In late August the Nikkei made a full recovery from the "Corona shock" lows touched in March, amid initiatives by the government and the central bank. What matters now is how Japan's economic recovery takes shape and how quickly corporations adapt to the new environment.

Looking beyond the Nikkei's recovery from "Corona shock" lows

The Nikkei Stock Average reached a milestone late in August when it rose above the 23,000 threshold, marking a full recovery from its low in the mid-16,500 range touched in March when the shock of the COVID-19 outbreak gripped the markets. To a certain degree, the Nikkei's rebound from that low can be justified when we factor in the government's stimulus package and the Bank of Japan's initiative to support the banking system in the wake of the pandemic.

What matters now is how the economic recovery takes shape following the pandemic-induced shock. Stock prices will rise if corporations adapt to the new environment, as we are already witnessing with the GAFA names in the US market. However, in our view, the recovery path by Japanese companies will be slightly different. The pandemic has changed domestic demand dynamics, which in turn could benefit manufacturers such as auto and parts makers as the social distancing trend increases demand for cars. Growing demand for digitization in the socially-distancing post-pandemic world could also favour electronic component manufacturers and makers of semiconductor manufacturing equipment.

Central bank monetary easing no doubt played a role as the markets tried to regroup from the shock of the pandemic. But rather than providing a strong upward thrust to stocks, it is perhaps more accurate to say that easing measures shored up the market and helped prevent a further tumble. Monetary easing and resulting excess liquidity are unlikely to propel stock prices much further; that will be up to the economy, accompanied by a shift in industry dynamics, recovering to pre-corona levels.

Prime Minister Abe's resignation and market implications

Japanese Prime Minister Shinzo Abe announced his resignation on 28 August, drawing to a close his tenure as the country's longest-serving premier. While Abe's announcement was a surprise, it needs to be noted that within Japan, “Abenomics” and his other economic policies were attracting almost no attention during the last stages of his administration.

Several candidates within the ruling Liberal Democratic Party (LDP) are vying to succeed Abe. But market focus rests on how the government continues to handle the Corona-induced economic shock and whether it would be willing to launch additional stimulus if necessary. The pandemic has also raised doubts about global value chains, and the government has opted to aid companies bringing production operations back to Japan. Abe's successor, regardless of who the LDP chooses, will have little choice but to continue such policies.

Relative to their Japanese peers, foreign investors may be taking a slightly different view of the political developments in Tokyo; for many foreign investors, Abe was synonymous with one of the most stable governments in the world and his departure would naturally be seen as a risk. The changing of the guard, therefore, could prompt some foreign investors to reduce their allocations in Japan. But the appointment of a new prime minister will not be negative enough to cause foreign investors to sell Japan aggressively, in our view. It is worth noting that in 2007, the last time Abe resigned after his first tenure as premier, Japanese stocks actually rose. Market focus had quickly shifted to other factors in 2007, and it could be no different in 2020.

Market: Japan equities rise in August

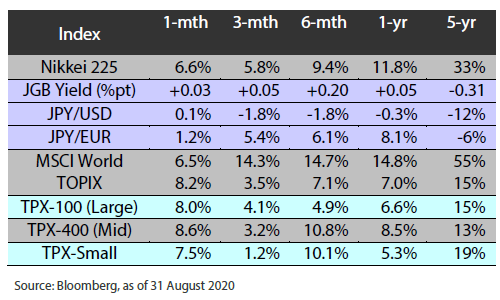

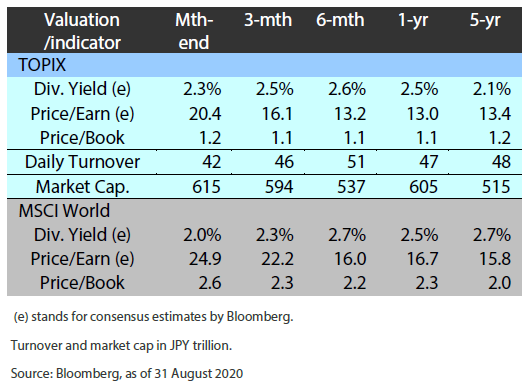

The Japanese equity market rose in August, with the TOPIX (w/dividends) rising 8.17% on-month and the Nikkei 225 (w/dividends) climbing 6.63%. Although stocks ultimately ended the month higher, the market was moved by a combination of positive and negative news. Negative factors included the sharp decline in Japan's April-June GDP growth, which highlighted the scale of COVID-19's impact on the Japanese economy, as well as increased political uncertainty following Prime Minister Shinzo Abe's decision to resign from his post. Nevertheless, Japanese stocks were bolstered by better-than-expected economic indicators from the US as well as news that US President Trump had signed a number of executive orders for further economic relief, which helped ease uncertainty around the future outlook for the US economy. In addition, expectations surrounding the progress toward the development of a new treatment and vaccine for COVID-19 also benefitted stocks. All of the 33 Tokyo Stock Exchange sectors rose during the month, with Air Transportation, Iron & Steel, and Land Transportation posting the strongest gains.

Exhibit 1: Major indices

Exhibit 2: Valuation and indicators

Exhibit 3: Major market indices

TOPIX

USD/JPY