Market review of the past year

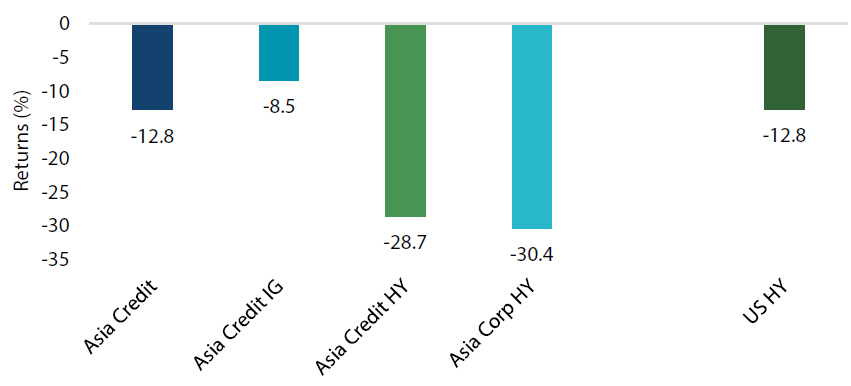

For the 12-month period through June 2022 Asian credits retreated 12.8% in total return as credit spreads widened and US Treasury (UST) yields surged. During the same period, Asia corporate high yield (HY) retreated 30.4% as credit spreads widened by about 291 bps. A combination of global market volatility and Asia-specific developments prompted weakness in Asian credits at the start of the period. The spread of the COVID-19 Delta variant across the world, alongside supply chain disruptions and rapidly rising inflation, gave rise to concerns over the resilience of the global economic recovery, weighing on risk sentiment.

Chart 1: Asia credit performance (July 2021 to June 2022)

Source: Nikko AM, Bloomberg, based on JPMorgan Asia Credit Index – JACI and Bloomberg US Corporate High Yield Index, as at 30 June 2022.

Source: Nikko AM, Bloomberg, based on JPMorgan Asia Credit Index – JACI and Bloomberg US Corporate High Yield Index, as at 30 June 2022.

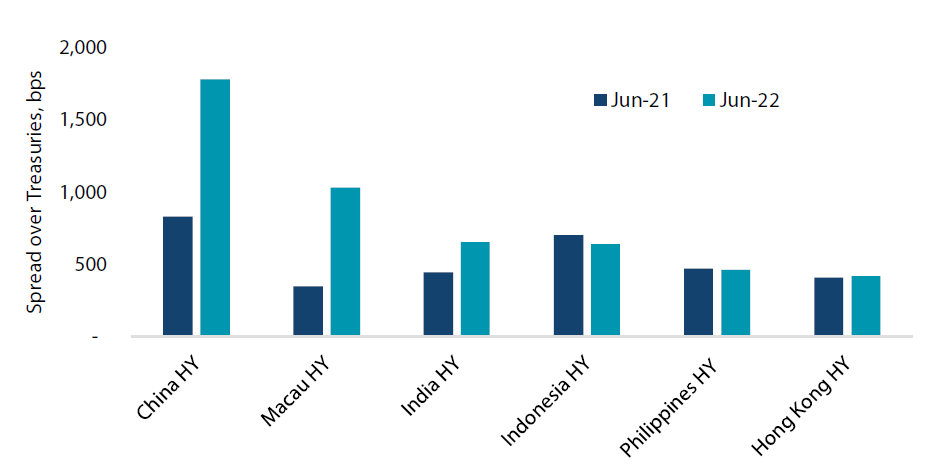

Regionally, the Chinese real estate sector, particularly the HY segment, was deeply affected by the Chinese government’s ongoing property tightening measures. In addition, persistent negative headlines and liquidity pressure facing a few weak companies broadly impacted the rest of the sector. China HY bonds contributed the most to the sharp decline in Asia HY performance. Concerns surrounding the potential default of one of China’s largest real estate conglomerates, China Evergrande Group (Evergrande) came into focus in August 2021. Negative developments intensified in September 2021, culminating in multiple-notch rating downgrades by all three major rating agencies, and Evergrande missed coupon payments on certain US dollar (USD) bonds. Negative headlines about liquidity stress and rating downgrades spread to other Chinese property companies. Towards the end of 2021, the People’s Bank of China (PBOC) unexpectedly cut the Required Reserve Ratio (RRR), showing a shift in the government’s policy priority towards ensuring growth stability in 2022. That said, overall risk sentiment remained subdued as investors weighed the potential negative impact on global mobility and growth recovery following the rapid spread of the COVID-19 Omicron variant.

