Summary

- US Treasury (UST) yields mostly fell in November, with the benchmark 2-year and 10-year yields declining to 4.312% and 3.607%, respectively, 17.3 basis points (bps) and 44.3 bps lower compared to end-October.

- Inflationary pressures within the region varied in October. The central banks of Malaysia, Indonesia, South Korea and the Philippines hiked policy rates in November. Gross domestic product (GDP) growth for some ASEAN countries rebounded in the third quarter.

- China further relaxed its COVID restrictions even as the infected case statistics have continued to climb since the beginning of 2022. Policymakers stepped up their support for the property sector by announcing a 16-point rescue package to ensure the “stable and healthy development” of the Chinese property sector. The People’s Bank of China (PBOC) cut the reserve requirement ratio (RRR) for most banks, effective 5 December 2022.

- We prefer Singapore, South Korea, India and Indonesia government bonds. We favour the Singapore dollar as we see further room for its outperformance against other regional currencies.

- Asian credits gained 5.47% in November, as spreads tightened by about 82 bps and UST yields dropped. Asian high-yield (HY) surged 15.25%, outperforming Asian high-grade (HG) credits, which gained 3.86%.

- Going forward, we believe there is room for Asian credit spreads to tighten in the early part of 2023 given the light positioning of global investors; fresh capital and risk allocation to the asset class at the start of the year may also contribute to the spread tightening.

Asian rates and foreign exchange (FX)

Market review

USTs rally in November

UST yields mostly fell in November. Yields initially treaded higher as the US Federal Reserve (Fed) delivered a well-telegraphed 75 bps rate hike at the Federal Open Market Committee (FOMC) meeting. Although the accompanying statement signalled a possible deceleration in the pace of tightening, Fed Chair Jerome Powell’s comments at the FOMC press conference tempered the dovishness, as he declared that “incoming data suggests the ultimate level of interest rates will be higher than previously anticipated”. Meanwhile, US non-farm payrolls increased by 261,000 in October, trumping estimates again. Monetary policy expectations quickly shifted lower after the rises in the US October headline and core consumer price indexes (CPI) were more moderate than forecast. Hopes that inflationary pressures are finally ebbing, given that the headline CPI print had eased for the fourth consecutive month, prompted a significant rally in USTs as well as risk assets. UST yields continued to drift lower thereafter, supported partly by the softer-than-anticipated producer price index (PPI) inflation data and the minutes from the Fed’s recent meeting which were perceived to be largely dovish by the markets. At the end of the month, the benchmark 2-year and 10-year UST yields were at 4.312% and 3.607%, respectively, 17.3 bps and 44.3 bps lower compared to end-October.

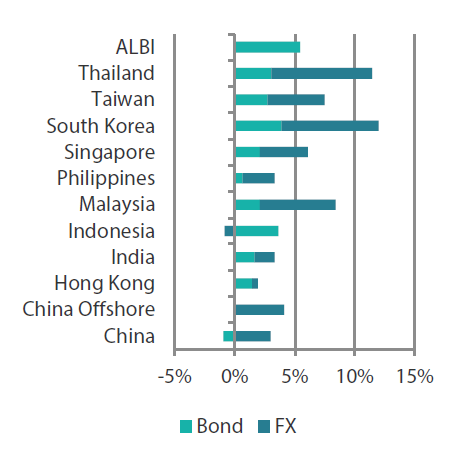

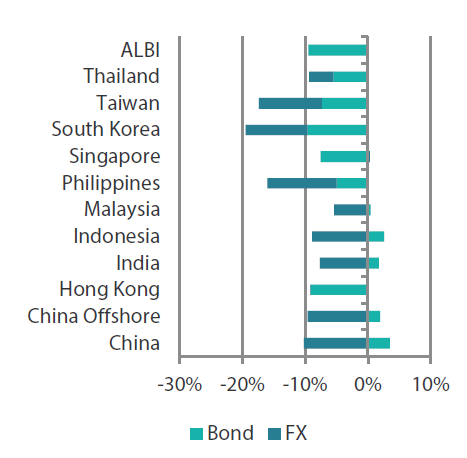

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 November 2022 | For one year ending 30 November 2022 | |

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 November 2022

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Headline CPI prints generally moderate in October

The rise in headline CPI prints in China, India, Indonesia, Malaysia, Singapore and Thailand eased but accelerated in South Korea and the Philippines. In Singapore, the rise in both the headline and core CPI inflation prints moderated, partly on smaller increases in prices of electricity & gas, retail and other goods and services. Similarly, overall inflation in Thailand moderated in October, on the back of easing energy and raw food inflation. Thailand’s core inflation, however, remained sticky, increasing marginally to 3.17% year-on-year (YoY) from 3.12%. In Malaysia, headline CPI moderated to 4.0% YoY, driven largely by slower transport inflation and smaller increases in prices of housing/utilities/fuels. Inflationary pressures in Indonesia similarly eased, due partly to a drop in food inflation. In contrast, headline CPI in the Philippines accelerated to 7.7% YoY on the back of rising food prices, faster than the 6.9% figure recorded in the preceding month. Stripping out prices of volatile commodities, core inflation in the Philippines also jumped, rising to 5.9% in October from an upwardly revised 5.0% in the prior month.

GDP growth rebounds in the third quarter

Countries in the region posted faster GDP growth in the three months ending September 2022. Economic activity in the Philippines accelerated to 7.6% YoY in the third quarter, up from an upwardly revised 7.5% in the prior quarter. Similarly, GDP growth in Indonesia improved, to 5.72% YoY (from 5.45%), as investment growth picked up while private consumption weakened. Over in Malaysia, economic activity—boosted also by rising domestic demand and strong exports—rose 14.2% YoY in the third quarter. Elsewhere, Thailand’s economy grew at its fastest pace in over a year in the same period. GDP growth improved to 4.5% YoY (from 2.5%), supported partly by a rise in domestic demand.

Central banks continue to hike policy rates

The central banks of Malaysia, Indonesia, South Korea and the Philippines hiked their policy rates again in November. Bank Negara Malaysia raised its policy rate by 25 bps to 2.75%. Similar to the previous meeting, the Monetary Policy Committee remained relatively optimistic about the growth outlook. Bank Indonesia lifted its key rate by another 50 bps to 5.25%, with Governor Perry Warjiyo describing the move as “pre-emptive” and “front-loaded” to cap inflation pressures and shore up the country’s currency. Similarly, the Bangko Sentral ng Pilipinas (BSP) raised its policy rate by 75 bps to 5.0% to arrest inflation, after raising rates by 50 bps in September. Notably, the BSP is projecting inflation to average 5.8% for this year and 4.3% in 2023. Meanwhile, the Bank of Korea (BOK) slowed the pace of policy tightening, raising its policy rate by a more modest 25 bps, following a 50-bps hike in the prior meeting. Moving forward, BOK’s governor also declared that the central bank would weigh domestic conditions in its policy decision, a shift from its previous focus on the Fed and foreign exchange market.

China eases COVID curbs despite rising infection cases; policymakers step up property sector support

China further eased its COVID restrictions even as case numbers increased to their highest levels since early 2022. Quarantine periods for close contacts and inbound travellers were reduced, and the penalty for airlines bringing in an excessive number of infected passengers was removed. The authorities also began to refine their zero-COVID policy implementation to reduce the impact on people’s lives. Separately, China’s policymakers stepped up their support for the property sector significantly. They unveiled a 16-point rescue package to ensure the “stable and healthy development” of the country’s embattled property sector. Following this move, several of the China’s largest banks pledged to provide at least Chinese yuan (CNY) 1.28 trillion in funding and/or credit lines for property developers. Subsequently, listed firms were allowed to resume private placements to raise funds to complete housing projects, build affordable housing and to finance working capital or debt repayments. In addition, it was reported that China Bond Insurance Co.—the state-backed company which launched a program guaranteeing local bond sales of cash-strapped developers—loosened the requirements for developers to access such funding. Meanwhile, the PBOC announced that it will cut the RRR for most banks, effective 5 December 2022. The PBOC expects the move to release about CNY 500 billion in loanable funds.

