Summary

- Signs of a sharp weakening in the US labour market and dovish signals from the Federal Reserve (Fed) fuelled a further decline in US Treasury (UST) yields in August. The July Federal Open Market Committee (FOMC) minutes further revealed that “the vast majority” of participants were ready to ease. At end-August, the benchmark 2-year and 10-year UST yields settled at 3.92% and 3.90%, respectively, 34 basis points (bps) and 13 bps lower compared to end-July.

- Within Asia, the Philippines took the leap and became the first major central bank in the region (outside of China) to cut rates ahead of the Fed. Regional economies saw decent second-quarter economic growth, while headline inflation prints were mixed in July.

- In this positive bond market environment driven by global monetary easing expectations, we favour government bonds from India, Indonesia and the Philippines, where higher yields remain attractive to investors.

- Asian credits gained 1.63% in August, supported by tightening credit spreads and a decline in UST yields. Asian investment-grade (IG) credit outperformed its Asian high-yield (HY) counterpart, returning 1.82%, as spreads narrowed 3 bps. Asian HY credit returned 0.48%, with spreads tightening by about 32 bps.

- We expect Asian credits’ robust fundamentals, along with still-strong demand-supply technicals, to help contain any spread widening potentially caused by the elevation of risks. These include local political uncertainties, trade tensions and concerns over November’s US presidential election outcome. The biggest risk, in our view, to Asia’s macroeconomic and credit outlook is a deep US and global economic recession, which, however, is not our base case. We still see any healthy correction as creating better entry opportunities for Asia credit, from the perspectives of both excess and total return.

Asian rates and FX

Market review

USTs rally further in August

Signs of a sharp weakening in the US labour market and dovish signals from the Fed fuelled a further decline in UST yields in August. The disappointing July employment report, which revealed weaker payroll numbers and a higher unemployment rate, sparked concerns about a more rapid slowdown in the US economy. Consequently, market expectations increased for a September rate cut from the Fed, prompting a broad re-pricing of the US policy rate cycle. This led to a pronounced decline in yields and a significant weakening of the US dollar. Subsequent benign inflation reports further reinforced expectations of more substantial rate cuts this year. Fed communications confirmed the likelihood of a September rate cut, with the July FOMC minutes revealing that “the vast majority” of participants were ready to ease. At the Jackson Hole Symposium, Fed Chair Jerome Powell echoed this sentiment, stating that “the time has come for policy to adjust”. At end-August, the benchmark 2-year and 10-year UST yields settled at 3.92% and 3.90%, respectively, 34 bps and 13 bps lower compared to end-July.

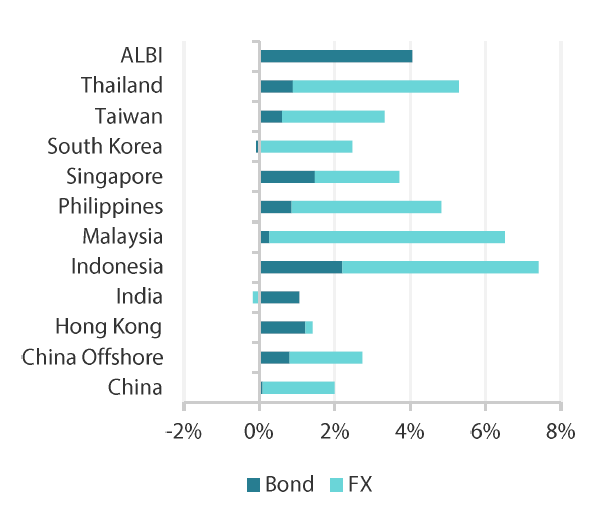

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

For the month ending 31 August 2024

|

For the year ending 31 August 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2024

Bangko Sentral ng Pilipinas eases policy rate by 25 bps; other central banks hold steady

The Bangko Sentral ng Pilipinas (BSP) become the first major central bank in the region, outside of China, to initiate a rate-cutting cycle, reducing its overnight repurchase facility rate by 25 bps to 6.25%, starting its easing cycle ahead of the Fed. The BSP expressed strong confidence that inflation risks have shifted to the downside and noted that “the current macroeconomic outlook supports a calibrated shift to a less restrictive monetary policy stance”.

In contrast, the Bank of Thailand (BOT) kept its key interest rate unchanged. The decision, however, was not unanimous, with one board member advocating for a 25-bps rate cut. The BOT acknowledged downside risks to its inflation forecasts, attributing these primarily to supply-side factors rather than weak demand.

Similarly, Bank Indonesia (BI) kept its policy rate unchanged but issued dovish signals. The BI now expects two Fed rate cuts in 2024, an increase from the previous prediction of just one cut. The BI policy statement emphasised the need to support economic growth and noted diminishing external risks. Nonetheless, BI Governor Perry Warjiyo reiterated that any rate cuts would be “data dependent”.

The Bank of Korea (BOK) kept interest rates unchanged but revised its inflation and growth forecasts downward for 2024, indicating a shift toward potential easing in the coming months. BOK Governor Rhee Chang-yong noted that while the decision to hold rates was unanimous, there has been an increase in the number of board members open to a possible rate cut in the next three months.

