Global markets may be missing the obvious, quieter China trade

Recently, China has been frequently appearing in global headlines, although many of these stories are not particularly encouraging. Several factors such as the rise in global trade barriers, increases in surplus inventories of Chinese industrial materials (ranging from copper to solar panels), tales of struggling domestic property markets and slowing consumer demand, have all contributed to a subdued stock performance. Amidst this fixation with the slowdown in the world’s second-largest economy, global markets may have missed something.

We believe that China’s bond market offers global investors much more than what is immediately apparent. In our view, Chinese bonds are an asset class that provides good diversification opportunities within a global portfolio. They also represent a “safe” asset from a nation with a current account surplus that is looking to generate consumer price rises in a world where others are struggling to keep inflation contained. We examine why it could be an error to overlook Chinese bonds—and indeed renminbi (RMB)-denominated bonds—within a global portfolio when considering both Chinese and global market dynamics.

China’s bond-friendly domestic dynamics

Although slower growth and low to negative inflation may deter equity investors, they reinforce the case for bonds for several reasons that are mentioned below:

- Slow Chinese growth: China’s economy is undergoing government-led restructuring from real estate towards “new” economy sectors such as electric vehicles, artificial intelligence and advanced manufacturing. This transition is expected to weigh on overall growth for now. Given the much larger size of the economy compared to the previous decade and an ageing population, China’s growth will be inherently slower than we have been used to.

- Low inflation: The impact of economic restructuring (especially the negative wealth effect and sentiment related to falling home prices) and the lack of direct cash transfers to households during the pandemic have led to slower demand and lack of inflationary pressures. Despite the slowdown over the last few years, China has still managed to reserve room for monetary policy as a lever for supporting growth, should the need arise.

- Measured fiscal stimulus: Fiscal policy is accommodative but measured, and we believe that the market could absorb a moderately higher supply of government bonds without causing excessive volatility.

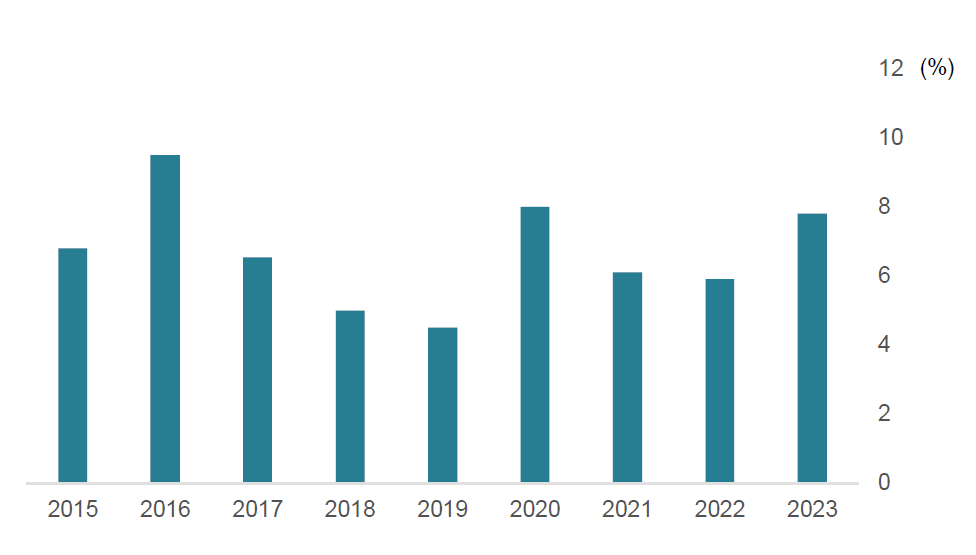

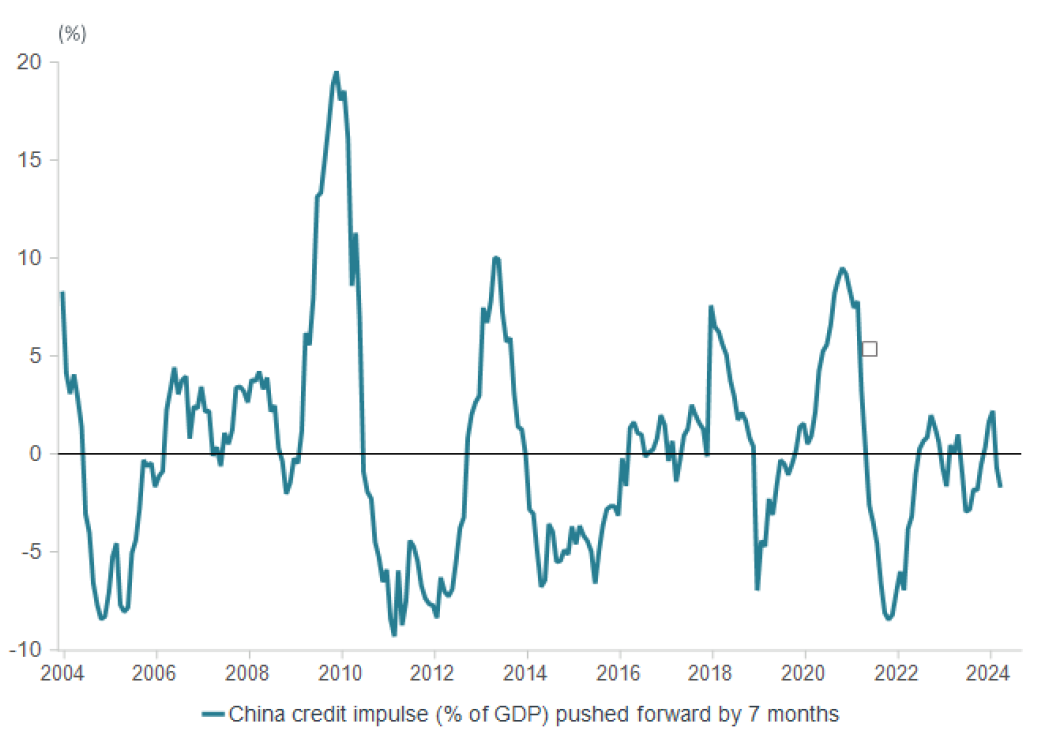

- Very low probability of default: The likelihood of default, either externally or internally, by Chinese government entities is very low, given factors such as high external surpluses. Although China’s gross debt-to-GDP is high, much of this is denominated in local currency. Moreover, domestic indebtedness has slowed, as indicated by China’s credit impulse (see Charts 1 and 2).

Chart 1: China’s net debt issuance has remained relatively controlled in recent years

Source: WIND, Bloomberg, NBS

Chart 2: China’s credit impulse shows domestic indebtedness has slowed

Source: Macrobond

Currency advantages: positive fundamentals for the RMB

RMB benefits from China having a current account surplus, which can help it weather periods of investment outflows. The currency has already corrected somewhat in 2022 against the CFETS index (a trade weighted currency basket) when China was hit hardest by the COVID-19 pandemic (Chart 3). Meanwhile, efforts by authorities to mitigate volatility create favourable conditions for risk/return. The RMB is under-represented in global reserves and the Chinese government’s desire to deepen the domestic bond market might also help support the recovery of Chinese domestic demand.

Chart 3 : RMB vs CFETS (trade partner) basket

Source: Macrobond

Despite escalating trade tensions between the US and China, trade ties within Asia (including Japan) appear to be strengthening, which might also increase regional demand among reserve-holding economies for RMB-denominated assets.

The benefits are not only domestic: Chinese, RMB bonds as global diversifiers

The benefits of holding RMB and Chinese bonds extend beyond domestic fundamentals. For example, Chinese Government Bonds (CGBs) have been a core holding within the Strategic Asset Allocation of the Global Multi Asset team over the past seven years, due to their unique characteristics. These bonds have maintained negative correlations to risk assets, providing strong diversification to portfolios. As inflationary dynamics resurface across developed economies, we expect China to continue providing better diversification to risk assets than many developed market sovereign bonds.

