Summary

- US Treasuries (USTs) rallied significantly in July, as markets drastically pulled forward their expectations for the US Federal Reserve’s (Fed) first interest-rate cut in this cycle. Yields tumbled across the curve on the final day of the month after the Fed held rates steady. At the end of the month, the benchmark 2-year and 10-year UST yields settled at 4.26% and 4.03%, respectively, 49.6 basis points (bps) and 36.6 bps lower compared to end-June.

- Within Asia, monetary authorities in South Korea, Malaysia, Indonesia and Singapore stood pat at their respective policy meetings. In contrast, the People’s Bank of China (PBOC) lowered several policy rates. Inflationary pressures in the region mostly eased in June. In terms of preference, we favour Indian and Philippine government bonds over their regional peers.

- Asian credits gained 1.32% in July, even though credit spreads remained mostly unchaged, due to to the sharp fall in UST yields. Asian investment-grade (IG) credit slightly underperformed its Asian high-yield (HY) counterpart, returning 1.30% , despite spreads widening 3.5 bps. Asian HY credit returned 1.47%, with spreads tightening by about 13 bps.

- The increase in new issue supply amidst falling all-in yields prompted modest profit taking, which drove spreads wider over June and July. We view such technical correction as healthy and believe it creates better entry opportunities. Demand for Asia credit remains robust, particularly from regional institutional investors looking to lock in attractive all-in yields. However, the emergence of certain negative risk factors may result in modestly higher volatility in Asia credit spreads in the second half of the year.

Asian rates and FX

Market review

USTs rally in July

USTs rallied significantly in July as markets drastically pulled forward their expectations for the Fed’s initial rate cut in this cycle. A soft US June jobs report and a broad-based cooldown in the June consumer price index (CPI), fuelled market optimism for a potential Fed rate cut as early as September. Ahead of the Fed’s July meeting, there was a moderation in the June US personal consumption expenditures inflation gauge. This further boosted expectations for an earlier start to the Fed’s monetary easing. Yields tumbled across the curve on the final day of the month after the Fed held rates steady, with Chair Jerome Powell signalling that the central bank is prepared to cut rates in September if inflation continues to decline. Meanwhile, the Bank of Japan raised interest rates towards the end of July and announced plans to reduce its government bond purchases, leading to a significant appreciation in the Japanese yen. At end-July, the benchmark 2-year and 10-year UST yields settled at 4.26% and 4.03% respectively, 49.6 bps and 36.6bps lower compared to end-June.

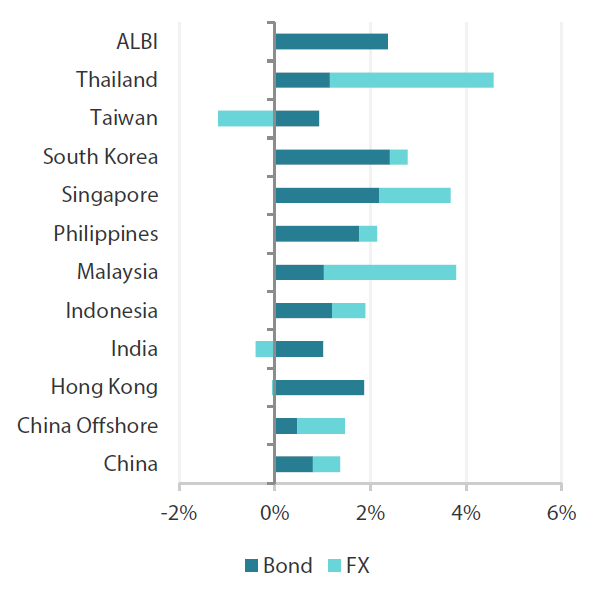

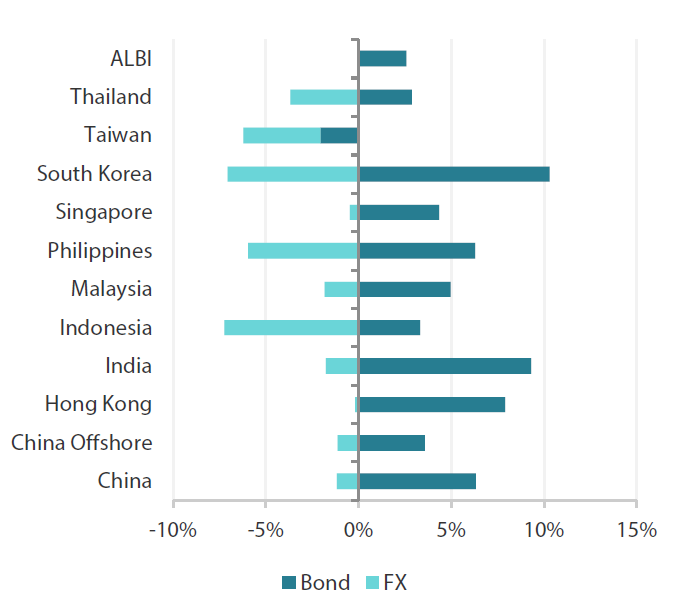

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 31 July 2024

|

For the year ending 31 July 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 July 2024.

