Key takeout

- The year 2020 was a challenge for Singapore. Its economy suffered a decline and its equity market returns were negative. But we believe that prospects for 2021 are better, with the economy poised for a recovery led by a global manufacturing-driven upturn in exports.

- In our view, 2020 was about resilience and 2021 will be about reviving returns. Much as value and cyclicals look attractive, regaining performance versus growth and quality, we believe the key to alpha is still sustainability in returns and positive fundamental change.

- The Singapore economy is on the mend. The strong recovery in exports points to positive returns, driven by a turnaround in earnings.

- We believe that the restructuring of Singapore will continue in 2021, as the country evolves as a technology, financial and investment hub and transforms its economic growth model towards innovation. We believe that the COVID-19 pandemic has accelerated innovation and created competitive advantages and opportunities for Singapore Inc.

- We look for relative growth winners in 2021, focusing on the dual theme of resilience and recovery. We are upbeat on companies which have exhibited resilience in sustainable growth and anticipate positive change in the recovery in global industrial growth and the re-opening of the economy.

- We favour industrials and technology in 2021 and are less optimistic on consumer staples. We are also selectively more upbeat on financials. We are cautious on telecommunications and property and have stronger convictions in other sectors.

- We remain positive on dividend investing. The yield spread for dividends against bond yields has improved favourably. With yields and interest rates likely to remain low, dividend yields are attractive and dividend stocks offer compelling value, in our view.

A review of 2020 and the road ahead in 2021

Singapore equity returns were among the weakest in Asia in 2020, returning -8.05%, as measured by Straits Times Index on a total return basis (STI Total Return) as of the end of December 2020. The negative economic impact arising from the pandemic—given the country’s open economy coupled with the high market representation in value and disrupted sectors such as banking, property, consumer discretionary and industrials—led to its underperformance within Asia.

Following the negative performance of 2020, we believe 2021 could see better returns and a recovery. The sharp rally of 16% (STI Total Return) in November 2020, following Joe Biden’s US presidential election win and positive news regarding COVID-19 vaccine developments, helped boost the market. We believe equity returns will remain supported by the re-opening of the Singapore economy and expect an improved market performance in 2021. With the backdrop of fewer global trade conflicts, accelerating exports, accommodative policy, higher return on equity and low foreign ownership, we expect the outlook for 2021 earnings to improve and that should support better market returns.

Recently, a commonly accepted approach appears to have formed: buy the laggards of 2020 and rotate into value and cyclicals, as vaccine news accelerates the rebound. While we do not disagree with such an approach, we would caution against a blanket shift in style. Instead, we continue to advocate a bottom-up strategy, focusing on picking companies with sustainable returns and positive change. These companies—those with strong competitive advantages in a new post-COVID-19 world that can sustain above market returns and have positive cyclical and restructuring catalysts in driving fundamental change—will offer the most potential for alpha in 2021, in our view. Much as performance in 2020 was about picking defensive growth, quality and resilience, we believe that 2021 will be about finding the best growth opportunities in reviving returns and embracing growth through innovation in a post-pandemic environment.

Economic rebound on track, supported by exports and fiscal policy

We believe that the recovery in the Singapore economy in 2021 will be driven by a combination of economic stimulus measures, regional improvement in trade and exports, and the normalisation of consumption and investment conditions arising from the prospects of vaccine delivery and easing of social restrictions.

The manufacturing sector has been the bright spot, with the recent third quarter (3Q) 2020 GDP surprising on the upside with a 5.8% year-on-year (YoY) decline, compared to advanced estimates of -7.0% YoY. The subsectors leading the recovery were bio-medical and electronics production, both which helped to offset weakness in the COVID-19-impacted service and construction segments.

We expect the export-led manufacturing recovery to be sustainable into the first half (1H) of 2021 and that this will help broaden the economic recovery in 2021. The current revival in China’s industrial and manufacturing production bodes positively for regional Asian exports, including those of Singapore. We believe Singapore exports are well placed due to the country’s open economy, which will benefit from the external lift in global demand and supply chain diversification.

Growth in 2021 will also be supported by government fiscal support, which was a critical driver in buffering the declines in the domestic economy in 2020. Looking forward to 2021, fiscal support is likely to be extended on a targeted basis to sectors such as aviation, tourism and healthcare to ensure a transition back to economic normalisation.

