Rise in Japan's long-term yields and its implications for equities

The benchmark 10-year Japanese government bond yield has been making headlines recently by reaching its highest level in 15 years. What has been equally eye-catching is the speed at which long-term yields have risen: having ended 2024 at around 1.1%, they have climbed above 1.5% as of this writing.

The swift rise in long-term yields can be primarily explained by the market's hasty recalibration of its expectations for the Japanese economy. Many market participants initially thought the wage increases and labour shortages which began to surface after the pandemic would not last long, and that inflation would fall back below 2% sooner or later. However, towards the end of 2023, the market began realising that wage increases, labour shortages and inflation might persist for a more extended period than expected. The Japanese economy was making a clear break from deflation and experiencing a structural transformation. The surge in long-term yields since the start of 2025 signifies that even those who were sceptical about the economy are now recognising the likelihood of this structural change.

Expectations for structural change are reflected in the market's increased focus on the domestic economy. Until recently, the domestic economy played a secondary role, with the assumption being that Japan would perform well if the global economy was in good health. However, recent developments in Japan's wages, labour market and inflation have thrust the domestic economy into the spotlight, especially in the bond market. The rapid rise in long-term yields shows that domestic factors are becoming a key driving force in the bond market.

In response to these developments, the Bank of Japan (BOJ) signalled its readiness to curb the rise in long-term yields. BOJ Governor Kazuo Ueda said in February that the central bank was ready to increase its bond buying. It is important to remember that the BOJ, like other central banks, dislikes rapid market fluctuations. Ueda's comments should be understood in this context: rather than halt the rise, the BOJ likely wants to temper any abrupt moves in the bond market. It is clear that the BOJ has mostly allowed market forces to determine long-term yield levels since Ueda became governor.

The general understanding is that higher long-term yields are negative for the equity market. We cannot rule out the possibility of equities being negatively affected by sudden bond market swings. However, any such impact may be temporary. In terms of earnings, corporate Japan is being strongly supported by a pick-up in domestic consumption, which could further accelerate if wages continue increasing at the current pace and inflationary pressures ease. The equity market will not have to look on in fear if the rise in long-term yields is tied to structural changes and improved corporate earnings, which are signs of a healthy, evolving economy.

Robust corporate profits reflect structural changes in Japan's economy

According to estimates, the combined net profits of companies listed in Japan's TOPIX are expected to have reached a fourth straight year of record highs for the 12 months ending March 2025. Factors contributing to this trend include a surge in inbound tourism, strength in the financial sector and a weak yen.

It may be natural to associate strong corporate profits with wage increases. However, the correlation between the two is not as direct as it might appear. As was observed during the Abenomics era, strong corporate profits tended to result in bonuses rather than wage increases, primarily because employers had to consider the risk of corporate profits being temporary.

However, as previously mentioned, Japan is currently experiencing a structural transformation. Corporate managers have a more positive outlook for future earnings, expecting increased sales. They also anticipate labour shortages. All these factors have led to wage increases. The virtuous circle of wages and prices is therefore expected to continue for at least another year. Anything beyond that will likely depend on the strength of domestic consumption.

In terms of consumption, the market appears to be anticipating further strengthening of consumer sentiment and domestic demand. These developments, together with the expected rise in real wages, are likely to provide the next boost to the equity market as it looks to domestic demand, instead of a weak yen, as a key driver. The market is going through a transition and this helps to explain why the record corporate earnings have not fully translated into a more robust performance by equity indices.

Concerning the potential impact of trade-related developments on Japanese corporate profits, US tariffs are seen more as a secondary risk rather than a primary risk. The US may decide to impose tariffs on imports from Japan, notably automobiles and semiconductor-related products. However, Japan has a range of options it can adopt. For example, it could attempt to evade tariffs by proposing to increase production in the US. Diplomacy will thus become a potential risk factor in trade talks, with Japanese Prime Minister Shigeru Ishiba and his staff responsible for leading negotiations with the current US administration.

Japanese equities slip in February on trade uncertainty, yen's moves

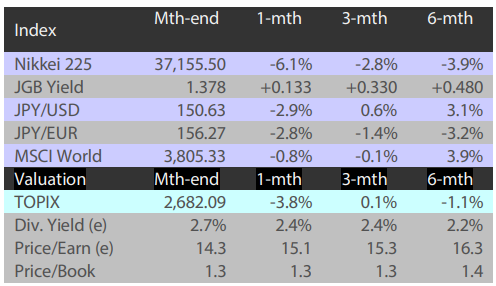

The Japanese equity market ended February lower with the TOPIX (w/dividends) down 3.79% on-month and the Nikkei 225 (w/dividends) falling 6.05%. Stocks started to slide after the US President signed an executive order to increase tariffs on goods from Mexico and other countries, heightening anxieties regarding the direction of the global economy. Later in the month when the US administration announced a delay to the implementation of the additional tariffs on Mexico and Canada, equities were boosted temporarily. However, overall the market was weighed down by the release of a number of US economic indicators pointing to a potential economic slowdown and uncertainty surrounding the country's tariff policy, in addition to the appreciation of the yen against the US dollar as the outlook for additional rate hikes from the BOJ appeared increasingly likely.

Of the 33 Tokyo Stock Exchange sectors, eight sectors rose, with Marine Transportation, Other Products, and Iron & Steel posting the strongest gains. In contrast, 25 sectors declined, including Precision Instruments, Services, and Machinery.

Exhibit 1: Major indices

Source: Bloomberg, 28 February 2025

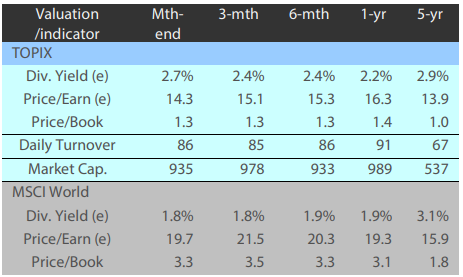

Exhibit 2: Valuation and indicators

Source: Bloomberg, 29 February 2025