Summary

- US Treasury (UST) yields ended mostly higher in December, while the dollar continued to strengthen after the Federal Reserve (Fed) signalled that it might conduct fewer interest rate cuts in 2025 than it had indicated earlier. The hawkish shift in Fed guidance, coupled with the strong data print and change in anticipated rate cuts in 2025, pushed UST yields higher. At the end of December, the benchmark 2-year and 10-year UST yields had settled at 4.24% and 4.57%, respectively, 9 basis points (bps) and 40 bps higher compared to the end of November.

- Within Asia, the Philippines reduced its policy rates by 25 bps, while India, Indonesia and Thailand opted to maintain their key policy rates. Headline inflation prints for November showed mixed trends across countries but remained generally stable.

- We expect Asian local government bonds to perform well in 2025, supported by accommodative central banks amid an environment of benign inflation and moderating growth. The ongoing global easing cycle is expected to lower global yields, further supporting Asian bond markets. Furthermore, we anticipate global growth to moderate in the medium term, driven in part by potential tariff threats from the US, which in turn is likely to support the overall bond market.

- Despite narrowing credit spreads, Asian credits posted a negative return of -0.80% in December as UST yields rose. Asian investment grade (IG) credits (-0.84%) underperformed Asian high-yield (HY) credits (-0.58%); since IG credits are generally longer in duration relative to their HY peers, HY credit spreads tightened more, by 55 bps, compared to IG credit spreads, which tightened by 3 bps.

- Against a benign macro backdrop, we expect Asian corporate and bank credit fundamentals to stay resilient, aside from a few sectors and specific credits which may be impacted by tariff threats or US policy changes. Overall revenue growth may see some moderation, but it should still remain at healthy levels, with profit margins holding steady due to lower input costs. We expect the Asia credit default rate to continue declining, along with a smaller percentage of fallen angel credits in the Asia IG space. This is driven in part by better credit quality among issuers, as many weaker companies have exited indexes over the past few years.

Asian rates and FX

Market review

The Fed cuts its benchmark policy rate by 25 bps

UST yields ended mostly higher in December, while the dollar continued to strengthen after the Fed projected fewer rate cuts in 2025 during the last Federal Open Market Committee (FOMC) meeting of 2024. UST yields were slightly elevated ahead of the inflation print releases, but trended higher after bearish moves in Europe and a poorly digested long-end bond auction. Yields stabilised ahead of the last FOMC meeting of 2024. The FOMC cut the Federal Funds rate target range by 25 bps to 4.25–4.50%. However, the hawkish shift in Fed guidance, together with strong data prints and change in anticipated rate cuts for 2025, pushed yields even higher. The dollar strengthened in tandem with higher yields.

Fed Chair Jerome Powell commented that he remained “very optimistic” about the US economy, calling its recent performance “remarkable”. On the labour market, he stated that downside risks “appear to have diminished” though “it’s clearly cooling further”. On the policy front, Powell commented that it was now “appropriate to move cautiously”. Meanwhile, more uncertainties regarding the US budget deficit loomed, as the Republicans and Democrats struggled to find agreements on the latest spending bill. At the end of December, the benchmark 2-year and 10-year UST yields settled at 4.24% and 4.57%, respectively, 9 bps and 40 bps higher compared to the end of November.

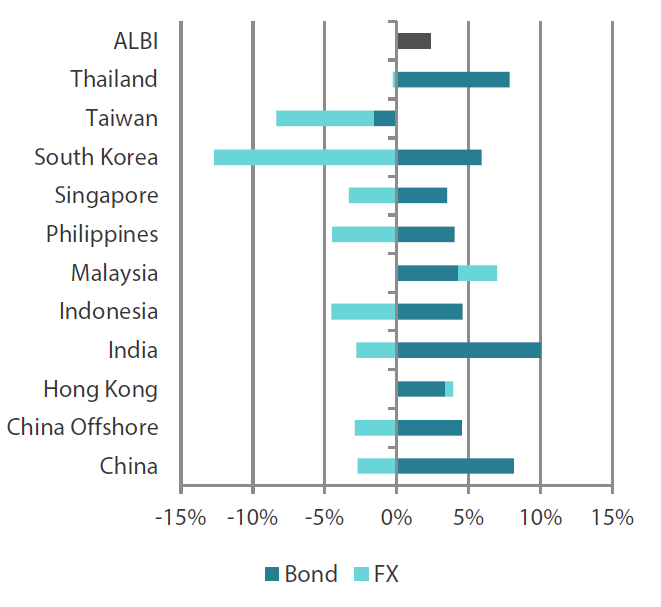

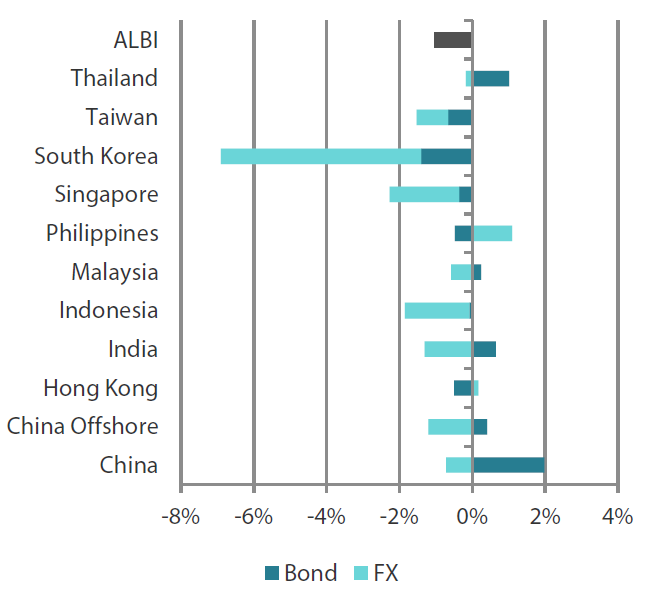

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 31 July 2024

|

For the year ending 31 July 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 December 2024.

The Philippines lowers policy rates while India, Thailand and Indonesia stand pat

The Bangko Sentral ng Pilipinas (BSP) again cut policy rates by 25 bps to 5.75% at its December monetary policy meeting. BSP Governor Eli Remolona commented that inflation is expected to continue to cool and stay within the target range of 2–4%, stating the well-anchored inflation expectations will continue to support the BSP’s shift towards less restrictive monetary policy. However, Remolona also said that the BSP no longer sees a cumulative 100 bps cut over 2025 as likely and acknowledged that monetary policy remains “on the tight side”.

The Bank of Thailand (BOT) kept policy rates unchanged at 2.25% in December after delivering a surprise cut at its previous meeting. The central bank sees the current rate as “consistent” with the economic outlook and inflation that is trending towards its target range, along with maintaining economic and financial stability in the face of “higher uncertainties” in the future. The BOT has stressed the importance of maintaining its neutral stance as the economy picks up slowly and inflation rises gradually towards its target range of 1–3%.

Bank Indonesia (BI) kept its interest rates unchanged at 6%, as the central bank focused on stabilising the Indonesian rupiah. BI Governor Perry Warjiyo reversed the dovish signals conveyed in previous meetings and adopted a more hawkish stance, noting the potential for the Fed to slow its rate cuts in 2025. Overall, BI maintained its 2024 GDP growth forecast at 4.7–5.5% and reaffirmed its commitment to maintaining pro-growth macroprudential policies.

Meanwhile, the Reserve Bank of India (RBI) decided to keep the repurchase rate unchanged, with four of the six Monetary Policy Committee (MPC) members supporting the decision, while the remaining two voted for a 25 bps rate cut. The MPC unanimously agreed to maintain a neutral policy stance. However, to enhance liquidity in the financial system, the central bank reduced the cash reserve ratio—the proportion of a bank’s total deposits required to be held in liquid cash with the RBI—by 50 bps.

Headline inflation prints remain stable in November

Headline consumer price index (CPI) inflation trends were mixed across different countries. In the Philippines, inflation accelerated to 2.5% year-on-year (YoY) in November from 2.3% in October, marking the second consecutive monthly increase. Policymakers attributed the rise partly to faster price increases in food and non-alcoholic beverages.

