Summary

- US Treasury (UST) yields fell in January, with the benchmark 2-year and 10-year yields ending at 4.203% and 3.511%, respectively, about 22.6 basis points (bps) and 36.6 bps lower compared to end-December.

- While Bank Negara Malaysia (BNM) left its policy rate unchanged, the Bank of Korea (BOK), Bank of Thailand (BOT) and Bank Indonesia (BI) raised their policy rates by 25 bps, respectively.

- The region’s inflation data for December was mixed, with headline consumer price index (CPI) numbers for China, Thailand, Indonesia and the Philippines accelerating. Inflation rates in India, Singapore and Malaysia moderated.

- China re-opened its borders on 8 January 2023. The Chinese policymakers also announced more support measures for the country’s property sector. Chinese Vice Premier Liu He proclaimed that real estate is a pillar of the Chinese economy.

- We maintain the view that global inflationary pressures may moderate further. We prefer Singapore, South Korea and Indonesia bonds. As for currencies, we favour the renminbi, the Singapore dollar and the Thai baht.

- Asian credits rose 2.98% in January, as spreads tightened about 17.45 bps and UST yields fell. Asian high-yield (HY) rose 7.15%, outperforming Asian high-grade (HG) credits, which gained 2.22%.

- We expect macro and corporate credit fundamentals across Asia ex-China to stay robust. Given the backdrop of declining UST yields and still resilient fundamentals, we believe that Asian credit spreads would stay within a range after the initial tightening at the start of the year.

Asian rates and FX

Market review

UST bond yields fall in January

USTs rallied in January and their yields fell, unwinding the bearish move at the end of 2022. The UST yield curve twisted flatter, with intermediate and long-dated Treasury bonds outperforming. Further moderation in the US core CPI amplified expectations of the US central bank being closer to a pause in its policy tightening cycle. Thereafter, the Bank of Japan’s decision to maintain its current yield curve control stance, against expectations for a policy change, together with apprehensions around a slowdown in the US following several weak domestic data prints, extended the price gains by USTs. Towards month-end, price action was largely muted as investors remained sidelined ahead of the Federal Open Market Committee (FOMC) meeting in early February. UST 2-year and 10-year yields ended January at 4.203% and 3.511%, respectively, about 22.6 bps and 36.6 bps lower compared to end-December.

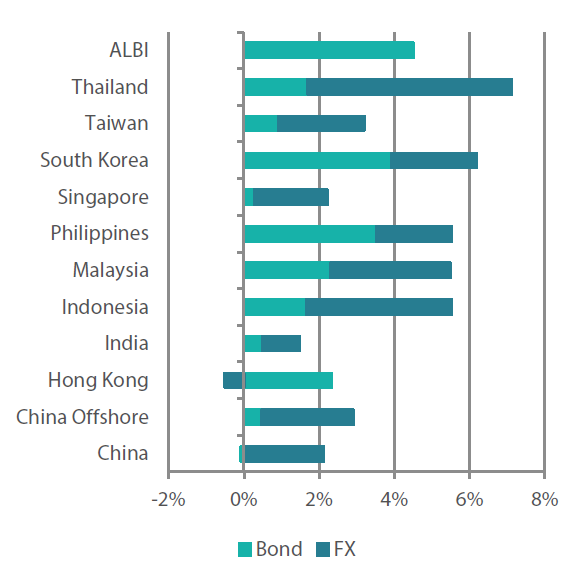

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

|

|

|

| For the month ending 31 January 2023 | For one year ending 31 January 2023 |

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 January 2023

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Central banks in South Korea, Thailand and Indonesia hike rates; BNM leaves its policy rate unchanged

Central banks in South Korea, Indonesia and Thailand raised their policy rates by 25 bps, while BNM opted to leave rates unchanged. BI commented that the cumulative 225 bps of policy rate hikes for this tightening cycle is “sufficient” to ensure core inflation stays within its target range in the first half of 2023, signalling that this might be its final hike. In contrast, the tone of BOT’s policy statement was more hawkish, declaring that “the policy rate should be normalized to the level that is consistent with sustainable growth in the long term”, signalling more potential hikes. The policy statement likewise highlighted increased upside risks to its core inflation outlook. Elsewhere, the BOK’s move was deemed dovish, as two dissenters voted to keep rates unchanged. The Korean monetary authority turned more bearish on its economic outlook, with the policy statement noting that the 2023 gross domestics product growth forecast is likely to be downgraded at its February meeting. BNM declared that the decision to pause allows the Monetary Policy Committee “to assess the impact of the cumulative past (Overnight Policy Rates) OPR adjustments, given the lag effects of monetary policy on the economy”.