Central banks in South Korea, Singapore, Malaysia and Indonesia stand pat; PBOC lowers several policy rates

Monetary authorities in South Korea, Malaysia and Indonesia left interest rates unchanged in July. Bank Negara Malaysia (BNM) maintained its overnight policy rate, stating that inflation is expected to rise in the coming months due to the recent removal of Malaysia’s diesel subsidy. However, BNM anticipates any increase in inflation to remain manageable thanks to mitigation measures aimed at minimising the cost of impact on businesses due to the subsidy’s removal.

Similarly, Bank Indonesia (BI) held its benchmark seven-day reverse repo rate steady, maintaining vigilance over the Indonesian rupiah. BI Governor Perry Warjiyo stated that the economy is well-supported by domestic demand and anticipates growth to range between 4.7–5.5% in 2024.

The Bank of Korea also held its base rate steady, issuing a statement that indicated a dovish shift in its policy stance. The central bank opened the door to rate cuts, indicating that they will decide on the timing and magnitude of these cuts based on a comprehensive evaluation of the slowing inflation trend and the potential trade-off between growth and financial stability resulting from a policy rate reduction.

Meanwhile, the Monetary Authority of Singapore (MAS) kept its overall policy settings unchanged. It revised its full-year forecast for headline inflation down to a range of 2–3% from the previous forecast of 2.5–3.5%. This reflects the lower-than-expected private transport inflation observed in recent months, but the MAS has maintained its 2024 estimate for core inflation at 2.5–3.5%.

In contrast, the PBOC lowered the seven-day reverse repo rate, as well as the one-year and five-year loan prime rates, each by 10 bps. Additionally, the PBOC trimmed the one-year medium-term lending facility (MLF) rate by 20 bps.

Inflationary pressures mostly decelerate in June

In June, overall inflation eased in South Korea, Thailand, Singapore, Indonesia and the Philippines. On the other hand, headline CPI prints in China and India increased. Malaysia’s headline inflation figure remained unchanged.

Indonesia’s headline CPI slowed to 2.51% YoY in June from 2.84% in May. This was lower than the market’s expected figure of 2.70%. The moderation was primarily due to decreases in the prices of food, beverages and tobacco. Stripping out food and energy prices, the core CPI eased to 1.90% from 1.93%.

In the Philippines, headline inflation decelerated to 3.7% YoY in June from 3.9% in May, partly due to a slowdown in the increase of transport and utility costs. Meanwhile, core inflation remained unchanged at 3.1%.

Singapore’s core inflation measure moderated significantly in June, easing well below market expectations to 2.9% YoY—a level last seen in March 2022. Policymakers attributed the decrease primarily to lower inflation for retail and other goods. The headline inflation for June also fell sharply, declining to 2.4% YoY from 3.1%, due to lower private transport costs and softer core inflation.

Inflation remained muted in China. While the headline CPI turned positive, it edged up only 0.2% YoY in June. The core CPI was 0.6%, remaining stable at this low level for the past two years, with food inflation being a significant drag over the last year.

Meanwhile, India’s CPI unexpectedly increased to 5.08% YoY in June, up from a 4.75% in May, driven partly by stronger food inflation. India’s core inflation remained steady at 3.1% YoY in June.

India lowers its fiscal deficit target

India’s Finance Minister Nirmala Sitharaman presented the third Modi government’s maiden budget, focusing on job creation, increasing infrastructure spending and maintaining control over the fiscal deficit. Notably, the fiscal deficit target for the fiscal year (FY) ending March 2025 was lowered to 4.9% of GDP from 5.1% in the interim budget announced in February. Additionally, the planned gross market borrowing was also lowered to Indian rupee (INR) 14.01 trillion for FY2025, down from INR 14.13 trillion.

No major policy changes announced at China’s Third Plenum

China’s Third Plenum meetings, held in mid-July, did not result in major policy changes. However, emphasis was placed on the continuation of prevailing themes such as the importance of security and adjustments to improve the share of local government incomes relative to the central government. Notably, the leadership announced that it would strive to meet this year’s growth target of 5%, despite slowing growth momentum in the second quarter.

Market outlook

Positive on India and Philippine bonds

We expect the broader trend of easing global yields, prompted by expectations for the Fed to begin lowering interest rates, to support a downward bias in regional bond yields. We continue to favour Indian and Philippine government bonds over their regional peers.

Recent dovish remarks from the Philippine central bank governor indicate a potential shift towards rate cuts, with lower-than-expected inflation prints in the last three months providing the monetary authority ample room to lower rates. In India, the growing divide within the central bank’s Monetary Policy Committee suggests that a pivot towards easing may happen soon. Indian government bonds were included in JP Morgan’s GBI-EM Index starting 28 June, with an initial 1% weight that will increase by 1% each month, reaching a maximum of 10% by March 2025. This gradual increase is expected to further support Indian bond prices.

