Summary

- US Treasury (UST) yields rose in August, prompted by data showing stronger-than-expected US employment growth. The rise in rates was supported by hawkish comments from some US Federal Reserve (Fed) officials. Rates climbed again heading into the Jackson Hole Symposium, at which Fed Chairman Jerome Powell suggested that the central bank may wait longer before hiking interest rates. Overall, 2-year and 10-year yields ended the month at 0.21% and 1.31%, respectively, about 2.4 basis points (bps) and 8.7 bps higher compared to end-July.

- Asian credits returned 1.08% in August, regaining some footing from the weakness in July. Credit spreads tightened by 21.6 bps, which more than offset the rise in UST yields. Asian high-grade (HG) gained 0.80%, with credit spreads tightening by 15.2 bps. Improved risk sentiment prompted outperformance of the Asian high-yield (HY) segment, which returned 2.07%, with credit spreads narrowing by 55 bps.

- Meanwhile, inflationary pressures mostly eased in July. The Bank of Korea (BOK) raised its policy rate while the Reserve Bank of India (RBI) announced measures to absorb excess liquidity. Separately, Malaysia appointed a new prime minister.

- We maintain our neutral stance on the rates market in the near-term. The tapering of asset purchases by the US Fed, which is expected to be announced soon, has been well signalled and should not bring too much volatility to rates markets, in our view. We also hold a sanguine view on Asian currencies, with a preference for the Singapore dollar (SGD).

- We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the second half of the year. However, near-term downside risks have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months.

Asian rates and FX

Market review

USTs rally in August

The month opened with a marked drop in yields, amid concerns of a rapid economic slowdown in the latter half of the year as the Delta variant raged globally. Yields adjusted higher soon after, prompted by data showing stronger-than-expected US employment growth. The July nonfarm payroll was up 943,000, while the unemployment rate fell from 5.9% in June to 5.4%, the lowest rate since the start of the pandemic. The rise in rates was further supported by subsequent hawkish comments from some US Fed officials, although yields briefly retraced their rise following softer US inflation and consumer sentiment readings. Rates climbed again heading into the Jackson Hole Symposium, at which Fed Chairman Jerome Powell suggested that the central bank may wait longer before hiking interest rates, improving better risk sentiment and causing the US dollar to weaken. Overall, 2-year and 10-year yields ended the month at 0.21% and 1.31%, respectively, about 2.4 bps and 8.7 bps higher compared to end-July.

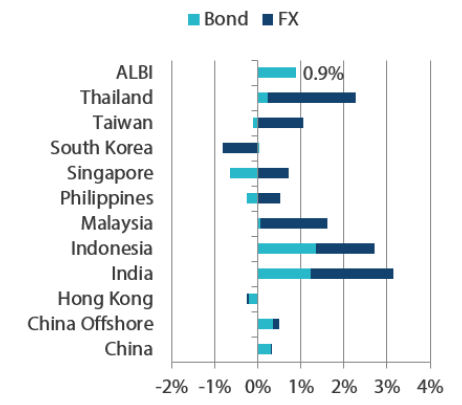

Chart 1: Markit iBoxx Asian Local Bond Index (ALBI)

| For the month ending 31 August 2021 | For the year ending 31 August 2021 | |

|

|

|

Source: Markit iBoxx Asian Local Currency Bond Indices, Bloomberg, 31 August 2021

Note: Bond returns refer to ALBI indices quoted in local currencies while FX refers to local currency movement against USD. ALBI regional index is in USD unhedged terms. Returns are based on historical prices. Past performance is not necessarily indicative of future performance.

