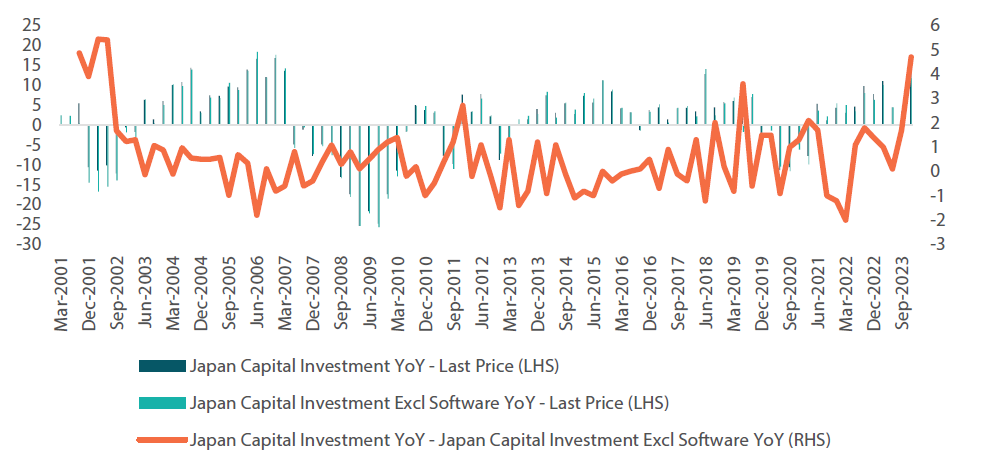

One of Japan’s more recent economic releases made us sit up and take notice. Within the very resilient Q4 capital expenditure figures released this week was one important reinforcing indicator of Japan’s structural recovery, or in the Bank of Japan (BOJ)’s language, its “virtuous circle” of reflation. This was evidenced by, above and beyond Japan’s resurgent spending on fixed assets, its decades-high implicit expenditure on software (see Chart 1), typically a proxy for the type of spending corporates engage in when making honest attempts to increase the productivity of their businesses. One near-term positive development for Japan is the very real possibility that the “technical recession” in Japan Q4 GDP (down 0.4% quarter-on-quarter) could be, thanks to unexpectedly strong Q4 capex, revised away.

Chart 1: The Q4 2023 surge in firms’ capital expenditure, particularly in software

Source: Ministry of Finance

But what gives us conviction that the increase in investment is structural, not merely cyclical? Our conviction lies in indications that widespread, chronic labour supply shortages are a proximate motivator of the surge in investment. A recent BOJ review article spells out for us why we should take Q4 capex (particularly software expenditure) seriously as a signal of Japan’s ongoing structural recovery.

US example shows that substituting capital for labour can create higher value-added jobs

Both in the US and in Japan, labour’s share of income has been declining for decades. The BOJ, however, points out that the economic context of these declines has been distinct in each country. In the US, these declines have been accompanied by (a) relative declines in capital goods and software prices comparative to wages which have led to (b) greater investment in labour-saving technologies and processes, which in turn have increased demand for high-skilled labour such as software development. As a result, the US has been better able to substitute capital for labour than has Japan, which has led to higher wages for skilled workers in the US, even as many lower-skilled tasks have been automated away. In the US, firms’ productivity-enhancing investments in intangible assets (such as software) in tandem with higher pay for skilled workers have resulted in productive use of these assets (to automate simpler tasks) while at the same time further contributing to demand for such skilled workers. Ultimately, the higher pay due skilled workers, for their productivity-enhancing capabilities, has been a reasonable price to pay to achieve a decrease in operational costs, and this in turn has enhanced firms’ profit margins. It is no coincidence therefore that forward projections of these margin-enhancing mechanics currently underlie lofty valuations of the US’s largest firms by market capitalisation.

No longer “lost”: Japan’s increasing trend toward business transformation

Japan’s ability to benefit from transformative business investments such as those described above has been limited, particularly over its “lost decades” of growth starting in the 1990s. Of late however, particularly since labour shortages have persisted and have become more acute, Japan’s abilities to introduce transformative technologies has been improving, even in the typically slow-to-adapt services sector. In fact, the BOJ describes labour shortages as one strong motivator among firms for transformative investments. Although it takes time for firms to conclude that labour shortages are not cyclical but structural, sure enough, once firms do reach the conclusion that labour shortages are chronic (according to the BOJ chronic labour shortages are defined as when firms on average experience five to eight quarters of difficulties in finding skilled labour), firms do increase their capital investments and particularly their software investments.

