Snapshot

The outlook is currently challenging. Tightening is coming, but it is not here yet and in the meantime current policy remains quite accommodative. There is no doubt that extremely easy policy—both monetary and fiscal—boosted equity prices, which were reinforced by the strong earnings that followed. Still, organic growth can continue, particularly if the highly transmissible but less virulent Omicron variant marks the transition from pandemic to endemic status where the world can finally return to some semblance of pre-COVID demand.

While corrections are often healthy, they can also be indicative of less benign economic environments ahead. Inflation is still running hot, though some pressure could dissipate on the back of normalising supply chains and returning demand for goods and services. This is not a private sector-fuelled credit bubble like we saw in 2008. Equity gains are indeed tied to real earnings and not just a dream of return on capital in the distant future like they were in 2000.

Still, we need to respect what the markets could be telling us—perhaps that outsized earnings growth in certain segments of the market may not be sustainable at the current pace. Earnings growth is naturally slowing as one would expect, given the dissipation of the demand recovery from COVID-related lockdowns. That said, the evolving dynamics do beg the question of which market segments might have been outsized beneficiaries of massive stimulus and redirected demand driven by COVID, as this stimulus could now mean revert. We are cautious, but the growth story remains intact while we remain cognizant of how asset prices could be affected as we return to a more normal monetary, fiscal and demand environment.

