The Fund seeks to achieve a NAV that closely correlates with the movement of the TOPIX Ex-Financials by investing in shares of the component stocks of the TOPIX Ex-Financials, and maintaining, in principle, a portfolio constructed consistent with the calculation method of the TOPIX Ex-Financials.

Key information

| Name: | Listed Index Fund TOPIX Ex-Financials | |

| Code: | 1586 |

Net Asset Value and Performance

| Fund Name | Listed Index Fund TOPIX Ex-Financials Open-end/Domestic/Equities/ETF/Index type |

| Listed Exchange | Tokyo Stock Exchange |

| Issue Code | 1586 |

| Targeted Investments | This fund mainly invests in stock issues adopted for TOPIX Ex-Financials. |

| Date Listed | 26 September 2013 (launched on 24 September 2013) |

| Exchange Trading Unit | 1 unit |

| Trust period | Unlimited |

| Computation Period | Every year, 9 Jan - 8 Jul, 9 Jul - 8 Jan |

| Closing Date | Every year, the 8th day of January and July |

| Dividends | All revenue from dividends arising from the trust assets will be, in principle, paid as dividends on the last day of the fiscal year after deducting expenses. *There is no guarantee on the payment or the amount of dividend. |

Fund Expenses

■Expenses to be borne directly by investors

| Subscription Fee | Independently set by Distributors *Please contact your Distributor for further information. *Subscription Fee is compensation for explanation and information providing about the Fund or investment environment, and is also including expense of clerical processing of the subscription. |

| Redemption Fee | Independently set by Distributors *Please contact your Distributor for further information. *Exchange Fee is compensation for clerical processing of the exchange. |