BOK raises its policy rate; RBI announce measures to absorb excess liquidity

South Korea became the first major Asian economy to deliver a rate hike during the pandemic after its central bank raised its policy rate by 25 bps to 0.75%. The decision comes as the monetary authority attempts to balance supporting the country's economic recovery against the risks of surging debt and rising inflation. The BOK also upgraded its outlook for private consumption, raised its 2021 consumer price index (CPI) inflation forecast to 2.1% (from 1.8%), while maintaining its GDP growth forecast of 4.0% for the year. In India, the central bank left policy rates unchanged and retained its accommodative stance. That said, the RBI announced that it would double the amount of liquidity it mops up with the variable rate reverse repo (VRRR) auctions to Indian rupee (INR) 4 trillion by end-September.

Inflationary pressures mostly ease across Asia in July

Headline CPI in China, India, Malaysia, Thailand, and the Philippines all moderated in July. Inflationary pressures in Thailand fell sharply, with the headline CPI easing to 0.45% in July, undershooting the central bank’s target range. The Philippines’ 4.0% CPI print was the lowest in seven months. Similar to the Philippines, lower transport inflation was a key driver of the softer headline CPI print in Malaysia. In China, although the producer price index (PPI) rebounded to 9.0% YoY (from 8.8%) in July, CPI inflation inched down to 1.0% (from 1.1%). Meanwhile, South Korea’s consumer prices in July accelerated to 2.6%, overshooting the central bank’s 2.0% inflation target for the fourth consecutive month, on the back of higher food and oil prices.

Bank Indonesia (BI) announces further bond purchases; India unveils a “National Monetisation Pipeline”

Towards month-end, BI announced that it would purchase government bonds worth up to Indonesian rupiah (IDR) 215 trillion in 2021 and IDR 224 trillion in 2022 to fund the government’s COVID-19 healthcare and welfare bills. Government bond yields declined following the announcement as bond supply for the remainder of the year was reduced. According to Finance Minister Sri Mulyani Indrawati, the agreement would bring down the government’s interest expense to roughly 2.2% of 2021 GDP (from 2.4%). Separately, the Indian government unveiled a four-year INR 6 trillion “National Monetisation Pipeline”, which aims to raise revenues by leasing existing brownfield infrastructure assets to the private sector, and using the money raised to build greenfield infrastructure.

Malaysia appoints a new prime minister

Malaysia’s King Al-Sultan Abdullah named Ismail Sabri Yaakob as the country’s new prime minister in August, marking the return of the United Malaysia National Organisation (UMNO) party to the country’s premiership. Ismail Sabri succeeded Muhyiddin Yassin who had resigned after losing his majority in the parliament. Notably, Tengku Zafrul Aziz retained his post as finance minister in the new cabinet. Four senior ministers from the previous government were also named to head the international trade, defence, works and education portfolios.

Market outlook

Neutral on rates; sanguine on Asian currencies

We maintain our neutral stance on the rates market in the near-term. The tapering of asset purchases by the US Fed, which is expected to be announced soon, has been well signalled and should not bring too much volatility to rates markets, in our view. Global recovery is expected to be gradual as the Delta variant lingers in some countries. US inflation, while elevated, is expected to ease going forward when base effects and transitory factors wane. Within Asian rates, we expect Indonesian and Malaysian government bonds to outperform. The extension of the burden-sharing scheme between BI and Indonesia’s Ministry of Finance translates to a further significant supply reduction in Indonesian bonds for the remainder of the year. Demand for Malaysian bonds should be supported by their higher carry vis-à-vis peers.

We hold a sanguine view on Asian currencies, with a preference for the SGD. The currency’s outperformance should be supported by growth optimism as Singapore surpasses the 80% vaccination threshold, paving the way for further economic reopening.

Asian credits

Market review

Asian credits register positive returns in August as spreads tighten

Asian credits returned 1.08% in August, regaining some footing from weakness in July. Credit spreads tightened by 21.6 bps, which more than offset the rise in UST yields. Asian HG gained 0.80% in the month, with credit spreads tightening by 15.2 bps. Improved risk sentiment prompted outperformance of the Asian HY segment which returned 2.07%, with credit spreads narrowing by 55 bps.