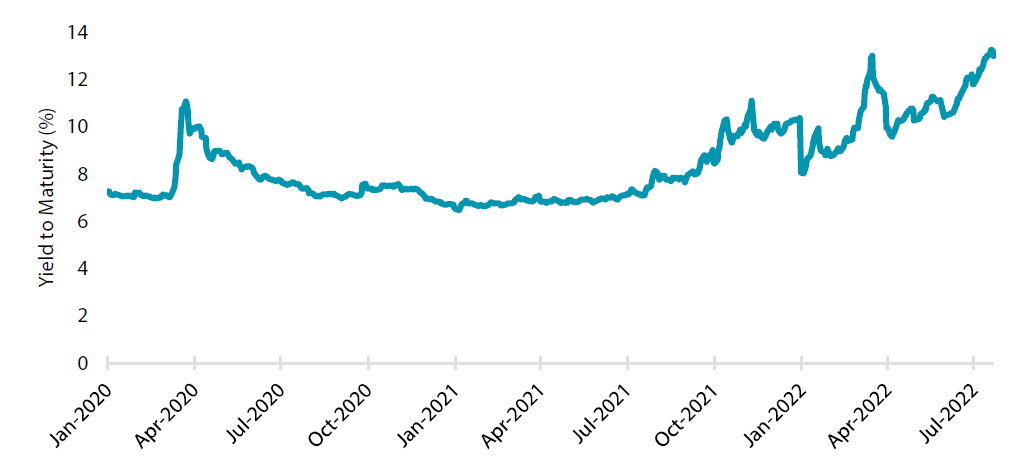

Asia credits experienced extreme volatility in the latter half of the period. Volatility in US rates prompted spreads to widen at the start of 2022. Asian HY experienced a sharp fall as sentiment on the Chinese property sector worsened. Increasing concerns of potential contagion risk to other parts of the Chinese economy weighed on China credits overall. Subsequently, the PBOC stepped up monetary stimulus and authorities declared more supportive measures for the property sector. In particular, news suggesting that the Chinese government was drafting nationwide rules to make it easier for developers to access pre-sale funds held in escrow accounts prompted a narrowing in credit spreads, particularly within China HY.

Chart 2: Asia corporate HY - yield

Source: Bloomberg, JP Morgan (based on JPMorgan Asia Credit Index – JACI High Yield – Corporate Index), as at 22 July 2022.

Source: Bloomberg, JP Morgan (based on JPMorgan Asia Credit Index – JACI High Yield – Corporate Index), as at 22 July 2022.

Rising geopolitical tensions between Russia and Ukraine triggered a sell-off in risk assets in mid-February 2022. As market uncertainty rose, risk assets sold off further and crude oil prices surged. Meanwhile, the Chinese government declared more supportive measures for the property sector. However, weak market sentiment prompted investors to focus on negative idiosyncratic news, particularly those regarding identified Chinese property issuers. Concerns of a further increase in inflationary pressures came into focus shortly after, pushing spreads even higher. Incremental lockdowns in key Chinese cities, news of possible delisting of some Chinese companies from US equities markets and idiosyncratic headlines within the Chinese property sector further weighed on already fragile market sentiment. Sentiment dramatically reversed after Chinese Vice Premier Liu He vowed to roll out policies to support the economy and capital markets, and amid reports that Chinese authorities are studying a plan for a sizable new stability fund to backstop troubled financial firms.

Chart 3: Asia HY credit spreads by country

Source: JP Morgan, as at 30 June 2022.

Source: JP Morgan, as at 30 June 2022.

Market sentiment weakened again following a string of negative macro news including CPI numbers that reflected accelerating inflationary pressures globally and more hawkish Fedspeak. In China, authorities continued to struggle to contain the country’s worst COVID-19 outbreak in two years. In response to the State Council’s call,

the PBOC announced a 25 bps cut in select banks’ RRR.