| Amount to be Retained in Trust Assets | None |

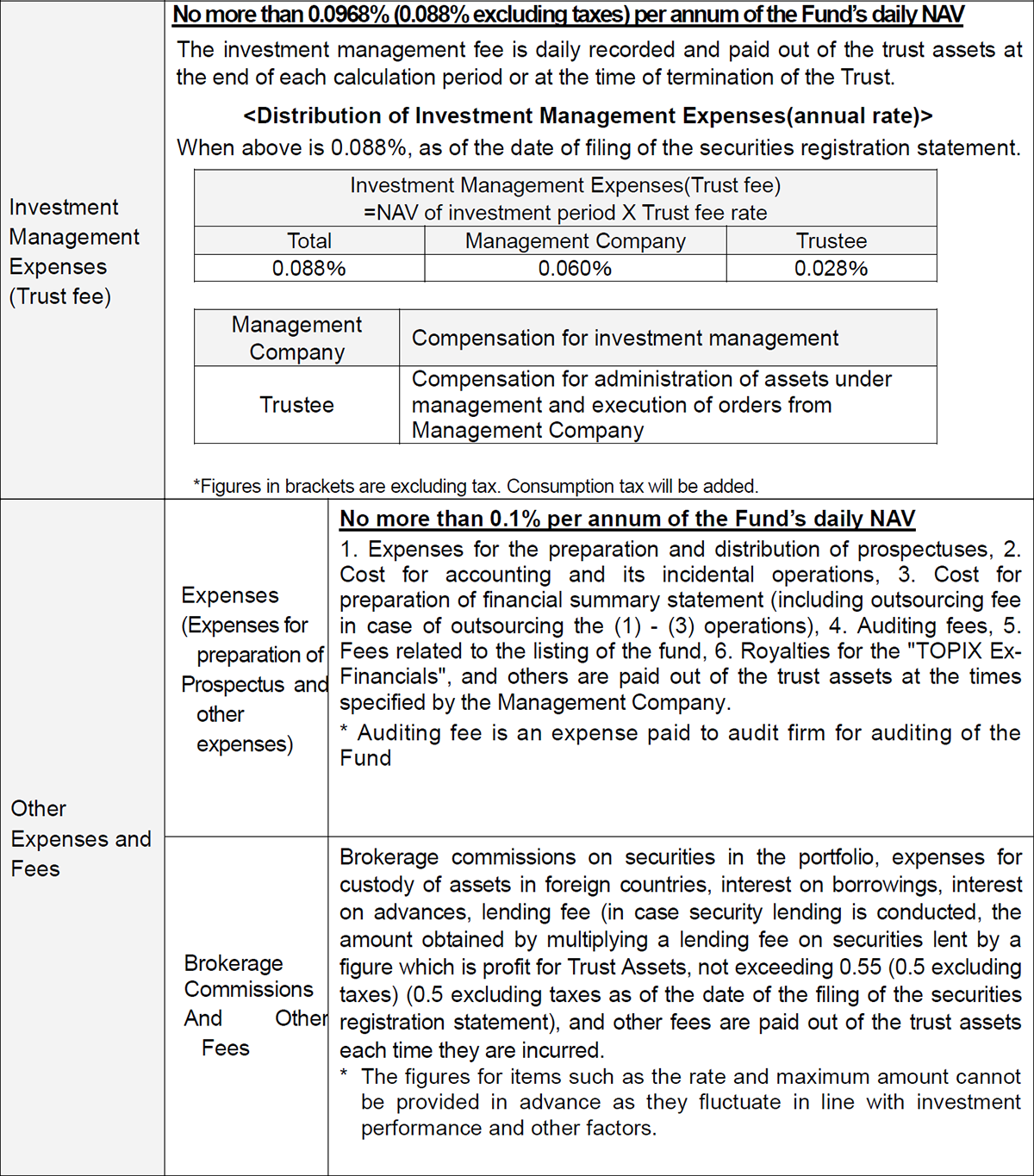

■Expenses to be borne indirectly by investors from trust assets

The total amount of expenses of the Fund to be borne by investors varies according to holding length and investment status, and thus cannot be shown.

Major Investment Restrictions

|

Trustee Companies

|

TOPIX Ex-Financials is calculated using free-float adjusted market capitalization as an index and targets issues that exclude those belonging to insurance, banking, securities and commodity futures trading industries, and other financial operations from issues calculated for TOPIX (Tokyo Stock Price Index).

TOPIX Ex-Financials is calculated by setting the July 5, 1993 closing price as the base time and setting the total market value on that date as 1,000 points.

* 33 industries specified by the Securities Code Council" shall be used when classifying industries.

Further Information

Japan Exchange Group (JPX)

Japan Exchange Group publishes summaries and lists of the ETFs, as well as other valuable information on their website.

S&P Global

- Listed ETF iNav

Please click this link to see the iNAV.

*Link to external sites.

Copyrights and Other Rights of TOPIX Ex-Financials

The TOPIX Ex-Financials index value and the TOPIX marks or trademarks are intellectual property rights owned by JPX Market Innovation & Research, Inc. or its affiliates (hereinafter, “JPX”). All rights and know-how relating to the TOPIX Ex-Financials, including calculation, publication and use of this index value, as well as all rights relating to the TOPIX marks or trademarks belong to JPX.

JPX reserves the right to change the method of calculation or publication, to cease the calculation or publication of the TOPIX Ex-Financials index value, or to modify the TOPIX marks or trademarks or cease the use thereof.

JPX makes no warranty or representation as to the results derived from the TOPIX Ex-Financials index value and the use of the TOPIX marks or trademarks, and as to the TOPIX Ex-Financials index value price of a particular date.

JPX does not guarantee the accuracy or completeness of the TOPIX Ex-Financials index value and data contained therein. Further, JPX shall not be liable for the miscalculation, incorrect publication, delayed or interrupted publication of the TOPIX Ex-Financials index value.

This Fund is not in any way sponsored, endorsed or promoted by JPX.

JPX does not bear any obligation to give an explanation of this Fund or advice on investments to any purchaser of this Fund or to the public.

JPX does not consider the needs of Nikko Asset Management Co., Ltd. or purchaser of this Fund in terms of issue composition and calculation for calculating the TOPIX Ex-Financials index value.

Including but not limited to the above items, JPX shall not be responsible for any damage resulting from the subscription into, sale or marketing of this fund.