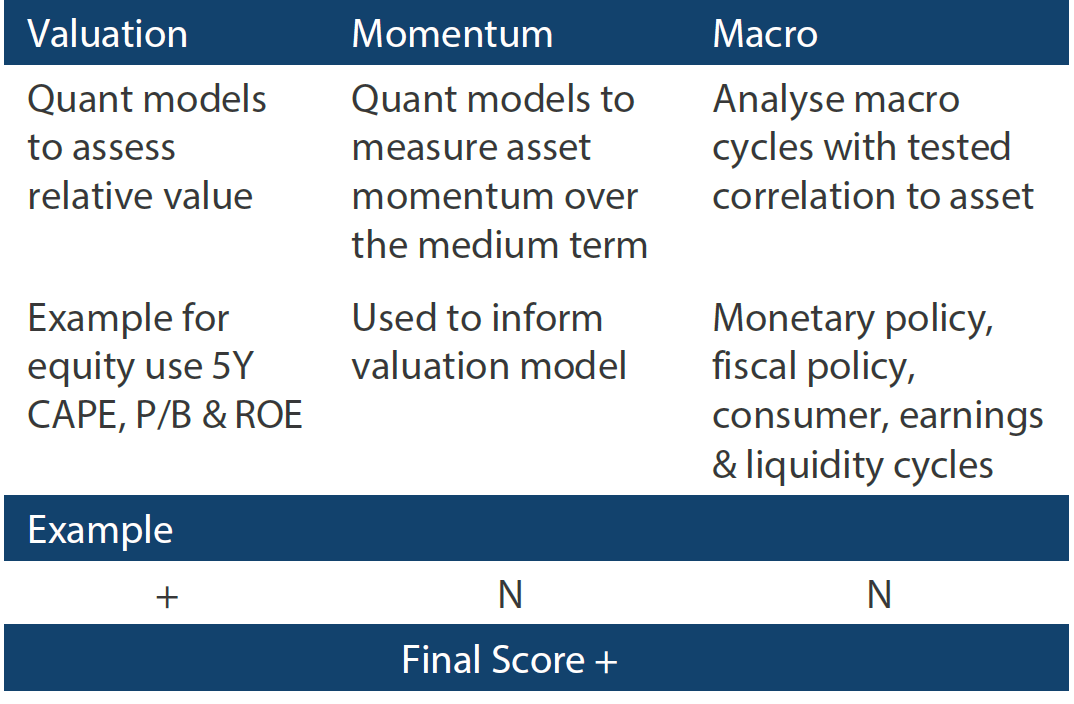

Cross-asset1

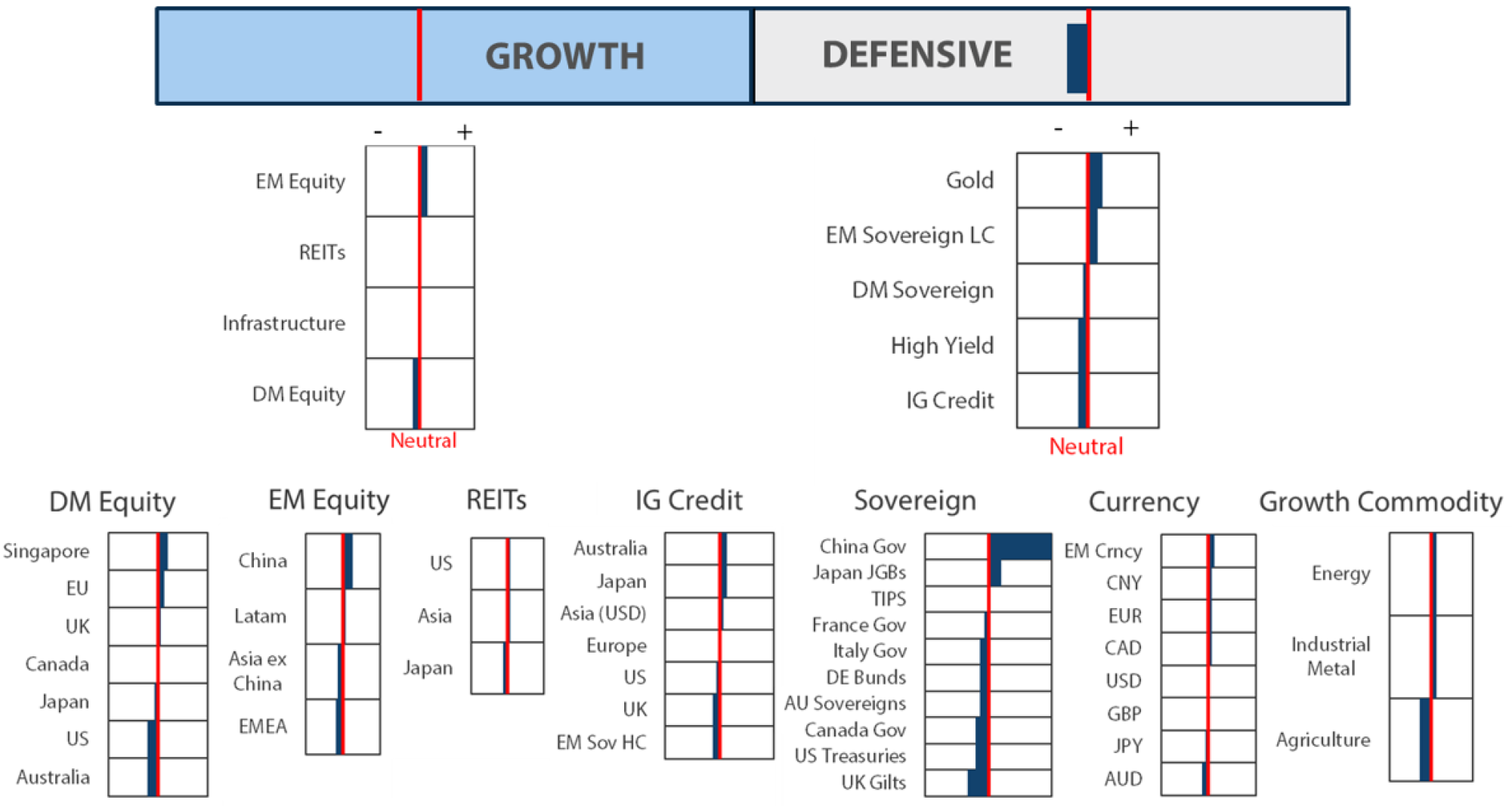

We reduced our view on growth to neutral while slightly decreasing our negative stance on defensives. This first month of the year was marked by a large jump in rates, instigating one of the biggest rotations of all time from growth to value. The rotation shared characteristics with 1Q21, but the damage to the growth sector was much deeper this time. The US Federal Reserve (Fed) has made crystal clear its focus on taming inflation, which means higher rates and, later in the year, a shrinking balance sheet.

With a hawkish Fed coupled with the latest US stimulus (Build Back Better) bill falling dead in the water—for now—markets have woken up to the realisation that the easy policy that drove income, liquidity and demand for two years is finally being removed. Yes, inflation woes are a concern to justify the tightening, but there is still an element of transitoriness which could lead to less urgency to tighten in the coming months.