Subsequently, concerns about rapidly tightening global financial conditions as major central banks embarked on a near synchronised and aggressive monetary policy tightening cycle prompted further widening in credit spreads.Fears of China’s growth slowdown was reinforced by April 2022 activity data which came out weaker than the already low expectations. Chinese policymakers acted to support the property sector, with the PBOC reducing the 5-year Loan Prime Rate (LPR) and lowering the minimum mortgage rates for first-time homebuyers. Towards the end of the period, Asian credit spreads—dragged largely by Chinese HY credits—continued to rise on the back of idiosyncratic developments and an acceleration in outflows from emerging market (EM) bond funds. Moody’s placing Fosun under review for a downgrade also pressured industrial and consumer names amid repositioning by investors eyeing risks from higher rates and recession.

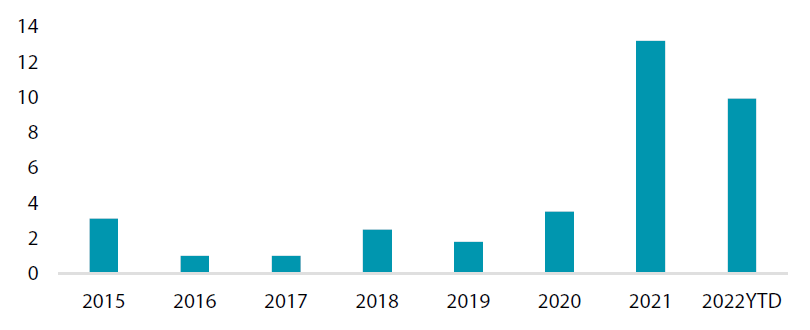

Credit defaults in the Asia HY space was at its highest in 2021 (dominated by the largest default coming from Evergrande) and are expected to remain high in 2022. Based on JP Morgan data, 2021 saw about USD 49 billion in defaults, or a 13.2% default rate, while H1 2022 saw about USD 35 billion in defaults, or a 10% default rate year-to-date.

Chart 4: Asia HY default rate, %

Source: JP Morgan, as at 30 June 2022.

Source: JP Morgan, as at 30 June 2022.

The UST yield curve also shifted higher over the year in review. Although the Asia HY market is relatively lower in duration, the rise by UST yields across the curve still contributed to negative returns during the period. The UST yield curve bear-flattened in the year, with yields climbing across the curve on concerns about inflation and central bank tightening. Overall, 2-year and 10-year UST yields ended the period at 2.96% and 3.02%, respectively, about 271 basis points (bps) and 155 bps higher compared to end-June 2021. UST yields saw a momentous rise, primarily led by increasing expectations of a more aggressive Federal Reserve (Fed) tightening cycle, on worries that inflation would be stickier than first thought. Data reflecting persistent inflation pressure and Federal Open Market Committee (FOMC) statements which suggested that the Fed’s balance sheet runoff could begin in 2022—close on the heels of its first interest rate hike—triggered a significant jump in UST yields.

Developments on the Russian-Ukraine border took centre stage in February 2022. Russia’s invasion of Ukraine prompted flight to safety. However, the drop in yields turned out to be short lived, with yields bouncing back as the market refocused on US inflation. The Fed delivered a well-telegraphed 25 bps rate hike in March, followed with a more aggressive 50 bps rate hike in May. The Fed then hiked by 75 bps hike in mid-June, its largest tightening move since 1994, as high inflation persisted.

