Introduction

Looking ahead into 2021, we identify five key themes in the post-COVID-19 era that we expect will positively impact companies in the Japanese market: a robust Chinese economy, deregulation, the Japanese government’s bid to decarbonise, corporate governance reform and a reactivation of the pre-pandemic themes that will gain traction, such as digitalisation and addressing the country’s aging social infrastructure.

China’s economic recovery and Japan

The Chinese economy has been a step ahead of its pandemic-stricken peers, showing a swift recovery from the negative effects of COVID-19. We assess Japanese corporate sectors that could benefit from a robust China.

China: Japan’s second largest trading partner

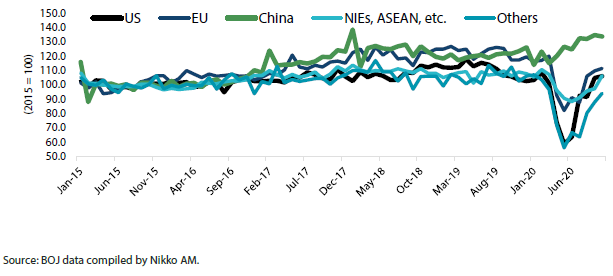

China is Japan’s second largest trading partner, accounting for about 20% of the country’s exports. Japan’s exports to the US, its largest trading partner, have been unstable during the pandemic. But its exports to China have been quite resilient due to China’s quick economic recovery from the COVID-19 crisis (Chart 1).

Chart 1: Japan’s exports by destination

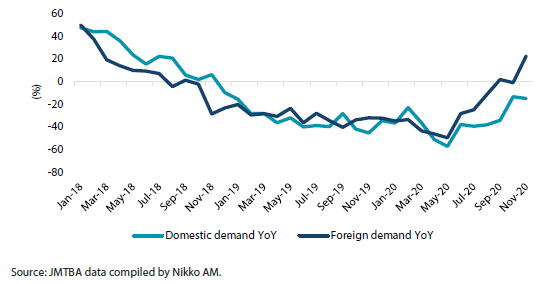

Demand for Japan’s machine tools provides an example of the role a strong Chinese economy is playing. According to Japan Machine Tools Builders’ Association (JMTBA), industry wide orders rose 8% year-on-year (YoY) in November 2020, marking positive YoY growth for the first time in 26 months. The growth in November was led by foreign demand (+22.5% YoY), which helped offset sluggish domestic demand (-15.2% YoY) (Chart 2). Strong foreign demand stemmed from orders that originated in China, including its infrastructure and semiconductor related sectors.

Chart 2: Japan machine tool orders

Also, it is worth noting that according to its forecast release in December 2020, the China Passenger Car Association (CPCA) expects the country’s new car sales in 2021 to surpass sales in 2020. If realised, that would be the first growth in four years and mark a 4% increase compared to sales expected in 2020. The CPCA expects the sales of new cars to increase thanks to the Chinese government’s policies geared toward supporting the domestic economy.

Furthermore, China, South Korea and Japan have eased business travel restrictions between themselves ahead of other trading partners, and the measure is expected to provide a boost for businesses spanning Japan and China. Japan is also better positioned to benefit from China’s growth in demand as the relationship between Washington and Beijing, which deteriorated considerably under the Trump administration, is likely to remain tense despite a change in US presidents.

Deregulation under PM Suga

PM expected to focus on populist policies

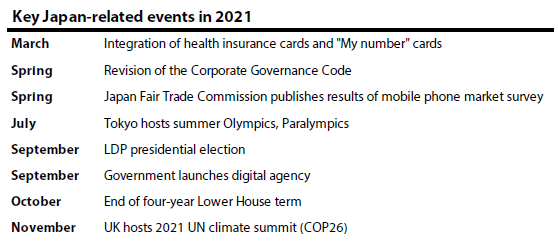

Japanese Prime Minister Yoshihide Suga, who took office in September 2020, is expected to solidify his position in 2021 in order to establish the basis for a long-term administration. Suga faces several challenges in 2021, the foremost being the pandemic, which is likely to remain the administration’s top agenda item at least through the first half of the year. Suga also has a daunting political calendar to contend with in 2021: the ruling Liberal Democratic Party’s presidential election in September, which he needs to win to remain premier, and a Lower House election in October, when the four-year term for the house expires.

