Snapshot

Although market volatility resurfaced in the early part of the April-June quarter as interest rate cuts in the US began to look less likely amid higher-than-expected inflation, risk assets bounced back and rallied strongly later in the quarter. This reflected signs of long-awaited softness in the US economy, which made it more likely that the US Federal Reserve (Fed) would be able to cut interest rates. The markets are now expecting two rate cuts by the Fed in 2024, with the first one potentially taking place as early as September. Furthermore, in the mid part of the quarter, Europe and Canada started off the rate-cutting cycle and set the stage for continued easing outside the US.

Following on from the early concern over US interest rates, events such as the Mexican election showed that volatility remained an issue in the mid part of the quarter, with the Mexican peso dropping sharply. At the end of the quarter, however, the environment was somewhat calmer for markets. This was underscored by two elections in Europe. In France, the worst-case scenario of Marine Le Pen’s National Rally party winning an absolute majority and gaining direct control of the country’s National Assembly was avoided, allowing investors to breathe a sigh of relief. In addition, a general election in the UK ended up in line with market expectations, with the opposition Labour Party winning a large parliamentary majority.

We now feel that it is increasingly likely that the Fed has successfully engineered a “no landing” scenario for the US economy, which should benefit markets and risk assets. Outside the US, the end of restrictive rates looks poised to support earnings growth and help drive global risk markets higher. Markets also look set to continue benefitting from increasing investment in artificial intelligence (AI), particularly in the US, while the structural reform story is supporting Japan.

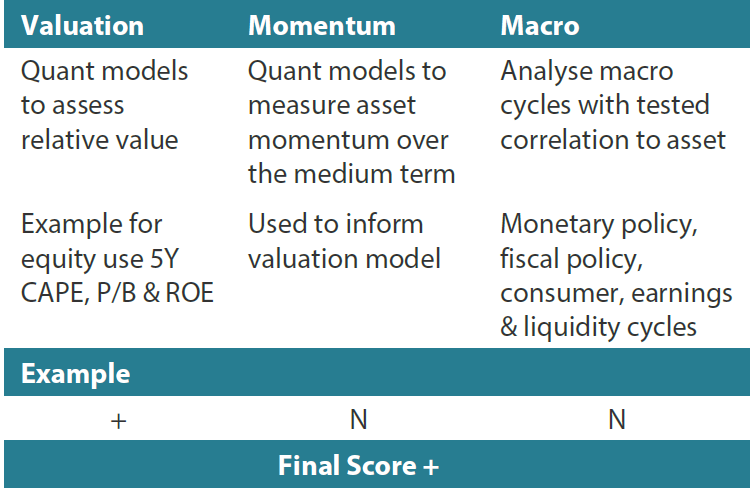

Cross-asset1

Throughout the April-June quarter, we maintained an overweight position in growth assets. The assets have a favourable outlook due to strong fiscal support, especially in the US, and the commencement of interest rate cuts in Europe and Canada. Within growth, we upgraded infrastructure significantly during the quarter to reflect opportunities critical to the development of AI, which in turn is heavily dependent on energy. On the other hand, we reduced our emerging market (EM) equity score from overweight to slightly underweight due to factors such as earnings growth uncertainty in China and better risk-reward opportunities in developed market (DM) equities.

As for defensive assets, we maintained a neutral position throughout the quarter. Within defensives, we reduced investment-grade (IG) credits during the period to a neutral score amid tightening spreads. Conversely, we increased our score in DM sovereigns, making these assets less underweight. Within this asset class we favour sovereigns from Europe and Canada, where central banks have room to cut interest rates. While the potential for monetary easing makes DM sovereigns attractive, we retain a cautious view on long-dated bonds due to their inverted yield curves.

1 The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View2)

2The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets: summary of score changes in Q2

While we maintained our overweight to growth assets throughout the quarter, score changes within growth assets were somewhat large. Infrastructure was upgraded substantially from significant underweight to marginal overweight to reflect opportunities driven by increasing energy demand associated with the development of AI. This was funded mainly by lowering scores in EM equities, which were downgraded from overweight to underweight. In addition, REITs were downgraded to larger underweight as the asset class is among the most sensitive to a higher-for-longer rates environment, which we believe is likely to remain in place for the US. Within DM equities that were maintained as overweight throughout the quarter, the rating disparities now look narrower as we took some profits on the US and Japan to make them both smaller overweight and upgraded the EU (to larger overweight), the UK (to neutral) and other regions (to smaller underweight). Meanwhile, we maintained commodity-linked equities at overweight throughout the quarter due to their combination of growth and inflation-hedging characteristics.

Growth assets experienced a downturn in April as they adjusted to changing expectations for US interest rates. However, they bounced back in May and extended their rally to new highs in June as sentiment turned to risk-on mode, fuelled by more balanced pricing of rates and inflation as well as a sustained revival of the manufacturing cycle. Certain sectors (such as tech) that continue to show strong sales and earnings growth rallied particularly strongly. However, the tech area is beginning to appear somewhat crowded. With that in mind, we are seeking other sources of growth as part of our diversification. One such secular growth theme that has lately been gaining widespread attention is obesity drugs.

Growth assets topic: What are GLP-1 and GIP?

Glucagon-like peptide-1 (GLP-1) and glucose-dependent insulinotropic polypeptide (GIP) are hormones in the gastrointestinal tract responsible for stimulating insulin secretion. Pharmaceutical companies had developed long-acting GLP-1-mimicking drug for diabetes, but they soon discovered that patients were losing weight as their appetite was suppressed. These incretins also slow down gastric emptying, which increases the patient’s sense of fullness. Due to its safety profile and weight-loss efficacy, a higher dose standalone obesity drug was approved by the US Food and Drug Administration (FDA) in 2021.

GIP acts in a similar way to GLP-1 by stimulating metabolism, particularly fat burning. Hence, it was added together with GLP-1, which increased the efficacy of weight loss. The dual-acting obesity drug was finally approved specifically to treat obesity in 2023.