Exports to provide a tailwind for earnings and market returns

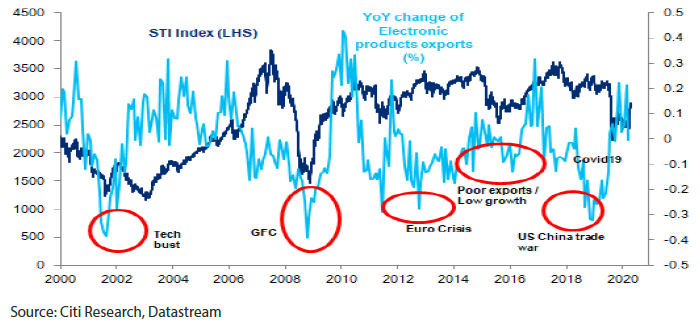

With strong export momentum in Singapore, there should be tailwinds for market returns and corporate earnings growth, based on historical trends. The previous pick-up in exports in Singapore in 2016 came amid a global industrial production recovery, which provided a strong catalyst for the equity market in 2016 and 2017 (see Chart 1). With a similar backdrop of strong export performance in 2020, the recovery in trade in 2020 and 2021 could provide strong tailwinds for equities in 2021.

Chart 1: STI performance relative to a change in exports

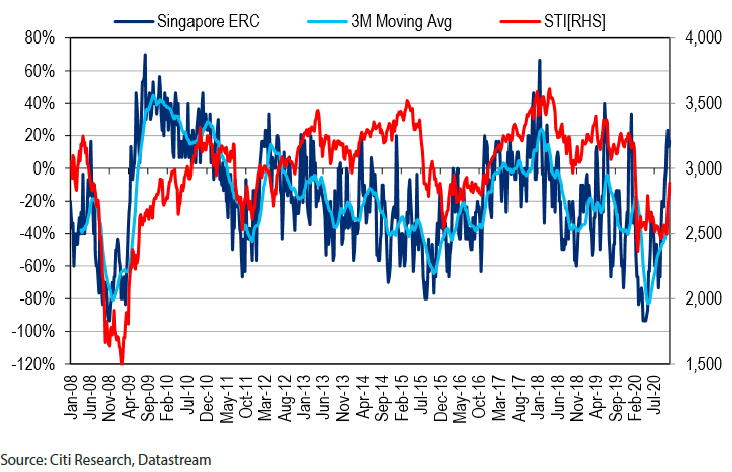

Corporate earnings in Singapore have fallen steeply, declining nearly 40% in 2020, accompanied by sharp negative revisions since the beginning of the year. These declines would have been sharper if not for the government support scheme. Earnings revisions, however, have started to bottom in 2Q2020, subsequently turning positive in November. We believe that the positive revision cycle in earnings, if sustained, will continue to drive equity market returns in 2021.

Chart 2: Singapore’s earnings revision count (ERC)

COVID-19 a catalyst for restructuring and recalibration

We believe that the restructuring of Singapore will continue as innovation transforms its economic growth model, strengthening its status as a technology, financial and trading hub. The pandemic has been a catalyst for change and an accelerator of innovation and transformation. Strong proactive government fiscal support for businesses to defray costs and the government’s tight control in managing COVID-19 cases have also helped position Singapore well in the crisis. We believe the transformation of its economy will continue in 2021, and that the country is well positioned to emerge stronger and more resilient from the pandemic.

We believe Singapore corporates are also restructuring their costs and recalibrating their business models towards new growth opportunities, which should allow them to emerge stronger from the pandemic. We look for relative growth winners, focusing on the dual theme of resilience and recovery. We are upbeat on companies which have demonstrated resilience in sustaining growth during the crisis and for which we anticipate growth in the current revival of global industrial production and the re-opening of the Singapore economy.

Leading candidates in the recovery in supply chain

Singapore, as a small city state, has thrived on its success as a financial and trading hub, capturing investment flows on continued globalisation. Trade wars and deglobalisation are recent challenges that it has faced. We see evidence that Singapore has been swift in adapting to these challenges; for example, it has reconfigured its supply chains and embraced new opportunities resulting from the crisis.

We identify key economic sectors which are primed to emerge stronger as we move into a post-pandemic economy. Cross border flows are key areas of strength in Singapore’s service and economic eco-system, and we see financial, manufacturing, logistics, consumer healthcare and food technology supply chains as growth opportunities when investing for transformation and positive change. The diversification of supply chains within Asia will also likely reinforce Singapore’s recovery in 2021.