While the technical damage to the markets could metastasize into a broader sell-off, the fundamentals look okay, especially when one considers the worst of COVID-19 may finally be behind us. We neutralised our growth positioning, also becoming more cautious on developed markets (DM) and favouring REITs and infrastructure for their defensive characteristics. On the defensive side, we reduced high yield (HY) on account of the vulnerability of the asset class to tightening financial conditions, and added to sovereigns, investment grade (IG) and gold to prepare for the possibility of deteriorating growth.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The massive rotation from growth to value in the first half of January was followed by even higher volatility that began to weigh on the broader market. But rather than suggesting darker economic days ahead for the global economy, recent market developments do command a deeper think on portfolio structures themselves, to harvest the upside of the economic recovery while mitigating the downside of the draining of stimulus-hatched excesses.

Yesterday’s safe assets are becoming risky, while assets that everyone sought to avoid, sometimes for many years, are now showing to be safe. Of course, if this were a temporary or irrational phenomenon, it would be better to stay the course with a similar portfolio composition, but we believe some of these developments indicate a deeper inflection point.

Amid the currently shifting economic and market environment, positioning among asset classes and exposures within asset classes become ever more critically important. Geographical allocations are important determinants of overall portfolio sector compositions and value characteristics, which hold the first key to building a safer exposure to economic growth in the months and potentially years ahead as we transition to a post-pandemic world.

Selecting the appropriate exposures within geographies also plays an extremely important role. While growth stocks offer attractive exposures to secular growth opportunities in a disrupted world, we also recognise that pockets of these markets may have realised outsized gains driven by stimulus that is now being removed. Value stocks, on the other hand, benefitted less from stimulus and perhaps will benefit more from returning organic growth of the real economy.

In the current environment, commodity sector exposures such as energy and mining could also benefit from returning economic growth and limited supply. Commodity sector exposures are growth assets that benefit from the turning economic cycle, while also playing a defensive role in helping to protect against rising rates and inflation that leave traditional defensive assets, including developed market bonds, more vulnerable.

When opportunities shift

In the depths of the COVID-driven market downturn, no one would have guessed the new heights to which US equities would go in just a few short years. Governments around the world turned on the monetary and fiscal spigots to fight massive economic headwinds, but none quite as much as the US. Between enormous asset purchases and generous fiscal support programmes, money was exceptionally plentiful by any definition.

