Snapshot

Relief rallies are always encouraging but do not necessarily portray parting clouds for a return to “normal” market conditions. The market is still digesting a rather dizzying array of challenging dynamics that have unfolded quickly over the last quarter, including (1) ever more aggressive central bank tightening to head off inflation, (2) a supply shock across the commodity complex which is adding to inflationary pressures and (3) the unknown knock-on effects of the Russia-Ukraine war itself as well as massive sanctions applied against Russia. These dynamics are clearly not supportive of global demand, but they do not necessarily unravel the case for a post-COVID demand recovery.

The key driver of sustainable growth in demand is mainly with the consumer. Post-COVID pent-up demand is real, and the consumer is well-positioned to make purchases from high savings, strong personal balance sheets and a decent jobs outlook. The challenge is rising inflation, which is still eclipsing the notable rise in nominal wages. In the months ahead, there may be a sense of relief as headline inflation moderates on the back of favourable base-effects, but inflation is unlikely to dissipate to levels considered “normal” between ongoing pressures from commodity prices and a new world order, which we refer to as reverse globalisation. This is the tricky part in assessing global growth dynamics when it comes to prospective central bank policy and how well the consumer can manage through both higher prices and higher rates.

Over the near-term, we are reasonably constructive on the growth outlook with a large caveat for the plethora of unknowns that have the potential to transmit longer-term structural headwinds that may be difficult for the consumer and the global economy to navigate.

