This month we assess how Japan losing its place as the world's largest creditor in fact underscores the country's transformation over the years; we also discuss the recent crude oil market disruptions from a Japanese market perspective.

Top global creditor no more, but Japan poised to enter a new growth phase

Recent data released by the Ministry of Finance (MOF) showed Japan losing its place as the world's largest creditor for the first time in 34 years in 2024. Japan lost the top spot although its net external assets increased by nearly 13% to Japanese yen (JPY ) 533 trillion. Japan was overtaken by Germany, which saw its net external assets increase to roughly JPY 570 trillion according to figures converted by the MOF. The fact that Germany's rise was due to its robust trade performance in contrast to Japan prompted some commentators to lament the data as another perceived sign of Japan's decline.

Indeed, Japan may no longer be the exporting powerhouse it once was. However, the data can be seen as an opportunity to assess how the once export-dependent economy has changed. Japan Inc. has gone on to establish itself as a direct manufacturer in overseas markets, which has reduced its reliance on exports. After undergoing this transformation, Japan could be poised to enter a new phase of growth amid a cyclical economic shift and a changing geopolitical landscape.

Japan's impressive post-war growth owed a large part to its export-oriented manufacturers. The situation began to change as Japan faced pressure from its trade partners, notably the US, which took issue with the large trade deficit between the two countries. As a result of such pressure, Japanese manufacturers such as automakers moved production out of Japan. Over time, the focus of Japanese companies shifted from domestic sales to the overseas market, with the latter increasingly playing a bigger role in terms of the bottom line. Many of the companies operating overseas opted not to repatriate their profits to Japan, and coupled with pressure from countries like the US to increase production in their host countries, direct foreign investment by Japanese companies increased.

Exchange rates played a significant role for companies operating outside of Japan. During the pre-Abenomics years when the yen was strong against the dollar, companies could suffer losses if they repatriated their profits earned overseas. As a result, many firms began managing their profits abroad, and their foreign asset holdings increased. When the yen eventually weakened during the Abenomics era, companies made profits on the books, but they had limited opportunities to increase wages or boost capex.

However, Japan is now undergoing a cyclical change. For one, wages have been rising for the first time in several decades amid a labour shortage, and overall production and capex is increasing as well. This virtuous cycle is expected to continue for the foreseeable future; with wage increases continuing and price rises slowing, Japan can experience a sustained period of increasing real wages. In addition, geopolitics may also favour Japan. As tensions deepen between western countries and China, Japan stands to benefit from supply chain realignments which may result in increased domestic capex. In short, manufacturing done in scale could return to a Japan which is now more diversified and globally integrated, paving the way for the next phase of economic prosperity.

For Japan, the assurance of oil supply is more important than price

The Israel-Iran conflict, which drew in the US, briefly upended crude oil prices and underscored Japan's reliance on imported commodities. Although Iran did not follow through with its threat to close the Strait of Hormuz, the mere possibility sent a momentary chill through Japanese markets. While countries like Israel and the US would likely not be significantly affected by the strait's closure, Japan, with around 90% of its oil imports passing through the waterway, faced a substantial risk in terms of oil supply interruption.

From an equity market perspective, oil supply disruptions present a problem for a wide range of sectors including energy, transportation, manufacturing (which rely heavily on imported raw materials), utilities and consumer goods. While the potential closure of the Strait of Hormuz made exciting headlines, Tehran was unlikely to take such a drastic step due to the negative repercussions it would have on its relationships with Middle Eastern neighbours. This does not mean that crude oil prices will remain stable, however; market fluctuations are expected to occur as tensions persist between Iran and its foes. However, the primary concern for Japan lies not in the price itself but in the assurance of oil supply, which seems relatively secure for now. Considering the current state of the oil market and international relations, it would be premature to draw parallels to the oil shock of the 1970s when assessing the present circumstances.

Japanese equities gain on monetary policy views, easing geopolitical tensions

The Japanese equity market ended June higher with the TOPIX (w/dividends) up 1.96% on-month and the Nikkei 225 (w/dividends) rising 6.82%. The rapid escalation of tensions in the Middle East spurred investors' risk-off sentiment, which weighed down stocks to an extent. However, overall the market was supported by positives such as remarks made by the governor of the Bank of Japan (BOJ) at a press conference following the most recent Monetary Policy Meeting which led to the view that the BOJ was reluctant to implement additional rate hikes. Other supporting factors included the easing of anxieties regarding the situation in the Middle East following the ceasefire agreement between Israel and Iran, as well as the alleviation of concerns surrounding US tariff policy in light of the potential for an extension to the negotiation period amid the temporary suspension of the reciprocal tariffs.

Of the 33 Tokyo Stock Exchange sectors, 22 sectors rose, including Other Products, Securities & Commodity Futures, and Machinery, while 11 sectors declined, including Transportation Equipment, Marine Transportation, and Rubber Products.

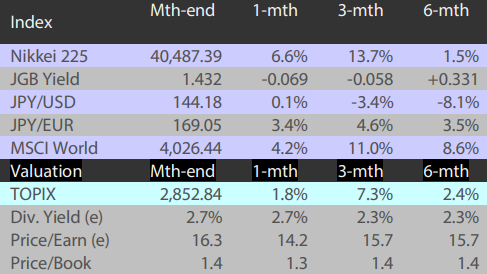

Exhibit 1: Major indices

Source: Bloomberg, 30 June 2025

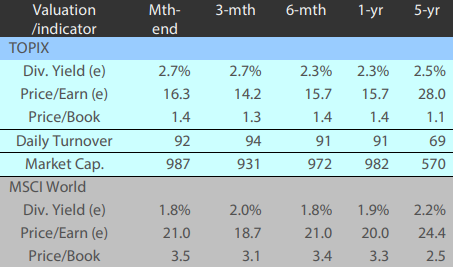

Exhibit 2: Valuation and indicators

Source: Bloomberg, 30 June 2025