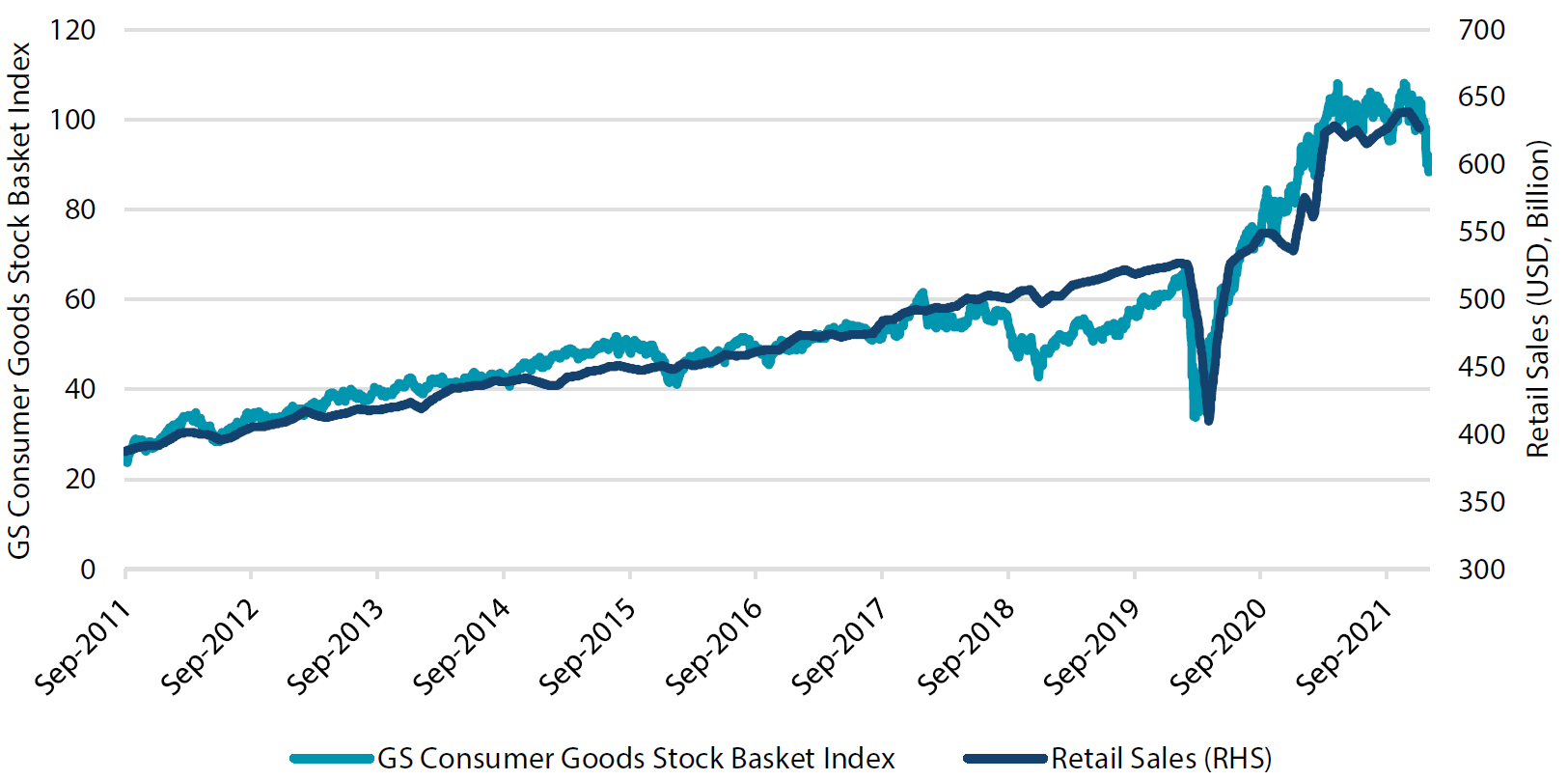

With healthy finances but also with limited ways to spend it due to COVID-related restrictions, consumers turned to buying, well—stuff. Retail sales leapt higher, much of it online, perhaps helping Wall Street more than Main Street as many small businesses went bust. The surge in retail demand has certainly been a boon for consumer goods stocks, but is it sustainable? Stimulus is ending and demand is shifting back from goods to services, so we suspect some mean reversion to more normal levels of demand is likely in store.

Chart 1: Retail sales versus consumer goods stocks

Source: Bloomberg, February 2022

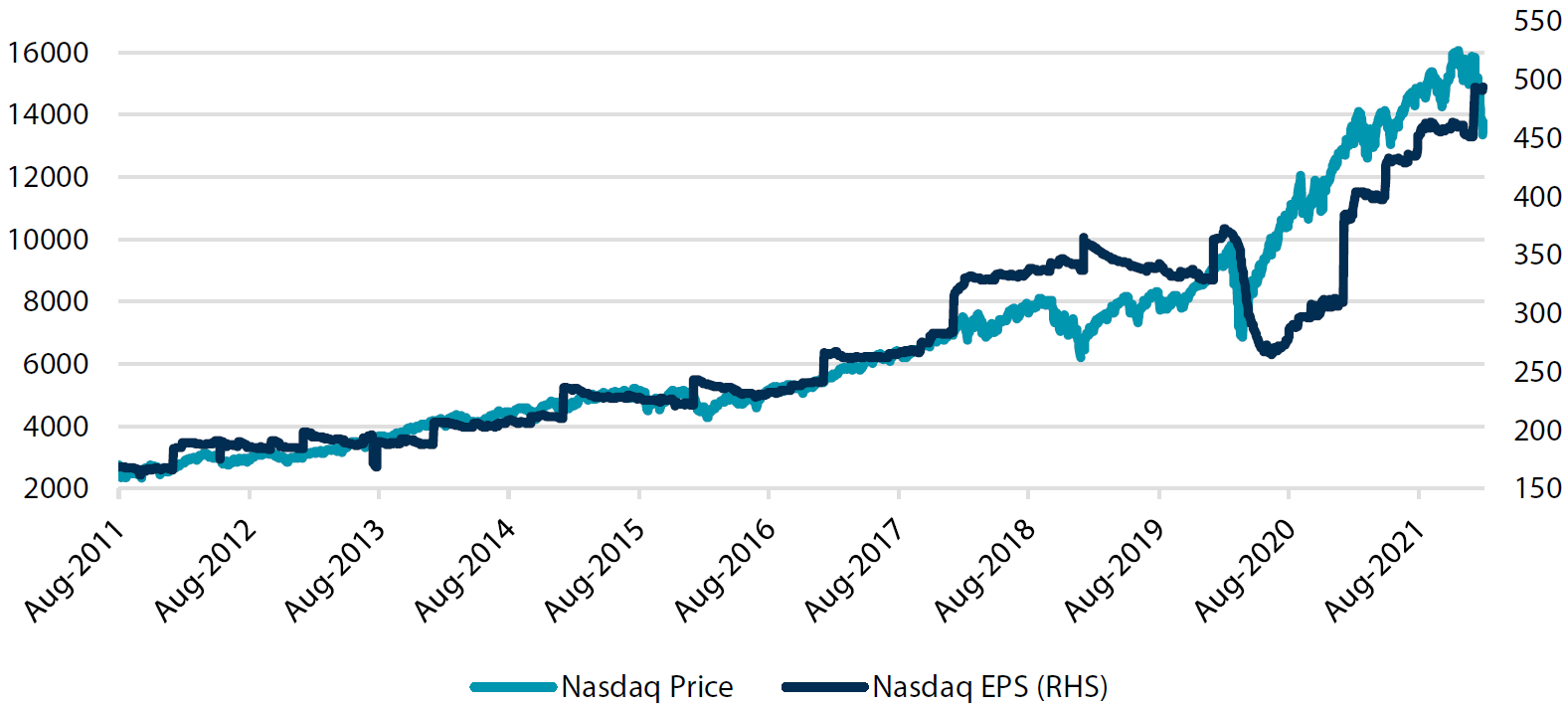

The story is similar for the tech-heavy NASDAQ, showing exceptional earnings growth and a leap in valuations to reflect an even better secular growth story. Working from home (WFH) commanded significant investment in tech solutions, both for the home and businesses, parts of which will change our lives forever. But is this growth sustainable?

Chart 2: Nasdaq price versus earnings

Source: Bloomberg, February 2022

We are still big believers in secular growth themes, but we also can’t help but imagine that some portion of the recent outsized growth will mean revert. Between the withdrawal of exceptional stimulus, rising rates and demand shifting to more normal patterns, our thesis is that earnings and stock multiples will continue to mean revert, suggesting that there may be better opportunities elsewhere to participate in the global recovery.

Meanwhile, earnings growth among value stocks looks decent and, importantly, reasonably sustainable—provided the economic recovery continues. Despite the rally year-to-date, valuations are still reasonable at about 16x earnings, which is the same level as early 2018 when 10-year US Treasuries (USTs) were yielding 3%, indicating less rate sensitivity.

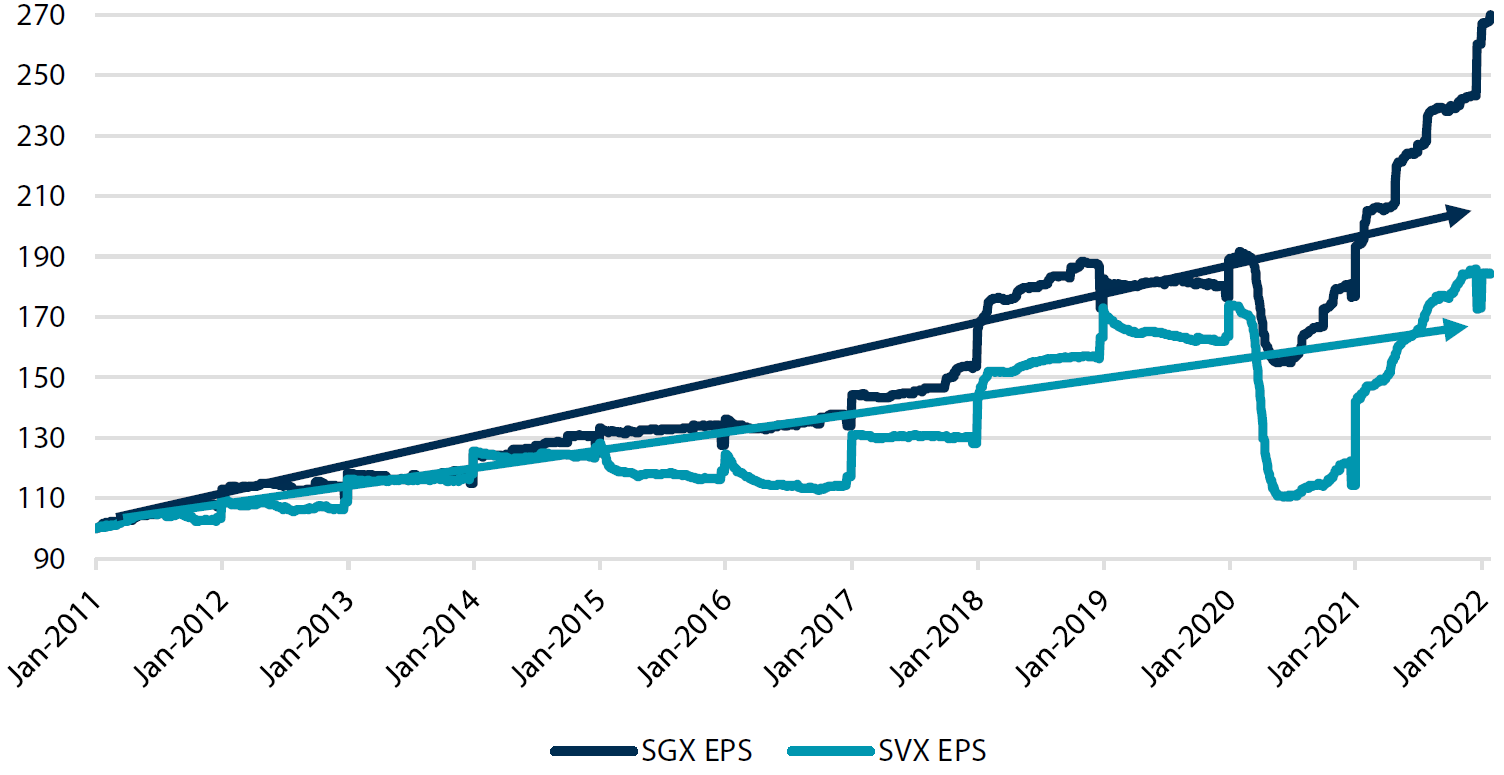

Chart 3: S&P 500 reported earnings, Growth versus Value

Source: Bloomberg, February 2022

Conviction views on growth assets

- Favour cyclicals: cyclicals will benefit from the economic recovery, while secular growth may need to further adjust to the post-stimulus environment.

- Favour financials: sector composition varies widely between markets and those that include exposures to financials, such as Singapore, have shown to be defensive in a rising rate environment where valuations remain attractive.

- Favour commodities: Commodities should also benefit from the economic recovery while production is limited, and also serve as a defensive asset in an inflationary environment.

Defensive assets

We maintain a negative view on defensive assets this month, just a little less so after a small upgrade to our view. A negative swing in global risk sentiment and rising volatility has increased safe-haven interest in sovereign bonds. While the backdrop of hawkish central banks is still a negative, higher global yields make sovereign bonds a more attractive destination to ride out the adjustments occurring in risk assets. A softer run of economic data resulting from the Omicron-fuelled increase in COVID-19 cases also introduces some doubt as to the veracity of the global recovery.

Within global credit, we marginally upgraded our view on IG credit at the expense of a downgrade in HY. The harmful impact of the recent wave of Omicron cases is being revealed in recent activity data, while central banks reiterate their intention to tighten monetary policy this year. Credit quality remains strong, but credit spreads have been under widening pressure. Sub-investment grade issuers in particular have been faced with higher borrowing costs as risk sentiment wanes.

Market-implied pricing for central bank monetary policy tightening has been rising steadily to start the year. The Fed has flagged that its first rate hike will come at its next meeting in March. However, even after the initial rate rises, global monetary policy will still be highly accommodative relative to the inflation pressures felt in many countries. We expect inflation will remain the dominant driver in the next few months, due to soaring energy prices and ongoing supply chain disruptions. These inflation concerns, plus rising geopolitical risks, are likely to be supportive of gold as an inflation hedge and safe haven.

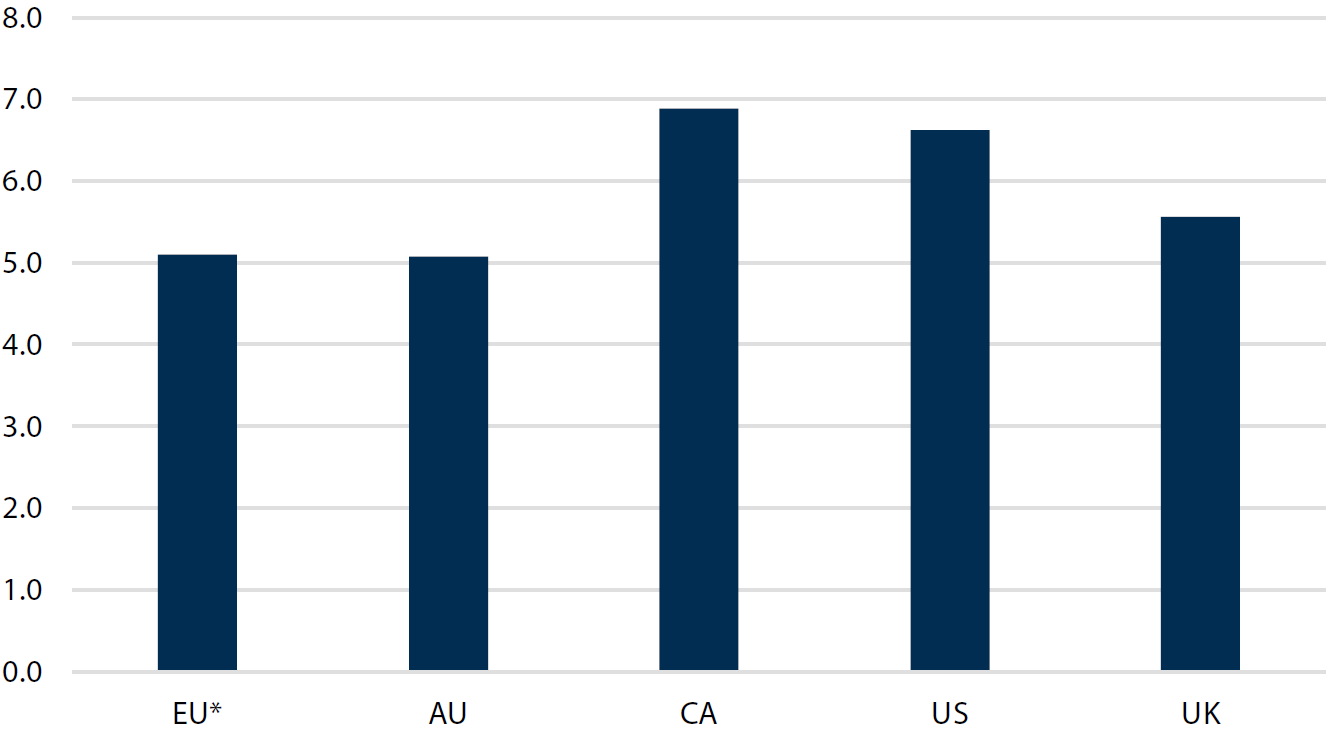

Two wrongs won’t make it right

Expectations surrounding central bank monetary policy in 2022 have changed markedly since the start of the year. Market pricing was already implying a gradual start to a global tightening cycle coming into 2022, but the pace of rate hikes has accelerated since. As shown in Chart 4, the Bank of Canada is expected to be the most aggressive, raising its bank rate seven times, followed by the Fed with at least six rate hikes. The Bank of England is perhaps the most hawkish central bank, having already delivered one and a half hikes with markets expecting at least five more. However, it is not unusual for markets to take a newly established trend, in this case for higher cash rates, and take it too far.

There is little doubt that central banks will, and should, begin to reduce the amount of monetary policy stimulus currently in place. Inflation has handily exceeded their forecasts from just 3-6 months ago and the economic rebound from the worst of the pandemic has been strong. Central banks are certainly tasked with ensuring that annual consumer price increases remain around 2% and long-term inflation expectations remain anchored as well. However, many of these institutions also have dual mandates that include maintaining a healthy economy in some form. In the case of the Fed, its mandate is to keep inflation low and to keep employment strong.

Chart 4: Number of rate hikes implied for 2022

* Based on 10 basis point (bp) move for EU, all others based on 25 bp move

Source: Bloomberg, February 2022

Judging by recent hawkish comments from some Federal Open Market Committee members, it appears there may be some signs of regret that US monetary policy wasn’t tightened earlier. Irrespective of the merits of that alternative scenario, embarking on an aggressively front-loaded course of policy tightening over the next 12 months to reduce demand and control inflation is not likely to atone for this potential policy error. It is more likely to damage the US economy and attract even more criticism of the Fed’s actions. Not tightening early enough and then over-tightening to catch up will not make it right and potentially damage the Fed’s credibility even further.

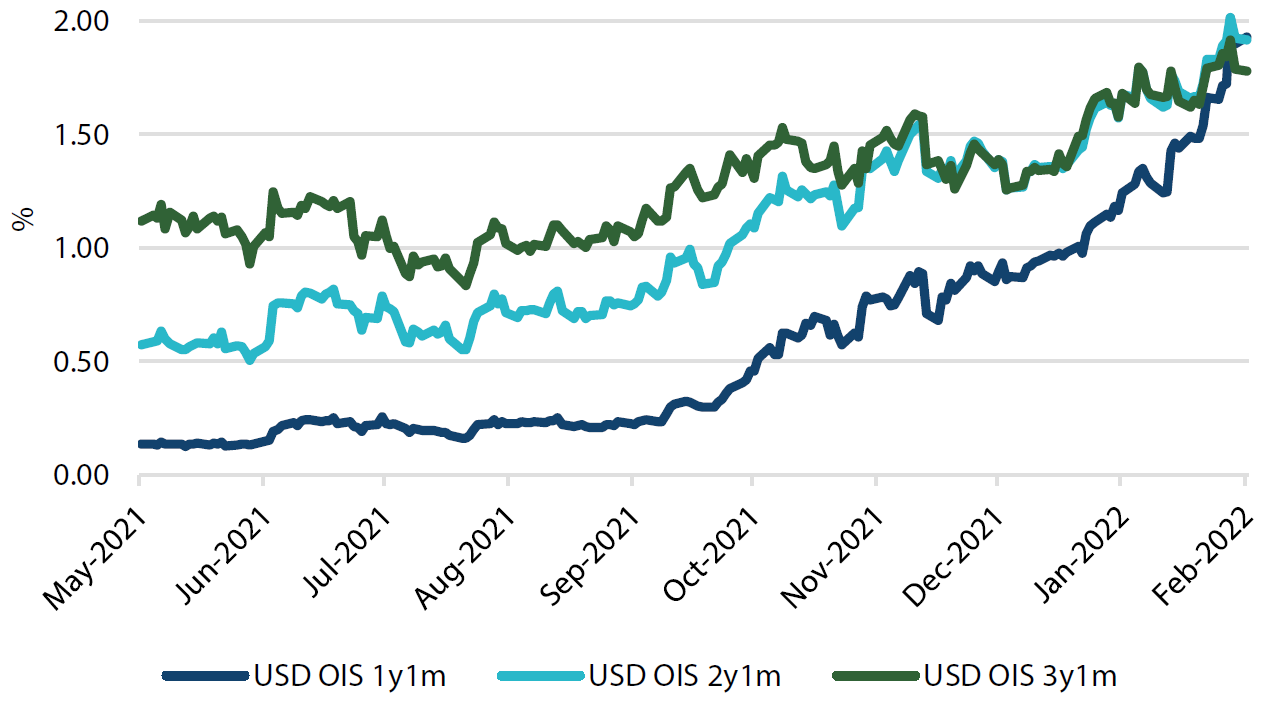

Chart 5 puts this into perspective, showing the market’s implied pricing for 1-month rates one, two and three years ahead. The implied path for the Fed Funds rate is such that all the rate hikes will be delivered in the next 12 months, with no changes in the second year, followed by a small chance of lower rates in the third year. This is akin to expecting the same policy mistake that the Fed has been criticised for in the past, tightening policy too sharply and causing a recession.

Chart 5: Overnight index swap (OIS) 1-month forwards

Source: Bloomberg, February 2022

Our view is that the Fed has likely learned the lessons of past tightening cycles and is unlikely to follow this course of action. While the inflation picture certainly looks ugly at this juncture, we expect it to be much less threatening by mid-year as base effects turn more benign and supply constraints begin to lessen. The result will be a tightening path that is more gradual than implied by market pricing but potentially longer lasting.

Conviction views on defensive assets

- China bonds still favoured: China’s government bonds offer higher yields and continue to display low correlation to global rate moves. Gradual easing by the People’s Bank of China will also provide support.

- Cautious on high yield bonds: Increased volatility across risk assets and central bank policy tightening will put pressure on lower grade credit.

- More constructive on gold: The combination of strong inflationary pressures and rising geopolitical risks should support gold as a safe haven asset.

Process

In-house research to understand the key drivers of return: