Summary

- US Treasury (UST) yields moved lower in November, ending at 1.45%, about 10.8 basis points (bps) lower than in end-October. Inflationary pressures mostly rose across Asia in October, except for the Philippines. Regional economies saw year-on-year gross domestic product (GDP) growth moderate in the third quarter, due to a surge in COVID-19 cases during the same period. The Bank of Korea (BOK) raised its policy rate by 25 bps. Central banks in the Philippines, Indonesia, Thailand and Malaysia kept their respective policy rates unchanged, pledging to support demand to ensure a sustained recovery.

- Asian credits returned 0.24% in November, as the drop in UST yields cushioned the 11.4 bps widening in credit spreads. The divergence in performance between Asian high-grade (HG) and high-yield (HY) segments continued during the month. Asian HG gained +0.51%, thanks to the drop in UST yields which compensated the moderate widening in credit spreads of 8.4 bps. However, Asian HY continued to be weighed down by concerns around the Chinese property sector and returned -0.82% as credit spreads widened 43.1 bps.

- Following the emergence of the new Omicron COVID-19 variant and with the World Health Organization (WHO) declaring its concern, we hold a neutral view on duration in the near term and a slightly cautious stance on Asia currencies.

- We believe the macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads. The tentative improvement in the COVID-19 situation across many Asian economies reinforces our view that the setback to growth in mid-2021 was temporary. Progress on vaccine rollouts, the gradual re-opening in a number of countries and still supportive fiscal and monetary policies should revive the growth momentum as we head into 2022.

- We are slightly cautious on rates markets and expect Indonesian bonds to outperform. On currencies, we expect the US dollar (USD) to resume its ascent against regional currencies when US rates adjust higher, with the Singapore dollar (SGD) likely to outperform.

Asian rates and FX

Market review

UST yields mostly lower in November

UST 10-year yields ended the month at 1.45%, about 10.8 bps lower than in end-October. UST yields initially moved lower, despite US non-farm payroll numbers reflecting an increase of 531,000 in October—up from an average growth of 398,000 in the prior two months—and the unemployment rate falling to 4.6%. UST yields subsequently moved higher, on the back of a rise in US headline and core consumer price index (CPI) numbers. The upward pressure on yields was sustained following news that Jerome Powell had been renominated as the US Federal Reserve (Fed) chairman, which reinforced expectations that the central bank would continue on its current path of policy normalisation. Towards the month-end, the discovery of a new, heavily mutated variant of COVID-19, Omicron, rattled risk appetite, triggering a plunge in yields as investors rushed to safe-haven assets. Front-end yields jumped on the last day of November, after Fed Chairman Powell signalled his support to accelerate the tapering process by “a few months”.

