Summary

- US Treasury (UST) yields traded in a relatively tight range in June, with short and intermediate Treasury bonds underperforming. At the end of the month, the benchmark 2-year and 10-year yields were at 4.90% and 3.84%, respectively, up 49.5 basis points (bps) and 19.3 bps compared to end-May.

- Central banks of India, Indonesia and the Philippines left their policy rates unchanged, while inflationary pressures across the region eased further in May.

- We remain constructive on relatively higher-yielding government bonds, on the back of the supportive macro backdrop for these countries. Our favourable view of higher-yielders is further grounded on the view that lower-yielding government bonds will be more vulnerable to volatility in UST bonds. As for currencies, we see Chinese renminbi (RMB) weakness weighing on the outlook for Asian currencies in the near term. Against such a backdrop, we have a more favourable view of the Indian rupee.

- Asian credits returned +0.32% in June, driven mainly by a 20 bps tightening in spreads. Asian high-grade (HG) credit registered losses of 0.16%, while Asian high-yield (HY) credit registered total returns of +3.01%.

- We expect macro and corporate credit fundamentals across Asia to stay robust, albeit slightly weaker than in 2022. Resilient domestic demand and the recovery of tourism, particularly in India and ASEAN economies, are seen offsetting the weakness in goods exports. However, regional and global uncertainties, coupled with the resilience of Asia credit thus far, make the valuation of Asia HG credit look slightly stretched compared to both historical levels and developed market spreads.

Asian rates and FX

Market review

The Fed holds rates steady

UST yields traded in a relatively tight range in June, with short and intermediate tenors underperforming. The month opened to rising yields after the US debt ceiling resolution prompted a rally in risk assets. Mid-month, the US Federal Open Market Committee (FOMC) kept its key rate unchanged—after raising it by a cumulative five percentage points since March 2022—but communicated that it was retaining a tightening bias. In particular, the FOMC signalled that two more increases are likely this year as inflation remains elevated. Although the pause was widely anticipated, the upward revision to the terminal rate estimate was largely unexpected. Besides the US Federal Reserve (Fed), other major global central banks including the Bank of England, the Bank of Canada and the European Central Bank—all of which delivered rate hikes—were likewise hawkish. Separately, key US economic data released in June remained largely above the Fed’s comfort zone. First-quarter GDP growth was revised higher, nonfarm payrolls for May increased by a bigger-than-expected 339,000 and May’s core consumer price index (CPI) remained sticky. At end-June, the benchmark 2-year and 10-year yields were at 4.90% and 3.84%, respectively, up 49.5 basis points (bps) and 19.3 bps compared to end-May.

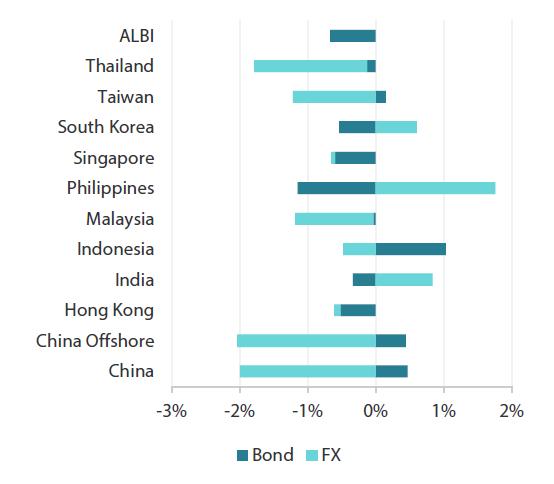

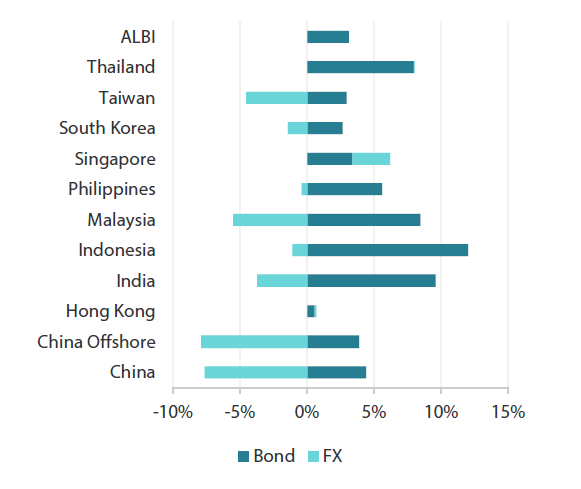

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 June 2023 | For the year ending 30 June 2023 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 June 2023.

