Prior to the Japanese Upper House elections on 20 July, uncertainty surrounding the outcome had put Japanese assets under pressure. The elections, which resulted in the ruling coalition's loss of its Upper House majority, are now over. The markets are beginning to view the elections as a past event, signalling a shift in focus.

After the Liberal Democratic Party (LDP) and New Komeito fell short of collectively securing 50 seats at the Upper House elections, the yen, Japanese equity and Japanese government bond (JGB) markets all saw a modest bounce. The ruling coalition now holds a total of 122 seats out of 248, compared to the opposition's combined 126.

The loss of the ruling coalition's majority may not lead to an abrupt sea-change in Japanese policy. That said, the minority ruling coalition still has much to accomplish with a reduced margin of support. One of the pressing tasks is further trade negotiations with the US before the 1 August deadline, after which Washington has threatened to impose a blanket 25% tariff on bilateral imports. Japan is motivated to gain concessions on product-specific tariffs, especially in key export sectors such as automobiles, auto parts, steel and semiconductors.

The outcome of the US-Japan bilateral trade negotiations may not entirely meet Japan's expectations, especially if it involves the imposition of product-specific tariffs. Although Japan's auto sector contributes the majority of neither industrial output nor of national employment, it has been a leader in driving wage increases and capex within the manufacturing sector. The sector's resilience is an important barometer of sentiment within manufacturing.

Although sector-specific tariffs will not reverse many of the underlying structural drivers of Japanese reflation and recovery from “lost decades of growth”, such as a structural labour supply shortages and production capacity constraints, sentiment remains an important indicator of Japan's “virtuous circle” of wages and prices. The upcoming focus will be on corporate investment and hiring intentions, which have shown strength according to the last BOJ Tankan survey. Any disappointments in trade negotiations could lead to temporary dips in stocks, followed by rebounds on positive news such as resilience in earnings, increased investments and optimistic hiring plans.

Another key task for the ruling coalition will be to negotiate with opposition parties regarding the FY2026 budget, a matter of significant interest to the JGB market. Because several opposition parties have challenged the ruling coalition's fiscal stance, markets are likely to be questioning the sustainability of Japan's recent fiscal achievements as the reflation process continues.

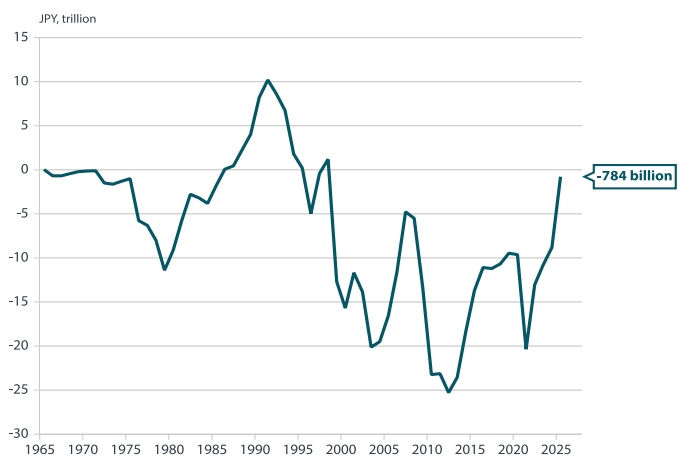

Even though the Japanese Ministry of Finance (MOF) is receiving record budget requests from lawmakers, the surge in tax receipts following the pandemic has brought Japan closer to achieving its primary balance goal than it has been in the past 25 years (see Chart 1).

Chart 1: Japan's primary balance

Source: Nikko AM, MOF

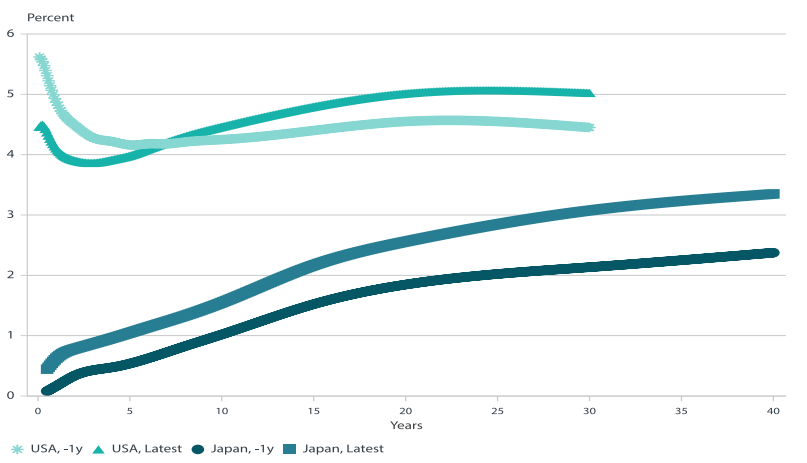

Should the ruling coalition be forced to compromise on fiscal discipline, including by rolling back hard-won consumption tax hikes, this could exert pressure on the long end of the JGB market. The market's long end has already come under pressure as the Bank of Japan has sought gradually to reduce its balance sheet as part of its exit from unconventional monetary policy.

Chart 2: US, Japan government bond yield curves

Source: Nikko AM, US Treasury, Macrobond, JBT

Regarding dollar-yen, Japanese fiscal policy and interest rates, as well as US fiscal and monetary policy, will come into the picture. It is worth noting that despite Japan's relatively higher debt-to-GDP ratio (over 200% gross and 150% net versus the US's gross figure of approximately 120%), the US's current account deficit requires constant inflows from abroad for funding. Therefore, global market sentiment likely holds greater comparative importance for the US than for Japan's bond market, although fiscal policy ultimately matters for both markets in the long term.

Considering that the US represents almost 60% of global reserves and global market cap, with a heavy reliance on foreign investments, worries about fiscal discipline may expose the US to persistent volatility in longer-term yields. This, in turn, may impact both public and private financing rates in the US.

On the other hand, in Japan, the government's ability to uphold a long-term commitment to fiscal prudence is more important than global market sentiment. The ability of the ruling minority party to negotiate a budget that not only satisfies the opposition but also meets domestic bond investors' expectations for ongoing prudence will be paramount.

While acknowledging the possibility of two-way trading in the short run, we still think the longer-term bias is towards dollar weakness as global investors seek increased portfolio diversification, assuming all other factors remain equal.