- 21 Feb 2024 — Earnings Report for Fiscal Year ended Jan 2024

- 21 Aug 2023 — Earnings Report for Fiscal Year ended Jul 2023

- 21 Feb 2023 — Earnings Report for Fiscal Year ended Jan 2023

- 19 Aug 2022 — Earnings Report for Fiscal Year ended Jul 2022

- 21 Feb 2022 — Earnings Report for Fiscal Year ended Jan 2022

- 20 Aug 2021 — Earnings Report for Fiscal Year ended Jul 2021

- 19 Feb 2021 — Earnings Report for Fiscal Year ended Jan 2021

- 20 Aug 2020 — Earnings Report for Fiscal Year ended Jul 2020 (9 Jan 2020 - 8 Jul 2020)

- 20 Feb 2020 — Earnings Report for Fiscal Year ended Jan 2020(9 Jul 2019 – 8 Jan 2020)

- 21 Aug 2019 — Earnings Report for Fiscal Year ended Jul 2019 (9 Jan 2019 - 8 Jul 2019)

- 21 Feb 2019 — Earnings Report for Fiscal Year ended Jan 2019 (9 Jul 2018 - 8 Jan 2019)

- 21 Aug 2018 — Earnings Report for Fiscal Year ended Jul 2018 (9 Jan 2018 - 8 Jul 2018)

- 21 Feb 2018 — Earnings Report for Fiscal Year ended Jan 2018 (9 Jul 2017 - 8 Jan 2018)

- 21 Aug 2017 — Earnings Report for Fiscal Year ended Jul 2017 (9 Jan 2017 - 8 Jul 2017)

- 21 Feb 2017 — Earnings Report for Fiscal Year ended Jan 2017 (9 Jul 2016 - 8 Jan 2017)

- 19 Aug 2016 — Earnings Report for Fiscal Year ended Jul 2016 (9 Jan 2016 - 8 Jul 2016)

- 19 Feb 2016 — Earnings Report for Fiscal Year ended Jan 2016 (9 Jul 2015 - 8 Jan 2016)

- 20 Aug 2015 — Earnings Report for Fiscal Year ended Jul 2015 (9 Jan 2015 - 8 Jul 2015)

- 20 Feb 2015 — Earnings Report for Fiscal Year ended Jan 2015 (9 Jul 2014 - 8 Jan 2015)

- 21 Aug 2014 — Earnings Report for Fiscal Year ended Jul 2014 (9 Jan 2014 - 8 Jul 2014)

- 20 Feb 2014 — Earnings Report for Fiscal Year ended Jan 2014 (24 Sep 2013 - 8 Jan 2014)

This Fund can be applied for as a cash creation and a cash redemption at Authorised Participants in addition to the Tokyo Stock Exchange.

Authorized Participants

- SMBC Nikko Securities Inc.

- Citigroup Global Markets Japan Inc.

- ABN AMRO Clearing Tokyo Co., Ltd.

- BNP Paribas Securities (Japan) Limited

- BofA Securities Japan Co., Ltd.

- Daiwa Securities Co. Ltd.

- Goldman Sachs Japan Co.,Ltd.

- JPMorgan Securities Japan Co., Ltd.

- Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

- Mizuho Securities Co., Ltd.

- Morgan Stanley MUFG Securities Co., Ltd.

- Nomura Securities Co., Ltd.

- Societe Generale Securities Japan Limited

Daily Creation and redemption are based on ETF's NAV calculated in early evening. Confirm non-tradable days by referring to trading calendar on our official homepage. Basket for creation is continually-updated on our official homepage.

Basically sell/buy underlying asset at last price of T day's market.

The flow chart below is showing the creation/redemption process for Nikko AM ETFs. Please note that transactions cannot be processed for days on which applications are not accepted.

Creation Flow for Cash Creation/Redemption Type ETFs

Redemption flow for cash Creation/Redemption Type ETFs

Investors are not guaranteed the investment principal that they commit. Investors may incur a loss and the value of their investment principal may fall below par as the result of a decline in market price or NAV. All profits and losses arising from investments in the Fund belong to the investors (beneficiaries). This Fund is different from saving deposit.

The Fund invests primarily in stocks. The NAV of the Fund may fall and investors may suffer a loss due to a decline in stock prices or deterioration in the financial conditions and business performance of an equity issuer. Investors may also incur losses due to exchange rate fluctuations when investing in assets denominated in foreign currencies.

Major risks are as follows:

1. Price Fluctuation Risk

Stock prices fluctuate as they are affected by information on the companyfs growth rate and profitability as well as changes in such information. They also fluctuate as they are affected by economic and political conditions in Japan and abroad. There is a risk that the Fund will suffer material losses if unexpected changes occur in stock price or liquidity.

2. Liquidity Risk

The Fund may incur unexpected losses when the size of the market or trading volumes is small. The purchase and sale prices of securities are influenced by trading volume, resulting in the risks that they cannot be traded at prices expected to be realized in light of the prevailing market trend, sold at the estimated prices, or that the trading volume is limited regardless of the level of prices.

3. Credit Risk

There is a risk that the Fund will incur material losses in the event of a serious crisis that directly or indirectly affects the business of a corporation in which the Fund invests. The prices of stocks of issuers may substantially decline (possibly to zero) due to fears of default or corporate bankruptcy, which can contribute to decline in the Fund NAV.

4. Foreign Currency Risk

For foreign currency-denominated assets, generally if the foreign exchange market moves so that the yen appreciates against the currency in which the concerned assets are held, the fund's NAV may depreciate as a result.

5. Security-lending Risk

Lending securities involves counterparty risks, which are the risks of contractual default or cancellation following bankruptcy, etc., by the counterparty. As a result, the Fund may suffer unexpected losses. Following the default or cancellation of a lending agreement, when liquidation procedures are implemented by using the collateral that is set aside in the lending agreement, the procurement cost of buying back the securities can surpass the collateral value, due to price fluctuations in the market. In such cases, the Fund is required to pay the difference, which may cause the Fund to incur losses.

Discrepancy factors between the TOPIX Ex-Financials and the NAV

The Fund seeks to match the NAV volatility with that of the TOPIX Ex-Financials, but it cannot guarantee that movements will be consistent with the Index for the following reasons:

- The Fund may be subjected to market impact when buying or selling individual stocks as it adjusts its portfolio in response to changes in the stocks that comprise the TOPIX Ex-Financials and capital changes among corporations. In addition, the Fund will incur various expenses, including trust fees, brokerage commissions, and audit fees.

- The management fee from lending securities or dividends of incorporated issues.

- When derivatives transactions such as futures are made, there may be disparity between the price movements of such transactions and that of some or all of the constituents of the TOPIX Ex-Financials.

Discrepancy between the market prices at which stocks are traded on exchanges and the NAV

The Fund is listed on the Tokyo Stock Exchange and the units are traded on that exchange. The market price of the units is affected primarily by the demand for the Fund, its performance, and how attractive it is to investors in comparison with their other investments. It is not possible to predict whether the units will sell in the market above or below the NAV.

*The factors that contribute to fluctuations in the NAV are not limited to those listed above.

Additional Considerations

- These materials are distribution materials created by Nikko Asset Management in order to increase investors' understanding of "Listed Index Fund TOPIX Ex-Financials".

- The provisions stipulated in Article 37-6 of the Financial Instruments and Exchange Act (the "cooling-off period") is not applicable to Fund transactions.

- This Fund differs from deposits or insurance policies in that it is not protected by the Deposit Insurance Corporation of Japan or the Policyholders Protection Corporation of Japan. Furthermore, the Japan Investor Protection Fund will not pay any compensation for units purchased from registered financial institutions, such as banks.

- When the Fund faces big redemption causing short term cash requirement or sudden change in the main trading market condition, there can be temporal decline in the liquidity of holding assets, resulting in the risks that Fund unable to trade securities at the expected market prices or appraised prices, or encounters limitation in trading volume. This may result in the negative influence on NAV, suspension of redemption applications, or delay in making payment of redemption.

- When applying to invest in the Fund, please make the decision to invest carefully after taking the time to read the delivered pre-agreement document and other relevant materials in detail.