Countries register decent growth in 2Q24

Gross domestic product (GDP) growth in the Philippines surpassed the upwardly revised growth of 5.8% year-on-year (YoY) in the first quarter of 2024 (1Q24), accelerating to 6.3% in 2Q24. During this period, investments increased by 11.5% and government spending expanded by 10.7%. However, consumer spending fell short of the expectations set by the BSP.

In Indonesia, the economy grew by 5.05% YoY in 2Q24, slightly slower than the 5.11% growth in the first quarter. The stronger-than-expected performance was largely driven by solid household and investment spending. For the full year, BI projects economic growth to be in a range of 4.7–5.5%.

Meanwhile, Thailand’s economy expanded by 2.3% YoY in the second quarter from an upwardly revised 1.6% in the first quarter, marking the fastest growth in five quarters. With the GDP growing 1.9% in the first half of 2024, the National Economic and Social Development Council (NESDC) has revised its full year GDP growth forecast to 2.3–2.8% (from 2.0–3.0%). The NESDC highlighted the recovery in tourism, strong domestic private consumption, robust government consumption and public investment and export recovery as key drivers to growth.

Elsewhere, GDP growth in India moderated to 6.7% YoY in 2Q24, down from 7.8% in the first quarter. The slowdown in growth, prompted partly by a contraction in government spending, was below the Indian central bank’s projection of 7.1%.

Headline CPI prints mixed in July

In July, the headline consumer price index (CPI) varied across countries. Increases were seen in China, South Korea, India, Thailand and the Philippines. On the other hand, inflation rates remained unchanged in Malaysia and Singapore while consumer prices cooled in Indonesia.

Malaysia's headline inflation remained steady at 2.0% YoY for the third consecutive month. Price increases were observed in key categories like health, restaurant and accommodation services and recreation and culture, while inflation in food and beverages eased.

In Singapore, core inflation eased to 2.5% YoY in July, the lowest since February 2022, marking the second consecutive month of easing. Headline inflation remained unchanged at 2.4%, driven by a slowdown in accommodation costs. The Ministry of Trade and Industry and the Monetary Authority of Singapore project core inflation to average 2.5–3.5% for 2024, with overall inflation ranging between 2% and 3%.

Meanwhile, Thailand’s headline CPI accelerated to 0.83% YoY in July, marking the fourth consecutive month of rising inflation, primarily due to higher fuel and fresh food prices. Core CPI rose to 0.52% from 0.36% in June.

China’s consumer inflation rose more than expected in July, but concerns about weak demand persist. The headline CPI was positive for the sixth consecutive month, rising 0.5% YoY, with the acceleration driven largely by food prices. However, core consumer inflation slowed to 0.4% in July, down from 0.6% in June.

Indonesia’s headline CPI inflation eased to 2.13% YoY in July from 2.51% in June; core CPI edged up to 1.95% from 1.90% the previous month.

Market outlook

Positive on India, South Korea, Indonesia and Philippine bonds

Chair Powell’s remarks at the Jackson Hole forum signalled that the Fed is prepared to commence rate cuts as early as September. Powell underscored that the US central bank’s focus has shifted from concerns about inflation to potential downside risks in the labour market. The anticipated easing of monetary policy is expected to keep driving market dynamics, likely leading to a further decline in UST yields and reinforcing overweight positions on duration.

As the Fed begins to ease, it paves the way for Asian central banks to normalise their policy rates. In this positive bond market environment driven by global monetary easing expectations, we favour government bonds from India, Indonesia and the Philippines, where higher yields remain attractive to investors. Additionally, we hold a positive view on South Korean government bonds, anticipating that the BOK is on the verge of initiating a rate-cutting cycle.

Asian credits

Market review

Asian credits register gains in August

Asian credits gained 1.63% in August, supported by tightening credit spreads and a decline in UST yields. The sharp drop in UST yields led Asian IG credits, which are longer in duration, to outperform Asian HY credits. Asian IG credits returned 1.82% as spreads narrowed by 3 bps. Meanwhile, Asian HY credits returned 0.48%, with spreads tightening by 32 bps.

An improvement in risk sentiment—fuelled by growing confidence that the Fed would begin rate cuts in September —led to a tightening of Asian credit spreads in August. However, the month began on a challenging note, with spreads widening significantly across the board, as risk assets sold off amid fears of a potential US recession. The markets quickly regained composure, and spreads gradually narrowed as subsequent data suggested that recession concerns might have been overblown.

Over in China, July’s activity data indicated a weak start to the third quarter, with credit data remaining sluggish. Attention remained on potential measures to support the housing market. However, news that local governments might be permitted to issue special local government bonds to purchase unsold housing units for conversion into affordable housing had limited market impact, as investors were sceptical about the feasibility of such measures.

