Nikkei suffers deepest single-day slide on record

Extreme turbulence hit Japanese equities at the start of this month, with the Nikkei Stock Average falling 4,451 yen to a nine-month low of 31,458 on 5 August, suffering its deepest single-day slide on record in yen terms. The tumble, which reverberated across the world, was caused by a confluence of factors including a rally by the yen versus the dollar and concerns about a weakening US economy. Although the Nikkei has retraced some of its losses—as of this writing, it was back near 35,000—it was still far from a record high above 42,000 reached just last month. We assess the factors that led to the downturn from its peak and consider what could be in store for the Japanese equity market.

Incompatibility of US easing expectations and hopes for “higher for longer”

There were four main factors, in our view, that propelled the Nikkei to that record high in July: (1) robustness of the semiconductor-related sectors, (2) prospects of the US overcoming inflation and eventually embarking on monetary easing, (3) dollar/yen strength on the back of expectations for the Federal Reserve (Fed) keeping interest rates “higher for longer” and (4) hopes for a post-COVID recovery by the Japanese economy supported by higher wages and increased consumption.

Of these four factors, (2) and (3) could not coexist for long. That became apparent when the dollar/yen plummeted recently in the wake of soft US employment data. We think that the reversal of dollar/yen strength and the realisation by the market of the incompatibility of US easing hopes and “higher for longer” US interest rates were the main reasons behind the recent slide seen in Japanese equities.

Domestic factors supportive of Japanese equities remain relatively unchanged

Domestic factors that have been supportive of Japanese equities, however, remain relatively unchanged. The narrative of Japan fully shaking off deflationary pressures thanks to rising real wages is still intact. Latest data showed that wages are continuing to rise, which is leading to increased consumption. Regarding the impact of the recent yen appreciation on corporate earnings, listed Japanese companies are seen to be assuming an average dollar/yen rate of 144 for the current fiscal year. Considering that dollar/yen was considerably stronger than 144 through much of the period (it was above 160 early in July), their earnings are expected to remain roughly in line with their forecasts if the currency pair is able to remain at current levels of around 145.

As for monetary policy, some have blamed the Bank of Japan (BOJ)’s interest rate hike late in July as being ill-timed. We do not subscribe to such views, although we think that the BOJ could push back its next rate hike following recent developments in the market.

Elaborating further on the impact the soft US economic data had on the broader market, we need to keep in mind that the downturn in Japanese equities was seen to be led in part by macro trend-following index players such as commodity trading advisors. The downturn they induced could eventually pave the way for others, notably domestic retail investors, to tip-toe into the market once volatility shows signs of settling down. The turbulence witnessed so far in August will no doubt be daunting for retail investors who entered the domestic market through the tax-free savings scheme known as the Nippon Individual Savings Account (NISA), which was hoped to ignite an investment boom among household savers when it was revised at the start of 2024. While it is difficult to predict how NISA investors will react to the market turbulence in the short term, their moves are expected to be relatively gradual and are therefore not expected to contribute to further volatility.

Main scenario for Japanese equities intact, with wage rises in focus

The Nikkei has essentially gone back to where it started 2024, prior to the market rise which was driven by a combination of US monetary easing prospects and “higher for longer” US interest rates. The levels seen this week, however, appear to be where the market looks to build a toe-hold for a path back to recovery. The main scenario for the Japanese equity market is basically unchanged; domestic demand remains strong, supported by the continuing rise in wages, which we believe could be the catalyst for a recovery by Japanese equities. Labour ministry data released on 6 August backs our view, with Japan’s real wages rising in June for the first time in 27 months and nominal wages marking their fastest growth since January 1997. If we were to tweak the aforementioned main scenario in light of recent developments, it would be for equities to remain on a steady footing with less focus on currency levels.

July market summary: Japan equities slip amid yen’s appreciation

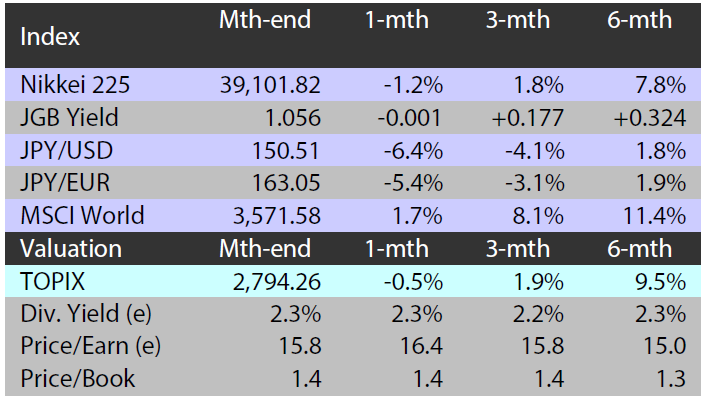

The Japanese equity market ended July lower with the TOPIX (w/dividends) down 0.54% on-month and the Nikkei 225 (w/dividends) falling 1.21%. Fed Chair Jerome Powell’s remarks and US economic indicators pointing to a slowdown in inflation led to expectations that the Fed could cut rates before the end of the year, which supported Japanese equities. However, overall the market was weighed down by negative factors, including rising concerns regarding the outlook for the semiconductor industry following reports from some news media sources that the US is considering tightening restrictions on China’s access to chips. At the same time, the yen strengthened against the US dollar amid speculation that rate hikes would be on the table at the BOJ’s Monetary Policy Meeting, diminishing expectations regarding exporters’ earnings.

Of the 33 Tokyo Stock Exchange sectors, 21 sectors rose with Pharmaceuticals, Construction, and Real Estate among the most significant gainers. In contrast, 12 sectors declined, including Transportation Equipment, Electric Power & Gas, and Nonferrous Metals.

Exhibit 1: Major indices

Source: Bloomberg, 31 July 2024 |

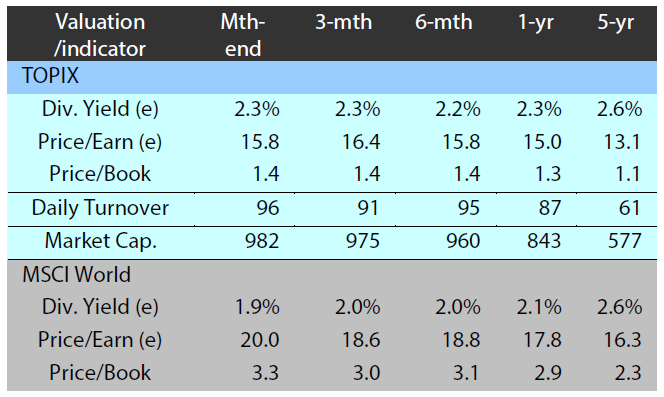

Exhibit 2: Valuation and indicators

Source: Bloomberg, 31 July 2024 |