In Indonesia, headline CPI inflation rose 1.55% YoY in November, slightly exceeding analysts' forecast of 1.50%, and remaining at the lower end of BI’s target range. Core inflation, which excludes volatile food and administered prices, increased to 2.26% YoY in November from 2.21% in October.

Thailand’s inflation rose to 0.95% YoY in November from 0.83% in October. Core inflation similarly edged up to 0.80% YoY from 0.77% over the same period.

In Singapore, headline inflation edged up to 1.6% YoY from 1.4% in October, which was lower than the expected 1.8%. Core inflation rose 1.9% YoY, lower than both the expected figure and October’s print of 2.1%.

In contrast, Malaysia’s headline inflation for November was slightly lower than consensus estimates and the previous month’s figure. Headline CPI inflation increased by 1.8% YoY in November compared to 1.9% in October, slightly below the expected 2.1%. Core inflation remained at 1.80% YoY in November for the third consecutive month.

In South Korea, headline inflation edged up in November but remained below the central bank’s 2% target. The headline CPI increased by 1.5% YoY, up from 1.3% in October, driven partly by higher transport inflation. Core CPI, which excludes food and energy prices, rose by 1.9% YoY, up from 1.8%.

Market Outlook

Asian local government bonds expected to outperform peers from other regions in 2025

Given the lower volatility of the market, we believe that Asia local government bonds are positioned for a decent performance in 2025. This will be supported by accommodative central banks amid an environment of benign inflation and moderating growth. The ongoing global easing cycle is expected to lower global yields and support Asian bond markets. Furthermore, we expect global growth to moderate in the medium term, driven in part by potential tariff threats from the US. This scenario is likely to support bond markets overall. Amid the uncertainties of the new Trump administration, we maintain a broadly cautious stance on Asian currencies in near term. That said, we expect the impact on Asian currencies to be tempered by the region’s strong fundamentals and the Fed’s easing path in the longer term.

As the Fed continues easing, Indian government bonds are becoming increasingly attractive due to their high real yields. Additionally, India’s services account is improving, buoyed by rising exports of software, travel and business services, which is alleviating pressures on its current account deficit. The inclusion of Indian bonds in JP Morgan’s GBI-EM Index is also expected to drive sustained foreign inflows, boosting demand further. Moreover, the Reserve Bank of India’s recent shift to a neutral monetary stance hints at a possible pivot to more accommodative measures going forward. Lastly, S&P Global’s positive outlook on India signals the potential for a long-awaited ratings upgrade in medium term.

Asian credits

Market review

Asian credit spreads tighten but higher UST yields drive negative returns

Asian credits posted a return of -0.80% in December despite credit spreads narrowing by about 7 bps as UST yields rose. Asian investment grade (IG) credits (-0.84%) underperformed Asian high-yield (HY) credits (-0.58%); as IG credits are generally longer in duration relative to their HY peers, HY credit spreads tightened more, by 55 bps, compared to IG credits, which tightened by 3 bps.

Asian credit spreads stayed largely range-bound in the first half of December. Chinese credits benefited from improved sentiment following China’s December Politburo meeting and Central Economic Work Conference (CEWC). During these meetings, top party officials acknowledged the significant challenges facing the economy and pledged to strengthen unconventional countercyclical policies. Notably, the CEWC committed to increasing the fiscal deficit for 2025, prioritising efforts to support consumption growth, and vowed to stabilise the property market to prevent further decline. China’s property market showed some signs of stabilisation in November as the sequential decline in new home prices narrowed. The supportive policy rhetoric helped overall China credit spreads to tighten 2 bps in December. However, certain HY real estate credits in China and Hong Kong faced some selling pressure during the month due to idiosyncratic developments.

South Korea, meanwhile, faced political turmoil following the imposition and quick revocation of martial law by President Yoon Suk Yeol. The impeachment of President Yoon and subsequently, acting President Han Duck-soo, left South Korea facing significant political uncertainty in 2025, with domestic economic momentum already flagging. South Korean financial markets, in particular the won and domestic equities, faced heightened volatility. However offshore Korean US dollar (USD)-credits proved more resilient, widening only 4 bps on the month.

Spreads for most other country segments tightened in December, with Indian credits outperforming slightly, tightening 9 bps.

Quiet primary market in December

The primary market was quiet in December, with just two IG new issues totalling USD 600 million, and no HY new issues.

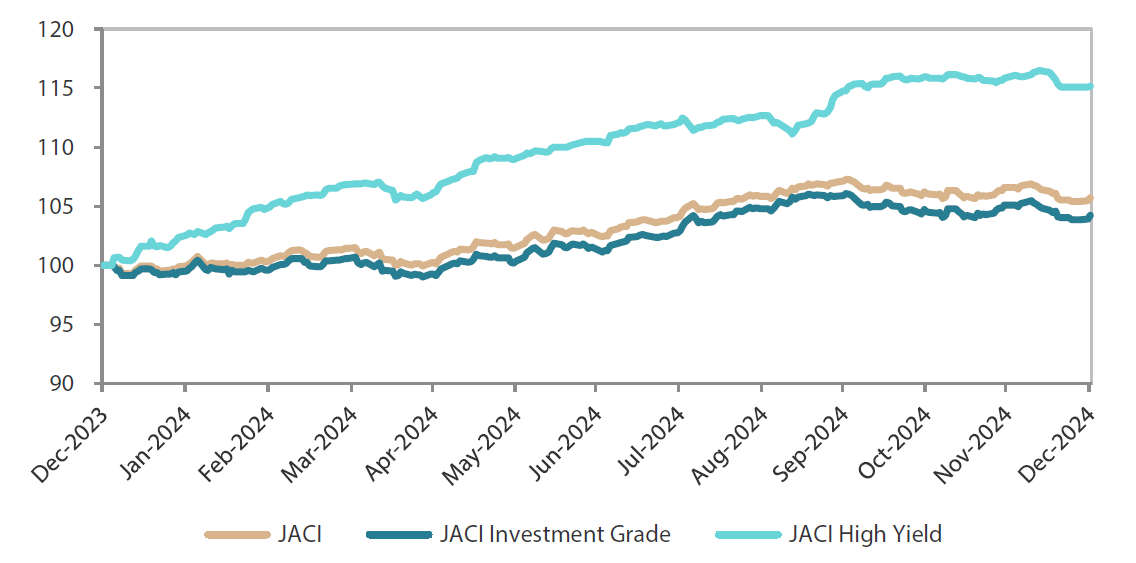

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 29 December 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 December 2024.

Asian credits

Market review

Asia credit yields remain attractive; spreads likely to be rangebound, returns to be driven by carry

We expect Asia credit fundamentals to stay resilient in 2025. China is expected to maintain efforts to rebalance its economy, adopting more accommodative policies to mitigate the effects of a challenging external environment due to US tariff risks and to stabilise overall growth. Asia ex-China macroeconomic fundamentals may moderate slightly from the robust levels seen in 2024 as export growth may face pressure, but they are expected to remain resilient overall. We believe that Asian central banks have ample room to ease monetary policy to support domestic demand.

Against a benign macroeconomic backdrop, we expect Asian corporate and bank credit fundamentals to also stay resilient, aside from a few sectors and specific credits which may be affected by tariff threats or US policy changes. Overall revenue growth could moderate but is expected to stay at healthy levels, with profit margins holding steady due to lower input costs. We expect most Asian corporates and banks to have started 2025 with strong balance sheets and adequate rating buffers. We expect Asia credit default rate to continue falling, accompanied by a smaller percentage of fallen angel credits in the Asia IG space. This trend is being driven in part by better credit quality among issuers, with many weaker companies exiting indexes over the past few years.

We expect to see higher gross supply in the Asia credit space in 2025 compared to the past two years. This is because a decline in US yields would reduce the funding cost gap between offshore and onshore debt. Many regular issuers may also wish to refinance in the USD-denominated market to maintain a longer-term presence. However, net supply will likely be subdued due to still-elevated redemptions. At the same time, we expect demand from regional investors to remain firm given the still high all-in yield.

While credit spreads are historically tight, the combination of supportive macroeconomic and corporate credit fundamentals, along with robust technicals, is expected to keep spreads mostly rangebound in 2025. We remain cautiously optimistic and prefer the crossover BBB- and BB-rated credit space trading in the low-to-mid 200 bps spread. We anticipate carry to be the main driver of Asia credit returns in 2025.