Summary

- US Treasury (UST) yields traded in a relatively narrow range in May. Inflation fears resurfaced, prompted by rising commodity prices and a marked increase in headline consumer and producer price indices in the US. Minutes of the Federal Reserve's (Fed) April Federal Open Market Committee (FOMC) meeting hinted that the central bank may soon begin to discuss tapering its asset purchases. Overall, the benchmark 2-year and 10-year yields ended the month at 0.143% and 1.596%, respectively, about 1.9 basis points (bps) and 3.2 bps lower compared to end-April.

- Asian credits returned +0.48% in May, driven by lower UST yields despite credit spreads widening 2.3 bps. Asian high-yield (HY) credits performed better than their high-grade (HG) counterparts, gaining 0.81%, with spreads tightening 4.0 bps. HG credits registered a total return of 0.38%, despite spreads widening 2.6 bps.

- Within the region, headline inflation prints accelerated in April. Monetary authorities maintained their policy rates while regional gross domestic product (GDP) growth remained weak. Separately, the People's Bank of China (PBOC) raised the reserve requirement ratio (RRR) for FX deposits.

- We continue to be selective in our view towards duration exposures and are relatively cautious on low yield countries and regions such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, in anticipation of possible further US dollar (USD) strength on the back of US growth optimism.

- We expect Asian credit spreads to tighten modestly from here, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccinations. While the macro backdrop remains favourable, and certain country-specific downside risks have eased, a degree of caution is still warranted.

Asian rates and FX

Market review

UST yields mostly fall in May

In May, UST yields traded in a relatively narrow range. US nonfarm employment increased by 266,000 in April, a huge disappointment relative to expectations for about a million new jobs. The weak headline number triggered a knee-jerk plunge that eventually faded as the market digested the data, with the initial slide in yields completely retraced by end of day. The week after, inflation fears resurfaced, prompted by rising commodity prices and a marked increase in both headline consumer and producer price indices in the US. Fed officials downplayed the inflation threat, describing the recent jump in price increases as "transitory". Minutes of the Fed's April FOMC meeting released mid-month hinted that it may soon begin to discuss tapering its asset purchases. Global reflation trade expectations cooled somewhat towards the month’s end as commodity prices softened, just as Chinese policymakers warned against commodity speculation. Overall, the benchmark 2-year and 10-year yields ended the month at 0.143% and 1.596%, respectively, about 1.9 bps and 3.2 bps lower compared to end-April.

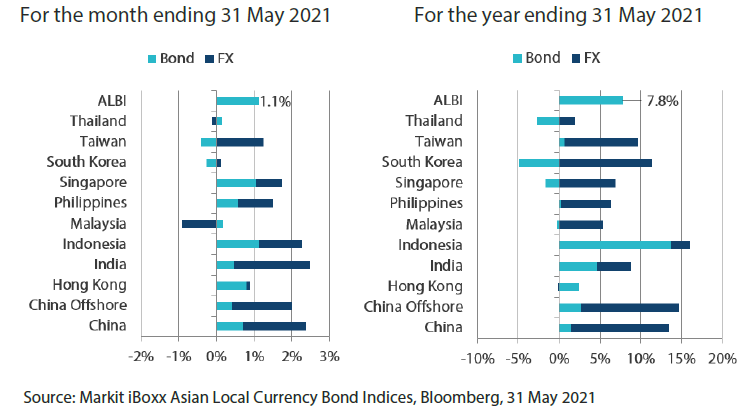

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Headline inflation prints accelerate in April

A low base effect from 2020 was a key contributor to higher April headline consumer price indexes (CPI) in South Korea, Singapore, Malaysia and Thailand. A marked increase in the transport index pushed headline CPI in Malaysia to a multi-year high of 4.7% year-on-year (YoY). Overall inflation in Thailand rose to 3.41%—its highest since December 2012—as energy and food prices rose. Headline CPI in Singapore accelerated to 2.1% in April, up from 1.3% the month before, and core inflation picked up to 0.6% from 0.5%. In Indonesia, overall inflation rose mildly in April, whereas core inflation moderated. Details revealed that food inflation rose, while transport inflation slowed. China's headline CPI rose to 0.9% YoY in April, with a rise in non-food price inflation being partly offset by declining pork prices. Headline April CPI in the Philippines was unchanged from March, as slower price increases for key food items offset higher energy costs.

Monetary authorities maintain their policy rates

Monetary policy remained supportive through the region, with central banks in South Korea, Thailand, Indonesia, Malaysia and the Philippines maintaining their policy rates. Notably, the Bank of Thailand sounded more cautious in their economic outlook, with the Monetary Policy Committee declaring growth likely to be "much lower" than its previous assessment. Similarly, the Bangko Sentral ng Pilipinas warned of "substantial downside risks to domestic demand", on the back of the latest COVID-19 wave and lockdown measures. In contrast, the Bank of Korea provided an upbeat growth outlook and raised its 2021 and 2022 GDP growth forecasts to 4.0% and 3.0% (from 3% and 2.5%), respectively. It also raised its 2021 CPI inflation forecast to 1.8% (from 1.4%).

1Q21 GDP in the Philippines, Indonesia, Thailand and Malaysia remain weak

GDP growth in the Philippines registered -4.2% YoY in the first three months of 2021. Private sector spending remained weak, although government spending growth provided a partial offset. In Indonesia, GDP growth improved to -0.7% YoY, led by investment and government spending. Elsewhere, economic activity in Thailand contracted 2.6% YoY in the first quarter, performing slightly better than expected. Following the release of the data, the National Economic and Social Development Council downgraded its growth outlook for this year to between 1.5–2.5% (from its previous forecast of 2.5–3.5%), citing the new wave of COVID-19 outbreak.

Singapore, Malaysia and Thailand face new COVID-19 waves

The month saw several countries confronting sharp rises in new COVID-19 cases, prompting governments to re-impose and/or extend mobility restrictions. Thailand's new infections logged an all-time high during the month. In Malaysia, the government announced a two-week nationwide lockdown until 14 June, to curb a relentless surge in new COVID-19 cases. Meanwhile, Singapore entered what authorities termed a "heightened alert" of Phase 2, as it seeks to control an increase in untraceable COVID-19 infections in the community. The measures came in force mid-month and will last for about one month.

PBOC raises the RRR for FX deposits

The Chinese central bank announced a 200 bps hike in the reserve requirement ratio for FX deposits, effective 15 June. Markets took this as a signal that the monetary authority is increasingly concerned about the rapid appreciation of the renminbi. Prior to this move, the bank had warned against one-way bets on the currency.

Market outlook

Cautious on rates markets; maintaining a defensive stance on currencies

We maintain our cautious view of the rates market and our defensive stance on currencies. Despite the stabilisation in US rates in recent months, flows into local government bond funds remained relatively weak. Going forward, we expect global growth recovery to gain momentum, and expect US rates to resume its uptrend as investors re-focus on the reflation theme. Meanwhile, we remain vigilant to any adverse impact this current COVID-19 wave may have on Asian economies.

We continue to be selective in our view regarding duration exposures and are relatively cautious on low yield countries such as Singapore, South Korea and Hong Kong. We remain defensive on regional currencies, as the USD could strengthen further on the back of US growth optimism.

Asian credits

Market review

Asian credit spreads end moderately wider; total returns still edge higher on UST gains

Asian credits returned +0.48% in May, driven by lower UST yields, despite credit spreads widening 2.3 bps. Asian HY credits performed better than their HG counterparts, gaining 0.81%, with spreads tightening 4.0 bps. HG credits registered a total return of 0.38%, despite spreads widening 2.6 bps.

Asian credits were rather subdued in May, although the underlying tone remained firm—especially towards the end of the month. Market focus shifted back to economic data, as well as global risk sentiment from regional idiosyncratic events that prompted volatile market swings in the prior month. Spreads drifted wider early in the month as some weaker-than-expected US economic data, coupled with rising inflation concerns, led to brief sell-offs in global equities and other risk assets. Inflation fears resurfaced following a rise in commodity prices, a significant upside surprise in the US April CPI report and an acceleration of the producer price index in China. Nevertheless, market sentiment was soothed by key Fed officials, who continued to characterise the spike in inflation as “transitory” and urged patience with their accommodative monetary policy stance. This contributed to a stabilisation in UST yields and risk sentiment as the month progressed. The latter half of the month saw several countries in the region confronting sharp rises in new COVID-19 cases, forcing governments to re-impose mobility restrictions, although the impact on credit spreads was limited.

By country, spreads of all major countries and regions, save for India and Hong Kong, widened in May. The outperformance of India was partly attributed to strong technicals and signs of a peak in the country’s second COVID-19 wave. The Reserve Bank of India’s swift response to buffer the impact of the new wave, together with comments from Standard & Poor’s that India’s sovereign rating would likely be retained for the next two years, were supportive factors as well.

Primary market activity slightly subdued due to long holidays

In May, 56 new issues raised a total of USD 20.5 billion in the market. Issuance within the HG space was noticeably lighter, due partly to holidays in China and Singapore. There were 25 new issues amounting to USD 10.4 billion within the HG space, and 31 new issues amounting to about USD 10.1 billion within the HY space.

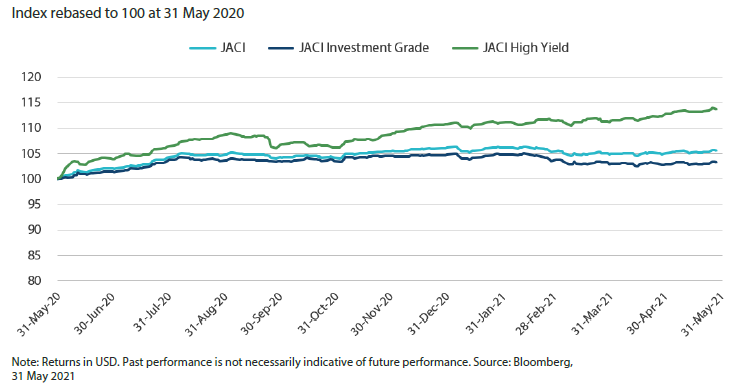

Chart 2: JP Morgan Asia Credit Index (JACI)

Market outlook

Asian credit spreads to remain resilient, though downside risks remain

We expect Asian credit spreads to tighten modestly from here, driven by the ongoing economic recovery, supportive fiscal and monetary policies and progress on COVID-19 vaccinations. Overall corporate credit fundamentals should remain robust, leading to stronger earnings momentum in the first half of 2021. That said, valuation is more neutral now having priced in a lot of the improving fundamentals. Further spread tightening from here will be more laboured, with more frequent market pull-backs likely. While the macro backdrop remains favourable, and certain country-specific downside risks have eased, a degree of caution is still warranted.

The reflation theme that gained momentum in late February to mid-March appears to have eased for now, but it may resume with global growth and inflation data expected to be very strong over the few months. A sharp and quick rise in UST yields may revive the pressure on many risk assets, including credit spreads.

In addition, the risk of US-China bilateral relations failing to stabilise remains elevated. Uncertainties relating to offshore bonds issued by a Chinese state-owned non-bank financial institution remain, but the contagion to other parts of Asian credit has been limited. Other China HG credits, both corporate and quasi-sovereign, have also recovered to a large extent, although the final outcome for the aforementioned issuer may still have an impact. Meanwhile, the surge in COVID-19 cases in India appears to have peaked. While localised lockdowns will likely remain in place through June, there is hope that the economic damage may be less severe than last year.