Japan is back: equities now pay a competitive premium for risk taken

For decades, investors have puzzled about what appears to be excessive risk-aversion implicit in historical returns delivered by the US equity market in excess of US government interest rates. Yet few have focused on a parallel phenomenon that should have been equally puzzling—the relatively poorer compensation that Japanese equity investors have received for decades of underperformance.

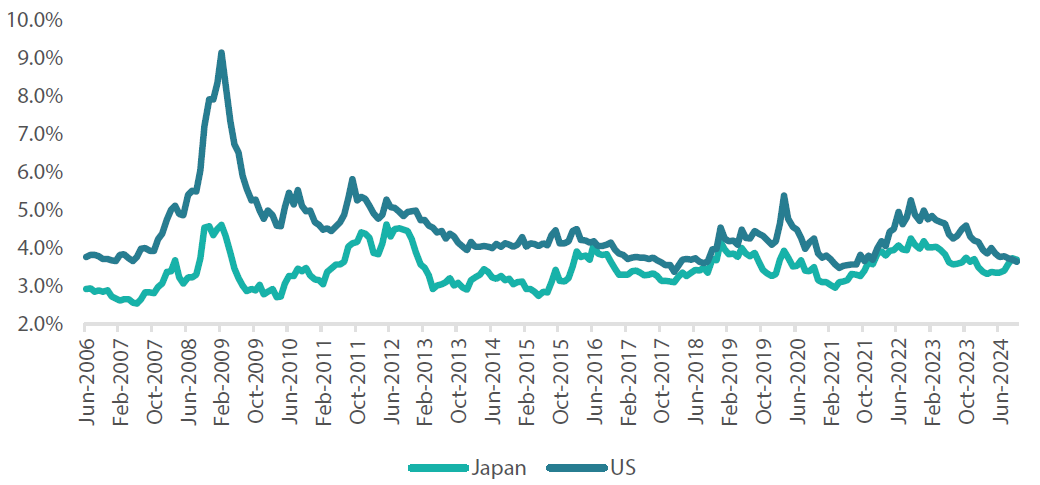

However, one significant recent development is the resurgence of Japan’s equity risk premium. The country’s equity market no longer offers inferior compensation compared to its US counterpart (as shown in Chart 1). This can be attributed to a combination of rising dividend payout ratios, strong earnings and the comparatively reasonable valuation of the underlying equities.

Chart 1: US and Japan equity risk premium: parity achieved

Source: Bloomberg, Nikko AM, October 2024

Background: the equity risk premium (ERP)

The ERP is the additional return that shareholders demand in excess of the risk-free rate of interest, to compensate for assuming the risk of market fluctuations. In other words, it represents the outsize returns that the market index should yield in good times to compensate for poor returns in bad times. The premium not only provides an estimate of the overall market price of risk, it also gives guidance for the cost of issuance of equity capital for the average index-listed firm.

First element: dividend payouts

Over Japan’s lost decades, both domestic and foreign investors have had to contend with low payouts even as increasingly risk-averse Japanese corporates shored up their balance sheets with cash. However, the confluence of reflation and structural changes to Japanese corporate governance made a palpable difference to equity returns. Now, Japanese corporates duly compensate investors for the risk of investing in their shareholdings.

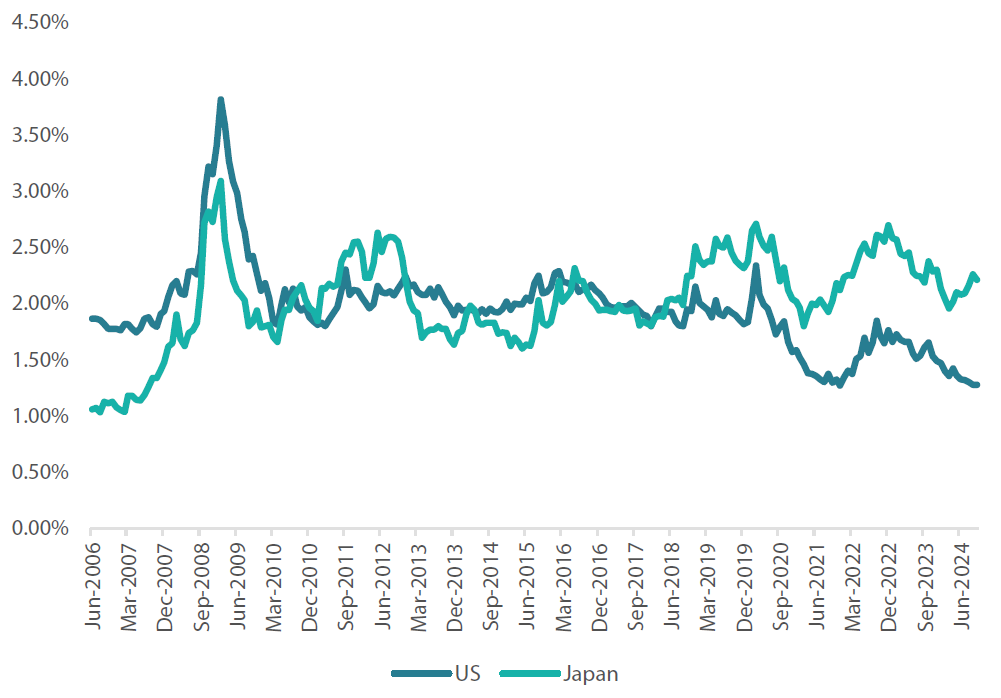

Mechanically, the ERP is derived by discounting future cash flows to present value, which includes both dividends and share buybacks, and then scaling these by current market pricing. Deriving these future cash flows involves analysis of long-term trends in corporate payouts. Meanwhile, we use consensus earnings forecasts before arriving at terminal growth. Japanese corporates have surpassed their US peers in dividend payouts in recent years and are also narrowing the gap in buying back shares, as shown in Chart 2.

Chart 2: US and Japan dividend yields

Source: Bloomberg, October 2024

Second element: strong earnings

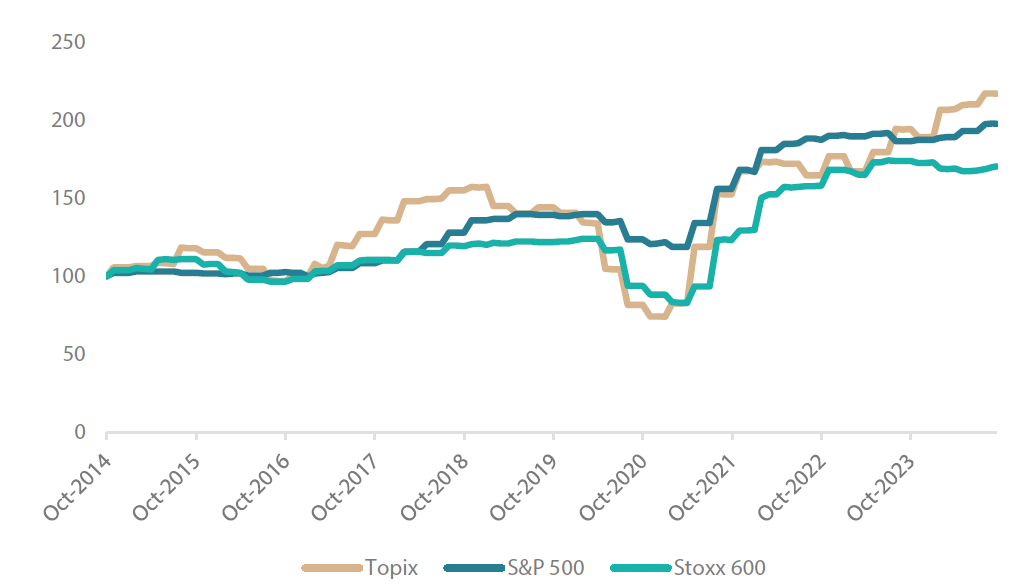

Strong earnings are instrumental to appropriate payouts; if payouts are high despite low earnings; they are not expected to be sustainable. Conversely, if payouts are too low compared to earnings growth and excess earnings are retained in cash, investors may consider the premium as insufficient compensation for the risk taken. Therefore, investors look for improvement in corporate payouts underpinned by strong earnings performance. Japanese large caps have demonstrated earnings growth that has kept pace with US firms, and outperformed European companies in the last decade (Chart 3).

Chart 3: Global equity trailing 12-month earnings

Rebased to 100 on October 2014

Source: Bloomberg, October 2024

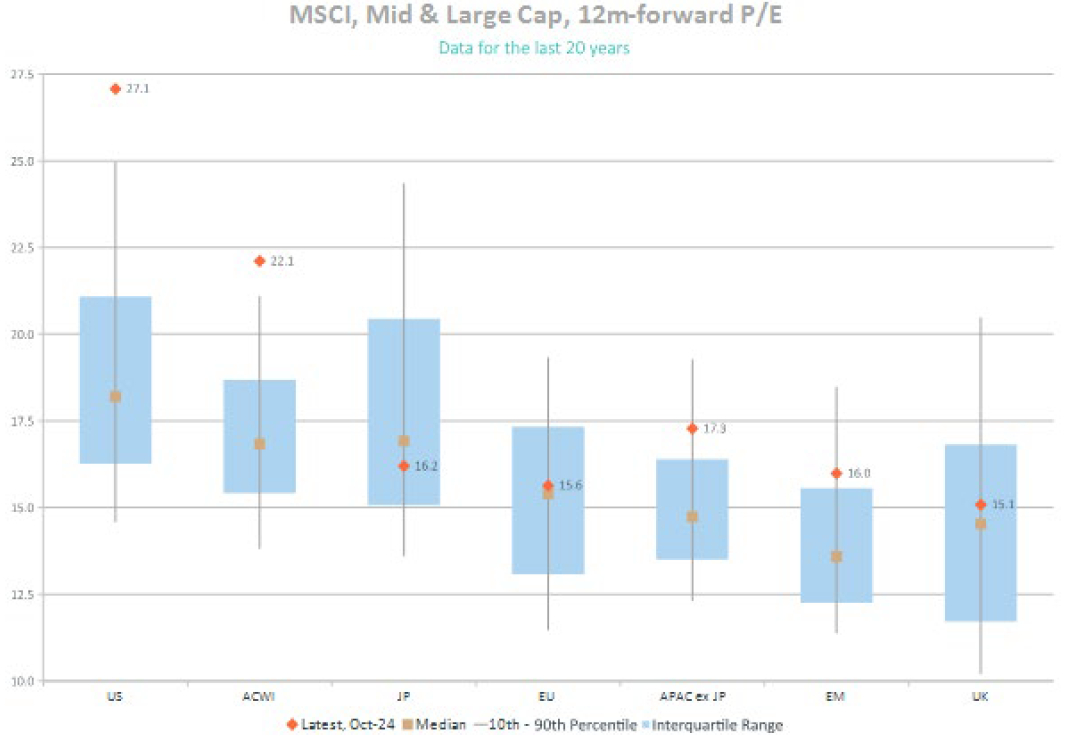

Third element: market pricing

In comparison to Japan’s robust earnings, Japanese equities have remained far less richly valued than those in the US in terms of market price, enhancing the relative present value of future dividends. Even though Japanese equities are undervalued relative to the US in terms of price/earnings, they still offer competitive returns to compensate shareholders for the risks of future valuation swings.

Chart 4: Relative equity market valuation

Source: Nikko AM Global Strategy, Macrobond

Japan’s long history of undercompensation, thanks to deflation

Deconstructing the many years in which Japan undercompensated investors for taking risk involves understanding the mechanisms that drive deflation itself. The deflationary mindset leads to a reduced future valuation of all economic activity, which creates an expectation of lower future returns on assets. Meanwhile, expectations that future returns on capital investments would be continually inferior to the ever-decreasing equity risk premium contributed to a consistent decline in capital investment.

Of course, theory suggests that if investors assume too low an equity risk premium, they may find themselves unable to cover their future liabilities, such as financing future pensioners’ retirement or other future expenses. As the equity risk premium declined, domestic investors became increasingly unwilling to assume the risk of investment and therefore left the market. However, foreign investors had the advantage of an appreciating yen (another legacy of deflation, where cash is king), which could offset equity losses. When the yen recently started depreciating and the interest rate differential widened, the “carry” trade rose in prominence, with foreign investors borrowing the relatively cheaper yen to fund their positions in appreciating Japanese equities.

Yet all along, during Japan’s “lost decades” of growth, it is possible that the drop in the ERP was overdone, thus truly undercompensating for future liabilities. This is particularly true because the market slump and deflationary dynamics following the bursting of Japan’s real estate and stock bubbles expedited domestic investor withdrawal from risk asset markets. This decline was much more sudden than any natural change in risk appetite that would accompany the demographic transition to an aging society. As equity risk premiums increase (decrease) as inflation also rises (falls) more than expected, it is feasible that the undercompensation for investing in Japanese equities over Japan’s “lost decades” was an integral part of structural deflation in Japan.

Why does the ERP matter? Another milestone in overcoming deflation

It is timely that Japan is starting to compensate investors adequately for risk-taking once again, just as recent stock market volatility has led investors to question whether there is an inherently high level of risk associated with investing in Japan. In reality however, these swings, which can prompt yen-borrowing “carry-traders” to exit the market, simply create opportunities for longer-term domestic investors who are systematically underweight and are looking for good levels to enter the market.

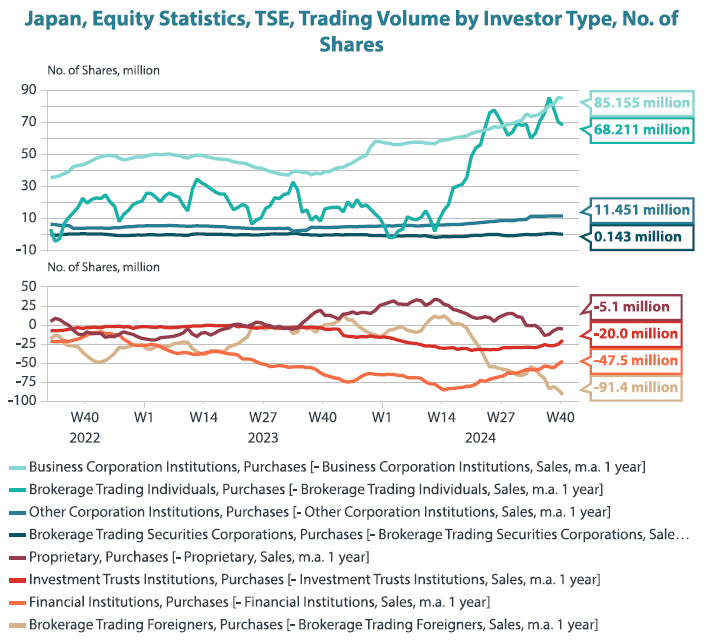

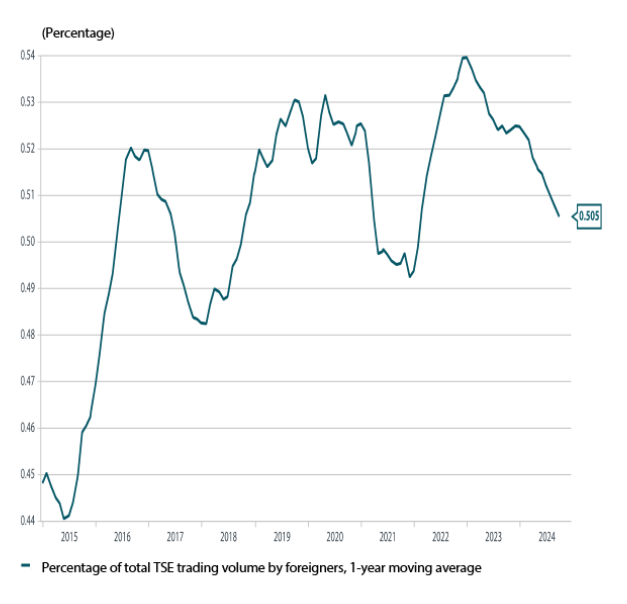

As shown in Charts 5 and 6, although foreign investors still make up almost half of the trading volume on the Tokyo Stock Exchange (TSE), their share of trading has been falling. Meanwhile, the share of “buy and hold” domestic investors—corporates buying back their own shares (at the same time strengthening governance), institutions topping up their domestic equity allocations and individuals (who still hold over 1 quadrillion yen in cash) leveraging the “New NISA” tax advantages to newly commence participation in financial markets—has been on the rise.

Charts 5 & 6: Domestic investors’ purchases rising, foreign investors’ share falling

Source: Nikko AM, TSE |

Source: Nikko AM, TSE |

Looking through volatility to a stronger, more stable shareholder base

Indeed, domestic investors, including households, are keen to take advantage of interim market volatility, a measure of market risk, to increase their holdings of Japanese equities. Meanwhile, emerging signs that market returns are becoming less concentrated in sectors favoured by foreign investors (like large export-oriented manufacturers who have historically capitalised on yen weakness) and are increasingly favouring those oriented toward more conservatively valued domestic demand-oriented firms are encouraging.

If sustained, the trend is indicative of potential to entrench the long-term sustainability of positive corporate growth within the emerging reflationary mindset of domestic consumers. Market participation of households may need to increase further to truly generate the wealth effect, in which strong market returns enhance consumer confidence. However, in the meantime, the revived rewards for investing in Japanese equities are increasingly landing right where it matters for reflation—the pocketbooks of domestic investors.