Market outlook

Prefer Singapore, South Korea, India and Indonesia bonds and the Singapore dollar

Global markets await the Fed’s pivot, and we believe the initial phase could be close. We share the view that the pivot will likely be in three phases, starting with the Fed tempering its pace of monetary policy tightening, then pausing its rate hikes to assess the impact of the delivered tightening measures before finally signalling that the inflationary trend has turned and that a rate cut is imminent.

From a market perspective, we expect monetary policy outlook to remain the primary driver of global rates moves in 2023.; we also believe that a Fed pivot will prompt a decline in global bond yields. Consequently, we have shifted to be more positive on duration overall, on the assessment that we are likely past peak hawkishness from the Fed and other developed market (DM) central banks. In particular, with the Fed Funds rate at around 4%, we believe the Fed is on the cusp of decelerating the pace of monetary policy tightening. We expect the UST yield curve to remain inverted in the near term, as rising concerns around growth coupled with easing inflation expectations place downward pressure on long-end yields. That said, should the actual terminal rate fall short of what the market is currently implying, short-end UST yields could start to outperform when the Fed’s first phase of pivot materialises.

Against regional peers within Asia, we favour Singapore and South Korean government bonds, given their relatively higher sensitivity to stabilising UST bond yields. Meanwhile, India and Indonesia bonds are likely to generate demand when upward pressure on global bond yields eases, with the market expected to focus on their attractive real yields relative to those of their regional peers.

On currencies, we take a neutral to underweight view on the US dollar, as we see waning demand for the currency when the Fed pivots. We expect overall Asia FX to outperform the US dollar and see further room for the Singapore dollar’s outperformance against other regional currencies as sticky core inflation may prompt the Monetary Authority of Singapore to keep the currency’s nominal effective exchange rate on an appreciating stance. Meanwhile, demand for the Thai baht could increase meaningfully once China reopens its borders and further boosts tourism flows into Thailand.

Asian credits

Market review

Asian credits stage a significant rally in November

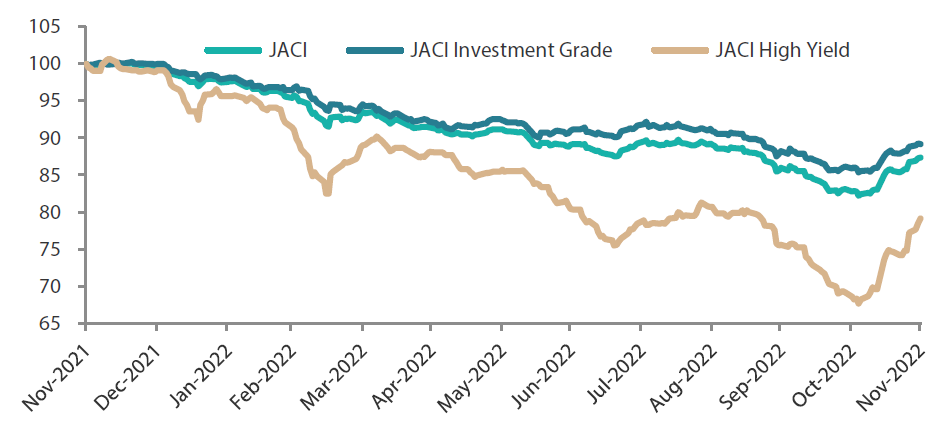

Asian credits gained 5.47% in November, as spreads tightened by about 82 bps and UST yields dropped. The marked improvement in risk sentiment led Asian HY to outperform Asian HG credits. Asian HG credit gained 3.86%, with spreads tightening about 36.7 bps, and Asian HY credit returned +15.25%, with spreads narrowing 436.5 bps.

Asian credit spreads traded within a relatively tight range in early November. Spreads initially felt upward pressure from Fed Chair Powell’s hawkish comments. Spreads were exposed to further upward pressure following a South Korean insurance company’s decision not to call its perpetual capital security at the first call date, although this decision was subsequently reversed after the event caused significant stress to the subordinated capital instruments issued by Korean financial institutions. These institutions were already on a fragile footing due to stresses in the onshore credit and short-term funding markets. Meanwhile, expectations towards China relaxing its COVID measures offset some of the pressure. Towards mid-month, several positive headlines triggered a significant move lower in spreads. The weaker-than-anticipated US October CPI fuelled hopes that the Fed would temper its pace of monetary policy tightening, prompting a sharp rally in risk assets. In China, authorities further eased COVID restrictions despite rising infection cases and amplified their commitment to contain the property crisis. The buoyant market sentiment encouraged fund inflows into emerging market (EM) bond funds and overshadowed the deteriorating COVID situation and weak China macro data. Overall, all major country segments in Asia, save for South Korea, narrowed during the month, with Macau gaming credits registering strong performance on optimism regarding further relaxation of China’s COVID restrictions. An announcement that Macau’s six incumbent operators had been awarded the gaming concessions for the next 10 years added to the positive tone.

Primary market activity remains quiet in November

Supply remained muted, with a total of just 22 new issues in the month. The primary market was largely shut in the first half of November, as issuers stayed on the side lines following the Fed meeting and some volatility in the financials space—particularly among South Korean credits. Activity picked up in the latter half of the month, as overall risk tone turned positive. The HG space saw just eight new issues amounting to USD 2.37 billion, while the HY space saw 14 new issues amounting to about USD 2.35 billion.

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 November 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2022

Market outlook

Technicals and resilient fundamentals to support Asia credit spreads at start of new year

We believe there is room for Asian credit spreads to tighten in the early part of 2023 given global investors’ light positioning, as well as the potential for fresh capital and risk allocation to the asset class at the start of the year. This comes against the backdrop of some positive catalysts, including a potential slowdown in Fed rate hikes and China’s policy shifts in certain key areas including COVID management, the property sector and internet platforms. Once the initial wave of inflows and deployment are over, the evolution of Asian credit spreads could become more tentative and there might be more volatility from the second quarter of 2023 onwards depending on the developments of growth and inflation, and consequently monetary policy, in the developed markets.

In our base case, disinflation is likely to become a stronger narrative in the US as we move through 2023. The US economy could experience a mild recession sometime in 2023, although the timing is uncertain. The balance of risk between a soft (very weak growth but no recession) and hard landing (more severe recession) scenarios seems even at this point. In our base case is for UST yields to gradually move lower through 2023.

China’s policy shifts is expected to support growth recovery in 2023, although risks around implementation and policy predictability remain. To be sure, China’s exit path from zero-COVID approach is likely to be gradual and stop-start in nature given the population’s low natural immunity and the country’s under-equipped healthcare system. China’s determination to follow through on the relaxation of COVID measures and expand support to the property sector beyond just financing to demand-oriented measures in order to revive new home sales growth will be critical, in our view, for sustaining positive investor sentiment towards China credits—both HG and HY. At the same time, while geopolitical tensions seem to have stabilised, latent risks remain, particularly around technology and the Taiwan issue.

Macro and corporate credit fundamentals across Asia ex-China are expected to stay robust, albeit weaker given the softness in exports, tighter global financial conditions and higher domestic interest rates. India and ASEAN economies, supported by tourism rebound and domestic reopening, are expected to fare better than export-dependent North Asia. Given the backdrop of declining UST yields and still resilient fundamentals, we expect Asian credit spreads to stay within a range after the initial tightening at the start of the year.

There are nevertheless downside risks to the base case scenario, key of which are more persistent-than-expected inflation across major economies which could lead to a more protracted hiking cycle and a higher terminal policy rate, a more severe economic downturn in the developed economies, backtracking of China’s easing policies on COVID and the property sector, and local funding and credit market stress, such as the one experienced by South Korea in October and November 2022. The materialisation of one or more of these downside risks could lead to the widening of Asian credit spreads from current levels.