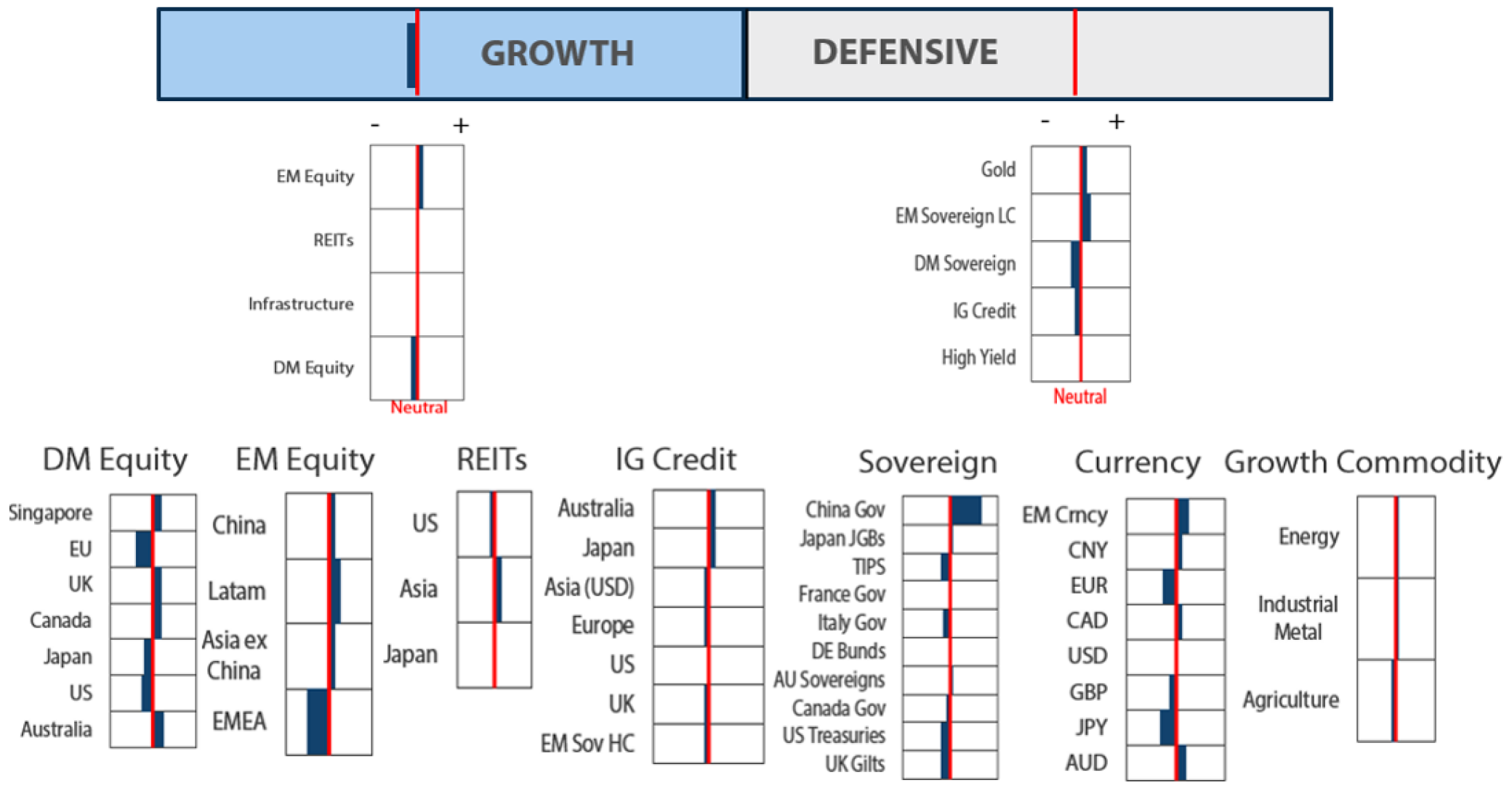

Cross-asset1

We cautiously increased growth to neutral while remaining still negative on defensive. The Russia-Ukraine war continues while the US and other NATO members have continued to add to a long list of sanctions against Russia. However, and very importantly, Russia energy exports continue to flow to Europe as of this writing, easing one of the greater concerns that energy exports might be curtailed, which would have had a more profound negative impact on the European economy. Commodity prices are on the rise, as expected, but some of the early parabolic moves shortly after the war began, indicating potential acute funding stress, have abated—for now.

We marginally decreased our negative view on Developed Markets (DM) for pockets of opportunities in a continued recovery as well as exposures to commodity-linked equities supported by attractive valuations and strong earnings growth. We still favour Emerging Markets (EM) equities, particularly given China’s latest efforts to lend policy support. On the defensive side, we increased our view on High Yield (HY) bonds to neutral as some of the acute stresses lifting spreads have abated, leaving yields attractive against a still relatively constructive growth outlook. To accommodate our lift in HY, we moderated our still-favourable view on EM Local Currency (LC) bonds and gold.

1The Multi Asset team’s cross-asset views are expressed at three different levels: (1) growth versus defensive, (2) cross asset within growth and defensive assets, and (3) relative asset views within each asset class. These levels describe our research and intuition that asset classes behave similarly or disparately in predictable ways, such that cross-asset scoring makes sense and ultimately leads to more deliberate and robust portfolio construction.

Asset Class Hierarchy (Team View1)

1The asset classes or sectors mentioned herein are a reflection of the portfolio manager’s current view of the investment strategies taken on behalf of the portfolio managed. The research framework is divided into 3 levels of analysis. The scores presented reflect the team’s view of each asset relative to others in its asset class. Scores within each asset class will average to neutral, with the exception of Commodity. These comments should not be constituted as an investment research or recommendation advice. Any prediction, projection or forecast on sectors, the economy and/or the market trends is not necessarily indicative of their future state or likely performances.

Research views

Growth assets

Allocators like ourselves typically spend their time making assessments of the contours of global demand to make dynamic allocation calls to lean toward opportunities while staying away from risks. Typically, we follow the economic cycle and smaller epicycles like the inventory cycle, but occasionally there are secular shifts that extend further down and transcend normal economic cycles, requiring a deeper think on overall portfolio construction.

