We have long been enthusiastic about the ASEAN share markets, and the region continues to offer appealing prospects. While the fundamental drivers behind ASEAN’s growth and opportunities are not entirely new, in our view the trends remain irrepressible. We discuss two key pillars—industrialisation and consumerisation—that are expected to help cement ASEAN’s place in the minds of investors

Background

Bustling city vibes, picturesque beaches, intricate architecture and the oh-so amazing local food. But that is not all that we like about the countries in a regional organisation called the Association of Southeast Asian Nations1 (ASEAN). Beyond its famed tourism destinations, ASEAN is also a unique investment region that forms an economic powerhouse, projected to be the world's fourth largest economy by 2030. The growth circulation in ASEAN is expected to finally materialise, and the longer term picture is supportive as ASEAN becomes much more involved in the global economy. The pace of industrialisation is set to accelerate, driving an increase in household income which would then support consumerisation. In turn, the larger consumer market is expected to attract more foreign direct investments, creating more jobs and driving wage growth.

ASEAN makes, the world takes

ASEAN is fast becoming a business friend that everyone needs, and a fitting alternative to Chinese supply chains and manufacturing. Firstly, the region has continually reinvigorated itself by climbing up the manufacturing value chain through the development of more sophisticated manufacturing capabilities, courtesy of the Fourth Industrial Revolution (Industry 4.0). Industry 4.0 technologies, such as the internet of things, advanced robotics and additive manufacturing (3D printing) are enabling manufacturers to shift from labour-intensive assembly activities to producing more innovative and higher-value goods such as electronics and machinery. Presently, the electronics industry is already an integral component of the manufacturing export sectors of economies like Malaysia and Singapore. Thailand has been a lynchpin of the global automotive parts and accessories industry. And now, the governments of ASEAN nations have ambitious blueprints to ensure their competitiveness in the Industry 4.0 era.

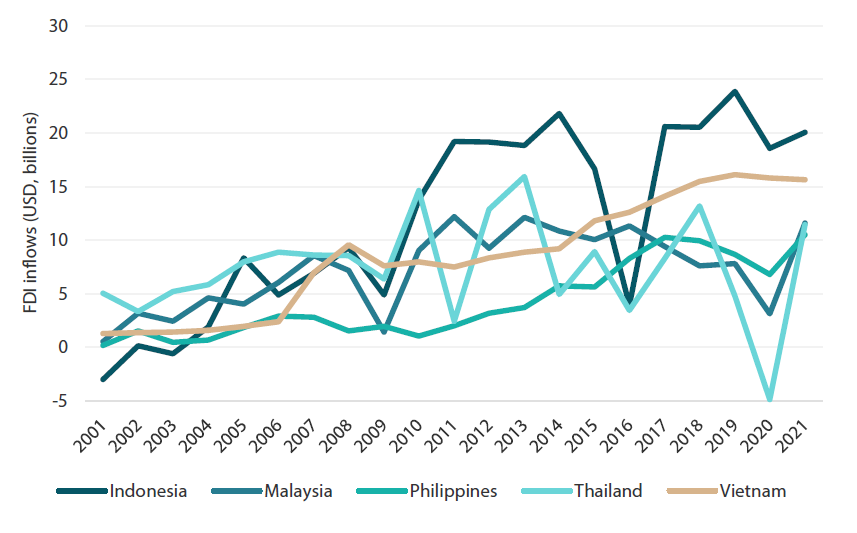

Of course, the great Sino-US spat and weighty political pressures are nudging global manufacturers of high-tech products, notably advanced semiconductors and automotives, to look beyond China for growth. While none of the countries come close to matching China's manufacturing capacity and prowess, ASEAN as a whole represents a top-notch substitute. Chalking the COVID-19 pandemic and the Russia-Ukraine war up to experience, companies are also bracing for future disruptions by diversifying their supply chains into ASEAN. It is worth mentioning that the world needs labour from ASEAN more than ever, as working-age populations in developed countries are heading towards a decline. In addition, labour in developed countries is relatively expensive, as labour costs move in tandem with increasing prosperity. Meanwhile, the large youth population in ASEAN (which we will touch on later) means a heightened demand for jobs, which would then bring down the cost of labour. Supported mainly by the supply chain shifts and abundant workers with lower costs, foreign direct investment (FDI) inflows into the ASEAN region have grown rapidly since the turn of the millennium (barring a dip during the early stages of the COVID-19 pandemic). Coupled with the expanding consumer market, we expect ASEAN to become an increasingly important magnet for FDI inflows (Chart 1).