The Asian credit market somewhat recovered in August from the prior month’s sharp sell-off. Encouraging US economic data pushed overall risk sentiment to be positive. More importantly, sentiment over Chinese credits saw a significant boost from a few factors: the release of both full-year 2020 and 1H2021 financial results of the troubled Chinese state-owned non-bank financial institution (NBFI), the company’s clarification that there would not be a debt restructuring plan and a preliminary announcement of a sizable capital injection from government-linked entities. Companies also largely reported year-on-year improvement in 1H2021 earnings, albeit partly due to favourable base effects. In the Chinese real estate sector, results show signs of declining margins, but generally most firms have managed to reduce leverage. Within the technology space, strong revenue growth also helped to ease market concerns on stricter regulatory measures. In light of higher energy prices on easing COVID-19 restrictions, oil majors also reported stronger earnings and improved credit fundamentals. On the negative side, Chinese data further pointed to the economy losing momentum, prompting policymakers to pledge additional support. The People’s Bank of China declared it would maintain stable credit growth and ramp up support for targeted sectors via monetary policy tools. Separately, China’s Ministry of Finance vowed to promote employment, accelerate fiscal spending and “moderately” quicken local government bond sales. Meanwhile, proliferation of the Delta variant remained a threat to global recovery.

Credit spreads tightened across most major Asian countries this month, with China and India outperforming. External capital infusion into the Chinese NBFI supported outperformance of Chinese credits. Meanwhile, sentiment towards Indian credits improved partly due to the government unveiling a four-year INR 6 trillion “National Monetisation Pipeline”, aiming to raise revenues by leasing existing brownfield infrastructure assets to the private sector, and using the money raised to build greenfield infrastructure. In contrast, Thai credits stood out, as spreads ended marginally wider. In frontier markets, S&P Global cut its rating outlook on Sri Lanka to “negative”, citing the country’s deteriorating fiscal position. Towards month-end, the International Monetary Fund allocated US dollar (USD) 816 million financing to Sri Lanka via the Special Drawing Rights facility.

Credit spreads widened across all Asian countries in July, with the frontier markets (Sri Lanka, Pakistan and Mongolia), China, India, Indonesia and Malaysia underperforming, while South Korea, Hong Kong, Singapore, and the Philippines outperformed. Indonesia and Malaysia, in particular, have struggled to contain the latest surge in COVID-19 cases, although in a positive sign the vaccination rollout in Malaysia accelerated. Still, Malaysian credits had to contend with ongoing political uncertainty which has dampened market sentiment. Spreads from the Philippines outperformed within the region, despite Fitch revising the outlook on the country’s “BBB” sovereign rating to “Negative”, citing concerns about weakened fiscal finances and the pandemic’s potentially negative effects on the economy.

Primary market activity subdued in August

In August, 50 new issues raised a total of USD 14.9 billion in the market. The HG space saw 26 new issues amounting to about USD 9.32 billion, including a USD 1.0 billion dual-tranche issue by Baidu Inc. and a USD 800 million dual-tranche issue from Inventive Global Investments Limited, a wholly-owned subsidiary of Agricultural Bank of China. Meanwhile, the HY space saw approximately USD 5.6 billion worth of new issues raised from 24 issues, including the USD 1.0 billion issue from HDFC Bank Limited.