Elsewhere in Asia, countries reported decent second-quarter economic growth. Credit rating agency Fitch Ratings affirmed India’s long-term foreign currency issuer default rating at “BBB-“ with a stable outlook, citing the country’s strong mid-term growth prospects, robust external finance position and improving fiscal deficit situation. In Thailand, Paetongtarn Shinawatra was appointed as prime minister days after the Constitutional Court dismissed her predecessor Srettha Thavisin. By the end of August, spreads for all major country segments—save for China, Hong Kong, Indonesia and Malaysia—widened.

Primary market activity remains active in August

New supply slowed in August. However, primary market activity remained robust, with a focus on Chinese and South Korean IG-rated financials and quasi-sovereigns. The IG space saw 17 new issues amounting to USD 8.02 billion, including the USD 2.5 billion three-tranche sovereign issue from the Republic of the Philippines, and the USD 1.0 billion two-tranche issue from Malaysia’s sovereign wealth fund Khazanah. Meanwhile, the HY space saw 10 new issues amounting to USD 2.43 billion.

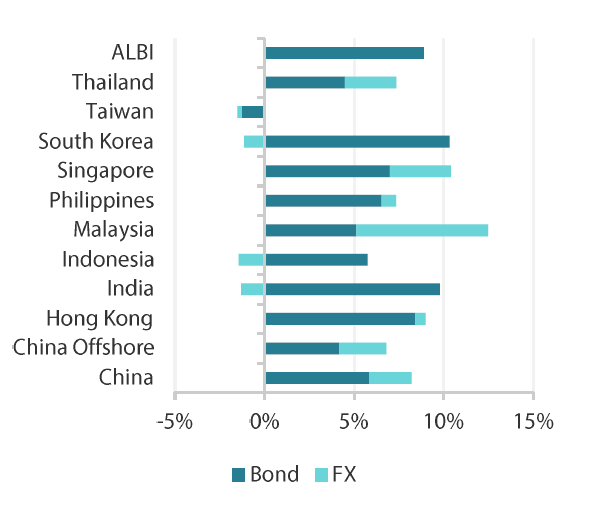

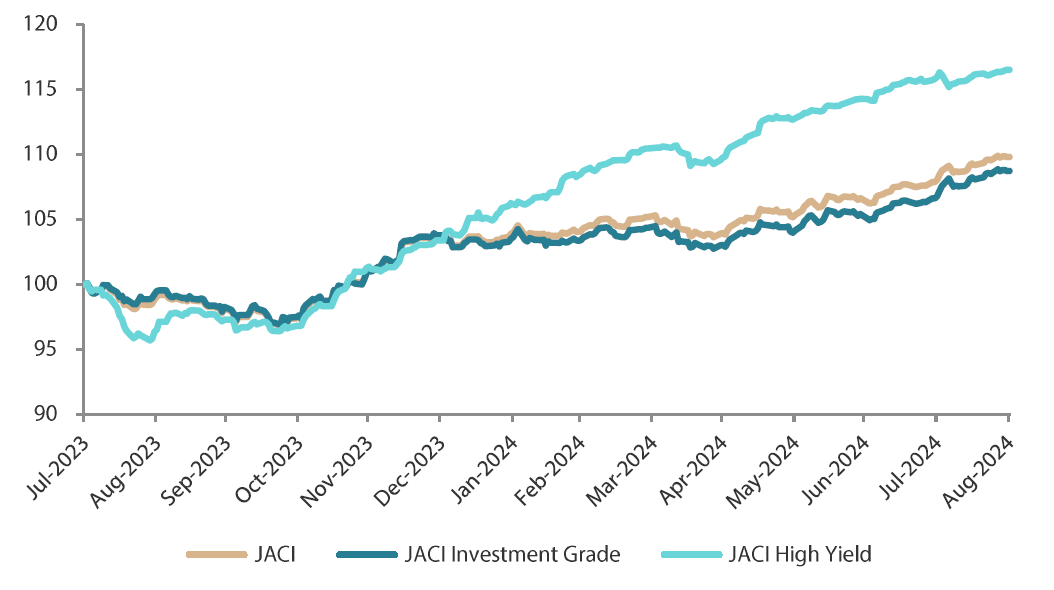

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 on 31 July 2023

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 August 2024.

Market outlook

Robust fundamentals and still-strong demand-supply technicals to support credit spreads

The fundamentals backdrop continues to support Asian credit. China’s overall policy stance remains incrementally accommodative. However, with recovery in the real economy and the property sector still fragile, more easing measures are likely needed.

Macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient, although they may moderate from the strong levels seen in the first half of 2024 as the global economy potentially enters a temporary soft patch, adding to the pressure of constrained domestic demand conditions. With the exception of a few sectors and idiosyncratic situations, most Asian IG corporate and banks are entering this softer period with strong balance sheets and adequate ratings buffers.

We expect these robust fundamentals, along with still-strong demand-supply technicals, to help contain any spread widening potentially caused by the elevation of risks. These include local political uncertainties, trade tensions and concerns over the US presidential election outcome in November. The biggest risk, in our view, to Asia’s macroeconomic and credit outlook is a deep US and global economic recession, which, however, is not our base case. We still see any healthy correction as creating better entry opportunities for Asia credit, from the perspectives of both excess and total return.