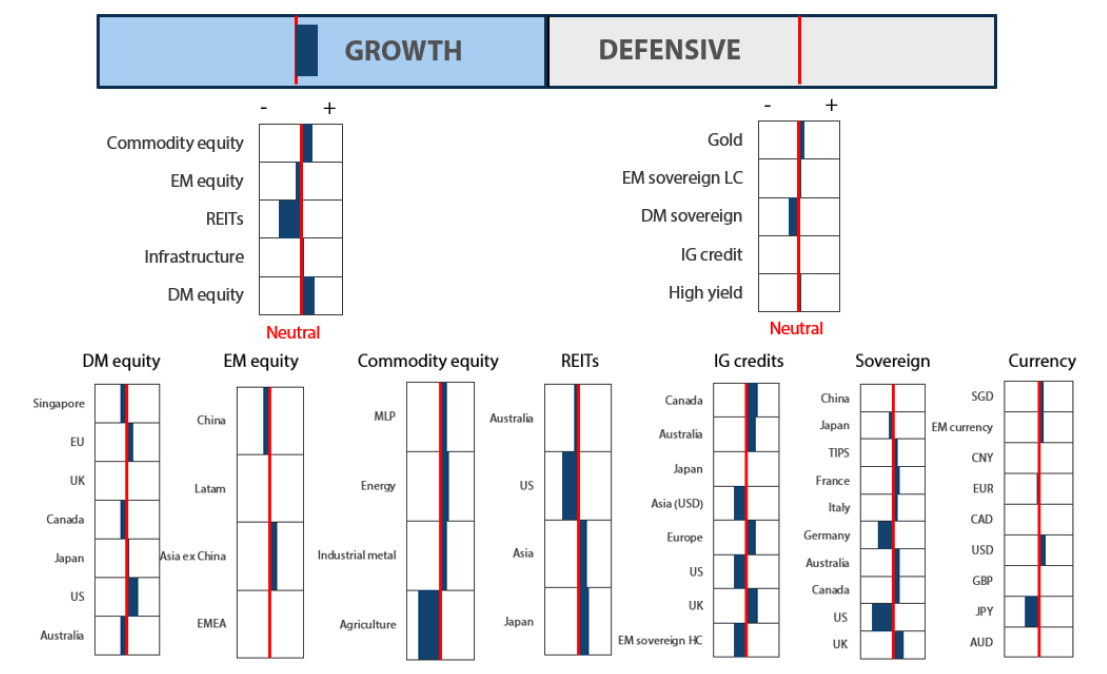

More recently, these drugs were approved by the FDA for the prevention of cardiovascular diseases; ongoing trials aim to show their effectiveness in reducing various diseases such as chronic kidney diseases, apnoea and diabetes. With the approvals by authorities, we believe it would pave the way for insurance coverage and make these drugs available to the general public. The total addressable market size for these drugs is projected to grow from US dollar (USD) 14 billion to USD 128 billion by the turn of the decade.

Chart 1: Estimated global obesity market opportunity

Source: Bloomberg June 2024

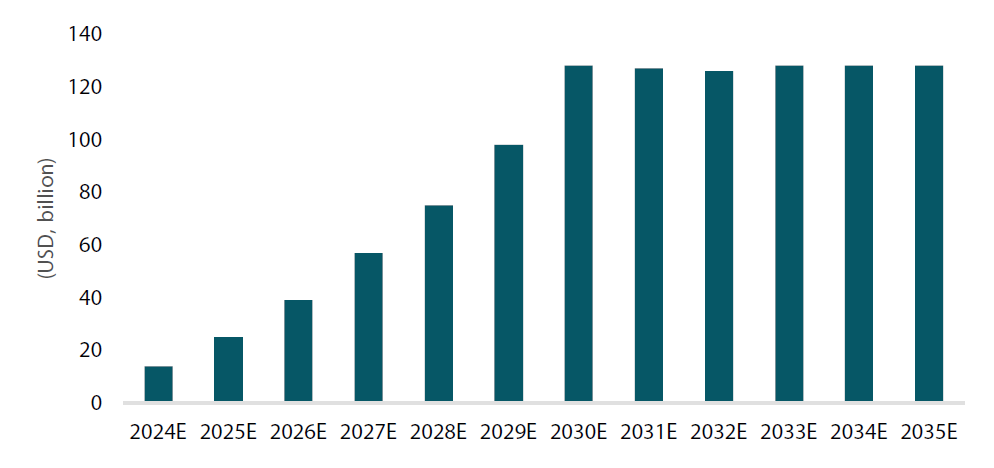

We think that the theme is still in its early stages with significant growth potential ahead. In terms of performance, companies with obesity drugs have done significantly better than those without. When we compare the two largest pharmaceutical companies with obesity drugs with the two largest pharmaceutical companies (by market capitalisation) without obesity drugs, we can see a big difference in performance over time.

Chart 2: Companies with obesity drugs (GLP-1/GIP) versus those without

Rebased to 100 on July 2021

Source: Blomberg July 2024

We think that the incumbent companies will likely face more competition over time. However, the lengthy process of obtaining FDA approvals and the huge capex involved in setting up production should continue to benefit the incumbents as they innovate and evolve their product offerings. For example, they might come up with new methods of administration like oral application and thereby develop moat-like franchises.

Conviction views on growth assets

Adding to US secular growth: US tech-related stocks continued marching higher as secular and cyclical tailwinds remain strong. Within the US, non-tech stocks lagged the broader rally but we expect them to start catching up as the economy slows and inflation comes under control against the backdrop of a more dovish monetary policy.

Adding to Europe with elections out of way: We believe Europe provides balance in a portfolio context, offering value and cyclical growth opportunities at still attractive valuations, particularly with anticipated rate cuts. The UK is also seen offering valuation opportunities with rate cuts likely on the horizon.