This past quarter, we have witnessed several epic shifts in market behaviour—starting with a violent rotation from growth to value followed by even more aggressive gains in commodities (and inflation pressures) driven by supply shortages, exacerbated by the Russia-Ukraine war. Inflation is printing at levels not seen in over 40 years, and markets have consequently been unrelenting in pricing ever-more aggressive central bank tightening. Is this a classic market overreaction, or does it mark the beginning of a longer-term secular shift in global macro dynamics? We think it is a bit of both.

Near-term, we see inflation likely easing at the margin for the simple reason that base-effects remain supportive. Given the fickle nature of markets, it would not surprise us to see perhaps some yield compression that may lend some support to growthy assets over the several quarters. However, over the longer term (2023 and beyond), additional surprises could be in store, such as inflation not returning to perceptions of “normal” levels for an extended period.

Of course, some inflationary pressures will prove in fact transitory in some sectors—autos are a good candidate—but others are gathering steam. Commodities were in tight supply even before the Russia-Ukraine war broke out, and the war itself and the sanctions that followed will only add to the supply-side squeeze. The war is also an accelerant of deglobalisation that started with the US-China trade war and fuelled by COVID-driven supply chain disruptions wherein onshoring some production overrides incentives for pure cost efficiency in the name of national and supply-chain security.

We still believe that technology disruption will continue to assert disinflationary forces, but the tides are shifting quickly—perhaps too quickly for the positive impacts to be realised to fully counteract the inflationary forces that are in place today. The still open questions on the durability of higher inflation dynamics are the labour market (whether workers can command ever-higher wages) and central bank policy (whether demand will be sacrificed to head off sustained inflation). No path is certain, so we aim to be adaptive and nimble in adjusting our views as events unfold.

Changing growth dynamics and implications for portfolio construction

We have written for some time on the benefits of commodity-linked equities, both for supportive fundamentals as well as their natural hedging characteristics against inflation. Given current inflation dynamics and the potential for more durable inflation beyond 2022, we shall take a step back to consider how not just commodity-linked assets can work in concert with other natural inflation hedges to protect the purchasing power of the portfolio—taking into those assets that fall into the defensive category as well.

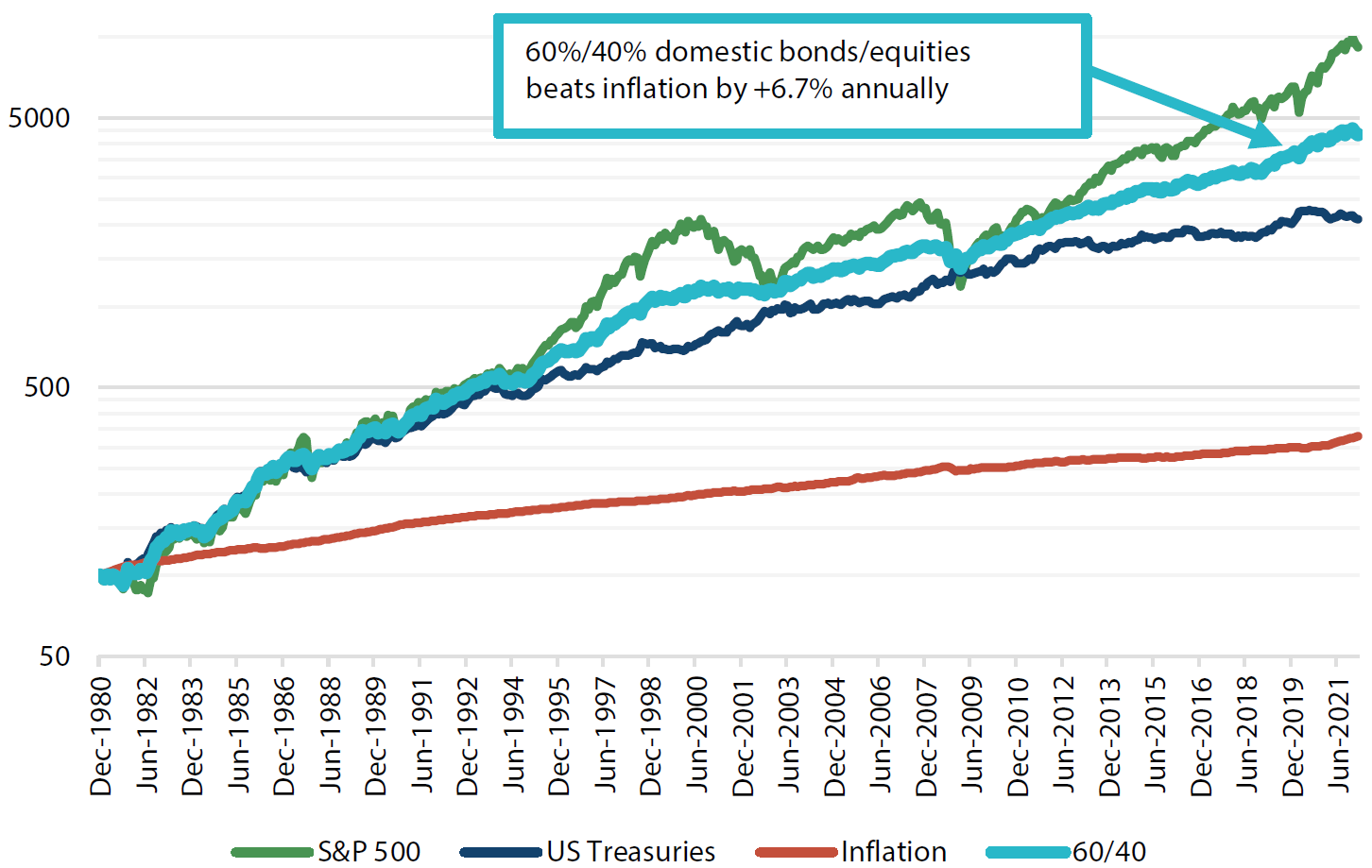

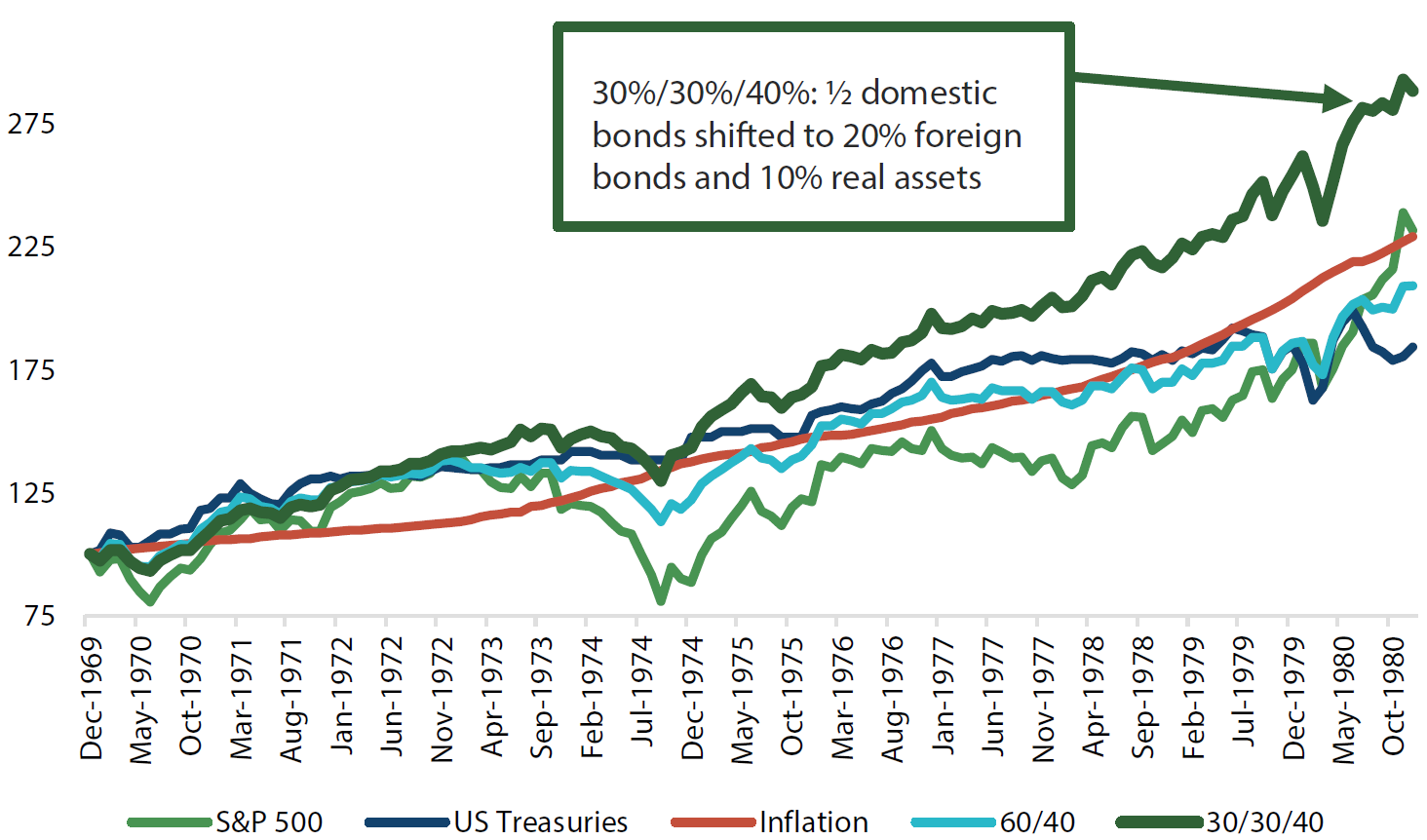

Generally, growth assets perform best when inflation is in decline or stable at reasonable levels. Disinflation expands profits as well as earnings multiples—particularly when yields compress so low that ordinarily very risk-averse investors are forced up the risk spectrum to protect purchasing power in an otherwise paltry yield environment. This ongoing dynamic has supported the balanced investor for more than 40 years, handily beating inflation not just to preserve purchasing power but also to expand it through capital appreciation.

Chart 1: 1980–today: US balanced investors enjoying 40 years of disinflation bliss

Source: Bloomberg, April 2022

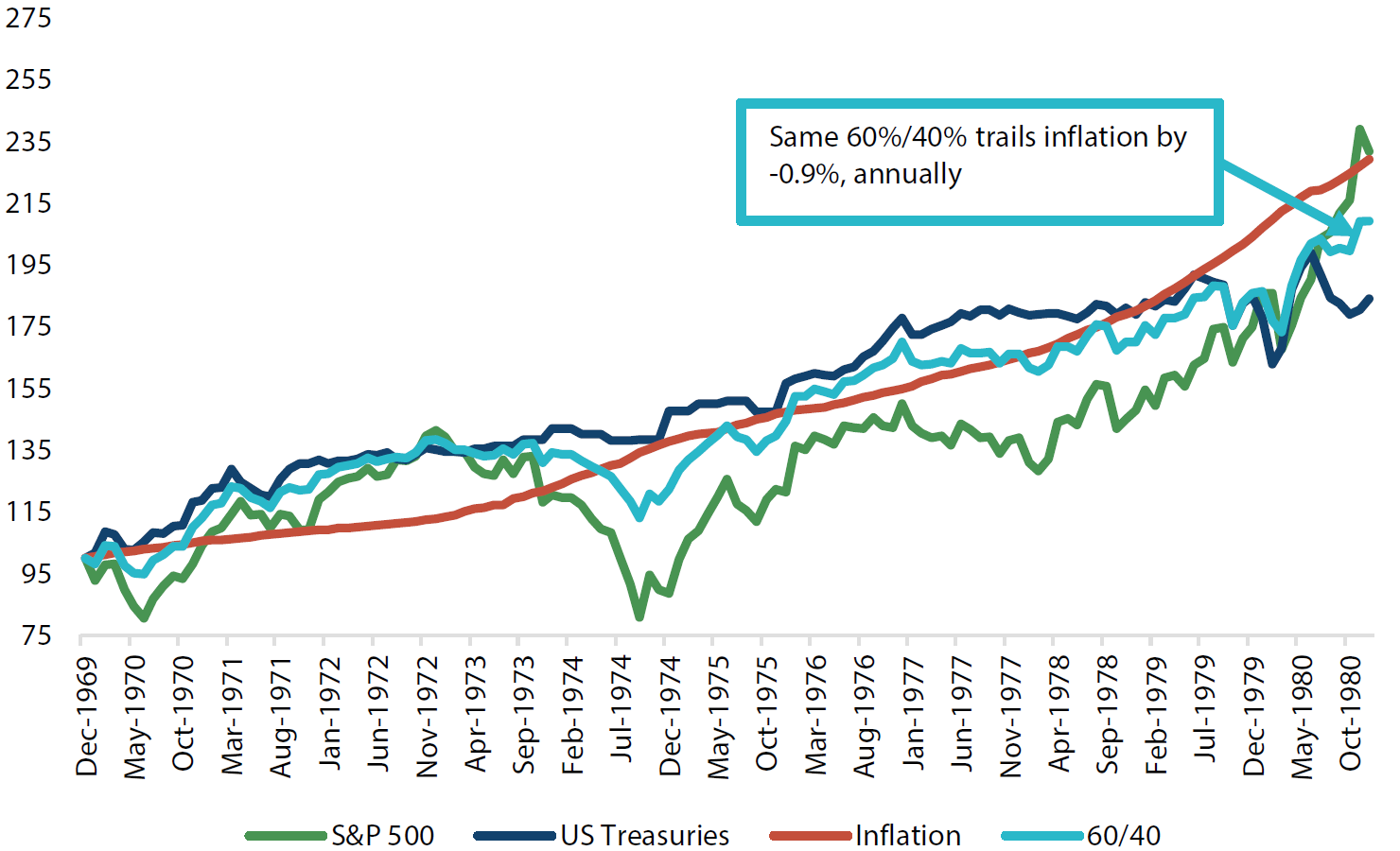

Of course, the beginning and ending points matter a great deal. In the early 1980s, inflation was just beginning to ease from a double-digit peak when equities and bond were very inexpensive, particularly when considering that inflation pressures were finally beginning to ebb. Disinflation over 40 years is a long time, helping to erase memories of inflationary dynamics in most market participants, so it is important to look even further back into history when inflation pressures were building and less kind to the balanced investor—in this case the 1970s.

Chart 2: 1970s: US balanced portfolio inflation stumble

Source: Bloomberg, April 2022

How can a balanced investor hedge inflation to preserve purchasing power? Real assets, such as gold and other commodities, can naturally hedge inflation, but foreign bonds (half FX unhedged) can also help to buffer the portfolio against local inflation. During the 1970s, Bundesbank (the central bank of Germany) was the notable standout in employing orthodox monetary policy (against the many that kept policy easy), supporting its bond market and also its currency, making it sensible to leave at least part of currency exposure unhedged.

Chart 3: 1970s: US balanced portfolio inflation hedged

Source: Bloomberg, April 2022

Today, real assets are also favoured as a natural inflation hedge while the People’s Bank of China is the standout central bank among its developed market peers, which favours China bonds and also the CNY currency. Global diversification in the equity space is a long-accepted principal of helping to provide more stable returns, and today there are many value opportunities, which are supportive in preserving purchasing power as well as capital appreciation objectives. The key moving forward is always remaining adaptive and nimble in responding to a quickly evolving global macro environment, assessing inflation dynamics against global growth dynamics as well as central banks’ response.

Conviction views on growth assets

- Remain cautious on secular growth: While we see the potential for inflation “relief” as a function of favourable base-effects in the months ahead that may offer a reprieve for some still expensive pockets of secular growth assets like the US technology sector, we remain cautious for long-term headwinds for including a rising rate environment and earnings growth that may have further to mean-revert in line with removal of stimulus policies.

- Favour quality growth currencies: Commodity price pressures are supportive of terms of trade for commodity exporters like the Australian dollar (AUD) and (Canadian dollar) CAD in developed markets, and also select emerging markets where central banks adhere to orthodox monetary policies to stay ahead of inflationary pressures.

- REITs and Infrastructure: In addition to commodity-linked equities, these alternative growth assets also offer a natural hedge to inflationary pressures and potential headwinds to cyclical growth; however, we remain selective to mitigate exposures that are negatively sensitive to rising rates.

Defensive assets

We maintained our negative view on sovereign bonds this month. Central bank hopes that inflation pressures would eventually subside have been dashed by surging energy prices as war rages in Ukraine. Many officials are now sounding the alarm and are communicating more urgency to tighten monetary policy. The first hike has been delivered in many countries and markets continue to ratchet up their expectations of terminal cash rates. While we anticipate opportunities to arise in sovereign bonds over coming months, we believe patience will continue to be rewarded for now.

At the same time, rising rates continue to provide substantial headwinds for global credit returns as well. Credit spreads have shown some signs of stabilising, but it has not been enough to offset the negative impact of higher rates. Even though credit quality remains strong, we remain cautious until there is more visibility around the conflict in Ukraine and until hawkish central bank sentiment begins to stabilise.

Within the defensive asset universe, gold continues to be one of the few bright spots. It provides a good hedge for macroeconomic risks on inflation, monetary policy and geopolitical uncertainty. However, we have tempered our view slightly as annual inflation measures are set to peak along with a reversal of base effects in the quarter ahead. Some supply stresses are also easing, and oil prices have retreated from their highs after the strong war-induced surge. On balance though, there is still plenty of uncertainty around each of these factors that should help maintain a healthy interest in gold.

All about that base (effect)

Global fixed income markets have just completed their worst quarter in many decades. The main driver of soaring bond yields has been a significant repricing of central bank monetary policy tightening expectations. The US Federal Reserve (Fed) for example, is now expected to raise its Fed Funds rate by an additional 2% this year to 2.5%. At the end of 2021, just four months ago, the market was expecting a modest hiking pace to just 1% by the end of 2022.

