Summary

- US Treasuries (USTs) were sold off in April due to concerns over a potential delay in the US Federal Reserve’s (Fed) easing cycle. Data released over the month indicated a strong labour market and inflation rates exceeding expectations. At the end of April, the benchmark 2- and 10-year UST yields settled at 5.04% and 4.68%, respectively, 41.5 basis points (bps) and 48.0 bps higher compared to the end of March.

- In terms of duration exposure, we maintain a positive outlook for medium-term duration, finding the current yield levels attractive. In order to have a similarly positive view for long-term duration, it may be necessary for US data to soften or for decreasing rates volatility to alter the current market dynamics.

- Asian credits fell 1.17% in April, despite credit spreads tightening 5 bps, as negative returns from USTs offset the positive contribution from spreads. Asian investment-grade (IG) credit underperformed its Asian high-yield (HY) counterpart, returning -1.26% even as spreads narrowed 9.5 bps. Meanwhile, Asian HY credit was down 0.62% with spreads widening by 6 bps.

- From a technical perspective, we expect Asia credit to remain well-supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains robust from regional institutional investors looking to lock in attractive yields. The realisation of certain negative risk factors may exert some widening pressure on Asia credit spreads, particularly in the IG segment.

Asian rates and FX

Market review

UST yields rise sharply in April amid fading rate-cut hopes

USTs underwent a sell-off in April due to concerns over a potential delay in the Fed’s easing cycle. The strong performance of the US labour market, highlighted by the addition of 303,000 jobs in March (the highest in ten months) and a decrease in the unemployment rate to 3.8%, drove up UST yields at the start of the month. Subsequently, the higher-than-expected US headline and core consumer price index (CPI) prints raised doubts about the Fed’s ability to begin lowering interest rates mid-year. It also raised questions about whether the Fed could cut rates in coming months in the absence of an economic slowdown. Although escalating tensions between Israel and Iran increased demand for perceived “safe-haven” assets, partially offsetting the rise in yields, hawkish statements from Fed officials, coupled with additional strong economic data, led markets to further push back their rate cut expectations. UST yields subsequently traded within a relatively narrow range in the latter half of the month as investors waited for the Federal Open Market Committee meeting, the UST quarterly refunding announcement and April payroll numbers. At end-April, the benchmark 2- and 10-year UST yields settled at 5.04% and 4.68%, respectively, 41.5 bps and 48 bps higher compared to end-March.

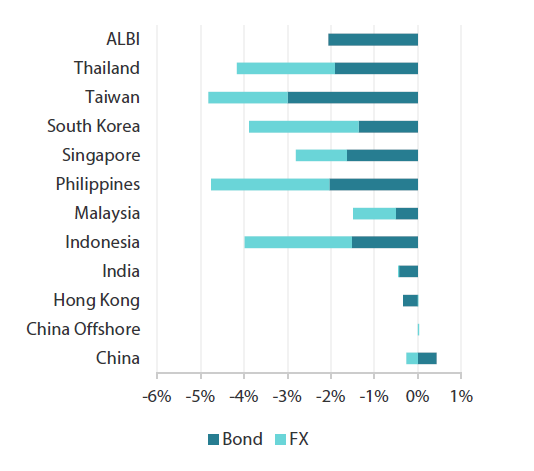

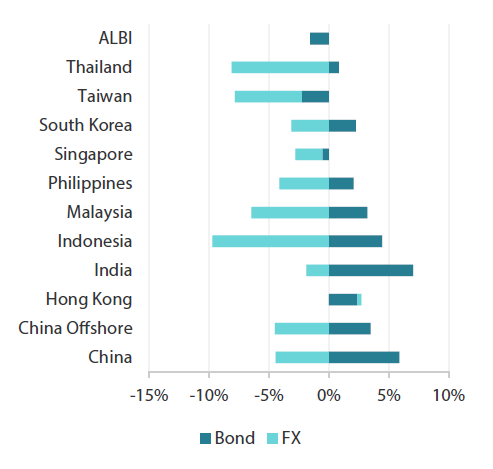

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

For the month ending 30 April 2024

|

For the year ending 30 April 2024

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 April 2024.