Taking some profit in Japan equities: We reduced our overweight to Japan in order to add to the US and Europe, where we see better risk rewards. We are still convinced of the structural reform story in Japan, where we expect companies to start deploying their capital via capex or by returning it to shareholders.

Still positive on commodity-linked equities: We continue to maintain our overweight position as the asset class continues to provide good diversification opportunities against inflation. The fundamentals of the sector remain compelling due to both cyclical and secular factors.

Defensive assets: summary of score changes in Q2

Score changes within defensive assets were relatively small compared to growth assets. We upgraded DM sovereigns gradually over the quarter to a smaller underweight, as the recent bond sell-off and potential for rate cuts make the asset class more attractive. However, since yield curves are still highly inverted in major markets, we prefer to remain underweight on long-dated bonds. The portfolios are currently positioned to take advantage of rate cuts occurring in Canada and Europe. The two locations have long been viewed as the most likely to move rates first due to their below-trend growth and the rapid pace at which inflation is returning to the targets set by their central banks. This stands in contrast with the US, where inflation remains above 3% and growth looks more resilient than expected. While we think that the Fed could adopt a more hawkish stance than the market expects, we also believe that it is preparing for its first rate cut later in 2024.

On the other hand, we downgraded IG credits from overweight to neutral. Credit spreads have continued to shrink and have now hit rather tight levels in certain countries including the US, outside of which locations such as Australia, Canada and Europe remain attractive. We also slightly downgraded EM local currency sovereigns but maintained them as overweight. Within the asset class, we continue to like India in view of the continuation of policies under Indian Prime Minister Narendra Modi’s administration following his election win. The stability of the Indian rupee is also a positive for us. Meanwhile, gold was maintained as overweight throughout the quarter and is still considered as an effective hedge not just against growth assets but also against excessive government spending.

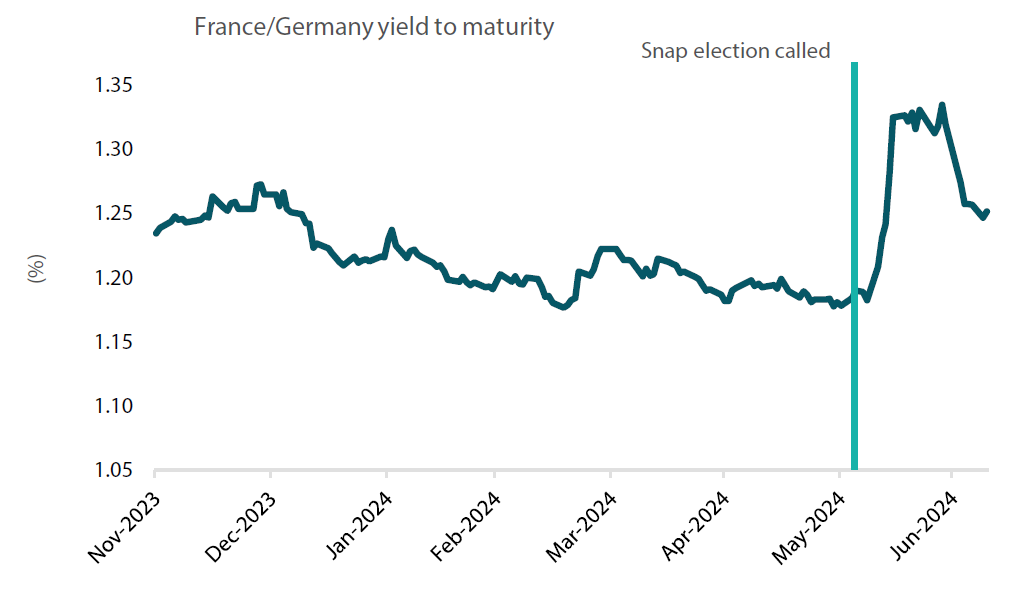

Defensive assets topic: French elections

French President Emmanuel Macron took a huge gamble at the beginning of June by calling for early parliamentary elections after having suffered a heavy defeat in European Parliament elections. This spooked the markets, and 10-year French bond yields climbed as much as 12 basis points to 3.28%. Investors were worried about far-right populists taking control of the parliament and pursuing major parts of Le Pen’s expansive fiscal and protectionist “French first” agenda. Since France has one of the larger deficits in Europe, any political party with the power to expand the deficit could be viewed negatively by the market.