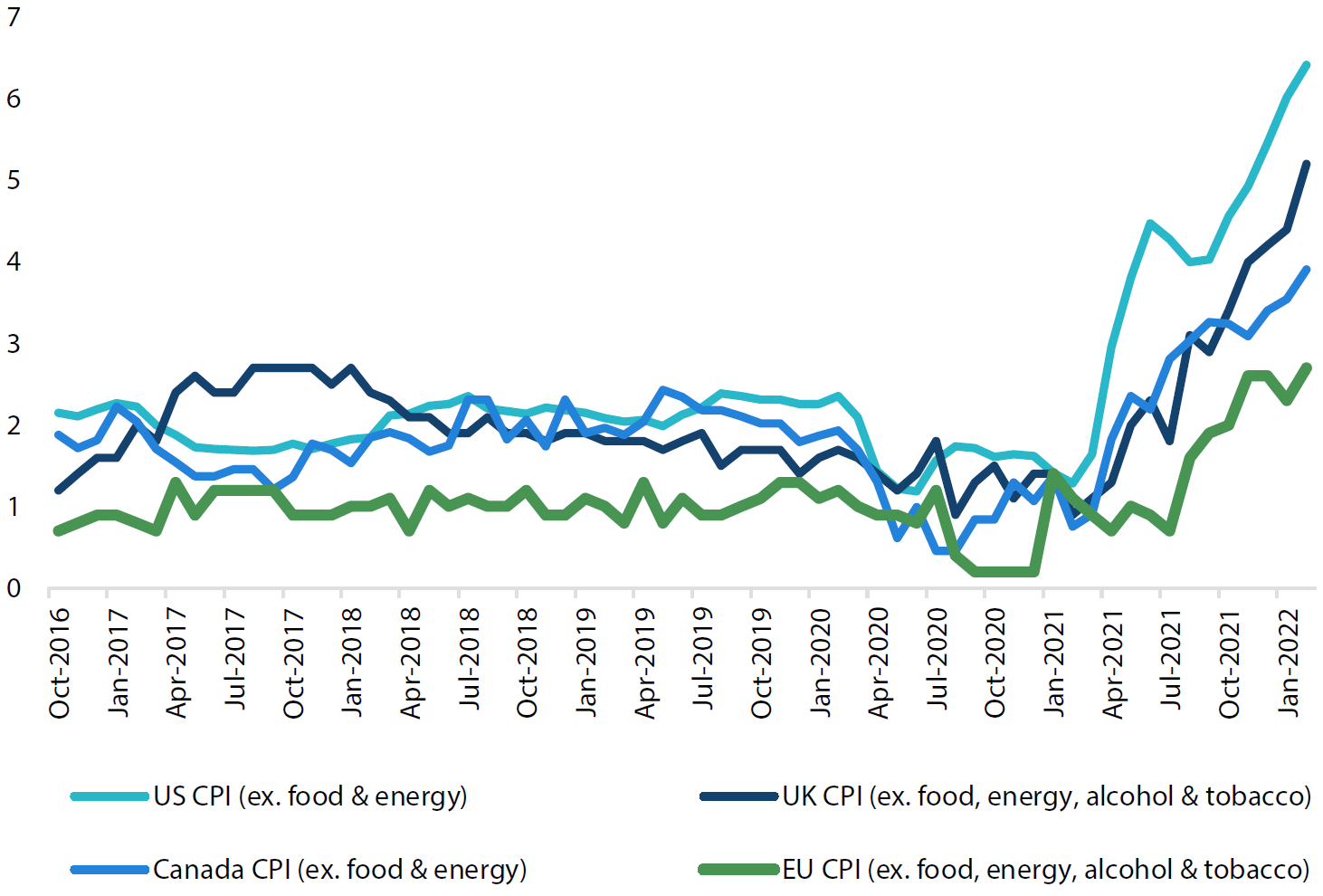

Markets and central banks have largely been on the same page, recognising a more urgent need to remove monetary policy accommodation that has been in place since March 2020 in response to the pandemic. Fuelling this repricing has been a rabid rise in inflation. Chart 4 shows annual core inflation over the last five years using CPI less food and energy for the US and Canada, and CPI less food, energy, alcohol and tobacco for the UK and Europe. Core inflation rates are clearly very elevated relative to history and well in excess of the 2% inflation target referenced by these central banks, providing ample justification for the repricing of expectations.

Chart 4: Core inflation over the past five years

Source: Bloomberg, March 2022

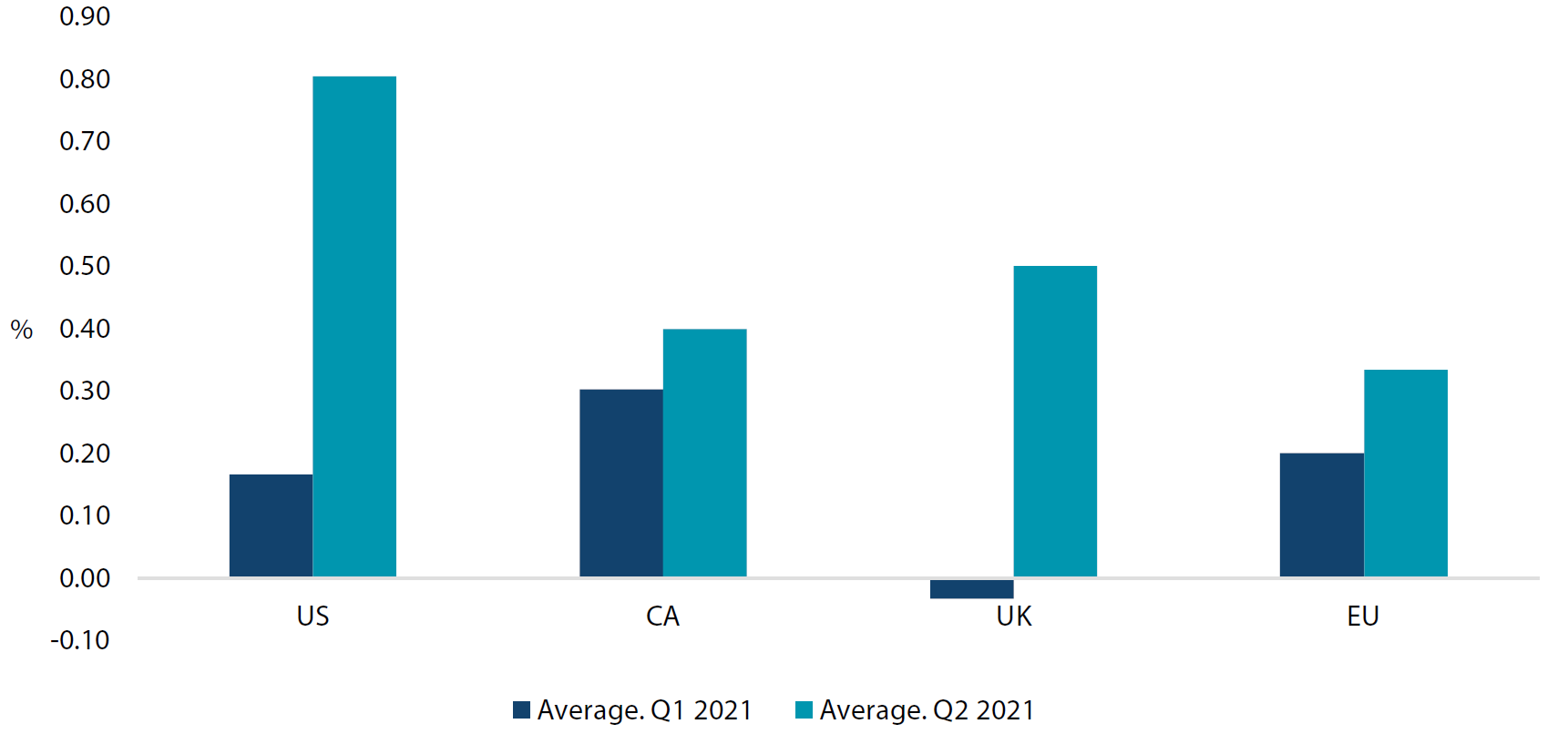

However, the current ensemble of market analysts and central bank officials insisting on more and more rate hikes may be too focussed on annual inflation rates today and are potentially underappreciating the potential path of core inflation for the balance of this year. Chart 5 shows the average monthly core inflation outcome for both the first and second quarters of 2021 for each of our countries. The point of this exercise is to gauge the base effect that has been impacting the annual inflation data. The low monthly readings in the first quarter last year have been replaced by higher readings this year, which has seen the annual inflation rates push higher. When we think about the upcoming second quarter for annual inflation, the base effect will transition from pushing rates higher to helping them move lower. This change in the base effect is most pronounced in the US and UK but is also evident in Canada and Europe.

Chart 5: Average monthly core inflation

Source: Bloomberg, March 2022

Given that the inflation narrative has been overwhelmingly bearish so far this year, we think that this base effect change for core inflation has the potential to interrupt this narrative as annual inflation begins to retreat. Once this spell is broken, or at least softened, investors are likely to appreciate the much more attractive yields on offer in sovereign bonds. This change could open up tactical opportunities to seek better returns from fixed income in the coming quarter.

Conviction views on defensive assets

- Sovereign bond yields reach attractive levels: The recent surge in annual inflation has likely peaked for now, opening up tactical opportunities to seek attractive yields in longer-duration bonds.

- China bonds still favoured: China’s government bonds offer higher yields and continue to display low correlation to global rate moves. The renminbi has also been strong, attracting safe haven demand under the steady hand of the People’s Bank of China.

- Emerging market (EM) bonds present value: EM central banks are well ahead of the developed world in terms of normalising rates in response to inflation pressures and therefore EM bonds offer attractive yields.

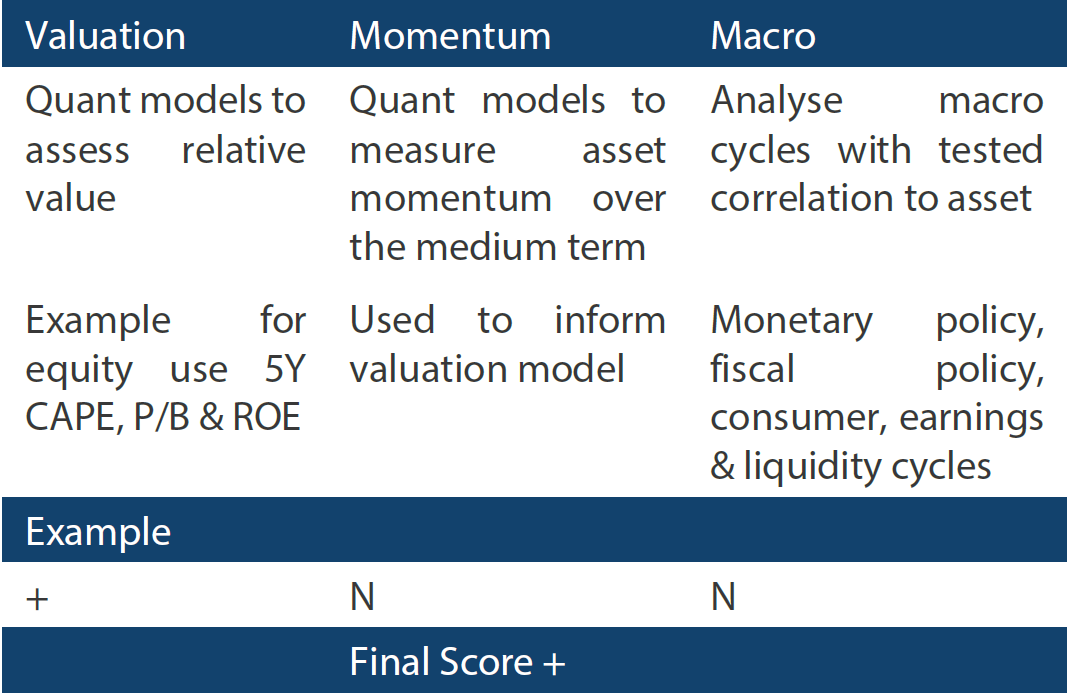

Process

In-house research to understand the key drivers of return: