|

|

|

|

|

Identifying Future Quality companies |

Analysing ESG factors |

Building differentiated portfolios of our best Future Quality ideas |

Delivering strong risk-adjusted returns |

The Global Equity Team

We are a team of experienced investment professionals with a belief that a collective approach to picking stocks and active portfolio management will produce the best results for clients. Over the past decade we have developed a successful and repeatable investment process that combines top-quality fundamental research, integrated environmental, social and governance (ESG) analysis and financial modelling, with rigorous portfolio construction and management. This approach has resulted in differentiated global equity portfolios built from our best Future Quality ideas.

Our Future Quality investment approach:

✓ Collective focus

✓ Integrated ESG process

✓ Highest-conviction investments

✓ Differentiated portfolios

✓ Strong track record

Future Quality

We are very particular about the type of company we invest in. We believe businesses that can attain and sustain high returns on invested capital will deliver better performance for shareholders over the long term. We call these Future Quality businesses.

Our investment process puts the search for these businesses at its heart, as we believe that the potential for Future Quality can be analysed and projected through detailed, fundamental research into a company, its management, finances and the markets it serves.

Future Quality with ESG

In our view, high-quality companies often aim to provide value to all stakeholders and demonstrate strong ESG credentials. Successfully addressing these factors increases the likelihood of a company being able to sustain returns, which is a key ingredient of Future Quality. Therefore ESG and stakeholder analysis are integral to our Future Quality research process.

We believe that investment markets will increasingly allocate capital to companies that have the potential to address ESG opportunities and issues, look after their stakeholders’ interests through good times and bad, while still achieving attractive and sustainable returns. Indeed, given the scale of the challenges faced across the world today, we have found that the number of companies that demonstrate these qualities has increased. We believe these companies are likely to be the long-term winners, and these are the investment opportunities that our Four-Pillar Future Quality process aims to uncover.

Identifying Future Quality

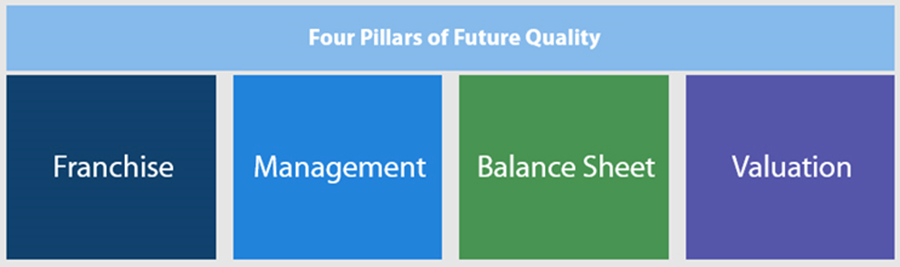

We assess the Future Quality and ESG merits of each investment opportunity using the same Four-Pillar framework:

Franchise Quality : We undertake detailed research into companies, their business models and the sectors they serve. We are looking for qualities that can help drive long-term growth, such as a strong competitive advantage, growing addressable market or improving market share. We also review companies’ ESG strengths and risks to gain insight into the likely sustainability of each franchise.

Management Quality : We identify strong management teams with proven track records and clear strategies for their businesses. We expect the management teams of our investment companies to be able to attract and retain the best talent and foster positive company cultures. We also seek companies that embrace robust governance standards, set stretching ESG-related targets and recognise the need to provide stakeholder value for all.

Balance Sheet Quality : We produce detailed financial models of potential holdings as we want our investments to have robust and sustainable balance sheets, as well as the capacity to finance growth through strong cash generation. We analyse capital allocation decisions to discover if management teams are making solid reinvestments in their businesses, in order to deliver and maintain key growth drivers and bolster ESG commitments.

Valuation : Our modelling and assessment of potential future cash flows is disciplined and conservative. Ultimately, we want to identify if share prices reflect the valuations in our models, or if there are opportunities that the market has not yet appreciated. Our analysis across the other pillars of the Future Quality framework feeds into the cash-flow projections and cost-of-capital estimates we use to value potential investments.

Our Collective Focus

We have fostered a strong team dynamic and our collective knowledge and experience are powerful tools for delivering investment performance. Our Portfolio Managers are seasoned investors with a broad skillset and significant accumulated knowledge, built up over many market cycles, which is brought to bear on our investment decision making. In addition, our newer analysts bring fresh ideas, while working hand in hand with the Portfolio Managers to research key long-term investment themes.

We operate a flat structure where all our Portfolio Managers have a dual role that combines investment analysis and portfolio management responsibilities. Within this structure, we actively challenge the ideas and research of colleagues throughout the Future Quality investment process in an open atmosphere of vigorous debate and constructive deliberation.

There is joint accountability for performance, as we take collective responsibility for approving companies for client portfolios. It is in everyone’s interest to ensure that the investment analysis is thorough, and no stone is left unturned in the search for Future Quality.

ESG and stakeholder analysis are undertaken directly by our team’s Portfolio Managers and fully integrated into the overall stock-picking process – a further crucial strength in our investment approach. During our Four-Pillar research process, we each have a responsibility to understand the ESG opportunities, issues and characteristics influencing potential holdings, while also considering how these could impact a company’s risk-return potential. This responsibility rests well with the team because of the breadth and depth of our analysis – we are specialists in the companies and industries we cover and can understand and evaluate the key ESG factors that may influence a company’s potential to generate attractive returns.

Our open culture of mutual respect allows our process to thrive, encourages independent thinking and leads to robust, constructive assessment of businesses under review. This process produces a portfolio tilt towards growth and quality.

“Our team-based approach is highly effective at scrutinising potential investments, analysing ESG criteria and monitoring risk. We have a flat structure that helps foster a collective focus to our stock reviews and portfolio construction, while minimising the potential for behavioural bias.”

Building Differentiated Portfolios

In the Global Equity team, we have a high-conviction strategy that is not constrained by benchmarks. Therefore, Future Quality can be sourced from listed businesses across any geography or sector. In a world awash with investment opportunities, our disciplined, accountable and transparent process helps us to focus on companies that we feel have the best potential to attain and sustain high returns.

Idea Generation

Investment ideas are sourced in several ways, including fundamental industry or thematic research, team discussions, independent analysis and in-house resources. We like to think of this as ‘joining the dots’, as we apply our knowledge and market understanding, in a lateral and pragmatic way, to find the best-available investment opportunities.

Fundamental Research

As we are fundamental, bottom-up stock selectors, we provide full financial models for our investment ideas. Our Portfolio Managers have specific sector responsibilities and are experts in the industries under their coverage. When analysing a company, we investigate it using the Four Pillars of our Future Quality investment approach, considering everything from industry dynamics, management strategy and consideration of stakeholders, through to capital expenditure decisions. Our research is fundamental and in-depth. Companies that do not initially meet our criteria are able to make it to the Peer-Challenge stage if our analysis indicates the potential for change, with a strong prospect of these businesses developing into sustainable, Future Quality stocks.

We regularly engage with companies through the investment process – from initial research through to portfolio inclusion and beyond. These discussions provide us with an opportunity to understand each business and industry better and to take a view on the quality of management teams and their strategies. We also engage on ESG factors, if we believe that further work is required to understand a prospect’s investment’s strategy and the key ESG dynamics at play.

Peer Challenge

Research templates are presented to the whole team at our Weekly Research Meeting. The template models, analyst reports and ESG-related assumptions are challenged by team members, with forecasts stress-tested, and business drivers and Future Quality factors deliberated. This research meeting ultimately leads to a team decision on the overall merits of the business in question, to decide whether it meets our criteria for potential portfolio inclusion.

Portfolio Construction

If approved at the Weekly Research Meeting, the company under review is compared to around one hundred other researched investments, using our Stock-Ranking Tool. Every month, each team member grades the Future Quality ideas for degree of conviction and outperformance potential. We then hold a Stock-Ranking Meeting to challenge and evaluate the portfolio and other researched ideas.

This forum leads to us optimising the investment mix, as we constantly focus on our best ideas – to ensure investment weights reflect our ranking scores. This process produces concentrated, high-conviction portfolios of around 40 to 50 holdings, with significant active weights that bear little resemblance to global benchmark indices. We build portfolios with risk-return characteristics that meet our clients’ requirements and are consistent with our Future Quality and sustainability targets.

Our analysis and monitoring of stocks and portfolios is a dynamic and ongoing process. We review our ranking scores monthly, and on an ad-hoc basis if there is a change to our analyst’s stock recommendation, because of new, relevant information. These changes are all thoroughly discussed, debated and actioned by the team, as necessary.

https://en.nikkoam.com/risk-information

All information in this document is correct as at March 2025.