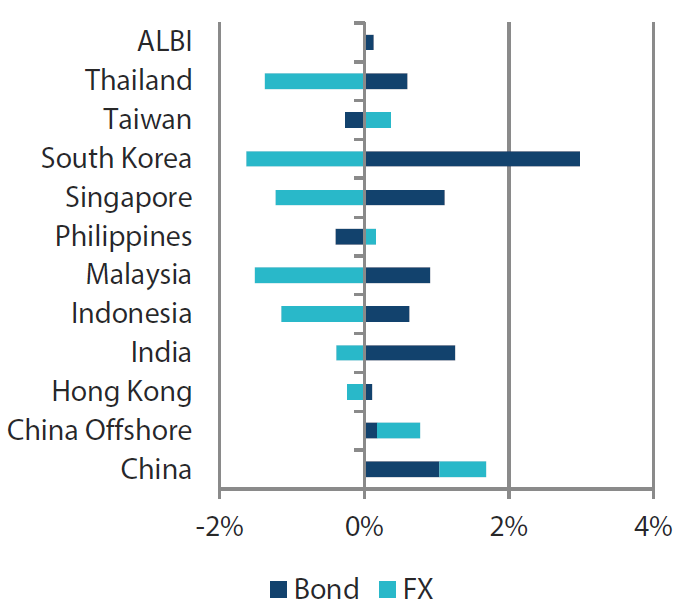

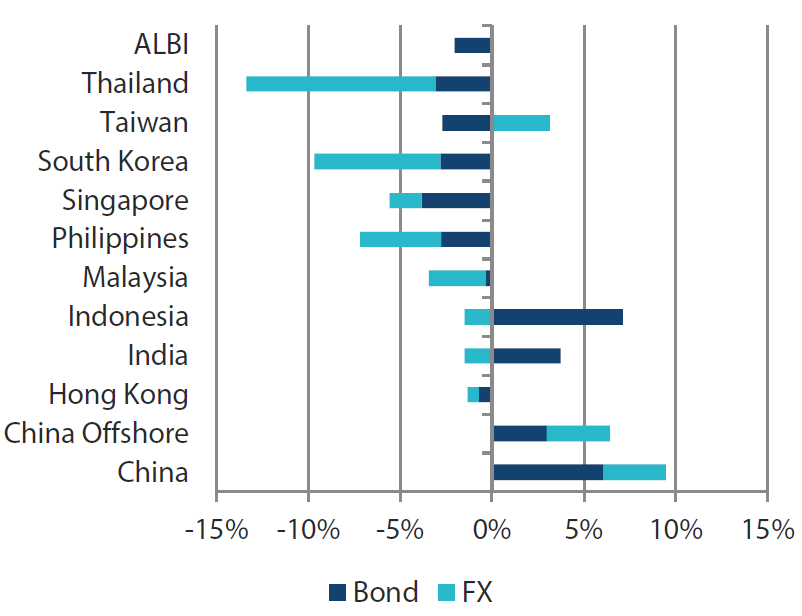

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 30 November 2021 | For the year ending 30 November 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 30 November 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

Inflationary pressures mostly rise in October

October headline CPI prints in China, South Korea, India, Malaysia, Thailand, Singapore and Indonesia were higher, but a similar gauge of inflation in the Philippines eased from September levels. The higher-than-expected headline CPI print in Singapore was driven in part by rising accommodation cost inflation. Nonetheless, private road transport cost inflation also increased. Headline inflation in Thailand also accelerated in October, rising 2.38% year-on-year (YoY), as domestic fuel and vegetable prices rose. Similarly, rising fuel prices, together with the cessation of electricity bill discounts, prompted the rise in Malaysia’s headline CPI in October. CPI inflation in South Korea rose to 3.2% YoY in October, driven by higher energy prices. Elsewhere, the higher CPI print in China was due partly to a sharp increase in vegetable prices and higher fuel and utility prices.

Gross domestic product (GDP) growth moderates in the third quarter

Regional economies saw YoY growth moderate in the third quarter, as countries dealt with a surge in COVID-19 cases during the period. Thailand’s economy contracted 0.3% YoY over the period, while Malaysia registered GDP growth of -4.5% during the July to September period. GDP growth in Indonesia moderated to 3.51% YoY in the period, partly due to a reversal of base effects. Economic expansion in the Philippines decelerated as well, although growth was markedly higher than expected as private consumption growth jumped, reflecting pent-up demand following lockdowns in the previous months.

Bank of Korea raises its policy rate by 25 bps

The BOK held its last monetary policy meeting for the year and decided to hike its policy rate by 25bps. The BOK governor emphasized that policy rates remained at accommodative levels and the move to raise rates was more about reducing the excessive accommodative conditions in the system, rather than a tightening of monetary policy. Meanwhile, central banks in the Philippines, Indonesia, Thailand and Malaysia kept their respective policy rates unchanged, pledging to support demand to ensure a sustained recovery.

Market outlook

Neutral on duration, slightly cautious on Asia currencies

The WHO declared Omicron a variant of concern. Many unknowns remain, such as the risks Omicron poses to public health, and whether available vaccines are effective against this new variant. Consequently, we deem it prudent to hold a neutral view on duration in the near term and a slightly cautious stance on Asia currencies.

Asian credits

Market review

Asian credits register positive returns in November on lower UST yields

Asian credits returned 0.24% in November, as the drop in UST yields cushioned the 11.4 bps widening in credit spreads. The divergence in performance between Asian high-grade (HG) and high-yield (HY) segments continued during the month. Asian HG gained +0.51%, thanks to the drop in UST yields which compensated the moderate widening in credit spreads of 8.4 bps. However, Asian HY continued to be weighed down by concerns around the Chinese property sector and returned -0.82% as credit spreads widened 43.1 bps.

The Asian credit market experienced significant volatility in November, with the Chinese property sector remaining the focal point of markets. The month started with negative headlines regarding Chinese property companies continuing to weigh on sentiment. As investors turned jittery, the sell-off spread to China’s stronger property developers, prompting a significant widening of overall spreads. Mid-month, news that Chinese policy makers would ease funding conditions for the troubled sector tempered contagion risk in the near-term, triggering a sharp recovery in Chinese property bonds. The improvement in market tone continued as several distressed Chinese property companies successfully announced arrangements to avoid defaults. News that China Huarong Asset Management would receive a sizable capital injection from state-owned financial institutions further shored up investor confidence. However, overall risk sentiment took a hit towards the month-end after the discovery of Omicron triggered concerns of potential widespread travel restrictions and renewed curbs to social activity.