Central banks of India, Indonesia and the Philippines leave their policy rates unchanged

Reserve Bank of India (RBI) Governor Shaktikanta Das cited uncertainty over the inflation outlook as the primary reason the central bank is staying focused on withdrawing accommodation. The RBI now projects annual inflation for the new fiscal year that started on April 2023 to register at 5.1% (from 5.2%), while it maintained the real GDP forecast at 6.5%. Over in the Philippines, Bangko Sentral ng Pilipinas (BSP) said “domestic growth momentum is expected to remain intact over the near term”, although recent data “suggest a likely moderation in economic activity over the policy horizon”. BSP also lowered its inflation forecast for 2023 to 5.4% (from 5.5%), while raising its inflation forecast for 2024 to 2.9% (from 2.8%). Separately, Eli Remolona was appointed as the next BSP governor, replacing Felipe Medalla when his term expires in July. Similarly, Bank Indonesia (BI) left its policy rate at 5.75%, with the overall tone of the policy statement remaining unchanged. BI reiterated its policy focus on maintaining currency stability and continues to forecast GDP growth of 4.5–5.3% for 2023, adding that it will employ macroprudential measures to bolster domestic demand.

Inflationary pressures ease further in May

Price pressures in the region moderated further in May. Singapore’s headline CPI rose 5.1% year-on-year (YoY) in the month, lower than the 5.7% increase in April, reflecting lower core inflation as well as a fall in private transport inflation. Consumer prices in Indonesia rose 4.0% in May, down from 4.33% in April, returning to within the central bank’s target range of 2–4% earlier than expected, prompted in part by lower transport and clothing inflation. BI had projected inflation to fall within the range only in the third quarter. In Thailand, price pressures moderated sharply, to 0.53% from 2.67%, undershooting the Bank of Thailand’s target range of 1–3%. The lower CPI print was driven largely by a sharp drop in electricity inflation amid an extension of electricity subsidies to certain households. Meanwhile, headline CPI in India cooled in May, registering 4.25% YoY—the lowest since April 2021—printing firmly within the RBI’s inflation band for the third consecutive month. Elsewhere, consumer price growth in the Philippines softened in May to 6.1% YoY from 6.6% in April as food and transport inflation eased.

Chinese economic data disappoints anew; People’s Bank of China cuts key policy rates

Official data released in the month revealed that China’s economic recovery continued to lose steam in May, prompting the government to revive its growth-supportive stance. Industrial production and retail sales growth slowed to 3.5% and 12.7% (from 5.6% and 18.4%), respectively. Fixed asset investment growth decelerated to 4.0% in the first five months of the year, down from 4.7% in the January to April period. The unemployment rate among young Chinese climbed to a new high of 20.8%. Meanwhile, aggregate financing (AF) came in at RMB 1.56 trillion, higher than April’s RMB 1.22 trillion but missing estimates of RMB 1.90 trillion. Financial institutions offered RMB 1.36 trillion of new loans in May, also missing estimates of RMB 1.55 trillion. These translated to a marked easing in the growth of both outstanding AF and RMB loans—to 9.5% and 11.4% YoY, respectively, from 10.0% and 11.8% in April.

Responding to the slew of significantly weak data, the People’s Bank of China (PBOC) lowered several policy rates and Chinese Premier Li Qiang declared that the government will take steps to boost demand. The seven-day repurchase rate, one-year medium-term lending facility rate, and one-year and five-year loan prime rates (LPR) were all trimmed by 10 bps each. The cut to the 5-year LPR—which serves as the benchmark rate for mortgage loans—undershot expectations of a 15-bps cut. Following this, the State Council pledged to roll out “more forceful measures” in a timely manner to “enhance the momentum of economic development, optimise the economic structure, and promote the sustained recovery of the economy”. However, policy stimulus has been falling short so far, with no concrete details of nationwide measures announced, prompting an eventual reversal in risk tone.

Market outlook

Prefer higher-yielding bonds

Headline inflation for most countries in the region has eased considerably, and market focus has shifted to growth. These factors are fuelling increasing expectations of central bank pivots within the latter half of the year. We remain constructive on relatively higher-yielding government bonds, on the back of the supportive macro backdrop for these countries. Our favourable view of higher-yielders is further grounded on the view that lower-yielding government bonds could be more vulnerable to UST volatility.

Prefer Indian rupee

We see renminbi weakness—prompted by concerns over slowing domestic growth and the lack of considerable policy response from Chinese policymakers—weighing on the outlook for Asian currencies in the near term. We have a more favourable view of the Indian rupee against such a backdrop. We expect low oil prices and India’s narrowing current account deficit to be supportive of rupee demand. In addition, the Indian government has recently sealed investment commitments from major multinational technology companies—a positive factor that will benefit long-term rupee demand, in our view.