As such, Suga is expected to focus on populist policies in 2021 to shore up his public approval rating. Some of these policies are expected to include expanding medical insurance coverage on fertility treatments, pressuring telecom companies to lower mobile phone fees and requiring the elderly to pay a larger share of healthcare costs.

Digital technology an important deregulation target

Another deregulation target for the Suga administration is digital technology, where regulations are seen to have hampered progress. Japan’s public sectors have been slow to invest in digitalisation and this is a deepening concern. According to the United Nations’ e-government rankings released in July, Japan was placed 14th in 2020, dropping from 10th in 2018. Japan received high marks for its telecommunications infrastructure and human capital but was rated low in areas such as online services.

The pandemic exposed how the digitalisation of Japan’s public sector had fallen behind. When the government decided to provide citizens with cash handouts earlier in 2020 to cope with lockdowns, most municipalities could only process requests by paperwork, and in some cases the recipients had to wait a month to receive their handouts.

The government took the situation seriously and intends to boost the digitalisation of the public sector. Prime Minister Suga made “digital transformation” (DX) of government administration one of his key policy pillars when he took office in September. The initiative will focus on digitalising the “My number” personal identification cards and creating a unified digital administrative system for the government and municipalities. Suga plans to set up a digital agency in 2021 and its establishment will help streamline administrative procedures pertaining to DX. Suga aims to complete the digitalisation by 2025, and investments into related systems are expected to begin in earnest in 2021.

In the private sector, in an effort to lay the groundwork to attract investments, the government in December 2020 announced reform proposals for DX-related taxes; firms that invest in cloud-based systems that transfer of data between departments and companies will be allowed to take as much as 5% of the capital spending as tax credit. We believe that such a tax proposal, if enacted, will benefit a significant number of IT service-related companies.

Reducing carbon emissions

Japan aims to rectify its unenviable carbon emissions record and 2021 could be a key year as it gears up to become carbon neutral by 2050. To achieve its goal, boosting hydrogen usage and production is among the steps it will take. The government is considering steps to encourage investments into decarbonisation-related initiatives through tax breaks, according to the draft outline of fiscal 2021 tax reforms. The government would allow a tax deduction of up to 10% of capital expenditures into the manufacture of products that lead to decarbonisation, such as next generation lithium ion batteries.

Against such a background, we expect hydrogen to become an important agent of change. Hydrogen usage offers an effective path towards decarbonisation. The Japanese government sharply raised its 2030 hydrogen usage target to 10 million tons from the initial goal of 300,000 tons. The ambitious goal reflects the government’s desire to create a hydrogen society by encouraging technological breakthroughs in hydrogen production and by triggering a change in the demand side. We believe that such a push will benefit a wide range of industries; for example, renewable energy sectors that generate the electricity necessary for hydrogen production, infrastructure sectors linked to the production and distribution of hydrogen and manufacturers of hydrogen fuel cells.

How the government’s push towards decarbonisation and the adoption of hydrogen plays out deserves close attention as Japan is home to a number of globally competitive companies with strengths in various hydrogen-related technologies. Toyota, for example, recently unveiled the second generation of its Mirai hydrogen fuel cell-powered vehicle. The second generation Mirai boasts a much longer range thanks to a redesigned hydrogen tank. Toyota also greatly improved its production capacity for the new Mirai, in a commitment to hydrogen mobility. Toyota is just one example among many Japanese companies that possess strong fuel cell battery technology in the mobility arena, and we believe they will have an extensive role to play as Japan decarbonises.

Japan’s proximity to China could also play an important role in its bid to decarbonise and adopt hydrogen. China made a pledge to become carbon neutral by 2060, and the adoption of renewable energy and hydrogen could be an option the regional powerhouse could choose in order to decarbonise.

Japan’s governance reform

For Japan, where reforms took a back seat in 2020 due to the pandemic, 2021 could market the beginning of “Governance 2.0”. We believe that there will be two main governance-related topics in 2021: the upcoming revision to the Corporate Governance Code and the realignment of the stock markets.