Bank Indonesia surprises with a rate hike while its regional peers stand pat

Indonesia’s central bank surprised markets by raising its benchmark seven-day reverse repo rate by 25 bps to 6.25%. Bank Indonesia Governor Perry Warjiyo described the decision as a “pre-emptive and forward-looking step to strengthen rupiah stability and cushion the impact of worsening global risks”. In contrast, central banks in Thailand, India, South Korea and the Philippines stood pat with their policy rates. In the Philippines, the Bangko Sentral ng Pilipinas raised its risk-adjusted inflation forecast for this year to 4.0% from 3.9% and noted that “risks to the inflation outlook continue to lean toward the upside”, partly due to the uptick in global crude oil prices, elevated food prices and higher transport and electricity costs. In India, minutes from the Reserve Bank of India’s Monetary Policy Committee meeting showed members’ optimism regarding growth and their comfort with the decline in core inflation. However, concerns persist about the risks associated with higher food inflation. Meanwhile, the Monetary Authority of Singapore (MAS) kept its overall policy settings unchanged. The MAS also retained its inflation forecast for both core and headline inflation at an average of 2.5–3.5% for the year, expecting pressures to cool further in the final quarter.

Inflationary pressures mostly ease in March

In March, headline CPI prints in China, India, Thailand and Singapore moderated. In Singapore, overall inflation eased to 2.7% year-on-year (YoY) in March, its lowest in over two years, from 3.4% in February. The slowdown was attributed to a decline in private transport costs and lower core inflation. In contrast, core CPI, which excludes private road transport and accommodation costs, rose 3.1% YoY in March. Thailand’s headline CPI fell by 0.47% YoY in March, marking the sixth consecutive month in negative territory. Core CPI rose 0.37% YoY, lower than February’s 0.43% gain. The rise in India’s headline CPI inflation moderated to 4.85% YoY from 5.09% in February. Core inflation, which excludes volatile food and energy prices, remained low, easing to 3.26% YoY from 3.39%. Conversely, headline CPI prints in Indonesia and the Philippines accelerated in March. The rise in Indonesia’s headline inflation gathered pace due to rising demand during the fasting month of Ramadan, reaching 3.05% YoY in March. This was the fastest pace since August 2023, rising from 2.75% in February. In the Philippines, headline inflation rose to 3.7% YoY in March, up from 3.4% in February, driven partly by higher food and transport inflation.

China’s Politburo calls for faster implementation of fiscal plans; Fitch downgrades outlook on China

At the end of April, the need for expedited implementation of this year’s fiscal plans was emphasised at China’s Politburo meeting. This includes the issuance of Ultra Long Special Chinese Government Bonds and Local Government Special Bonds, which are typically earmarked for infrastructure spending. The meeting also provided guidance for the central bank to lower rates and inject liquidity. On the property market, policymakers were instructed to explore measures to absorb excess housing inventory, which is a key market concern. Separately, credit rating company Fitch Ratings revised its outlook for China’s long-term foreign currency issuer default rating (IDR) from “stable” to “negative”, citing rising risks to the country’s public finances, while keeping the IDR at A+.

Market outlook

Positive on Indian bonds

The repricing of Fed rate cut expectations, along with the sustained strength of the US dollar, pose a challenge for central banks in the region. Consequently, the anticipated rate cuts that markets have factored in for the region may be at risk. UST yields have risen 41 to 50 bps across the curve following this month’s sell-off. We maintain a positive outlook for medium-term duration, finding the current yield levels attractive. In order to have a similarly positive view for long-term duration, it may be necessary for US data to soften or for decreasing rates volatility to alter the current market dynamics.

Against this backdrop, we favour Indian government bonds. Factors such as ebbing inflation and the upcoming inclusion of Indian bonds into JP Morgan’s GBI-EM Index in June 2024 are likely to bolster demand. Additionally, we expect the lower-than-expected borrowing plan for the first half of fiscal year 2025 (April to September 2024) to provide further support for Indian government bonds.

Asian credits

Market review

Asian credit spreads tighten further in April

Asian credits retreated 1.17% in April despite credit spreads tightening about 5 bps, as negative returns from USTs offset the positive contribution from spreads. The sell-off in USTs prompted Asian IG credits to underperform their Asian HY counterparts (as Asian IG credits have longer durations on the whole relative to Asian HY credits), returning -1.26% even though spreads narrowed by about 9.5 bps. Asian HY credit also registered losses, declining by 0.62%, with spreads widening by about 6 bps.

Asian credit spreads were initially unaffected by the sharp rise in UST yields, moving sideways for most of April. The overall resilience was supported by stable fundamentals and favourable technicals, as new supply remained relatively limited. Market response was also relatively calm to the news that Fitch Ratings had revised its outlook for China’s A+ IDR rating from “stable” to “negative”, citing increasing risks to the country’s public finances. Chinese property credits rallied, fuelled by speculation that policymakers would unveil more stimulus measures. During the month, China reported that its economy accelerated in the first quarter of 2024 (1Q24), with real gross domestic product (GDP) growth reaching a higher-than-expected 5.3% YoY, up from 5.2% in 4Q 2023. Elsewhere in Asia, preliminary estimates showed that South Korea, Malaysia and Singapore recorded GDP growth rates of 3.4%, 3.9% and 2.7%, respectively, in 1Q24, surpassing their growth rates from the previous quarter. Indonesia spreads widened slightly, as the weaker Indonesian rupiah and the rate hike by Bank Indonesia weighed on sentiment. Hong Kong property credits also pulled back, as profits were taken following strong performances in March. By the end of April, spreads for all major country segments, except for Indonesia and Hong Kong, tightened.

Primary market activity picks up in April

Activity in the primary market picked up further in April. The IG space saw 15 new issues amounting to US dollar (USD) 6.7 billion, including the USD 2.0 billion two-tranche issue from CK Hutchison. Meanwhile, the HY space saw two new issues amounting to USD 1.15 billion.

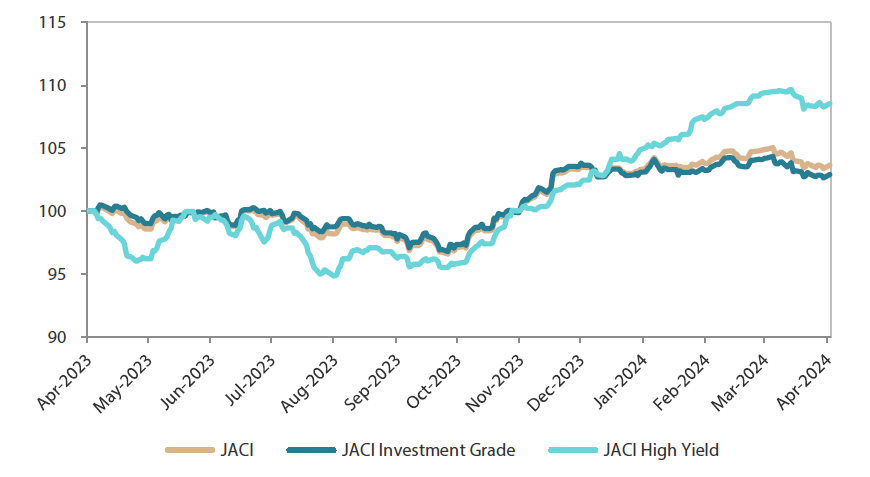

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 April 2024

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 April 2024.

Market outlook

Supportive Asia credit fundamentals and strong technicals, but tight valuation calls for caution

The fundamentals backdrop for Asian credit remains supportive. Previously in March, the National People’s Congress of China announced a 2024 growth target of “about 5%”, with a larger augmented deficit and continued accommodative monetary policy. This suggests that policymakers are aware of the challenging environment. China’s growth target still appears ambitious, given the drag from the slowdown in the property sector, which took place despite a stronger-than-expected GDP growth in 1Q24 and a recent recovery in the country’s Purchasing Managers’ Index. Meanwhile, macroeconomic and corporate credit fundamentals across Asia ex-China are expected to stay resilient with a recovery in exports growth potentially offsetting softer domestic conditions. Non-financial corporates may experience a slight weakening in both leverage and interest coverage ratios stemming from lower earnings growth and incrementally higher funding costs. However, we believe there is adequate ratings buffer for most, especially the IG corporates. Asian banking systems remain robust, with a stable deposit base, robust capitalisation and strong pre-provision profitability providing buffers against moderately higher credit costs ahead.

From a technical perspective, we expect Asia credit to remain well supported due to subdued net new supply as issuers continue to access cheaper onshore funding. Although fund flows into emerging market hard currency funds have remained weak, demand remains strong from regional institutional investors looking to lock in attractive yields. However, even after last month’s sell-off, these positive factors appear to have been largely priced in. The realisation of some negative risk factors such as a weaker-than-expected global economy, as well as local political uncertainties and geopolitical tensions, may exert some widening pressure on Asia credit spreads, particularly the IG segment.