As a virtuous inflation cycle helps boost stocks, labour shortages come into focus

As we look at the factors behind the recent rise in Japanese equities, which saw the Nikkei Stock Average touch a 33-year high at the start of July, a picture has emerged in which inflation plays a prominent role. Ongoing corporate governance reforms initiated by the Tokyo Stock Exchange and Warren Buffett’s upbeat view on Japan have been helpful for stocks. However, with the country on the throes of shaking off an entrenched deflationary mindset, a view that inflation is here to stay is perhaps the biggest factor behind the Nikkei’s recent peak. Inflation driven by expectations for sustained labour shortage-induced wage increases may have been a key incentive for macro-style investors to embrace the Japanese market. The country has been facing a shrinking labour force as its working age population has declined steadily amid a falling birth rate; more recently, the re-opening of the economy after the COVID-19 pandemic and the ensuing scramble by firms to re-hire have contributed to the labour crunch. The rise in Japan’s inflation rate could eventually slow amid declining energy and commodity prices. However, inflationary pressures are likely to persist as labour shortages enable wages to rise over the longer term.

Not too long ago the government was urging corporations to hike wages. But firms no longer need such encouragement as they compete to secure workers from a limited labour pool. Corporations also have an incentive to raise wages as sales have been improving; if this virtuous cycle continues, consumers will develop a more positive mindset and inflation will gain acceptance. Consumers are unlikely to slip back into a deflationary mindset if the rate at which wages rise can eventually outpace inflation.

As inflation takes hold, some may assume that Japan’s retail investors will turn their attention to equity investments. However, individual Japanese investors, relative to their peers in other countries, are seen to be more cautious towards stocks, and such a trait is unlikely to change overnight. And despite popular belief, stocks may not necessarily provide a good hedge against inflation. Ordinary bank deposits could offer better protection as their rates track short-term interest rates. That said, inflation may give individual investors a chance to think about stock investments in the longer term, especially ahead of the 2024 expansion of the Nippon Individual Savings Account tax-exempt investment scheme.

In sum, the current inflation phase could become an important inflection point for Japan when coupled with the recovery in domestic demand, and if external demand is spared the worst of global recessionary fears.

The BOJ under Ueda: Commendable so far but surprises could be in store

The new Bank of Japan (BOJ) Governor Kazuo Ueda, who assumed leadership of the central bank in April, has done a commendable job so far. Of note is Ueda’s ability to avoid slips of the tongue, which has helped stabilise the market. However, the new governor’s skills will be put to a genuine test if inflation becomes more entrenched, as the BOJ will then have to reconsider its easy monetary policy stance. Thus far Ueda has displayed good communication abilities. He has presided over two monetary policy board meetings at which the BOJ conveyed to the market that it will retain its easy policy for the time being.

Ueda’s relatively smooth start is due in part to his predecessor Haruhiko Kuroda, who gave the BOJ some policy flexibility by widening the yield curve control (YCC) band. The tweaking of the YCC scheme initially raised the prospect of the BOJ further adjusting, then eventually abandoning, its easy monetary policy stance. However, it now appears that policy change expectations have perhaps ebbed excessively in some quarters of the market, as demonstrated by the decline in Japanese government bond (JGB) yields. Ueda may effectively be saying that the BOJ is looking for concrete signs that inflation is here to say. If the central bank can gather such evidence, Ueda likely has the ability to communicate the BOJ’s intent to alter its policy course gradually and steadily. At the same time, Ueda has made it clear that surprises regarding the YCC scheme may be unavoidable.

When the time comes for the BOJ to change the YCC scheme, the market is expected to focus on how Ueda manages the aforementioned surprises and whether the BOJ can limit market volatility. The yen is likely to appreciate rapidly if the BOJ opts to raise interest rates or scraps YCC; the central bank could come under fire by those who focus on the perceived negatives of a stronger currency. The BOJ would undoubtedly want to avoid such a scenario and manage the surprise elements of its communication to that end. Nevertheless, we should be prepared for JGB yields to rise and not react in total shock when the BOJ does make its move; Ueda has warned, after all, that surprises are in store.

Market: Japan stocks gain in June on overseas inflows, upbeat earnings views

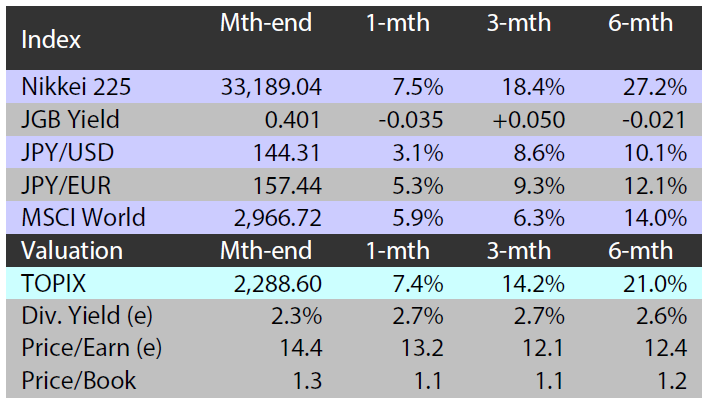

In June the Japanese equity market climbed on the back of inflows from overseas investors as well as expectations for improvement in corporate earnings as the yen further depreciated. The TOPIX (w/dividends) rallied 7.55% on-month and the Nikkei 225 (w/dividends) surged 7.61%. Stocks were somewhat weighed down by the outlook for US rate hikes to continue following Federal Reserve Chair Powell’s recent testimony, but investor sentiment improved after the US congress passed the debt ceiling bill. Japanese equities were also boosted by the BOJ leaving its accommodative monetary policy unchanged at its Monetary Policy Meeting, as well as receding concerns of deterioration in the US economy following the release of a number of positive economic indicators.

All of the 33 Tokyo Stock Exchange sectors rose on-month.

Exhibit 1: Major indices

Source: Bloomberg, as at 30 June 2023

Source: Bloomberg, as at 30 June 2023

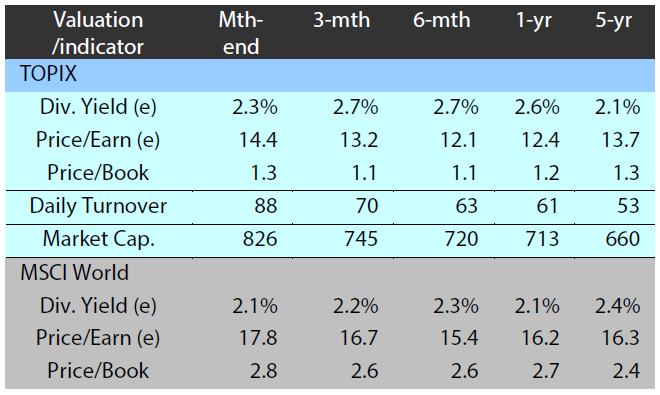

Exhibit 2: Valuation and indicators

Source: Bloomberg, as at 30 June 2023

Source: Bloomberg, as at 30 June 2023