Asia corporate HY market: Changes during the last year

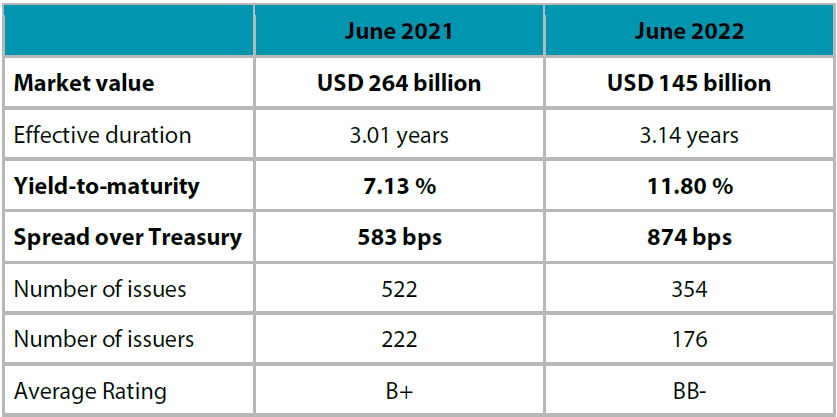

With the stress in the China HY market last year, during which real estate issuers had limited access to the offshore market, we saw the Asia high yield space’s profile evolve. Market size, based on the outstanding bonds in the JPMorgan Asia Corporate High Yield Index, has significantly declined in the last year. It declined from USD 262 billion market value as of end-June 2021to USD 145 billion as of end-June 2022. Market face value also dropped from USD 264 billion to USD 187 billion in the same period, a 29% decline year-on-year. Aside from limited new issues, several issuers were removed from the Asia HY index due to defaults. With the exit of these default issuers from the index, the market’s average credit rating moved from B+ to BB-.

Table 1: JP Morgan Asia Credit Index (JACI) - High Yield – Corporates – Market Profile

Source: JP Morgan, as at 30 June 2022.

Source: JP Morgan, as at 30 June 2022.

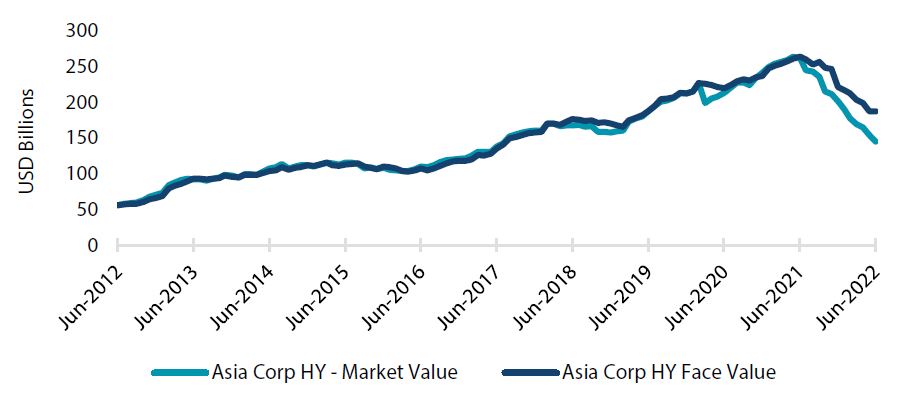

Chart 5: Asia Corporate HY – market size

Source: JP Morgan, 30 June 2022.

Source: JP Morgan, 30 June 2022.