Headline CPI prints mixed in December

The region’s inflation data for December was mixed. The rise by headline CPI numbers in China, Thailand, Indonesia and the Philippines accelerated, while overall inflation rates in India, Singapore and Malaysia moderated. Indonesia’s 5.51% year-on-year (YoY) headline annual inflation rate was higher than expected, propped up partly by higher prices of airfares, house rents and foodstuff. Overall inflation in the Philippines similarly quickened, inching up to 8.1% in December, as prices of food, beverages, clothing and footwear rose. In contrast, headline CPI in Malaysia moderated slightly, to 3.8% YoY in December from 4.0% in November, as food prices grew at a slower pace. Singapore’s headline CPI print similarly moderated, prompted largely by easing private transport inflation.

China re-opens it borders, announces more support measures for its property sector

China re-opened on 8 January 2023, after shutting its borders at the start of the COVID-19 pandemic three years ago. Separately, China’s policymakers announced more support measures for the country’s embattled property sector. In early January, the Chinese authorities were reported to be considering measures to shore up the balance sheets of “systemically important” developers. Private equity funds were also allowed to resume raising funds for residential property developments, while the Minister of Housing and Urban-Rural Development declared that the Chinese government would strongly support demand for first home purchases via the reduction in down payment ratios and mortgage rates and reasonably support demand for upgraders. Thereafter, headlines revealed that the Chinese regulators were encouraging financial institutions to facilitate debt extension and provide loans for the working capital of the “systemically important” developers. Towards month-end, Vice Premier Liu He proclaimed that real estate was a pillar of the Chinese economy.

Market outlook

Remain constructive on overall duration; prefer Singapore, South Korea and Indonesia bonds

We maintain the view that global inflationary pressures will moderate further. Together with a weaker global growth outlook in 2023, the US Federal Reserve (Fed) may pause hiking rates by end of the first quarter. Against this backdrop, we are broadly constructive on regional bonds, expecting most Asian central banks to be nearing the end of their rate hike cycles. Within the region, we favour Singapore government securities and South Korean government bonds, given their relatively higher sensitivities to stabilising UST yields. Meanwhile, we anticipate demand for Indonesia bonds to be supported by resumption of foreign inflows. As upward pressure on global bond yields eases, attention has refocused to their attractive real yields relative to those of their regional peers. BI’s signal that it has delivered the final hike in this cycle provides a further tailwind in the space.

Renminbi, Singapore dollar and Thai baht preferred

On currencies, we maintain our neutral to underweight view on the US dollar, anticipating waning demand for the currency when the Fed pivots. The earlier-than-expected re-opening of Chinese borders, coupled with the lifting of COVID measures, should support regional growth and foreign exchange sentiment. We expect overall Asian currencies to outperform the dollar and see the Thai baht and the Singapore dollar further outperform their regional peers. In Singapore, sticky core inflation may prompt the Monetary Authority of Singapore to keep the Singapore dollar nominal effective exchange rate on an appreciating stance. Optimism of a return to a healthy current account surplus as Chinese tourists come back bodes well for the Thai baht. Meanwhile, we see the renminbi benefitting from a pick-up in the Chinese economy amid an expected global slowdown.

Asian credits

Market review

Asian credit spreads tighten as optimism of a China recovery lifts sentiment

Asian credits rose 2.98% in January, recording its third consecutive month of gains, as spreads tightened about 17.45 bps and UST yields fell. Positive risk sentiment led Asian HY to outperform Asian HG credits. Asian HG credit gained 2.22%, despite spreads widening about 3.68 bps, on lower UST yields. Asian HY credit returned +7.15%, with spreads narrowing 163.08 bps.

Asia credit spreads tightened steadily in the month, extending the rally that started in November. Demand was buoyed by increased optimism that the US has moved beyond peak inflation, and on expectations of robust recovery in the Chinese economy with the effective removal of essentially all COVID restrictions. Chinese policymakers’ resolve to provide additional support for its property sector further reinforced positive risk sentiment. In early January, Chinese authorities were reportedly considering measures to shore up the balance sheet of “high quality” and “systemically important” developers. This was followed by news that the government was encouraging financial institutions to facilitate debt extension and provide loans for working capital. In addition, the Chief of the Ministry of Housing and Urban-Rural Development declared that the Chinese government would “strongly support” demand for first home purchases via the reduction in down payment ratios and mortgage rates, and “reasonably support” demand for upgraders. These constructive headlines triggered a significant narrowing in spreads of Chinese property credits. As global risk tone improved, fund flows into emerging markets (EM), including Asia, accelerated, with new issues in Asia credit space still underwhelming in a global context despite having picked up somewhat in January. Towards the end of the month, the release of a short-seller report on India’s Adani Group prompted some market volatility, albeit largely contained within select Indian credits. Overall, spreads of major country-segments in Asia—save for India, Indonesia, Malaysia and South Korea—tightened in the month.

Primary market activity picks up in January

New issuances for Asian credits picked up significantly in January, with 31 new issues amounting to USD 23.19 billion being raised. The HG space saw 26 new issues amounting to about USD 22 billion, including the USD 3.5 billion three-tranche issue from Export-Import Bank of Korea, USD 4.0 billion four-tranche sovereign issue from Hong Kong, USD 3.0 billion three-tranche sovereign issue from the Philippines and USD 3.0 billion three-tranche sovereign issue from Indonesia. Meanwhile, primary activity within the HY space was much more muted, with five issuers raising USD 1.19 billion in the month.

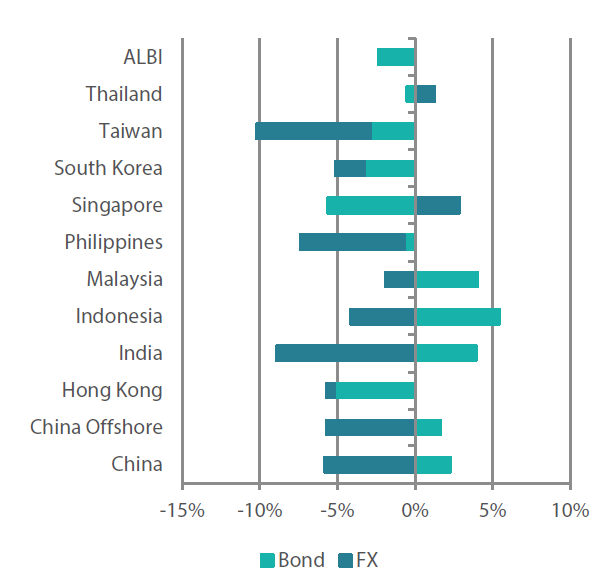

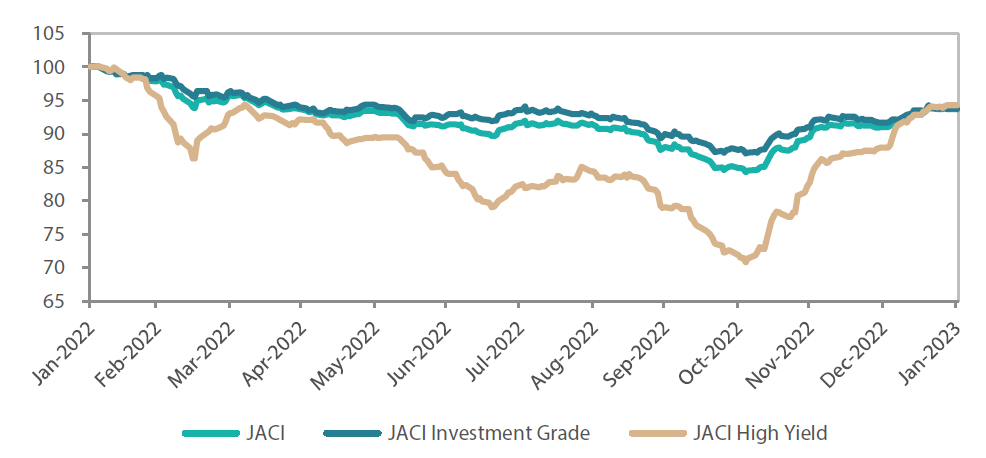

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 January 2022

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 31 January 2023

Market outlook

Technicals and resilient fundamentals to support Asia credit spreads at start of 2023

Our expectations for Asian credit spreads to tighten in the early part of 2023 are playing out, driven by the positive catalysts, including a potential slowdown in Fed rate hikes and China’s policy shifts in key areas. Indeed, peak COVID exit wave appears to have passed in major Chinese cities which, coupled with the shift towards a pro-growth and pro-market policy stance across the property and internet platform sectors, suggest an earlier and sharper growth recovery for China. This not only supports market sentiment but also provides meaningful positive spillover for other Asian economies more broadly, for example through tourism flows and support for exports of goods and commodities. Chinese leadership also appears to have softened its foreign policy stance, although geopolitical tensions are unlikely to disappear completely.

Macro and corporate credit fundamentals across Asia ex-China are therefore expected to stay robust, albeit slightly weaker than in 2022. Indian and ASEAN economies, supported by tourism rebound and domestic reopening, are expected to fare better than export-dependent North Asia. Given the backdrop of declining UST yields and still resilient fundamentals, we expect Asian credit spreads to stay within a range after the initial tightening at the start of the year.

We are nevertheless cognizant of downside risks to the base case scenario, key of which are more persistent-than-expected inflation across major economies (that would lead to a more protracted hiking cycle and a higher terminal policy rate), and a more severe economic downturn in the developed economies. The materialisation of one or more of these downside risks could lead to the widening of Asian credit spreads from current levels.