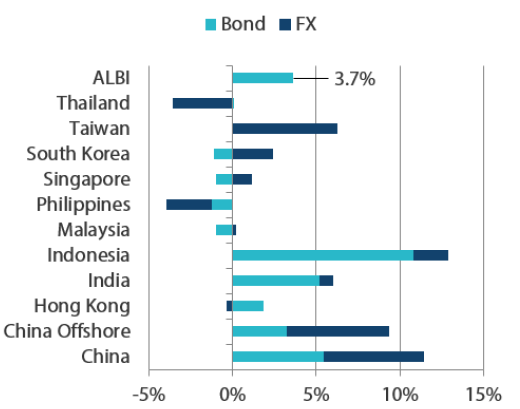

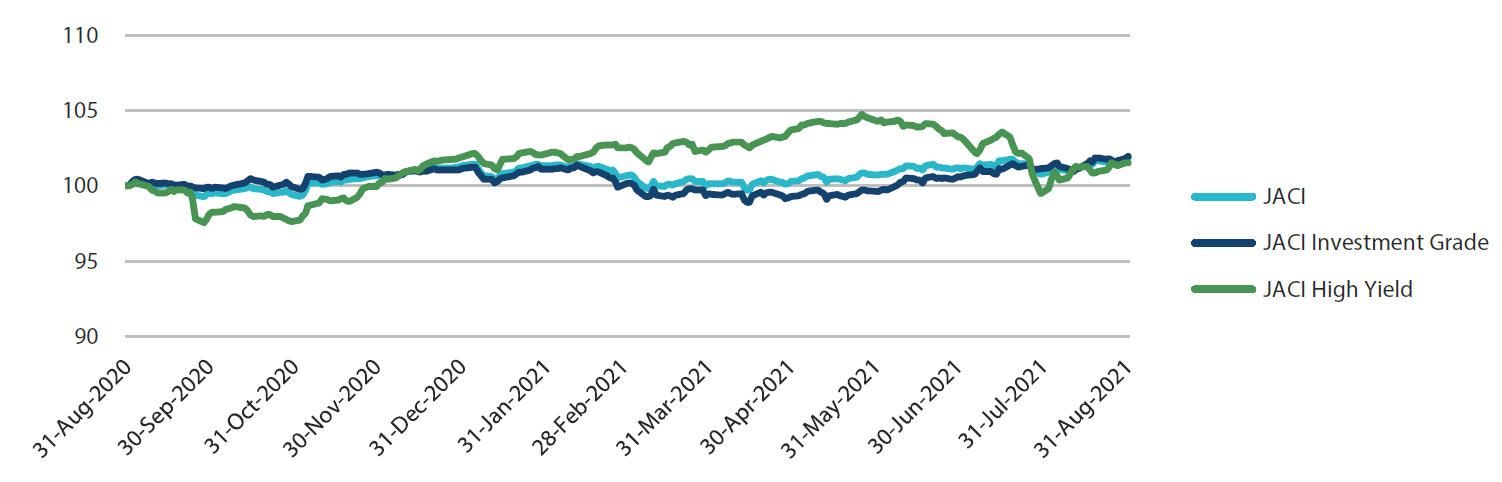

Chart 2: JP Morgan Asia Credit Index (JACI)

Index rebased to 100 at 31 August 2020

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 31 August 2021

Note: Returns in USD. Past performance is not necessarily indicative of future performance. Source: Bloomberg, 31 August 2021

Market outlook

Fundamentals supportive of tighter Asian credit spreads though downside risks have increased

We believe medium-term fundamentals remain supportive of moderately tighter Asian credit spreads over the second half of the year. However, near-term downside risks have increased, which calls for a more gradual and selective approach to adding credit risk over the next few months.

The spread of the Delta variant which led to a surge in coronavirus cases over the last few months is likely to dampen the growth rebound across many Asian countries, although this setback is likely to just delay rather than derail the whole recovery process. Progress on vaccine rollout, the gradual re-opening in a number of countries, as well as still supportive fiscal and monetary policies, are expected to revive the growth momentum once the current COVID-19 wave subsides. Similarly, we expect overall corporate credit fundamentals to remain robust, although the positive earnings momentum in the second half of 2021 could be softer and may vary in degree by sector. Specifically, certain service industries, such as travel and leisure, are likely to be impacted by the COVID-19 resurgence. Sectors affected by regulatory changes and ongoing policy tightening in China would also experience greater pressure on credit metrics.

In addition to the risk of a more pronounced economic impact from the ongoing COVID-19 wave, as well as uncertainties regarding the scope of regulatory and policy reforms in China, other key risks in the near-term include a more aggressive tightening of monetary policy in the US and worsening US-China bilateral relations.