Indicators released during the month saw relatively positive macro data from the US while numbers out of China were weak in contrast. During the month, US President Joe Biden and Chinese President Xi Jinping held their first virtual summit since Biden took office in January. Although the meeting produced few breakthroughs, it paved the way for negotiations in 2022.

Performance diverged across countries in November. Thai credits outperformed; their spreads narrowed about 4.5 bps as Thailand’s aggressive border reopening improved the country’s economic outlook. In contrast, Indonesian credits underperformed, with spreads widening by about 15.6 bps, as risk assets succumbed to a sell-off on Omicron fears and concerns over tighter US Fed policy, which affected long-end sovereigns and quasi sovereigns. China credits also underperformed. Their spreads widened by 9.1 bps, with the sell-off in the property sector spreading to higher-rated developers and other segments. Separately, Fitch Ratings retained its “BBB-/ Negative” rating for India, citing concerns about the country’s debt trajectory.

Primary market activity largely subdued in November

Weak market sentiment continued to be a key factor subduing primary market activity. In the market, 42 new issues raised a total of US dollar (USD) 14.79 billion. The HG space saw 27 new issues amounting to about USD 11.34 billion, including a USD 1.20 billion three-tranche issue from SF Holding Investments, USD 1.0 billion two-tranche issue from DBS Holdings and a USD 1.0 billion Hong Kong sovereign issue. Meanwhile, the HY space saw approximately USD 3.45 billion worth of new issues raised from 15 issues.

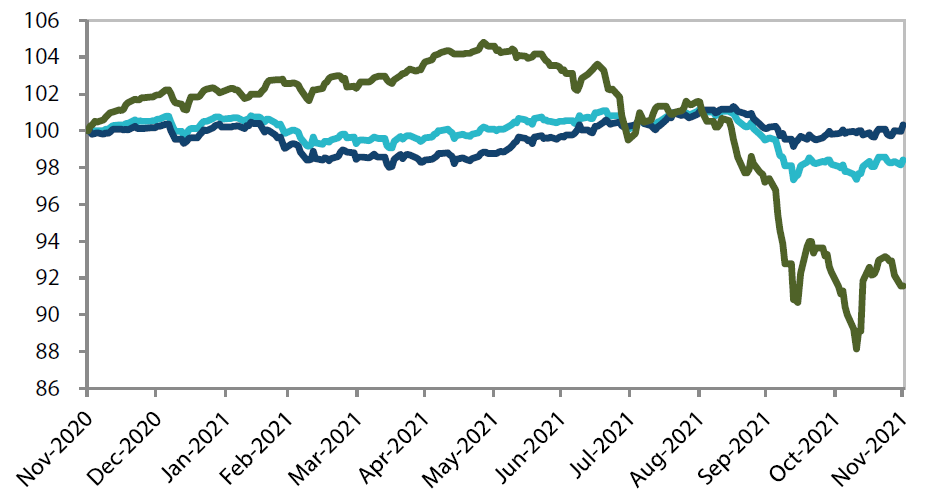

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 30 November 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Note: Returns in USD. Past performance is not necessarily indicative of future performance.

Source: Bloomberg, 30 November 2021

Market outlook

Fundamentals supportive of Asian credit spreads, though downside risks increase

The macro backdrop and robust corporate credit fundamentals remain supportive of Asia credit spreads, in our view. Tentative improvement in the COVID-19 situation across many Asian economies reinforces our view that the setback to growth in mid-2021 was temporary. Progress on vaccine rollouts, the gradual re-opening in a number of countries and still supportive fiscal and monetary policies should revive the growth momentum heading into 2022.

We expect overall corporate credit fundamentals to remain robust, with earnings growth staying strong—albeit with a slight moderation from the pace seen in 2021. Corporate leverage and interest coverage in Asia are expected to remain manageable overall, although some divergence across sectors is likely. Notably, weak sales and liquidity pressure could continue to impact the weaker developers in the China real estate space, potentially leading to more distress or default events. However, there have been tentative signs of authorities stepping in to stabilise credit access and market sentiment to prevent an over-correction that could lead to systemic risks. Credit selection will remain key although overall valuation and more benign policy environment going forward argue for spread tightening and opportunities in this space.

The key downside risks to Asian credit in 2022 include a deeper China economic slowdown and aggressive tightening of monetary policy in the US and other major economies in response to prolonged, elevated inflation. Economic recovery from the pandemic may suffer a setback with the possible emergence of new mutated virus variants that current vaccines prove ineffective against. Meanwhile, despite some recent positive developments, uncertainties relating to US-China relations remain in the background.