We highlight a few Singapore companies which have been recalibrating amid the pandemic. Companies such as in-flight caterer and gateway services provider SATS1; technology services, products and solutions provider Venture Corporation1; and Singapore conglomerate Keppel Corporation1 are examples of corporate names that are embracing new opportunities, even as they recalibrate their growth priorities in the new post-COVID-19 environment.

SATS is fast reconfiguring its business towards growth opportunities in non-aviation food, particularly in food services, fast casual food and retail. While waiting for the aviation industry to recover, it is also expected to take advantage of opportunities in the supply chain, particularly in its airfreight capability to facilitate the handling of e-commerce and pharmaceutical products.

Keppel Corp is fast pivoting towards renewables and evolving as a sustainable developer of infrastructure and property assets. In recent months, the company has conducted a transformation plan and strategic review to consider new growth footprints in the offshore and marine, logistics and infrastructure arena.

Meanwhile, Venture Corp continues to evolve towards an advanced manufacturing and medical technology company with a growing footprint in healthcare and life science. We believe the pandemic has also positioned the company to develop its medical diagnostic capability in new revenue areas, such as test kits, point of care diagnostic tools and vaccine research equipment.

1Reference to any particular securities or sectors is purely for illustrative purposes only and does not constitute a recommendation to buy, sell or hold any securities or to be relied upon as financial advice in any way.

Singapore market outlook and strategy

We expect Singapore’s GDP to recover in 2021, with growth nearing 6% for the year, driven by a rebound in global industrial production and a revival of domestic activity, as the economy reopens and the impact of the COVID-19 pandemic starts to ease. Thanks to the positive COVID-19 vaccine news, we have seen a sharp rebound in consensus earnings since November, with steep downward revisions made early in 2020 being reversed. We expect corporates to continue making positive earnings revisions into 2021 on the back of greater optimism around COVID-19 vaccines and an export-driven recovery in GDP.

Following the sharp equity rally in November 2020, Singapore stocks no longer trade at crisis valuations, but they have not fully discounted the recovery in 2021, in our opinion. We consider the market to be reasonably attractive on a 2021 price-to-earnings multiple of 14 times, versus its historical average of 13 times, with the potential for earnings upgrades in 2021. On a price-to-book multiple, market valuations are also undemanding at 1.1 times, which is close to the lows during the 2008 Global Financial Crisis (GFC) of 1.0 times and 1998 Asian Financial Crisis of 0.8 times. Finally, from a dividend yield perspective, the Singapore market is also moderately attractive with a prospective dividend yield in excess of 4%.

In terms of equity convictions, we believe returns in 2021 will be anchored by companies and sectors that can maintain resilience in growth and are well placed for a recovery in returns as the economy recovers. We remain positive on companies that rank strongly on sustainable returns, actively pursue innovation and are key beneficiaries of the Singapore restructuring story. We also like well-placed companies that benefit from cyclical tailwinds and a recovery in exports from the resumption of trade.

We favour industrials and technology most in 2021. In general, we favour stocks that are well positioned to ride the global industrial cyclical tailwinds and those that benefit from a recovery by exports within the technology supply chain. We see the potential for positive earnings surprises for both sectors as the Singapore economy recovers. We also believe they offer strong growth propositions to restore and exceed pre-pandemic 2019 earnings. We moderate our optimistic view on consumer staples, which now look less attractive. We are also selectively more upbeat on financials in 2021, as we believe the worst of the credit provision cycle is behind us. We have a cautious view of telecommunications due to the sector’s less attractive growth outlook. We also remain cautious on property, given the potential declines in property prices as well as rentals, as companies grapple with higher vacancies and defaults which arise from the failures of small- and medium-sized companies and unemployment.

Positive on dividend investing in 2021

For dividend strategies, 2020 was a good year. In particular, the strategy that focuses on resilient business franchises, which maintained dividend growth amid a backdrop of falling earnings and dividend cuts, performed well. Overall equity market returns in 2020 were negative, but dividend stocks with resilient growth prospects and defensible earnings/dividends both outperformed and delivered absolute returns.

We believe the environment in 2021 will remain supportive for dividend investing. The continued decline in interest rates and the low interest rate environment in Singapore have presented a dividend yield versus interest yield spread of more than 3%, which looks attractive against a post-GFC historical backdrop. We remain positive on high dividend- yielding stocks with good prospects to maintain and sustain their distribution per unit growth amid the low interest rate environment. We expect yield compression to drive returns for good-quality dividend moats. Sectors we are most positive on include industrial/logistics REITs, infrastructure trusts as well as selective retail REITs, which appear well positioned for the economic recovery.