Chart 3: French government bond yields spike after Macron calls for snap election

Source: Bloomberg, July 2024

To the surprise of many, the second round of voting for the French elections early in July ended with the left-wing New Popular Front (NFP) party winning the most seats, while Macron’s centrist party won the second largest number of seats and Le Pen’s National Rally party trailing in third.

The NFP party campaigned on left-leaning policies, which include increasing the minimum wage, capping the prices of essential goods and undoing the pension reform that increased the retirement age to 64. The party proposed increasing tax rates on businesses to fund the spending, trying to show that the overall cost of their program would be neutral. Given France has one of the larger fiscal deficits in the eurozone at around -5.5% of GDP, the bond market was right to be unnerved about what these policies could represent.

Positively, however, given that it is a hung parliament and each party is almost equally represented, this means that it will be difficult for any true legislative change to be pushed through. This will create instability for the French political system. However, it creates more certainty for financial markets, and much like the Indian election result, it may eventually be viewed as a neutral outcome. We would expect the French/German government bond yield spread to continue contracting towards its pre-snap election level; considering the interest rate-cutting cycle that the European Central Bank is entering, we continue to favour French government bonds as a defensive asset within portfolios.

Conviction views on defensive assets

Short-dated IG credit: Credit spreads remain at fair levels, but many markets still exhibit inverse yield curves, making longer-dated credit less appealing. Until curves steepen, shorter-dated credit is likely to remain our preference.

Gold remains an attractive hedge: Gold has been resilient in the face of rising real yields and a strong dollar, while proving to be an effective hedge against geopolitical risks and persistent inflation pressures.

Attractive yields in EM: Real yields in this sector are generally very attractive, and we have a preference for quality EM currencies which can provide strong levels of yield, such as the Indian rupee.

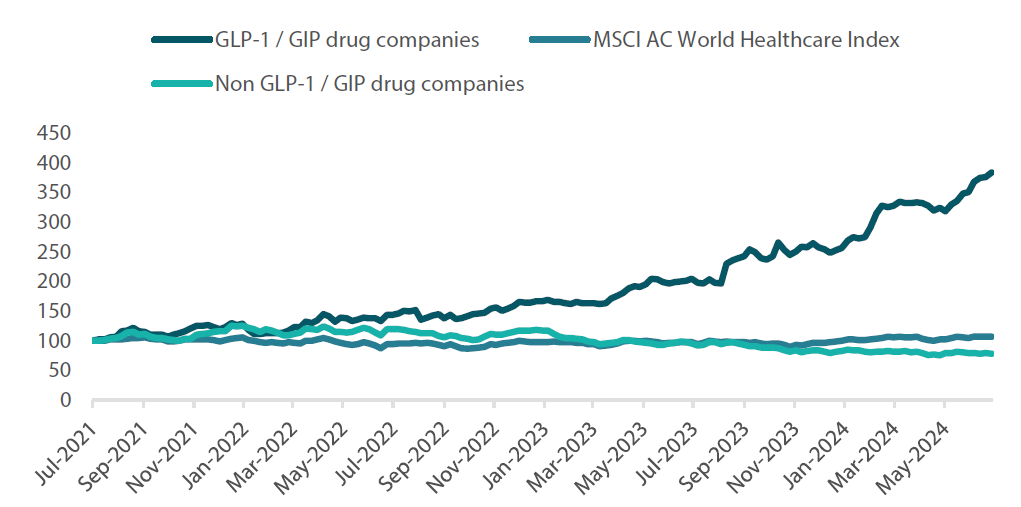

Process

In-house research to understand the key drivers of return: