Snapshot

Despite very bumpy economic data—particularly on inflation—rates have compressed, implying most of the “surprises” have already been priced in. This is positive for growth assets that respond better to yield curve stability than the sudden steepening that defined the first quarter. While markets appear to hang on to every new data release as if it may be the determinant of a new inflection point, the reality is that it will take time (months) to understand the contours of growth and inflation before the US Federal Reserve (Fed) is prepared to make a move. In this context, daily data flow may do more to feed competing narratives and splashy headlines than to inform investment decisions.

We see stability in interest rates continuing, at least over the near term. The growth story is still unambiguously positive outside of sporadic COVID-19 waves and concerns about new variants, but even there more targeted lockdowns are doing much less damage to the real economy than in 2020. The US is still leading the way in terms of normalising demand, but Europe and other regions are catching up. Even those regions still in the midst of a COVID-19 wave and/or slow vaccine rollouts are benefiting from the return of global demand.

Over the last decade, markets seemed almost trained to believe in binary outcomes contingent on stimulus being added or removed, however slowly. This makes some sense following the Global Financial Crisis (GFC) given the extent of systemic damage that did require a more prolonged stimulus programme. This time around, the financial system is healthy and spreading growth has the potential to be more self-sustaining. Of course, the path toward that end will not be easy with spikes in volatility virtually guaranteed, and while we remain cautious on this front, the growth outlook remains quite positive, in our view.

Cross-asset1

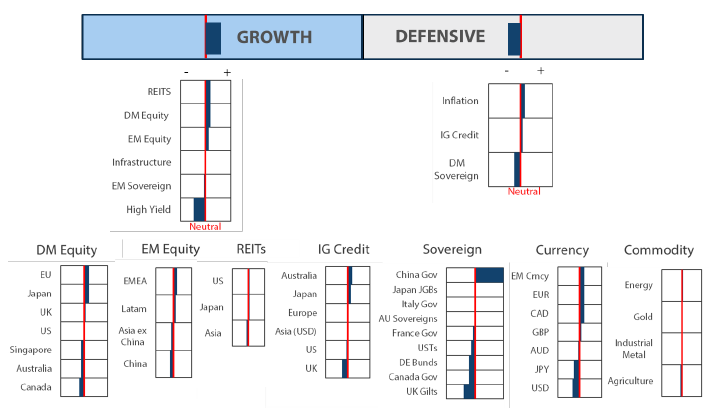

We continue to favour growth and have reduced our cautious view on defensives on the premise that even though inflation can continue to surprise to the upside, the Fed has convinced markets that it will keep policy easy for some time. This is more a near-term call, as we believe volatility will return again as we get closer to Q4 when the Fed is expected to announce its gradual withdrawal of asset purchases (QE), anticipated to begin in early 2022.

The near-term calm in rates has taken momentum out of the rotation from growth to value, but the sensitivity to rates is still quite high with evidence of reinvigorated value momentum, even from the mildest of upturns in rates. The key question on every investor’s minds is whether inflation is “transitory” as posed by the Fed, or if it could it be longer-lasting, with the risk of un-anchoring inflation expectations requiring the Fed to tighten more aggressively. Our base case is that it will prove transitory, but the fat tail risk must be weighed very carefully. Meanwhile, we also became marginally more positive on investment grade (IG) and developed market (DM) sovereigns, funded from inflation.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

The tug of war between growth and value continues, while easing rates may give growth an edge at the margin—for now. The last major rotation from growth to value occurred 20 years ago in 2001 when the dotcom implosion was followed by a decade of prosperity for commodities and other value sectors that benefited from both strong investment in China infrastructure and US property, as well as consumption from a buoyant global economy.

This time, the argument for a full rotation is less clear cut because unlike the late 1990s when technology captured imaginations but earnings to a lesser degree, technology today is all about earnings growth and strong cash flow that is systematically disrupting every industry sector on a global scale. Yes, tech is currently expensive, and while value offers interesting cyclical opportunities, secular growth offered through the tech sector remains compelling as well, so the battle favouring value over growth is not so easily won.

We maintain our reflationary outlook, which includes an element of rotation from growth to value—particularly when the rise in rates resume later this year—but we are still constructive on tech offering exposure to secular growth that stands to accelerate given the “technology arms race” between the US and China. Just days ago, the US senate passed a USD 250 billion bill to boost tech research and development. Like Haliburton benefiting from a conventional war in supplying the military, there will be a number of beneficiaries of the new tech war in supplying new infrastructure.

Europe: Value, cyclical growth with a touch of secular growth

For some time, we have favoured European equities for their value characteristics, and recently upgraded our view given the pick-up in activity on the back of a now successful vaccine rollout. However, as Europe comprises an amalgam of different sectors and countries, we explore here our positive view more deeply.

Why does Europe constitute value? One could say it is partly for the region’s anaemic economic growth since the GFC that had depressed asset prices for the better part of a decade, but it is mainly for its sector composition. Just as the US is more growth-oriented as a function of technology having a large weight in the index, Europe is more value-oriented for its heavier weight in value sectors.

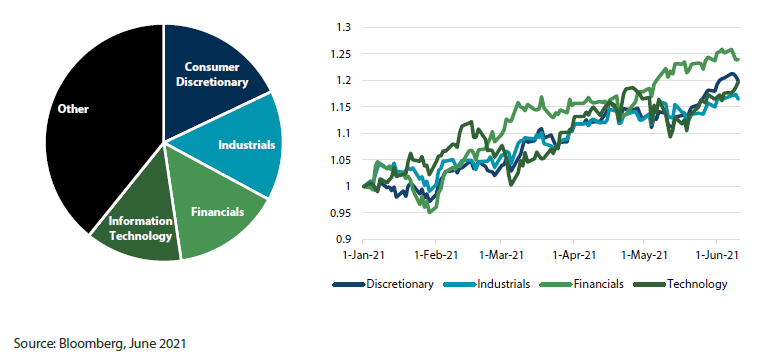

As shown in the charts below, the top four sectors by weight (~60% of the overall index) include Financials—a clear value play—which is the top performer year-to-date, and also consumer discretionary and industrials that become value in cyclical downturns and of course benefit (and rerate) during cyclical upturns. Interestingly, tech is also among the top sector performers—clearly not a value play.

Chart 1: Europe’s top four sectors by weight (left), and their performance (right)

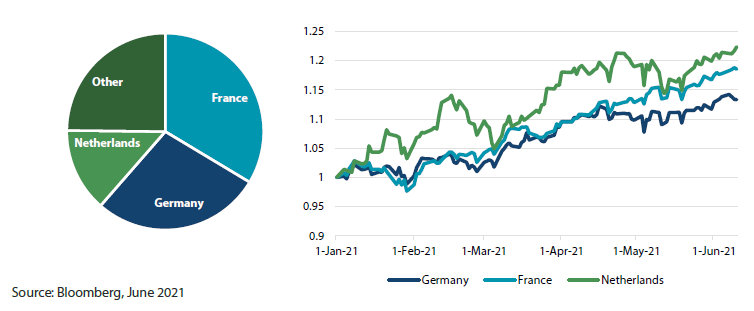

Viewed through a different lens, the top three countries by index weight are France, Germany and the Netherlands (~75% of the overall index). Germany and France have large exposures to consumer discretionary and industrials while Germany is more exposed to external demand (China) and France is more exposed to domestic demand. France has outperformed Germany since late April—we think for its domestic exposure that more directly benefits from the re-opening. The Netherlands, on the other hand, is quite different, heavily exposed to technology—specifically semiconductors—that benefits from secular growth in technology hardware, which is accelerating with the US-China tech war.

Chart 2: Europe’s top three countries by weight (left), and their performance (right)

Europe presents interesting opportunities on different levels. We usually describe it as both a value and cyclical story, but less mentioned is the secular growth story. As we balance our equity exposures around the world, it is important to find the right balance between all of these characteristics as well as the geographical sources of demand (domestic versus external) that ultimately generate revenues and deliver performance.

Conviction views on growth assets

- Increased infrastructure: We recently added Master Limited Partnerships (MLPs) to the infrastructure mix; these are generally comprised of energy-related concerns. While demand for such energy infrastructure has picked up on the back of higher demand and energy prices, MLP valuations are still quite depressed and income yields quite attractive. In essence, MLPs introduce cyclical exposure to infrastructure that stands to benefit from the reflationary environment that we continue to expect.

- Increased FX growth exposures:As we expect rates to remain subdued, at least over the near term, there is less risk of a USD surge similar to what occurred during Q1 when the yield curve steepened so quickly. Both fiscal and monetary policy in the US remain accommodative, which supports reflationary conditions that in turn support growth currencies over the defensive USD.

Defensive assets

Our view on defensive assets improved marginally in the short term although we remain cautious over the medium term. Global bond yields have been mostly range-bound over the last few months as the initial surge to higher levels has abated. Although there has been some taper talk in the market, most central banks are unlikely to follow through in the near term. Improving growth expectations have also caught up with the strong economic data, reducing the prospects for significant positive surprises. These factors lead us to be slightly more constructive on government bonds over the North American summer months.

Global credit spreads have also been steady as developed countries work to increase vaccination rates and reopen their economies. While inflation pressures are building, most notably in the US, central banks continue to view them as mostly transitory. As a result, we believe that monetary policy will continue to be highly supportive for businesses in the near term. Our more constructive near-term outlook for global rates will improve the attractiveness of carry provided by investment grade credit.

Defensive assets that provide a hedge against higher inflation will continue to play an important role in the period ahead. Global real yields have remained sharply negative even as annual rates of inflation are increasing significantly, benefiting both gold and inflation-linked bonds. Gold prices have also recovered from first-quarter weakness as central banks and speculators have added back to positions. However, we remain watchful of real yields as growth dynamics continue to improve, and central banks begin to feel pressure to review their highly accommodative policy settings.

More constructive on dollar-bloc bonds

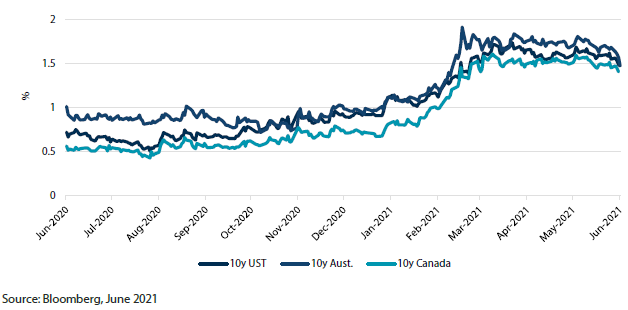

Rising global bond yields have been one of the most important investment themes this year. Not only has this move delivered poor returns for government bond investors but it has also been a contributing factor to the significant growth to value rotation that has occurred in equities. The sharp rise in yields occurred in the first quarter; Chart 3 shows dollar-bloc 10-year bond yields topping out around late March. However, since those highs, momentum has waned, and the second quarter has seen stable to lower yields.

Chart 3: Dollar-bloc 10-year sovereign bond yields

We would highlight a few main reasons for this, which also leads into our more constructive view on global sovereign bonds in the near term. While the first quarter was punctuated by positive growth and inflation data surprises relative to market expectations, analysts have now largely caught up with the strong economic rebound underway. This leaves further significant upside surprises less likely as the effects of the pandemic recede in the rear-view mirror. We have little doubt that growth and inflation will continue to be strong, but investors are less likely to be surprised by these outcomes.

It is also clear that inflation pressures evident in recent data have led to robust discussions on the path for inflation. Investors worry about the risk of higher inflation expectations becoming entrenched. The Fed and the European Central Bank (ECB) have both pushed back against these concerns and pledged to keep monetary conditions accommodative for many more months. As a result, their quantitative easing (QE) programmes continue at full throttle and we expect this to be case for the remainder of this year. Also noteworthy is that bond investors have largely shrugged off the stronger inflation data and seemingly sided with central banks as evidenced by the lack of new highs in global yields.

The subdued reaction to rising inflation from bond investors may also be reflective of overly bearish positioning. The prevalent narrative of inflation concerns amongst investors, and selling by Japan, which is the largest foreign holder of US Treasuries, would both seem to indicate bearish outlooks for bonds. In addition, trend-following traders are likely to be very short in US Treasuries as they are seen to have built positions in line with the strong negative price momentum. The drop off in this momentum will curtail any additional increases in short positions and may eventually lead to some reductions. This bearish positioning, combined with central banks that are not ready to reduce policy accommodation just yet, leaves us with a more constructive view on sovereign bonds for the near term.

Conviction views on defensive assets

- Extend sovereign duration for the near term: While the longer-term trend for higher rates is still intact, near term conditions for sovereign bonds have improved.

- China government bonds are preferred safe haven: China’s government bonds offer higher yields and lower volatility relative to traditional developed market sovereign bonds and should benefit from slower credit and economic growth.

- More cautious on Italian government bonds: Future ECB meetings will be keenly watched as the time approaches to discuss reducing support. Italian bonds stand to lose the most from an eventual reduction in ECB’s buying and we expect to see cracks appearing in the “unity” government later this year.

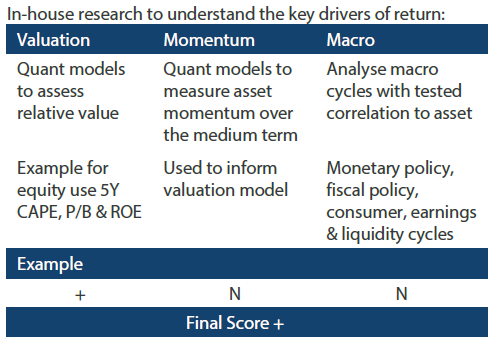

Process