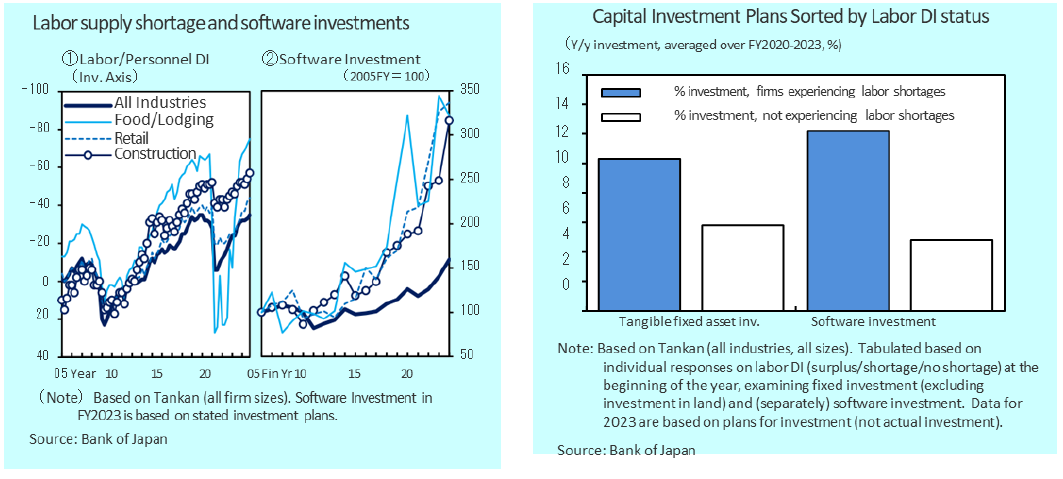

Using quarterly BOJ Tankan data, Charts 2 and 3 show how the lagged relationship between structural labour shortages and investment plays out. The left-hand side of Chart 2 shows the Tankan labour diffusion sub-index among particularly labour-intensive industries (such as food/lodging, services, and construction), with readings increasingly below zero indicative of intensifying skilled labour shortages. On the right-hand side of Chart 2, it may be observed that, with several quarters’ lag to labour shortages, an accelerating surge in software investment has become evident in such industries. To cite concrete examples of transformative labour-saving capital expenditures, “self-check-out” became more widespread in the retail sector during the coronavirus pandemic. Concurrently “automatic check-in” in the lodging sector became a new norm around the same period. These are examples of investment in software and productivity-enhancing capital expenditures bearing fruit.

Charts 2 and 3: Relationship between structural labour shortages and investment

Source: Bank of Japan. See BOJ Review (2023-J-13), published in December 2023.

That these expenditures were motivated specifically by labour shortages are made clear in Chart 3, where capital investment in tangible fixed assets and software are segmented by firms who, at the beginning of each year (2020-2023) reported difficulties finding skilled labour versus those who encountered no such difficulties. Very clearly, firms who encountered labour shortages at the beginning of the year made significantly greater year-on-year investments in both tangible fixed assets and software than those firms who did not report such shortages.

Translating productive investments into firm fundamentals

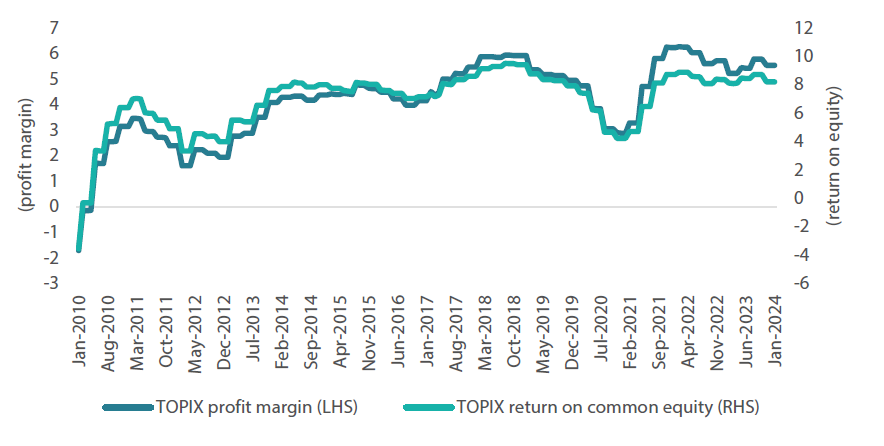

As we noted in our recent piece, "Japan transitioning from cyclical reflation to structural recovery for balanced growth", return to nominal GDP growth has helped Japanese corporates increase revenues which in turn have translated to increased profits. This cyclical rebound however has also been accompanied by a more structural improvement—the fruits of deployment of free cash flow toward new productivity-enhancing investments. As we observe in Chart 4, the profit margins of TOPIX constituents have been slowly improving, as has, alongside them, return on equity.

Chart 4: Improvements in TOPIX profit margins and return on equity

Source: Bloomberg, Nikko AM Global Strategy. Data as at 24 February 2024.

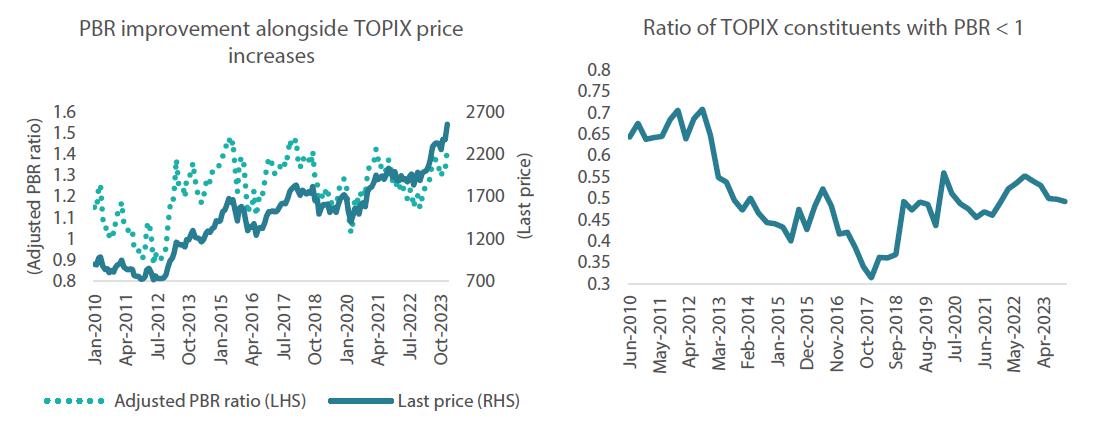

Meanwhile, highs in the TOPIX have helped the average price-to-book (PBR) ratio to rise, on average above 1, a key indicator within the Tokyo Stock Exchange’s new governance-enhancing listing framework (see Chart 5). Yet as both we and the BOJ note, the “virtuous circle” is an ongoing reflation process that will take time to manifest. Indeed, even despite the improvement in average TOPIX PBR’s, we observe that there are plenty of firms with valuations still below 1, many of which have room to invest cash balances in productivity-enhancing technology going forward (see Chart 6).

Charts 5 and 6

Source: Bloomberg, Nikko AM Global Strategy. Data as at 24 February 2024.

Reflation eases the blow of attrition of firms

During Japan’s “lost decades”, the received wisdom had been that the deficit of demand ensuing from Japan’s aging and eventually shrinking demography rationalised the expectation of ever-weaker growth and ever-lower prices. Although demographics are rarely linear, interpreting them as such when projecting future sales have sometimes set companies up for a shock once labour market slack has well and truly worked its way through the economy.

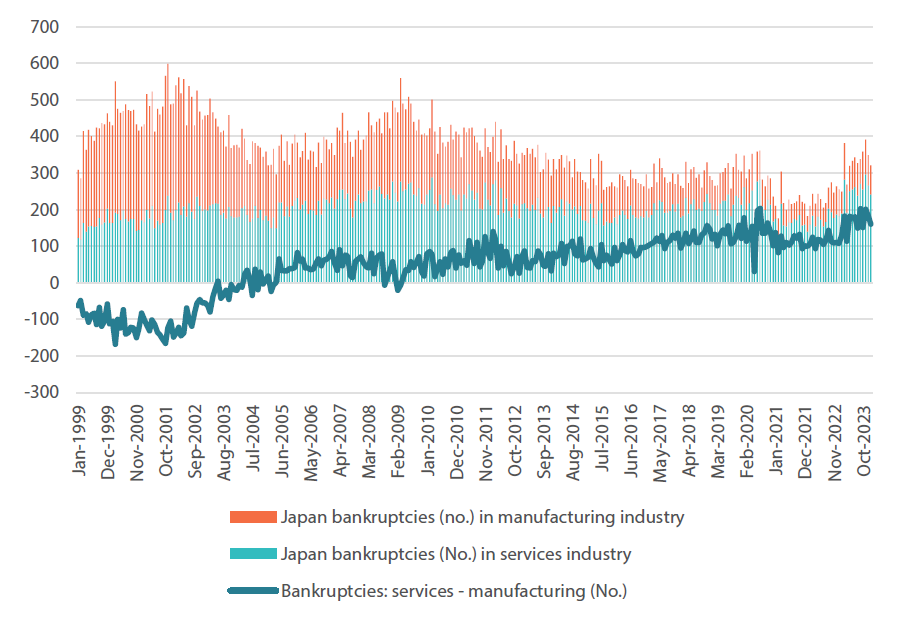

The results have not been uniformly positive for all Japanese firms. Indeed, it is evident that bankruptcies are markedly higher for labour-intensive services sector firms than for more easily automatable manufacturing sector firms. Chart 7 shows that the relative rate of services to manufacturing sector bankruptcies has hit a multi-year high, even in an environment of accommodative financial conditions. During the pandemic, reports of bankruptcy specifically stemming from inability of firms to handle labour supply shortages became prominent. Meanwhile, as pandemic conditions eased, the ensuing environment of recovering firm pricing power amid labour supply shortages created a more benign economic environment for unprofitable “zombie” firms to exit the market with limited knock-on effects on household income.

Chart 7: Number of manufacturing vs. services bankruptcies

Source: Bloomberg, Nikko AM Global Strategy. Data as at 24 February 2024.

Why sentiment remains highly important: deconstructing the “deflationary mindset”

Ultimately, learning from the successes of productivity-enhancing firms is only half the battle for corporate Japan. The other half is for firms to continue making productivity-enhancing investments even through business cycles and ensuring that the “deflationary mindset” remains well and truly a thing of the past. As such, corporate sentiment surveys such as the Tankan or expectations component of the Economy Watchers Survey are likely to be scrutinized by the BOJ and market participants alike for signals that firms continue to do their part to keep the “virtuous circle” of reflation alive.