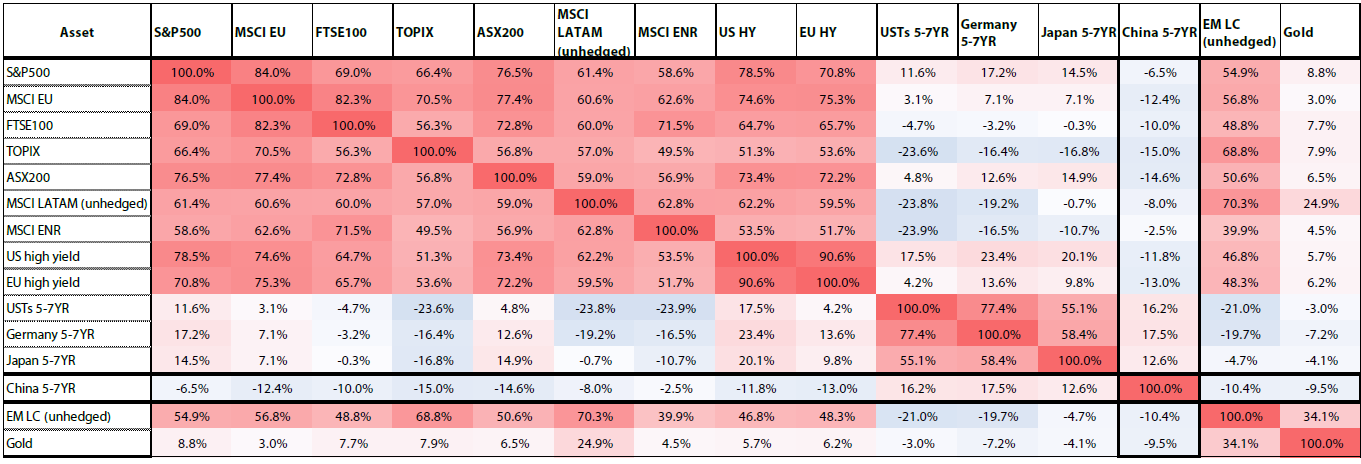

Portfolio advantages: diversification through Chinese bonds

Nikko AM’s risk model (Table 1) depicts the unique characteristics of the Chinese bond market, with correlations staying negative against most equity markets and are only marginally positive against the traditional sovereign bond markets. Over the past three years, the Chinese monetary policy cycle has decoupled from the developed world, with falling cash rates in China enabling its bond market to play a more traditional role in defensive portfolio allocation. Additionally, as described above, the low inflation levels, slowing property sector and reduced trend growth imply that these defensive characteristics are likely to persist as Chinese monetary policy will remain decoupled from Western countries.

Table 1: Chinese bonds are a good diversifier

Source: Nikko AM

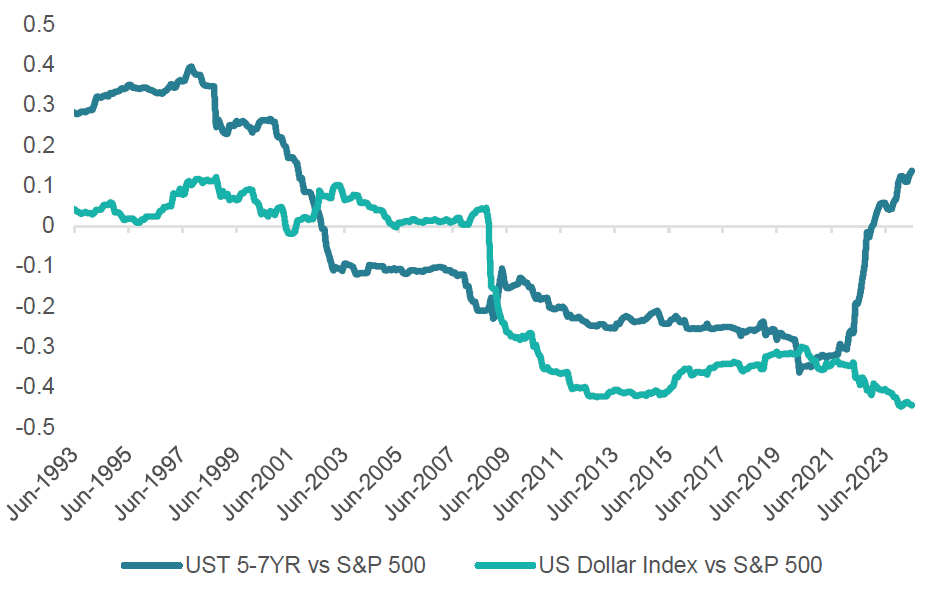

This can be compared to the correlation between risk assets and US Treasuries, where the correlation to the S&P 500 has gone from negative to positive (Chart 4). Contrary to China, high inflation and rising cash rates in the US have resulted in the performance of all financial assets becoming more similar, meaning that the traditionally defensive asset once used to diversify risk is now contributing to an increase in portfolio volatility. Should inflation prove to be stickier than the market currently expects, it would be reasonable to expect that this would keep the correlation higher than it was over the past 20 years, leading to a more consistent relationship between equity and bonds that previously existed during the inflationary period from 1970 to 1990. Table 2 below depicts the shift that has occurred in the US Treasury market over the past three years, compared to the US dollar, which has become a more defensive alternative.

Chart 4: Correlation between US Treasuries and the S&P 500 according to Nikko AM’s long-term risk model

Source: Nikko AM

Hedged or unhedged?

Currency-hedged bonds currently yield only marginal returns. Chinese bonds are no exception; for example, the 10-year CGB yields approximately -0.40% for a Japan-based investor when hedged back to yen. However, because the Chinese yuan is managed against a basket of currencies with a high weighting for the dollar, the currency shows more resilience against the strength of its US counterpart. Importantly, while US Treasuries have increased their correlation to risk assets over the past three years, the dollar has retained its negative correlation as depicted above.

This implies that holding unhedged Chinese bonds can lead to increased diversification, depending on the base currency used by the investor. Table 3 below shows the effect of unhedged as well as hedged Chinese bonds for both Japanese yen and Singapore dollar investors. Interestingly, for the investor using the Singapore dollar, removing the hedge on Chinese bonds leads to improved diversification against risk assets, while for the investor using the yen, it results in strong levels of diversification against interest rate duration risk (notably US 5 to 7-year). This can offer additional protection in the portfolio depending on the asset mix and can help improve yield by reducing hedging costs.

Table 3: Effect of hedged, unhedged Chinese bonds according to Nikko AM’s long-term risk model

Source: Nikko AM

Note: this figure presents a heat map of diversification benefits in terms of weighted correlation between individual indices and an index of Chinese 5 to 7- year sovereign bonds, either (a) fully hedged into Japanese yen (JPY) or (b) unhedged versus (i) a portfolio with base currency of JPY and hedged unless otherwise noted or (ii) a portfolio with base currency of Singapore dollar (SGD) and hedged unless otherwise noted. It is clear to see that for the SGD-denominated portfolio, holding China 5-7 year bonds un-hedged provides diversification benefits against equity risk, though less so for the JPY-denominated portfolio, which achieves better diversification benefit against equity risk from holding the bonds hedged.

Should we worry about the US fiscal position?

In the context of this report, the final point worth exploring is whether the US fiscal balance is sustainable with respect to US Treasuries. Currently, the US government is running a fiscal deficit exceeding 5% of the GDP, a deficit level that has historically been seen only during recessionary periods. This high level of deficit will increase the government’s debt burden, leading to greater bond issuance. As the IMF describes, this may make the last mile of disinflation harder to achieve. If inflation remains elevated and the US government needs to issue a large amount of bonds, from a strategic perspective it might be an opportune time to continue diversifying away from US Treasuries as the higher financing costs could make the debt trajectory unsustainable.

On the other hand, although China also has relatively high levels of debt, its general government debt-to-GDP ratio remains lower than that of the US. Moreover, China’s lower interest rates make servicing of interest costs more manageable. While it remains unclear whether the US debt load will become unsustainable, from a global portfolio perspective we believe that the diversification benefits on offer and China’s low inflation environment make the country’s bonds a key market to explore as an alternative to US Treasuries.

Conclusion: Chinese bonds offer a valuable source of diversification

As we have outlined above, there is not only a compelling case for Chinese bonds on their own merits, but also as a valuable source of diversification in a global multi-asset portfolio. Chinese bonds can provide diversification against risk assets where traditional “risk free” assets (developed market government bonds) have recently underperformed. There is also a significant probability that Chinese bonds will continue providing good diversification value in the future. This is due to the diverse macroeconomic dynamics between China and many developed bond markets, notably the US. Meanwhile, the RMB may provide diversification in its own right. However, we believe that the currency diversification value it offers depends on the currency denomination of the underlying portfolio.