Asian credits

Market review

Asian credits close higher on the back of sharp gains in USTs

Asian credits gained 1.32% in July, even though credit spreads were mostly unchanged, as UST yields fell sharply. Asian IG credits slightly underperformed Asian HY credits, gaining 1.30%, despite spreads widening by 3.5 bps. Meanwhile, Asian HY returned 1.47% as spreads tightened by about 13 bps.

Asian credits remained relatively resilient in July even though primary market activity remained relatively busy. The market mood was mostly positive, supported by expectations of an imminent rate cut by the Fed. However, the possibility of a second Trump presidency in the US tempered some of this optimism, particularly for Chinese credits.

In China, economic growth slowed to 4.7% YoY in the second quarter, down from 5.3% in the first three months of 2024. Notably, the need to meet this year’s growth target of “around 5%” was stressed at the Third Plenum. Following the Third Plenum, unexpected monetary policy measures were implemented, including notable cuts to the seven-day reverse repo and one-year MLF rates. Additionally, there were mixed signs from the property sector; while June sales showed continued improvement, signs were for the recovery to slow down in July.

Elsewhere in Asia, countries reported recent second-quarter growth. Advance estimates indicated that the Singapore economy expanded 2.9% YoY, while preliminary estimates for Malaysia indicated a YoY growth of 5.8%, which exceeded all expectations.

Performance diverged across country segments in July. China, Hong Kong, India, Thailand and Singapore credit spreads tightened, while Macau, South Korea, Taiwan, Philippines, Indonesia and Malaysia credit spreads widened.

Primary market activity remains active in July

In July, issuance of new supply slowed following June’s high volume. However, primary market activity remained robust with Chinese and South Korean IG-rated financials and quasi-sovereigns coming into focus. The IG space saw 19 new issues amounting to USD 10.2 billion, including the USD 1.0 billion sovereign issue from the Hong Kong government, the USD 1.0 billion two-tranche issue from China Cinda, and USD 1.0 billion issues from Kraton Corp and China Construction Bank. Meanwhile, the HY space saw five new issues amounting to USD 1.25 billion.

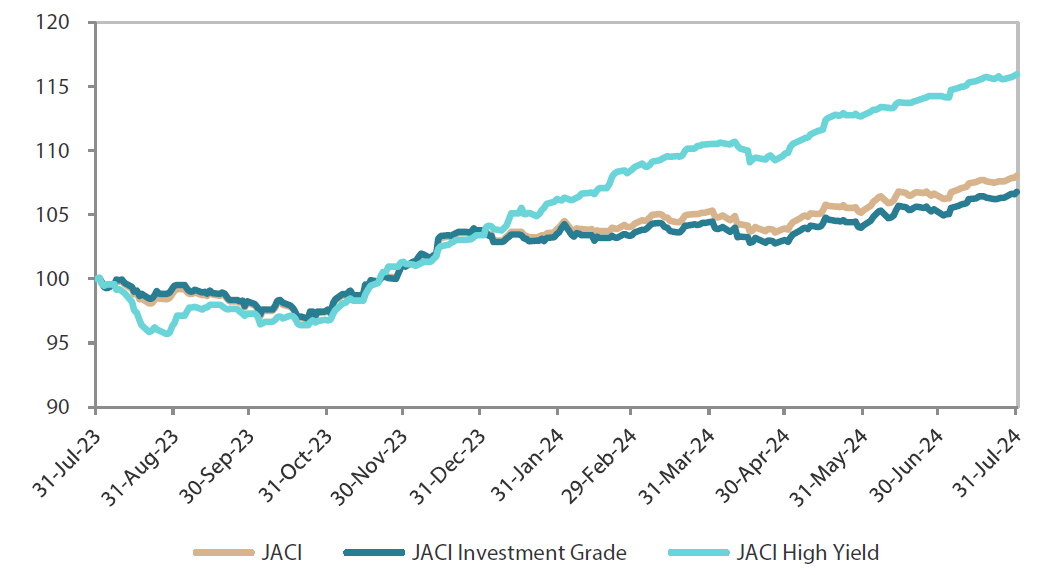

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 July 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 July 2024.

Market outlook

Healthy technical correction creates better entry opportunities amidst supportive fundamentals

The fundamentals backdrop for Asian credit remains supportive. China’s overall policy stance remains incrementally accommodative. However, given the still-fragile recovery in the real economy, particularly in the property market, more easing measures may follow.

Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient, with a recovery in exports growth potentially offsetting softer domestic conditions. While non-financial corporates may experience a slight weakening in credit metrics stemming from lower earnings growth and incrementally higher funding costs, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with strong capitalisation and pre-provision profitability providing buffers against moderately higher credit costs ahead.

The pick-up in new issue supply amidst falling all-in yields prompted modest profit-taking which drove spreads wider in June and July. We see such a technical correction as healthy and believe that it creates better entry opportunities. Demand for Asia credit remains strong from regional institutional investors looking to lock in attractive all-in yields, even as fund flows into emerging market hard currency funds remain subdued. Looking ahead, some risks may bring some volatility in Asia credit spreads in the second half of the year. These risks include local political uncertainties, trade tensions and concerns over the outcome of the US presidential election in November.