Chart 1: FDI inflow in ASEAN-6 excluding Singapore

Source: United Nations Conference on Trade and Development (2022)

Source: United Nations Conference on Trade and Development (2022)

Furthermore, evolving investment flows look set to further strengthen the economic ties between ASEAN and the rest of the world, especially as ASEAN nations become involved in more trade agreements. The Regional Comprehensive Economic Partnership (RCEP)—the world’s largest free trade agreement spanning the Asia-Pacific region—has lent further credence to this notion. This trade liberalisation initiative is seen boosting trade and investment flows among the 15 member countries, and these economies account for almost 30% of global GDP and about a third of the world’s population2.

Quest to become the next electric vehicle hub

Companies have been scouring for an avenue to seize significant growth through new green transition and decarbonisation business-building opportunities, and ASEAN has answered the call to help electric vehicle (EV) players diversify their production hubs and supply chains. Policymakers in the region are introducing wide-ranging incentives and goals to drive the adoption of EVs as part of meeting the climate change challenge in Asia as well as to attract investments in vehicle assembly and parts manufacturing. And such tremendous growth of EVs are expected to result in rising demand for raw materials such as nickel and copper needed to manufacture both EVs and batteries. Nickel and copper are likely to see a drastic increase in demand in the coming decade.

Boasting abundant natural resources, Indonesia’s strategy to transform itself from a provider of raw materials into a regional manufacturing hub for EV batteries hinges on using its vast nickel reserves to attract international investment. Indonesian President Joko Widodo’s commitment in building out the country’s EV supply chain has manifested in initiatives such as tax incentives (the country has been courting top producers including Tesla and BYD) and setting up what it lauded as the first EV battery factory in Southeast Asia (jointly developed by South Korean carmaker Hyundai Motor and battery producer LG Energy Solution).

Another significant participant in the EV supply network is Thailand, often touted as the "Detroit of Asia", having been a stronghold in automobile manufacturing for decades. To ensure that the wheels of its automobile industry keep turning in the future, the kingdom has introduced incentives such as reduced import tax for EV parts and excise tax cuts for imported EVs amid several other subsidy programmes. The Thai government is also pushing ahead with its mega project Eastern Economic Corridor (part of its Thailand 4.0 policy), which is turning three provinces into a hub for technological manufacturing and services including EVs. Taiwan’s contract manufacturer Foxconn is one of the investors—building an EV plant in Thailand in a joint venture with Thai energy conglomerate PTT. Undeterred by the lack of land and resources, Singapore is also jockeying for a spot in the global battery market by exploring new opportunities in areas such as battery waste recycling, an industry still in its infancy. At the higher end of the value chain, several EV makers have established research and development (R&D) hubs in Singapore. Chinese EV maker Nio is setting up a R&D centre for autonomous driving and artificial intelligence in the city-state. In addition, Hyundai Motor Group is building the Hyundai Motor Group Innovation Centre in Singapore, which is capable of small-scale production of EVs. As such, ASEAN’s EV market remains poised for high growth amid the accelerated adoption on the back of decreasing costs.