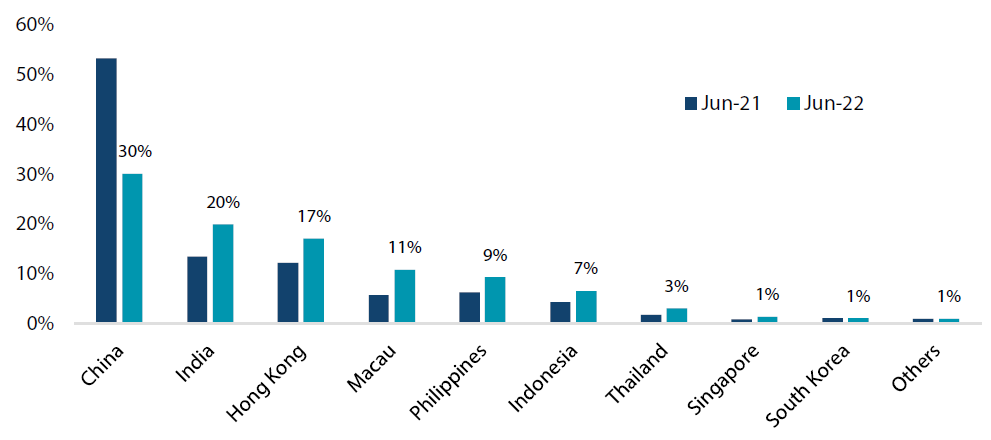

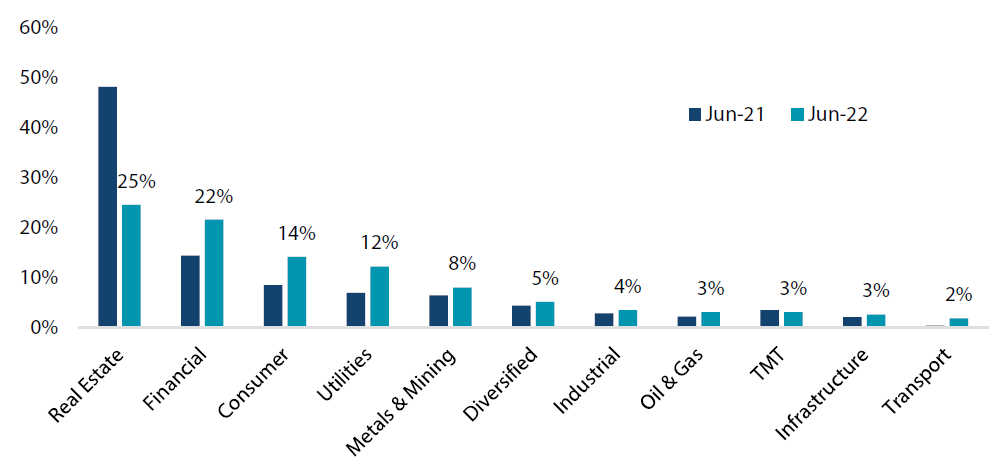

In terms of country profile, China HY’s weight in the market has declined to 30% as of end-June 2022 from 53% a year ago. China property HY, which was the biggest sector in the market at 41%, declined to just 15%. China’s reduced weight led to higher allocations for other markets, especially India, which saw its weight increased from 14% to 20%. Similarly, the overall real estate sector allocation has declined from 48% to 25%, just a little above the 22% allocation to the financial sector. In some ways developments over the past year has led to a reduced concentration risk for the overall Asia high yield market.

Chart 6: Asia corporate HY – market weight by country

Source: JP Morgan, Nikko AM, as at 30 June 2022.

Source: JP Morgan, Nikko AM, as at 30 June 2022.

Chart 7: Asia corporate HY – market weight by sector

Source: JP Morgan, Nikko AM, as at 30 June 2022.

Source: JP Morgan, Nikko AM, as at 30 June 2022.

Market outlook

Asia HY credit had a tough start to 2022, succumbing to heavy selling pressure, particularly in the second quarter. Apart from geopolitical tensions, tighter financial conditions (as central banks globally tightened monetary policy aggressively and in sync to control inflation) and rising recession risk in major developed economies, sentiment toward Asia HY has been heavily weighed down by sustained stress in China’s property sector. Going forward, we believe the pace of correction will moderate.

Thus far, defaults in Asia HY credit have been constrained to the China property sector and credit events outside the sector have remained relatively under control (please refer to our recorded presentation for a detailed outlook of the China property sector). Although the USD credit market seems to have shut down due to market volatility, Asian corporates have been able to obtain funding from onshore bond markets and/or via bank loans.

In addition, macro headwinds—the below factors in particular—that contributed to the spread widening this year have become more manageable.

- UST yield and USD strength: The poor performance of EM risk assets YTD has, in large part, been driven by the combination of high risk-free yields and USD strength. Currently, UST yields have plateaued and USD strength has abated, giving EM a well-deserved breather. This backdrop bodes well for Asia as it generally outperforms its global EM peers as a result of stronger macro fundamentals and timely monetary policies.

- Fund outflow: As UST yields moderate, fund outflows could also have peaked. This, together with limited new issuances, is providing a constructive technical backdrop for non-China HY.

All told, we are cognizant that some downside risks remain. In addition to the deceleration of developed economies, China’s COVID-19 strategy would be a key risk to watch going forward. While the recent easing of lockdowns and mobility restrictions in China has provided some boost to its economic activities, the country’s persistence on its zero-COVID strategy means the recovery momentum remains vulnerable to renewed outbreaks.