Japan’s Corporate Governance code to be revised again

The Corporate Governance (CG) code, first introduced in 2015, is expected to be revised for the second time in the spring of 2021. As of December 2020, the framework of the revamped guidelines has gradually become visible. Regarding the revisions, the media have focused on areas such as diversification of management and increasing the number of independent outside directors. While these are important aspects to consider, our focus rests on the fact that a groundwork is being laid towards corporate governance reform shifting from the “formality” phase to an actual “substance” phase; this brings the CG code revisions closer to their intended purpose of improving Japanese corporate profitability, which leads to higher shareholder value.

Under such a shift from formality to substance, the “practical guidelines” released by Japan’s Ministry of Economy, Trade and Industry (METI) intended to reinforce the CG code deserves special attention. The guidelines have included an outline of effective group governance (June 2019) and best practice guides to business portfolio management (July 2020), and we hope that these guidelines spark lively debates between investors and corporations, providing the latter with an opportunity to reassess the role they are required to play.

Indeed, we are seeing an increasing number of “parent-child dual listing” arrangements being dissolved; recent high-profile examples include NTT’s buyout of its mobile unit NTT Docomo, Sony’s takeover of listed subsidiary Sony Financial Holdings and Mitsubishi Chemical Holdings taking full control of Mitsubishi Tanabe Pharma. The parent-child dual listings are unique to Japan and have come under increasing criticism as such arrangements are seen to undermine minority interests amid the ongoing CG reform. The parent-child dual listings are also part of the issues that CG reform intends to address through effective group governance and business portfolio management mentioned above.

We hope that the CG code revision fosters debates by corporations, both within themselves and with investors, and leads to actions that increases shareholder value.

Realignment of the stock markets

Along with the CG code revision, the planned realignment of Japan’s stock markets is another important governance-related topic to consider.

Japan’s Financial Services Agency revealed an outline of the realignment initiative in December 2019, and the Tokyo Stock Exchange has been leading plans to revamp its market segments and the TOPIX index, with the change expected to come into effect in April 2022.Plans to realign the market segments have taken shape, with a framework revealed in February 2020 and a systematic outline of the new market framework expected to be released later. Under the proposed realignment the five current market segments—first section, second section, Mothers, JASDAQ growth and JASDAQ standard—will be reshuffled into “prime”, “standard” and “growth”. Companies in the prime section, which will replace the current first section, will be required to have a tradable market capitalisation of at least JPY 10 billion.

A clear definition of “tradable number of shares” is yet to be revealed; furthermore, companies that do not meet the market capitalisation requirement are expected to be granted a certain grace period. It is therefore difficult to assess what impact the realigning of the market segments could have. Still, companies, particularly SMEs, could make business decisions intended to boost their market capitalisation (and therefore shareholder value) and increase their tradable shares.

Currently, the TOPIX index consists of companies listed on the first section. But after the realignment this will no longer be the case. According to the guidelines released in February 2020, a limit will be set on the number of companies that will be eligible for selection on the TOPIX index and that these will be reshuffled regularly. Further information regarding the TOPIX index revision has been limited since. While we wait for new information, our hopes are that the new TOPIX index improves in quality both as an investment vehicle and a benchmark, and that the revision serves as an incentive for companies to improve their shareholder value.

Summary: Back to basics

For Japan, long stuck with an aging and decreasing population, 2021 could be a year to go back to the basics and improve its productivity. When the pandemic eventually ends, the market will not only be shifting its focus to post-COVID-19 opportunities but will also turn its attention back to the challenges Japan faced before the pandemic.

The pandemic served to divert attention from Japan’s long-standing challenges in certain cases, but the fact remains that the country faces a myriad of issues to deal with. In fact, the coronavirus crisis may have sharpened the focus on the challenges Japan faces, and as the economy normalises and the public becomes accustomed to COVID-19, demand for these issues to be addressed is likely to increase again.

The most pressing issue, in our view, is reinforcing Japan’s IT infrastructure. In a “DX report” published in September 2018, METI warned that aging Japanese IT systems could tumble off a “digital cliff” in 2025. Efforts to modernise Japan’s IT systems stalled in 2020 due to the pandemic but are expected to pick up again in 2021. The pandemic increased focus on shifts to clouds and DX investments and the trend is likely to provide an incentive to bring IT systems up to date.

In addition to digitalisation, Japan is faced with several other issues, such as aging social infrastructure, the need for automation to counter labour shortages and integrating information and communications technology into education. The pandemic may have temporarily diverted attention from these issues. But these challenges only deepened during the pandemic, and we believe that they will return to the forefront in 2021.