The many new faces of the ASEAN consumers

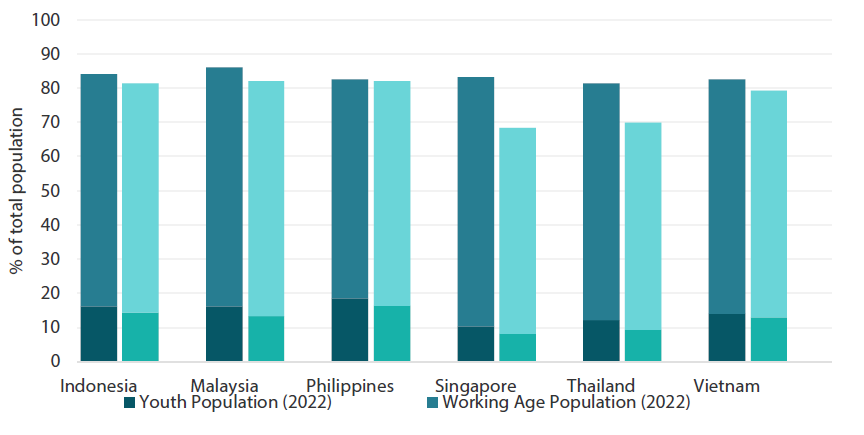

Demographic changes can seem slow and at times imperceptible. However, we think that the future is now, as the underlying population dynamics has set the stage for ASEAN’s demographic dividend to be harvested. Demographic dividend, a feature described as an increase in the average citizen’s contribution to GDP, can be attributed to a change in a population’s age structure. Specifically, it occurs when the proportion of the working-age population is bigger than the dependent population, defined as those under 15 years and above 65 years of age. Within ASEAN, the working-age population is projected to continue to increase until 2037 in Vietnam, 2047 in Indonesia and beyond 2060 in the Philippines (Chart 2). Along with the growing ranks of middle classes and new consumers, which have manifested in the rate of urbanisation, new demands for consumption upgrades are being created.

Chart 2: ASEAN’s youth population and working-age population (2022 and 2040)

Source: United Nations Data Portal Population Division (2023)

Source: United Nations Data Portal Population Division (2023)

Households are now able to make significant discretionary and higher quality purchases, progressively transforming ASEAN into a consumption heavyweight. We have observed the following broad trends: a greater focus on leisure activities, increasing brand awareness and more emphasis on healthcare. While some may label such pursuits as “hedonistic”, we think this is simply reflective of the spending power as it stands today. The growing affluence in ASEAN countries is galvanising its consumers towards more extravagant, and often pricier, versions of everything from pasar malam (street markets in Southeast Asia that open in the evenings) burgers to fast fashion apparel. Many firms are prepared to seize on these new demographic patterns and lifestyle choices by producing goods and services that cater to customers who are willing to pay more for quality. Along with the “piggy-bank boom”—a result of the pandemic savings amassed by households—we see strong potential for consumption upgrade in both necessities and non-necessities, including consumer packaged goods and healthcare.

The digital march

Online purchases may be as old as the internet itself, but not too long ago most consumers did not even dream of having someone else pick up their groceries or toiletries from the marketplace and deliver these products to their doorsteps. The COVID-19 pandemic accelerated the shift to e-commerce as millions of consumers chose to shop online. Retailers without an e-commerce presence had to act fast or risked losing these customers to other businesses that could accommodate demand for frictionless online shopping experiences. A few markets in ASEAN may have passed their inflection points. But as a whole, e-commerce is still on a gradual rise in ASEAN. The sector still has significant room for further growth, in our view, and it would not be surprising if ASEAN can match China’s e-commerce penetration rate eventually.

Speaking of e-commerce, how can we forget about payment—one of the most fundamental economic activities. Humans have come a long way, progressing through cowrie shells, metal coins and paper money throughout the millennia. Digital banking is now a reliable solution, aided by extensive internet connectivity and widespread smartphone usage. The onset of the pandemic (again) put into warp speed the usage of online payment systems and forced financial services companies to reinvent themselves for the digital age. Digital payment options and applications have simply made the process of making online payments in real time so much more convenient with higher user security. Further, more consumers and households are making the shift to digital as access to bank accounts improves. Beyond making payments, the credit side of the business boomed too, serving the discretionary wants of an aspirational population. Let the numbers speak for themselves. The digital economy across ASEAN-6, comprising of Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam—is projected to grow 6% annually, reaching as much as a whopping USD 1 trillion by 20303. There are so many facets to the rise of consumer digitisation and we see direct beneficiaries in areas such as new media, digital healthcare, e-commerce and digital banking, to name a few.

Conclusion

Not only are the ASEAN economies benefiting from a "demographic dividend” but they have also undertaken steps to spruce themselves up to attract FDI. We remain most optimistic towards EV, energy transition and the technology supply chain. In addition to trade pacts facilitating access to new markets and providing broader trade opportunities, international businesses are rethinking the global value chain and are searching for ways to diversify risks. And if demographics are truly a game changer, then we can look forward to ASEAN’s tremendous growth potential. We have reached a very exciting phase in ASEAN today, and investors may wish to resharpen their focus on the region.

1ASEAN’s 10 member states are Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam

2Source: Ministry of Trade and Industry Singapore (2023). Regional Comprehensive Economic Partnership (RCEP) Agreement

3Source: Google, Temasek and Bain & Company (2022). e-Conomy Southeast Asia (SEA) Report - Through the waves, towards a sea of opportunity.

Any reference to a particular security is purely for illustrative purpose only and does not constitute a recommendation to buy, sell or hold any security. Nor should it be relied upon as financial advice in any way.