble burst and tech crashed. Companies such as Amazon managed to survive the dotcom bust to deliver strong profits, but most did not.

In the current environment, the tech sector includes mega cap high growth tech companies that are also delivering strong current earnings and cash flow. NASDAQ is a decent proxy for these mega cap companies. Of course, most know these large companies had an impressive run due to COVID-19, partly on massive stimulus but also due to a change in behaviour as tech and e-commerce were used to overcome mobility restrictions. As a result, NASDAQ is up an incredible 80% from the beginning of 2020. What’s more impressive? Unprofitable tech was up 4x through mid-February 2021, but the bubble has now burst.

Chart 2: NASDAQ (Profitable) versus high growth unprofitable tech

Source: Bloomberg, January 2022. The GS Non-Profitable Tech Basket consists of non-profitable US listed companies in innovative industries. Technology is defined quite broadly to include new economy companies across GICS industry groupings.

We expect the bubble in unprofitable tech to continue to deflate as exceptionally easy policy and excess liquidity will no longer be there to feed the capital requirements where cash flow is inadequate to fill the gap. On the other hand, we still like profitable tech that is likely to continue to harvest secular growth. We expect the demand for tech solutions to combat COVID-19 restrictions to certainly wane, but industry disruption will continue where semiconductors and software continue to infiltrate our daily lives.

Conviction views on growth assets

- Favour energy: Energy took a massive hit at the onset of Omicron as governments were quick to react with new restrictions. As it is becoming apparent that restrictions will be less necessary to combat the new variant, energy prices have risen and have further to go, in our view.

- Favour growth currencies: These are early days of dollar weakness. But given the various market dynamics and particularly the fact that the dollar has been weaker on a more hawkish Fed, we expect this trend to continue, which is a positive feedback loop with global growth.

Defensive assets

We maintained our cautious view on defensive assets this month. Fearful of the market's reaction to the new Omicron variant, safe haven demand for sovereign bonds was robust to finish out 2021. Unlike in March 2020, vaccination rates today are high in most developed countries and governments have gathered significant data on the behaviour of the virus. We expect the global economic recovery to continue and for elevated inflation pressure to push central banks towards reducing the policy accommodation put in place at the beginning of the pandemic. Balance sheets for both consumers and businesses are strong coming out of the pandemic-induced recession, and we fear that markets are underestimating the degree to which monetary policy must tighten in order to ensure inflation settles back to an acceptable level.

Within global credit, we downgraded our already negative view on investment grade credit (IG) and continue to prefer high yield (HY). Valuations for credit remain generally expensive as central banks begin to gradually remove their pandemic related monetary policy support in 2022. Nevertheless, credit quality is still strong and likely to keep improving, but rising global yields will be an ongoing headwind for corporate bonds. The more attractive targets for higher yields are therefore in US HY and selected emerging market (local currency) bonds.

Markets have been unsettled to start the new year as the Fed accelerates its tapering of bond purchases and projects more tightening than it indicated prior to its December 2021 meeting. However, monetary policy remains ultra-accommodative, judging by the currently very high inflation readings. In our view, inflation pressures will remain the dominant driver in the coming quarter as low base effects, recovering energy prices and supply chain disruptions continue to stoke annual inflation. As a result, demand for inflation protection should remain strong, benefiting both gold and inflation-linked bonds.

What about the ECB?

There is little doubt that recent weeks have been dominated by discussion of the “Fed pivot” following the institution’s meeting in mid-December. As central bank to the world’s largest economy, analysts and commentators can be forgiven for this focus on the Fed. However, for this month we have chosen to look further afield and review the European Central Bank’s (ECB) current guidance on monetary policy and market pricing for the expected path of European rates.

The last ECB meeting of 2021 offered more of the same recipe for monetary policy. While many other central banks are already in the process of tapering their large-scale asset purchases, the ECB has been slow to the party with plans to discontinue its pandemic emergency purchase programme (PEPP) only taking effect at the end of March. After which, it will increase the pace of purchases in its other quantitative easing (QE) programme, the asset purchase plan (APP), from EUR 20 billion per month to EUR 40 billion over the second quarter before easing this back to the original amount by the fourth quarter. This will constitute a net reduction in asset purchases from April onwards, but also means that the ECB maintains its QE programme for much longer than its peers.

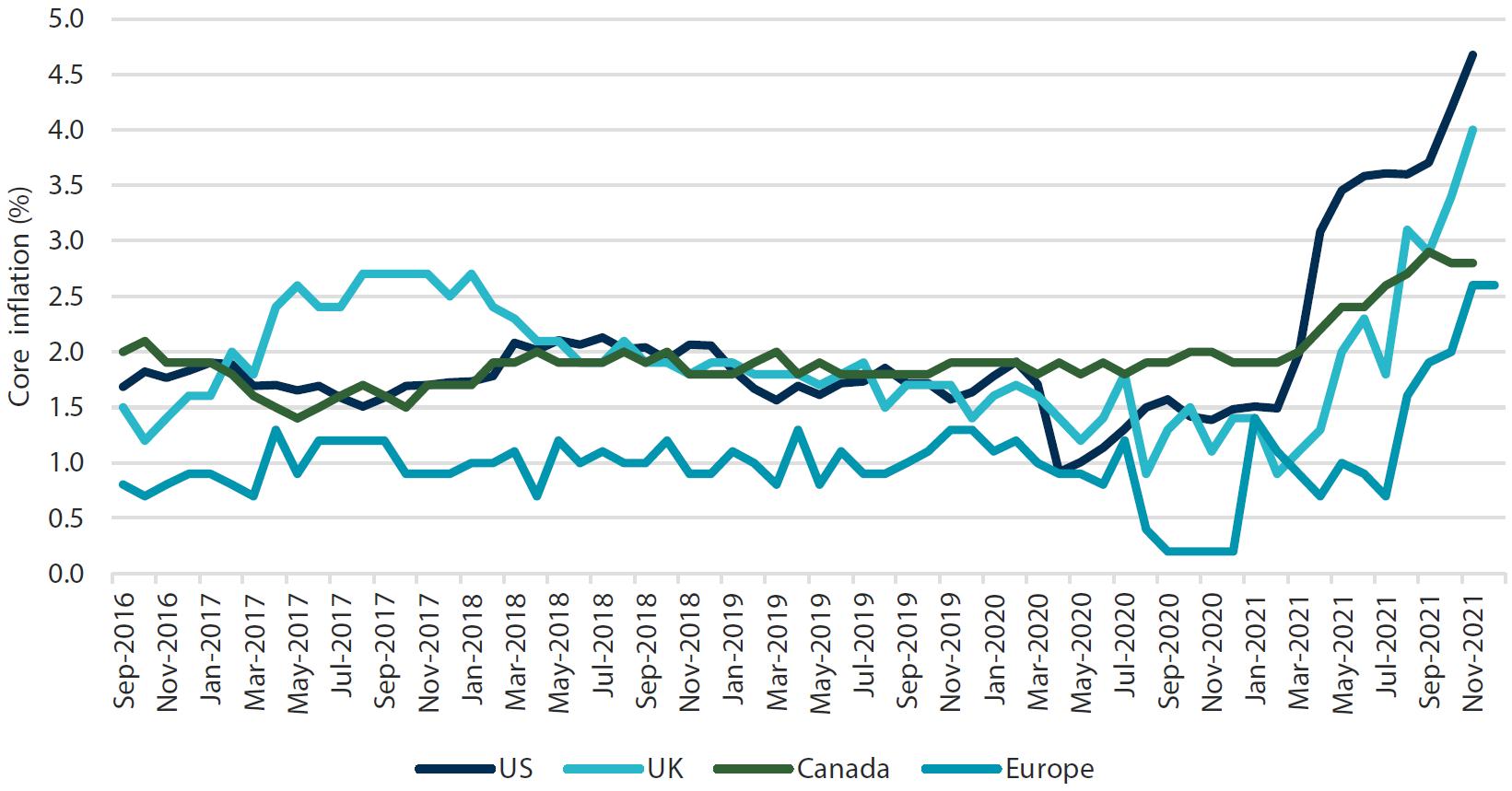

In a relative sense, this slower withdrawal of QE has some justification as European core inflation is still lower than those of its peers, as shown in Chart 3. While all of these countries’ central banks have inflation objectives centred around 2% and European inflation is exceeding this target, the overshoot is by much less than either the US or the UK. However, the base effects for annual core inflation in Europe are decidedly unfriendly for the next few months with January and February 2021 averaging a fall in prices of 0.2% per month. This is likely to see core inflation breach 3% ahead of the ECB’s February meeting. As a result, we expect markets to continue to challenge the ECB on its fundamentally dovish stance in the face of rising inflation pressures.

Chart 3: European core inflation versus peers

Source: Bloomberg, January 2022

Source: Bloomberg, January 2022

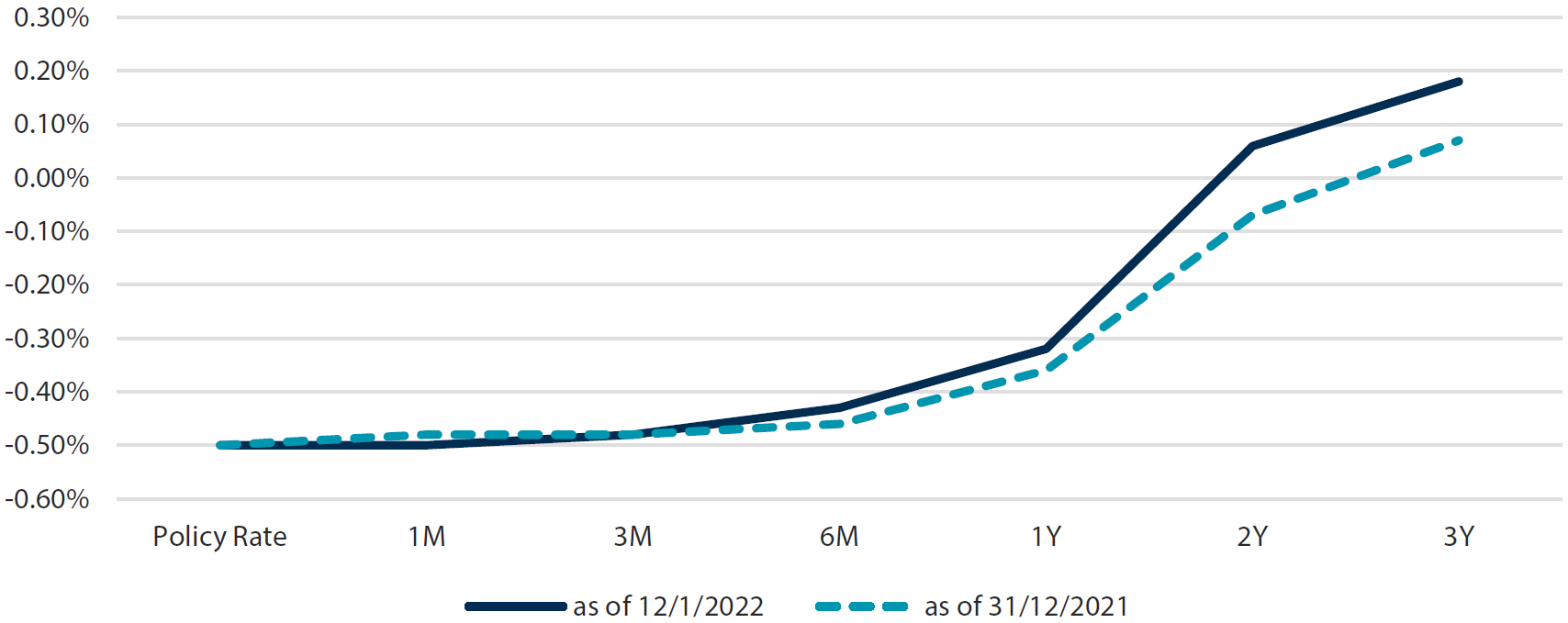

Market-implied pricing for the ECB’s target rate is shown in Chart 4. Expectations for ECB rate hikes have risen slightly to start the year but have failed to keep up with the larger rises seen for Fed rates in 2022. The first 0.10% rate hike is fully priced in and is expected to occur much later in the year. This is in sharp contrast to pricing for the Fed, Bank of England and Bank of Canada, where 0.75%–1% of tightening is fully priced for 2022.

Chart 4: Market-implied path for ECB rates

Source: Bloomberg, January 2022

Source: Bloomberg, January 2022

While the ECB is likely to continue pushing back against market pricing that conflicts with its dovish forward guidance, we expect these frictions to only increase in the coming weeks. Inflation pressures in Europe are still building and the ECB is likely to be disappointed in its expectation that higher prices will prove to be mostly transitory. In the short term, we expect European bond prices to come under pressure. Markets are likely to price greater inflation risk in long-term bonds as the ECB is increasingly seen as “behind the curve”.

Conviction views on defensive assets

- China bonds still favoured: China’s government bonds offer higher yields and lower volatility, and gradual easing by the People’s Bank of China will provide additional support.

- More cautious on Euro sovereign bonds: Low (or negative) yields and rising inflation pressures in Europe are not a good mix for attractive returns, especially as the ECB continues to pursue its stimulatory policies.

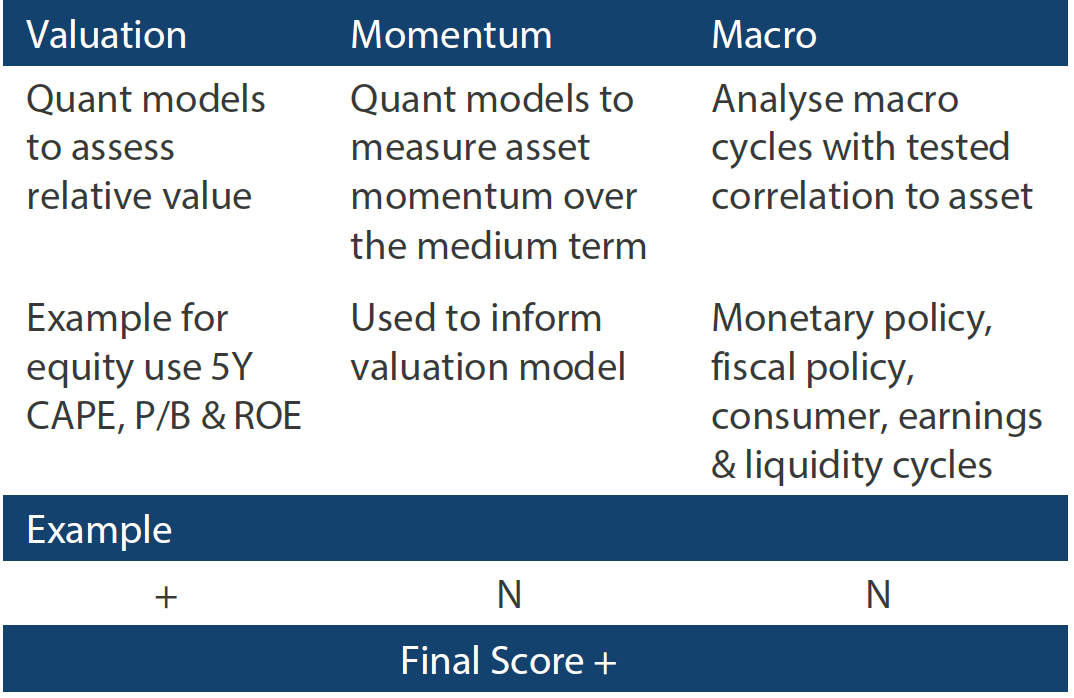

Process

In-house research to understand the key drivers of return: