We discuss how growing calls to reduce Japan's consumption tax rate provide a chance to focus on how consumption can be stimulated, potentially triggering a secular change in spending behaviour; we also assess the recent surge in super-long Japanese government bond (JGB) yields and its possible implications for monetary and fiscal policy.

Calls for tax cuts provide chance to focus on how to stimulate consumption

With an upper house election scheduled for July, calls to decrease Japan's consumption tax rate have grown among political parties aiming to appeal to inflation-hit voters. The rising cost of living has emerged as a major worry for voters who have seen the price of rice, a staple in Japan, double over the past year. The consumption tax rate is therefore expected to become the central issue at the upcoming election. While the ruling Liberal Democratic Party (LDP) has so far been cautious about lowering the consumption tax rate, the opposition parties have put forth various proposals, including a call for the 10% rate to be reduced to zero.

The equity market is expected to react positively if the consumption tax rate is reduced. However, the market's enthusiasm may wane in the long term as attention shifts to how the government plans to compensate for the loss in tax revenue, potentially through the issuance of deficit-covering government debt. Government bond yields are likely to rise in response and the Bank of Japan (BOJ) may feel the need to hike interest rates again, both of which could be negative for the equity market.

However, it is worth highlighting that the equity market's primary focus has been on the recovery in domestic consumption. Even a modest reduction in the tax rate, such as a decrease by one or two percentage points, or a targeted tax cut on specific items like food products, could significantly stimulate consumption and result in a secular, lasting change in spending patterns. While it is difficult to predict the spending pattern of general consumers, the potential for a secular shift in spending is a possibility worth keeping in mind. This is because such a shift would stimulate capital expenditure, which, in turn, might offset the adverse effects of a rise in long-term yields likely to occur if the government lowers the consumption tax rate.

Some may view the increasing calls to lower the consumption tax rate as a form of fiscal populism. It is not easy to define fiscal populism in the current context. However, it can be argued that if the spending is carried out in a wasteful, impulsive manner, it would be in line with the negative connotations typically associated with fiscal populism. Even if Japan has to resort to debt issuance, it has a chance to spend prudently and trigger a secular change in consumer spending behaviour. This, to a large part, will depend on whether the politicians advocating for lower consumption tax rates possess the determination and commitment to fulfil their pledges when given the opportunity to do so. Lawmakers should bear in mind that reducing consumption tax rates is not the sole method to stimulate consumer activity.

Rise in super-long JGB yields and potential developments to consider

Rising expectations of a potential reduction in the consumption tax rate have seemingly gone hand in hand with a surge in Japan's 30-year and 40-year government bond yields, which captured global attention by climbing to record highs in May. The prospect of tax rate reductions and the likelihood of the government needing to increase debt issuance to offset revenue shortfalls have been key drivers behind the rise in yields of these super-long JGBs. However, other factors have also contributed to the uptick in super-long JGB yields, particularly the ongoing virtuous cycle of prices and wages, which is expected to persist amidst a persistent labour supply shortage.

The steepening of the JGB yield curve presents various implications for the domestic equity market. On the downside, rapid steepening of the yield curve could introduce volatility into the broader markets. Nevertheless, the equity market could interpret the uptick in super-long JGB yields more positively as part of the positive cycle of prices and wages, which has the potential to drive capital expenditure that supports equity valuations.

There are several potential developments to consider in relation to the super-long bonds and the broader JGB market. The super-long segment of the JGB market lacks liquidity compared to shorter maturities, which could lead to heightened volatility, particularly in response to credit-related events. For instance, a credit rating downgrade might not significantly impact the overall JGB market (similar to recent events with US Treasuries), but it could trigger temporary turbulence in super-long JGBs.

In terms of monetary policy, a sustained rise in super-long JGB yields could prompt the BOJ to gradually hike interest rates in response. From a fiscal policy perspective, the Ministry of Finance (MOF) could consider reducing the issuance of super-long JGBs and increasing debt with shorter maturities. However, the MOF may reserve such measures for extreme circumstances. Even if the JGB yield curve steepens excessively as a result of spiking super-long JGB yields, the curve is expected to eventually return to a more typical shape, supported by demand from investors with long-term liabilities.

Japanese equities gain in May as concerns towards the global economy ease

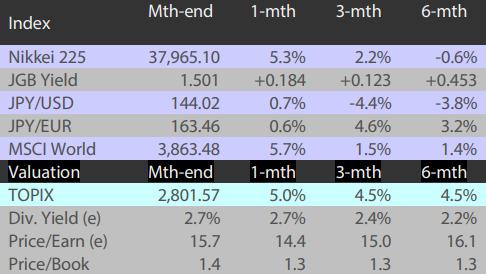

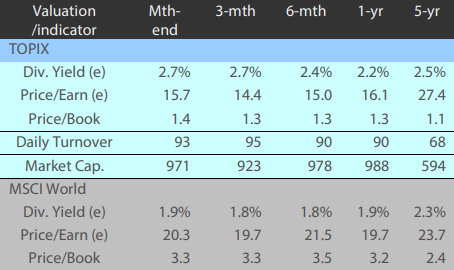

The Japanese equity market ended May higher with the TOPIX (w/dividends) up 5.10% on-month and the Nikkei 225 (w/dividends) rising 5.33%. The yen temporarily appreciated against the US dollar ahead of the meeting between the US and Japanese finance ministers due to concerns that Japan would face pressure to strengthen its currency's value, which had a negative impact on stocks. However, this was offset by a number of positives including the US and China coming to an agreement to significantly lower the additional tariffs that were levied on top of the reciprocal tariffs, which allayed concerns of deterioration in the global economy, resulting in Japanese domestic demand-driven stocks being bought widely. Other supporting factors included the solid performance of Japanese high tech-related stocks against a backdrop of strong earnings at a major US chip maker, as well as the US Court of International Trade ordering a halt to the Trump administration's reciprocal tariffs.

Of the 33 Tokyo Stock Exchange sectors, 29 sectors rose, with Nonferrous Metals, Warehousing & Harbor Transportation Services, and Machinery posting the strongest gains. In contrast, 4 sectors declined, including Electric Power & Gas, Pulp & Paper, and Iron & Steel.

Exhibit 1: Major indices

Source: Bloomberg, 30 May 2025

Exhibit 2: Valuation and indicators

Source: Bloomberg, 30 May 2025