Asian credits

Market review

Asian credits register positive returns in June

Asian credits returned +0.32% in June, driven mainly by a 20-bps tightening in spreads. Asian HG credits underperformed their HY counterpart, registering losses of 0.16% despite spreads narrowing 11 bps, as UST yields rose. Asian HY credit registered total returns of +3.01%, with spreads tightening 77 bps.

Asian credit spreads tightened steadily in the first half of the month. Positive risk tone was propped up largely by mounting speculation about a potential significant stimulus package from Chinese policymakers after activity and credit data were soft again in May. With data suggesting that the Chinese economic recovery is continuing to lose traction, the government revived its growth-supportive stance. In particular, the PBOC lowered several policy rates and Premier Li Qiang declared that the government will take steps to boost demand. Although some headlines reported a possible issuance of special treasury bonds to aid local government and boost business confidence, as well as probable substantial measures to address the beleaguered Chinese property market, policy stimulus eventually fell short, with no concrete details of nationwide measures being announced. This, together with another default in the China real estate space, prompted some reversal in risk tone, particularly within Chinese credits. However, encouraging US growth data released just before the end of the second quarter provided some offset, boosting demand for risk assets including Asian credits. Towards the end of the month, sentiment in frontier Asian economies turned positive as funding support from the International Monetary Fund appears more forthcoming to meet short-term external financing needs. Overall, spreads of all major country segments in Asia tightened in June.

Primary market remains subdued in June

Issuers raised a total of US dollar (USD) 9.12 billion in the primary market in June, although they were mostly sidelined before the FOMC meeting. The HG space saw 12 new issues amounting to about USD 7.60 billion, including the USD 2.0 billion two-tranche issue from Standard Chartered PLC. Meanwhile, the HY space saw eight new issues amounting to USD 1.52 billion in the month.

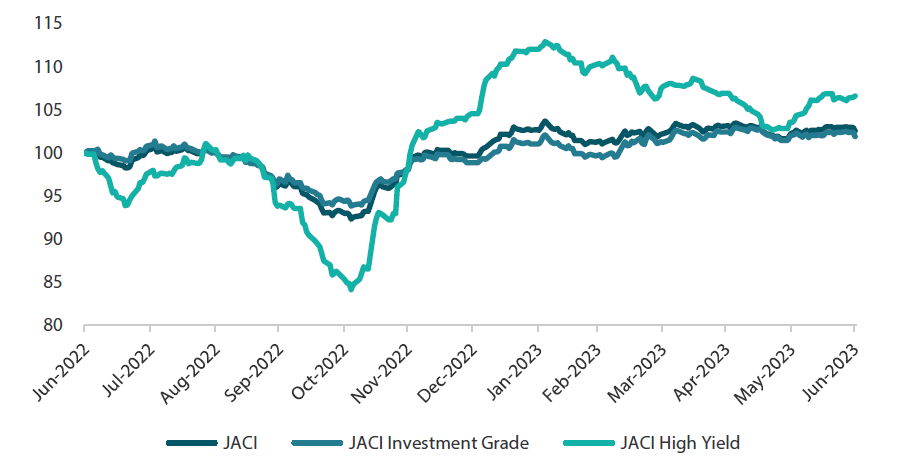

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 June 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 June 2023.

Market outlook

Asia macro and corporate credit fundamentals to stay robust, but valuation somewhat stretched

Macro and corporate credit fundamentals across Asia are expected to stay robust, albeit slightly weaker than in 2022. Resilient domestic demand and the recovery of tourism, particularly in India and ASEAN economies, are seen offsetting the weakness in goods exports. Asian banking systems remain strong; we expect a stable deposit base, robust capitalisation, benign asset quality and improving profitability to enable Asian banks to withstand the modestly more challenging growth environment ahead.

However, we are entering a more uncertain phase with multiple cross currents, both regional and global, at play. These include the Fed’s next move, recession risk in the developed markets, softening of China’s recovery momentum and ongoing geopolitical tensions. These uncertainties, coupled with the resilience of Asia credit thus far, make the valuation of Asia HG credit look slightly stretched compared to both historical levels and developed market spreads. At the same time, we think that more meaningful property easing measures from the Chinese authorities are needed to stabilise the China HY market—the delivery of which remains uncertain despite growing expectations. As such, we take a more cautious view towards risk in the near-term, while acknowledging that favourable technical conditions due to the much lower gross supply this year may keep spreads tight for some time.